April 2025

Nutraceuticals Market (By Type: Dietary Supplements {Proteins & Peptides, Vitamins & Minerals, Herbals, and Others}, Functional Beverages {Fruit & Vegetable Juices and Drinks, Dairy & Dairy Alternative Drinks, Noncarbonated Drinks, and Other}, Functional Food, and Personal Care; By Form: Capsules, Liquid & Gummies, Tablets & Soft Gels, Powder, and Others) - Global Industry Analysis, Market Size, Share, Growth, Trends, Regional Outlook and Forecasts, 2024 - 2033

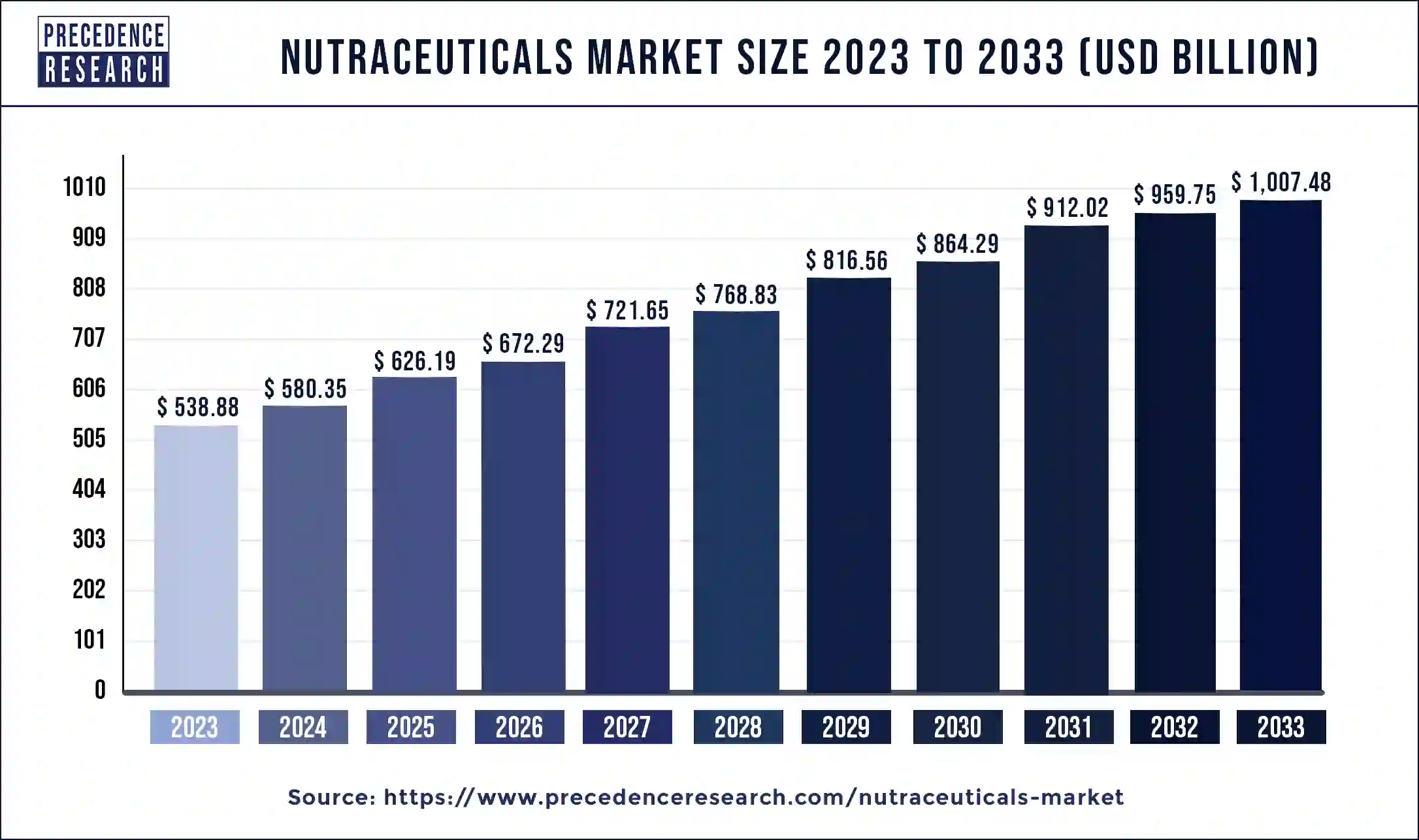

The global nutraceuticals market size was accounted for USD 538.88 billion in 2023 and is expected to hit around USD 1007.48 billion by 2033, growing at a CAGR of 6.45% during the estimated period 2024 to 2033. Nutraceuticals is a comprehensive umbrella term which is used to label any product acquired from food origin with additional health advantages over and above the basic nutritious value available in foods. Nutraceuticals can be regarded as non-precise biological remedies used to boost general health, regulate indications and avert malignant developments. The explanation of nutraceuticals and allied output generally relies on the origin. Nutraceuticals can be segmented on the foundation of their natural basis, pharmacological circumstances, as well as chemical structure of the products. Most often nutraceuticals are organized in the following classes: functional food, dietary supplements, pharmaceuticals, and medicinal food.

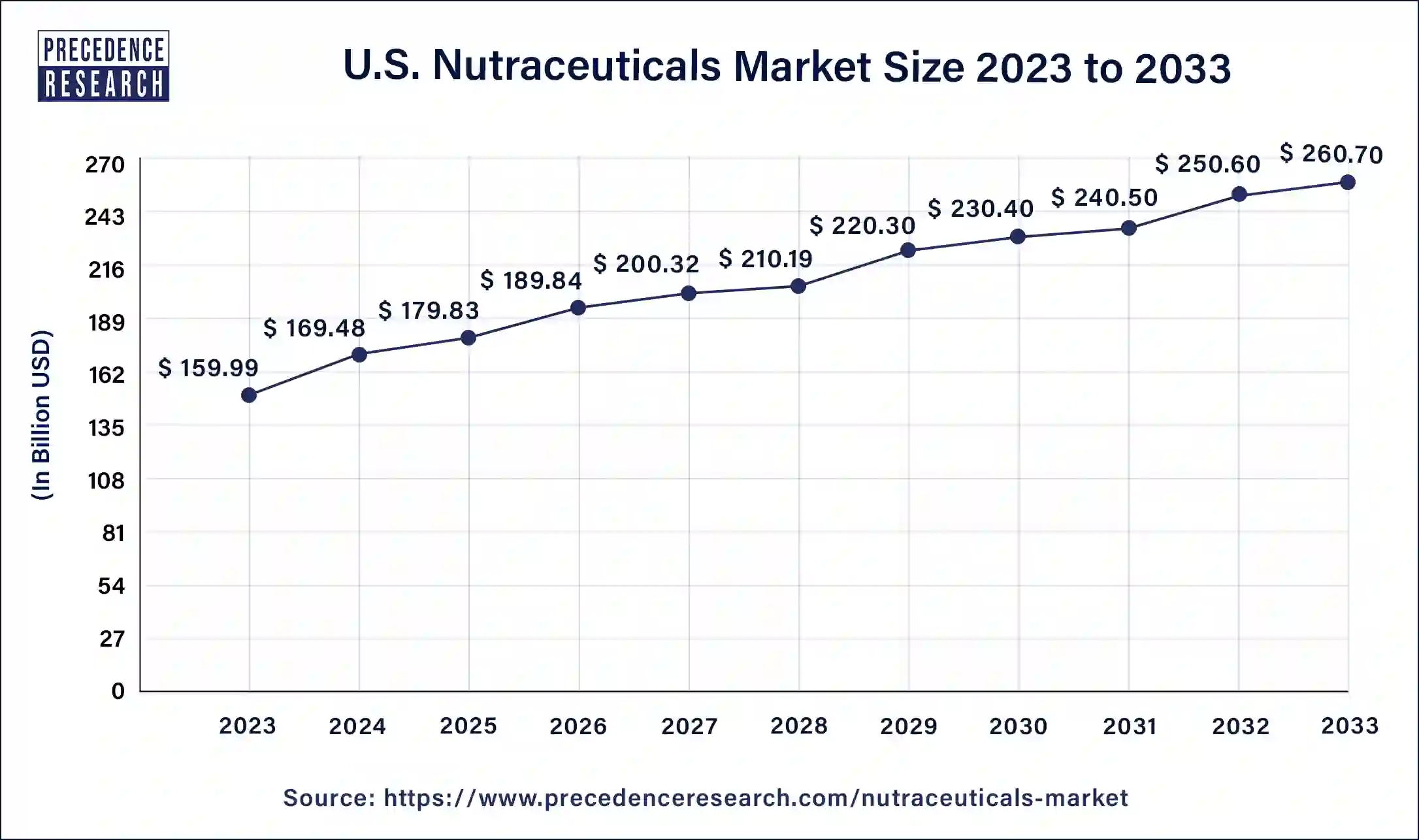

The U.S. nutraceuticals market size was valued at USD 159.99 billion in 2023 and is expected to reach around USD 260.70 billion by 2033. The U.S. nutraceuticals market is growing at a compound annual growth rate (CAGR) of 5% from 2024 to 2033.

The comprehensive research account covers substantial projections and inclinations of nutraceuticals throughout chief regions encompassing Africa, Asia Pacific, Europe, Latin America, North America, Middle East.

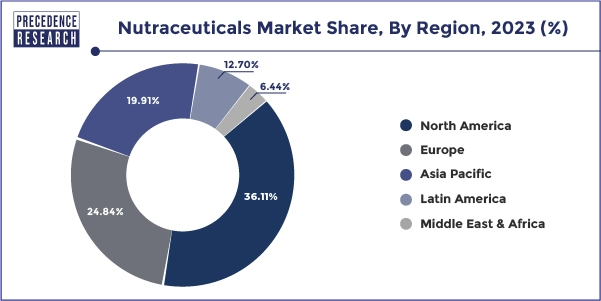

The North America region is growing due to presence of major manufacturers, high disposable income, and increasing focus on physical appearance. In 2023, North America dominated the nutraceuticals market due to increasing health awareness, rising disposable incomes, a growing aging population, and increasing sales. Prior to the onset of the pandemic, the U.S. witnessed a steady increase of 5% ($345 million) in dietary supplement sales in 2019 compared to the previous year. However, during the first wave of the pandemic, specifically in the six weeks preceding April 5th, 2020, there was a significant surge of 44% ($435 million) in sales, indicating a heightened demand for dietary supplements. Notably, multivitamins experienced a substantial spike in demand in March 2020, with sales rising by 51.2% and total sales of vitamins and supplements reaching nearly 120 million units for that period alone. This highlights the increased consumer interest in and reliance on dietary supplements during the early stages of the pandemic in the U.S.

Europe reported succeeding highest share predominantly owing to greater elderly population and growing occurrence of chronic ailments. Asia Pacific is projected to advance at the highest compounded annual growth rate majorly owing to increasing popularity of e-commerce websites, growing awareness about importance of well-being and health, and the rising middle-class populace. Middle East, Latin America, and African region is expected to exhibit note-worthy growth in the projected time-frame.

| Report Highlights | Details |

| Market Size in 2024 | USD 580.35 Billion |

| Market Size by 2033 | USD 1007.48 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 6.45% |

| Base Year | 2023 |

| Historic Data | 2020 to 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Form, Sales Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

| Companies Mentioned | Archer Daniels Midland Company, General Mills, Inc., I. du Pont de Nemours and Company, Aland (Jiangsu) Nutraceutical Co., Ltd., BASF SE, Cargill, Incorporated, Royal DSM N.V., Groupe Danone S.A., Nestle S.A., PepsiCo Inc. |

The nutraceutical supply chains are struggling on a global scale to keep pace with the rapid spread of the COVID-19 virus. Most of the companies have their manufacturing units in Asia. The disruption in supply chain due to the COVID-19 pandemic has caused a slump in the availability of nutraceuticals across the globe.

The disruptive effects of the novel coronavirus pandemic have placed an enormous strain on the global supply of nutraceutical products, thus increasing the risk of shortages. Although production across various industries in Asia has gradually resumed, the U.S. pharmaceutical and nutraceutical manufacturers, which heavily source directly and indirectly from Asia, are exposed to high risks in supply shortages. However, the COVID-19 pandemic has also presented growth opportunities for the manufacturers of nutraceuticals as the focus has shifted towards consumption of supplements such as multi-vitamins, omega-3 fatty acids, and protein supplements for maintaining a stronger immunity.

Market Drivers

Increasing use of Nutraceuticals for their potential therapeutic outcomes in various diseases and ailments

Over the few years, nutraceuticals have been increasingly used in various therapeutic outcomes. Nutraceutical products are not only used for better health outcomes but to reduce the risk of heart diseases, cancer, and other related diseases like insomnia, cataracts, weakened memory, menopausal symptoms, and gastrointestinal problems. Nutraceuticals products, such as those derived from a combination of ginger, garlic, and honey, are effective in treating headaches and migraines caused by stress. Other nutraceutical products like green tea, Vitamin E, and Vitamin C are being used for various purposes, such as improving hair health and complexion and treating conditions like varicose veins, alcoholism, depression, and lethargy, among others.

Increasing prevalence of chronic diseases

There has been a rise in chronic diseases such as diabetes, cardiovascular diseases, cancer, and Obesity. According to WHO, the mortality rate each year due to chronic illness is equivalent to 74%. About 17 million die due before the age of 70;86% of these premature deaths occur in low-and middle-income countries. CVD accounts for the most deaths, 17.9 million people annually, followed by cancers (9.3), chronic respiratory diseases (4.1 million), and diabetes (2.0 million including kidney disease deaths caused by diabetes). These group of diseases accounts for over 80% of all premature Chronic disease deaths. As the prevalence of chronic diseases continues to rise, consumers are increasingly turning to nutraceuticals as a part of their preventive or complementary healthcare strategies. Nutraceuticals are gaining popularity as a complementary or alternative approach for managing these chronic conditions, as they are often perceived as safer with fewer side effects compared to conventional pharmaceuticals.

Development of function-specific antioxidants

Antioxidants are compounds that help neutralize harmful free radicals in the body, which cause oxidative stress and contribute to various health issues such as aging, inflammation, and chronic diseases. The development of function-specific antioxidants, such as polyphenols, flavonoids, and carotenoids, with targeted health benefits, is driving the nutraceuticals market. For instance, antioxidants derived from green tea, berries, and other plant-based sources are being formulated into nutraceutical products that are marketed for their potential anti-aging, anti-inflammatory, and immune-boosting properties, among others.

Market Restraints

Safety Concerns

Although nutraceuticals are known to have numerous benefits that continue to expand, there is a certain side effects as well. Thus, a safety concern arises. Major safety concern includes ingredient safety. Nutraceuticals contains a wide range of ingredients, including herbs, botanicals, vitamins, minerals, and other bioactive compounds. However, not all ingredients used in nutraceuticals are safe for everyone. Some nutraceuticals induce allergic reactions. Another factor that raises safety concerns is dosage level, manufacturing processes, and lack of standardized safety assessments. Excessive or inappropriate use of nutraceuticals can result in adverse effects, and inconsistencies in manufacturing practices and quality control standards can impact product quality and safety. Additionally, the lack of standardized safety assessments can create uncertainties regarding safety profiles and potential interactions. Addressing these concerns through proper dosage guidelines, rigorous quality control measures, and standardized safety assessments is crucial to ensure the safe use of nutraceuticals by consumers.

Competition from conventional pharmaceuticals

Nutraceuticals face competition from conventional pharmaceuticals that are backed by extensive research, regulatory approvals, and established marketing channels. In some cases, consumers opt for conventional pharmaceuticals over nutraceuticals for acute or severe health conditions, where pharmaceuticals are perceived to offer more immediate and proven benefits. This competition from pharmaceuticals poses a challenge for the nutraceuticals market, particularly in areas where there is limited scientific evidence supporting the efficacy of nutraceuticals.

Market Opportunity

Nutraceuticals in the treatment of Prostate Cancer

Prostate cancer, the most common type of cancer in American males and the second leading cause of cancer-related mortality, present challenges in terms of resistance to treatment and disease progression. Men of U.S. and African descent have been identified with the highest prostate cancer mortality rates. While current treatment strategies are effective, there is a need for more non-toxic and efficient therapeutic approaches to manage and treat this disease. Nutraceuticals offer a promising opportunity as safe and effective anti-prostate cancer agents. Precision in medicine design is improved by utilizing nutraceuticals while reducing the toxicities associated with chemotherapy and overcoming resistance to disease progression. Nutraceuticals have the potential to treat both localized and advanced prostate cancer, making them a valuable opportunity in the nutraceuticals market for prostate cancer management and treatment.

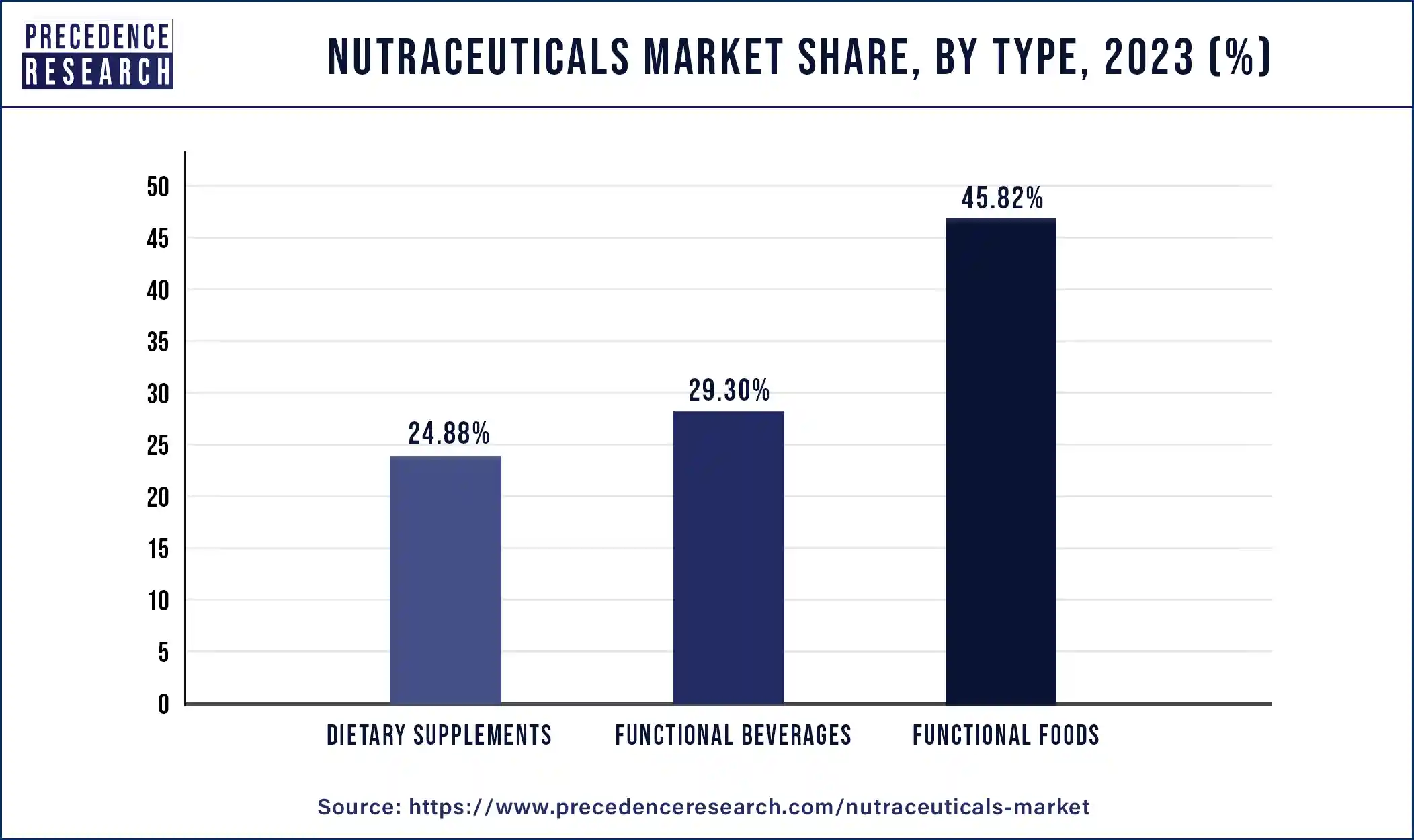

Functional Food Segment Reported Foremost Market Stake in 2023

The functional food segment dominated the nutraceuticals market in 2023, the segment is observed to sustain the position throughout the forecast period. With a growing aging population worldwide, there is a rising demand for functional foods that support healthy aging, address age-related health concerns, and improve overall well-being. This demographic shift contributes to the dominance of the functional food segment in the nutraceuticals market. Ongoing research and innovation drive the development of new functional food products with enhanced health benefits. Companies invest in R&D to identify novel ingredients, formulations, and delivery systems that address specific health concerns, further driving market growth.

The dietary supplements segment is observed to expand at a notable rate during the forecast period. Dietary supplements offer a convenient way for consumers to incorporate essential nutrients into their diets without significant changes in their eating habits. They are widely available over-the-counter in various forms such as pills, capsules, powders, and liquids, making them accessible to a broad consumer base.

The tablets segment dominated the nutraceuticals market

The tablets segment dominated the nutraceuticals market in 2023. Easy availability of tablets for multiple end-users in the market globally, has supported the dominance of the segments in the market. Moreover, the cost-effectiveness of tablets used for dietary supplements and vitamin- deficiency has offered expansion to the market in past years. Consumers are seen adding tablets as supplementary solutions into their diets. The growing promotion of vitamin and other supplements by governments in multiple countries is seen to promote the growth of the segment.

The companies focusing on research and development are expected to lead the global nutraceuticals market. Leading competitors contending in global nutraceuticals market are as follows:

With the aim of well recognizing the present standing of nutraceuticals, and guidelines implemented by the developed countries, Precedence Research anticipated the future advancement of the nutraceuticals industry. This study bids qualitative and quantitative intelligences on nutraceuticals market and estimation of business size and development trend for feasible market sectors.

Segments Covered in the Report

By Type

By Form

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

February 2024

July 2024

April 2024