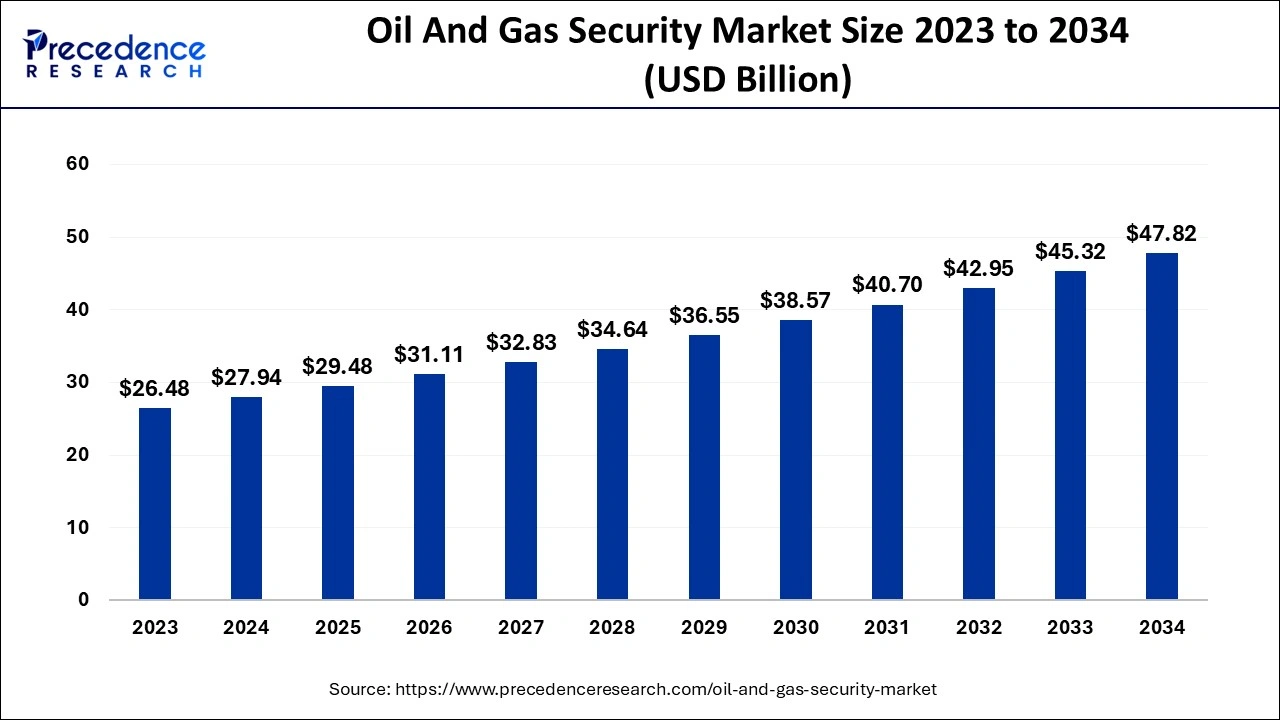

The global oil and gas security market size accounted for USD 27.94 billion in 2024, grew to USD 29.48 billion in 2025 and is projected to surpass around USD 47.82 billion by 2034, representing a healthy CAGR of 5.52% between 2024 and 2034. The North America oil and gas security market size is calculated at USD 9.50 billion in 2024 and is expected to grow at a fastest CAGR of 5.66% during the forecast year.

The global oil and gas security market size is calculated at USD 27.94 billion in 2024 and is anticipated to reach around USD 47.82 billion by 2034, expanding at a CAGR of 5.52% between 2024 and 2034. The constant threat of cyber-attacks on oil and gas infrastructure is the key factor driving the oil and gas security market growth. Also, growing production activities in remote locations along with the regulatory compliances imposed by the government can fuel market growth further.

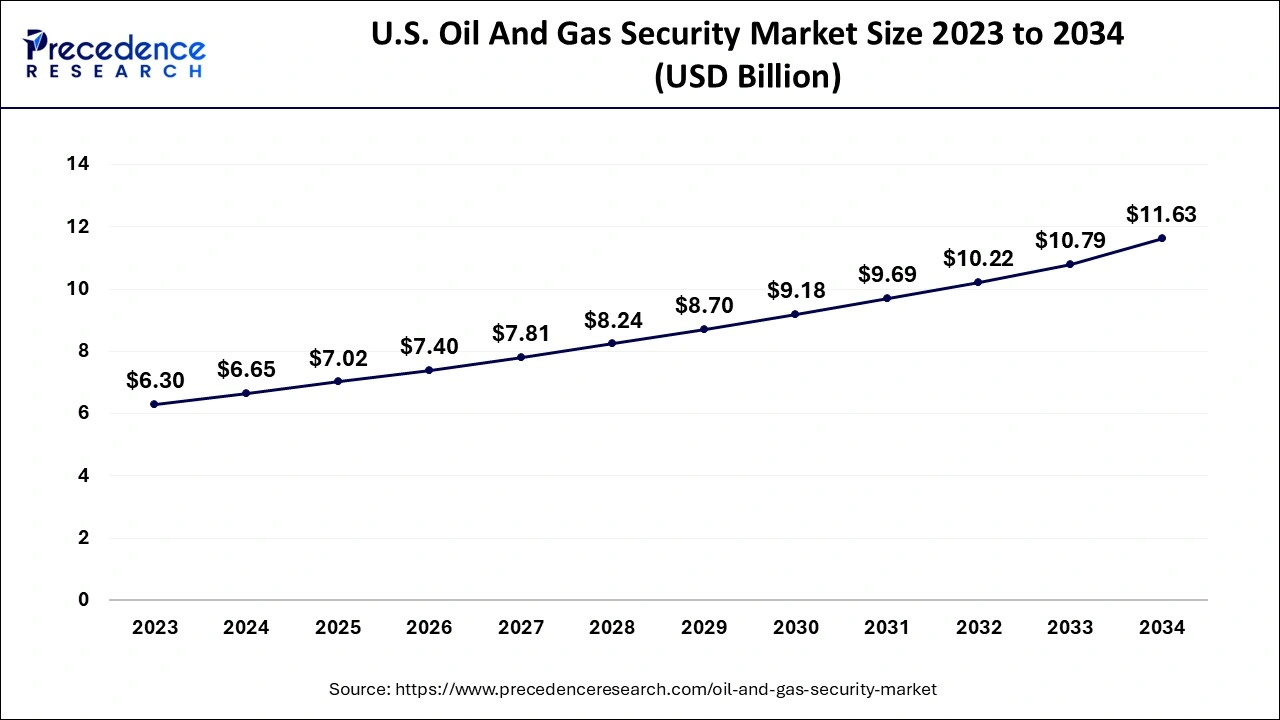

The U.S. oil and gas security market size is estimated at USD 6.65 billion in 2024 and is expected to be worth around USD 11.63 billion by 2034, growing at a CAGR of 5.73% between 2024 and 2034.

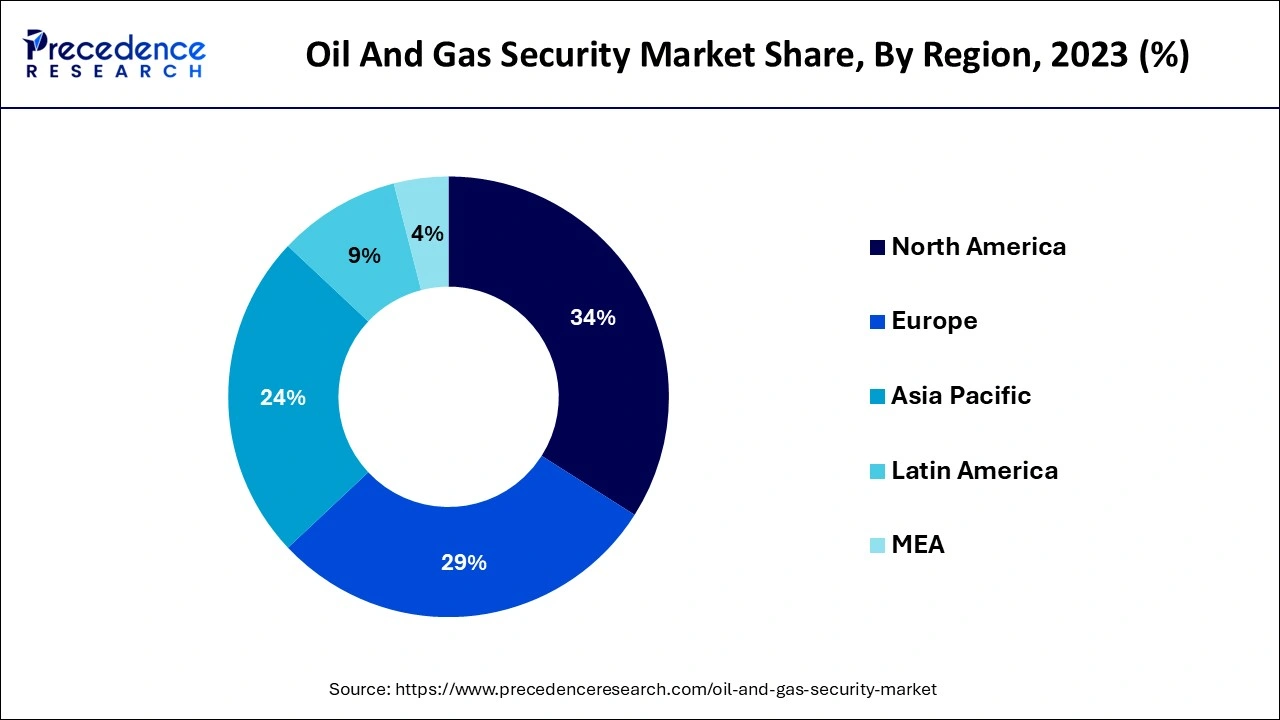

North America dominated the oil and gas security market in 2023. The dominance of the segment can be attributed to ongoing technological advancements like data analytics and the Internet of Things (IoT), which are revolutionizing the market. Companies are utilizing this cutting-edge technology to improve predictive analytics and real-time monitoring. Furthermore, the geopolitical impact of the U.S. plays an important part in its dominance. With its strategic alliances and military presence, the U.S. across the globe is working to protect oil and gas supply chains.

Asia Pacific is expected to witness the fastest growth in the oil and gas security market during the studied period. The growth of the region can be linked to the increase in cyber threats targeting major infrastructure has become a substantial issue for the industry. Moreover, countries like Japan have applied stringent regulations and a rise in investments in AI-driven threat-identifying systems for their oil and gas facilities.

The oil and gas security market is the safeguarding of the industrial operational technology of the oil and gas industry and infrastructure from potential data theft and cyber-attacks. The rise in cyber-attacks on the operational technology of oil and gas companies highlights the growing need for advanced security measures. This also includes protection systems like data acquisition (SCADA) and supervisory control coupled with distributed control systems. However, the persistent need for security upgrades and high capital costs are the main drawbacks of the system.

List of countries by oil exported in 2022

| Country | Oil exports 2022 (bb/day) |

| Saudi Arabia (OPEC) | 7,363,640 |

| Russia (OPEC+) | 4,780,354 |

| Iraq (OPEC) | 3,712,420 |

| United States | 3,604,000 |

| Canada | 3,350,200 |

| United Arab Emirates (OPEC) | 2,717,117 |

| Kuwait (OPEC) | 1,878,852 |

| Norway | 1,558,159 |

| Nigeria (OPEC) | 1,388,260 |

| Brazil | 1,346,417 |

Role of AI in the Oil and Gas Market

AI has extensive applications in the industry, changing conventional processes and systems. Some common AI applications are drilling optimization, reservoir analysis, predictive maintenance, safety, and risk management, pipeline integrity management, and supply chain optimization. Furthermore, AI can analyze market trends and historical data to predict future needs for oil and gas products. Also, AI can help companies make informed decisions, mitigate environmental risks and reduce costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 47.82 Billion |

| Market Size in 2024 | USD 27.94 Billion |

| Market Size in 2025 | USD 29.48 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.52% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, End user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising need for regulatory compliance

The strict regulatory environment controlling the oil and gas security market plays a key role in boosting the requirement for security solutions. Regulatory entities and governments of many industries are imposing strict regulations to protect critical infrastructure and protect public safety. Additionally, market players are working towards collaboration and compliance with security experts and industry associations. This collaboration optimizes the progress of market-wide security standards.

Geopolitical risks

Geopolitical risks can affect the oil and gas security market in many ways. Geopolitical risks can lead to uncertainty and instability in the production, distribution, and consumption of oil. Moreover, Geopolitical risks can influence insurance capacity, which can have a substantial impact on small and medium-sized businesses. The geopolitical challenges can have wide r implications for diplomacy and global security.

Rising digitization

The oil and gas security market has undergone a digital transformation in past years, as players are increasingly depending on interconnected digital systems to carry out their operations. This surge in digitization has resulted in lucrative opportunities for cyber-attacks to exploit insecurities and gain unauthorized access to crucial infrastructure. Furthermore, many market players are implementing high cybersecurity measures to protect their digital infrastructure against cyber threats.

The hardware segment dominated the global oil and gas security market in 2023. The dominance of the segment can be attributed to the increasing utilization of physical equipment like access control systems, surveillance cameras, and communication devices in cyber security measures. These components further established the l infrastructure base for protecting oil and gas facilities against unauthorized access and other threats. Hardware components provide connectivity to remote locations by meeting the need for reliable power.

The services segment will show significant growth in the oil and gas security market over the forecast period. The growth of the segment can be linked to the expanding threat landscape, and strict regulatory complaints propel the requirement for customized security services. In addition, various oil and gas players lack complex security systems, which has led to a surge in the outsourcing of security measures. This segment encompasses a wide range of offerings, such as system integration of risk assessment, security consulting, and employee training.

The oil & gas companies segment led the global oil and gas security market in 2023. The dominance of the segment can be credited to the increasing need for comprehensive security solutions by Oil and gas companies to safeguard their personnel, assets, and operations across the overall chain. Moreover, Oilfield services companies offer technical skills, services, and equipment for testing, drilling, exploring, and producing oil and gas. The oil and gas companies also produce products like chemicals and plastics.

The pipeline operators segment is expected to grow at the fastest rate in the oil and gas security market over the projected period. The growth of the segment can be driven by the growing requirement for tailored pipeline security solutions, and regulatory compliance needs all contribute to the expansion of the market. Furthermore, by investing in innovative security solutions catered to pipeline protection, market players can overcome risks, ensure safe transportation, and protect critical infrastructure through wide pipeline networks.

Segments Covered in the Report

By Component

By End user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client