August 2024

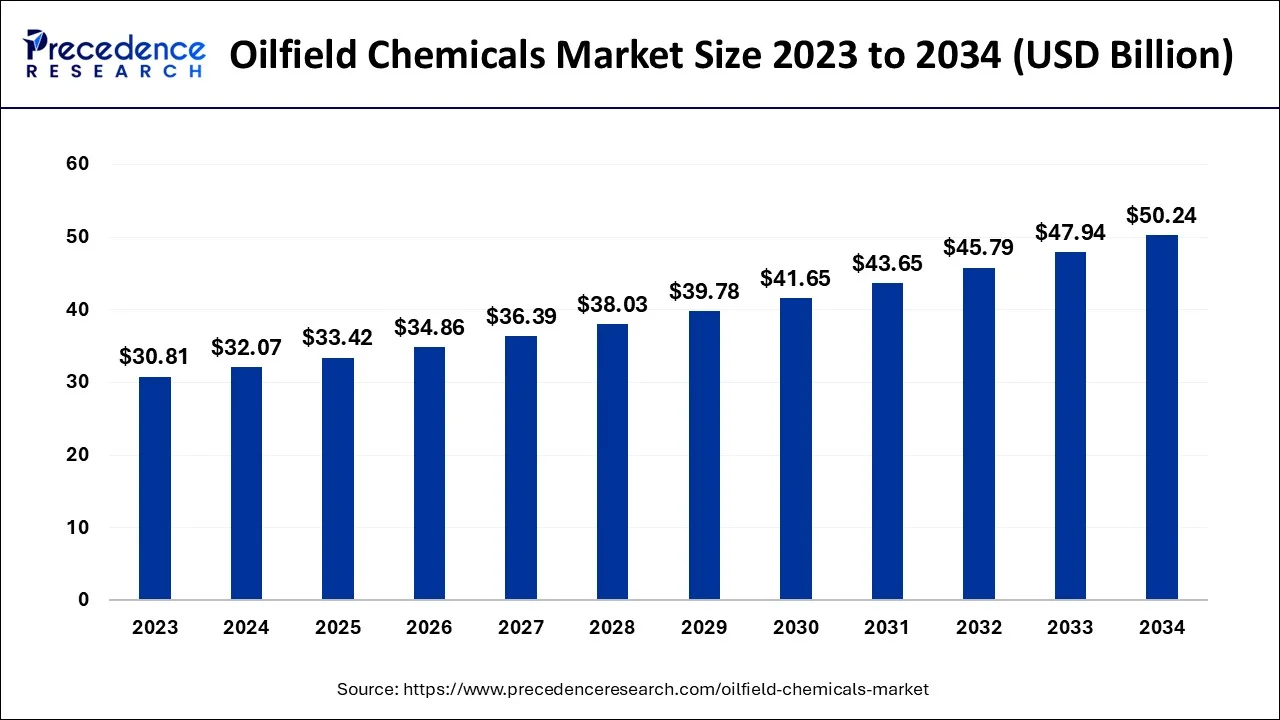

The global oilfield chemicals market size accounted for USD 32.07 billion in 2024, grew to USD 33.42 billion in 2025 and is predicted to surpass around USD 50.24 billion by 2034, expanding at a CAGR of 4.50% between 2024 and 2034. The Middle East and Africa oilfield chemicals market size accounted for USD 12.68 billion in 2024 and is anticipated to grow at a fastest CAGR of 4.60% during the forecast year.

The global oilfield chemicals market size is estimated at USD 32.07 billion in 2024 and is anticipated to reach around USD 50.24 billion by 2034, expanding at a CAGR of 4.50% between 2024 and 2034.

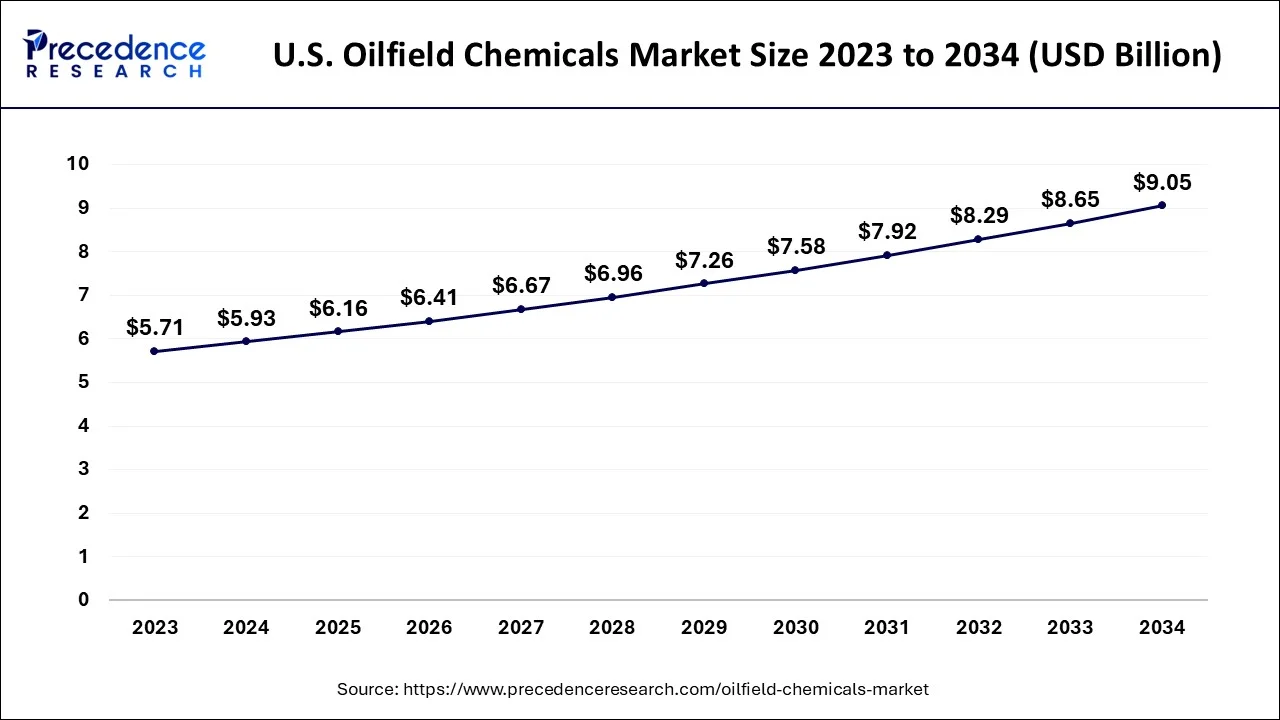

The U.S. oilfield chemicals market size accounted for USD 5.93 billion in 2023 and is expected to be worth around USD 9.05 billion by 2034, growing at a CAGR of 4.2% from 2024 to 2034.

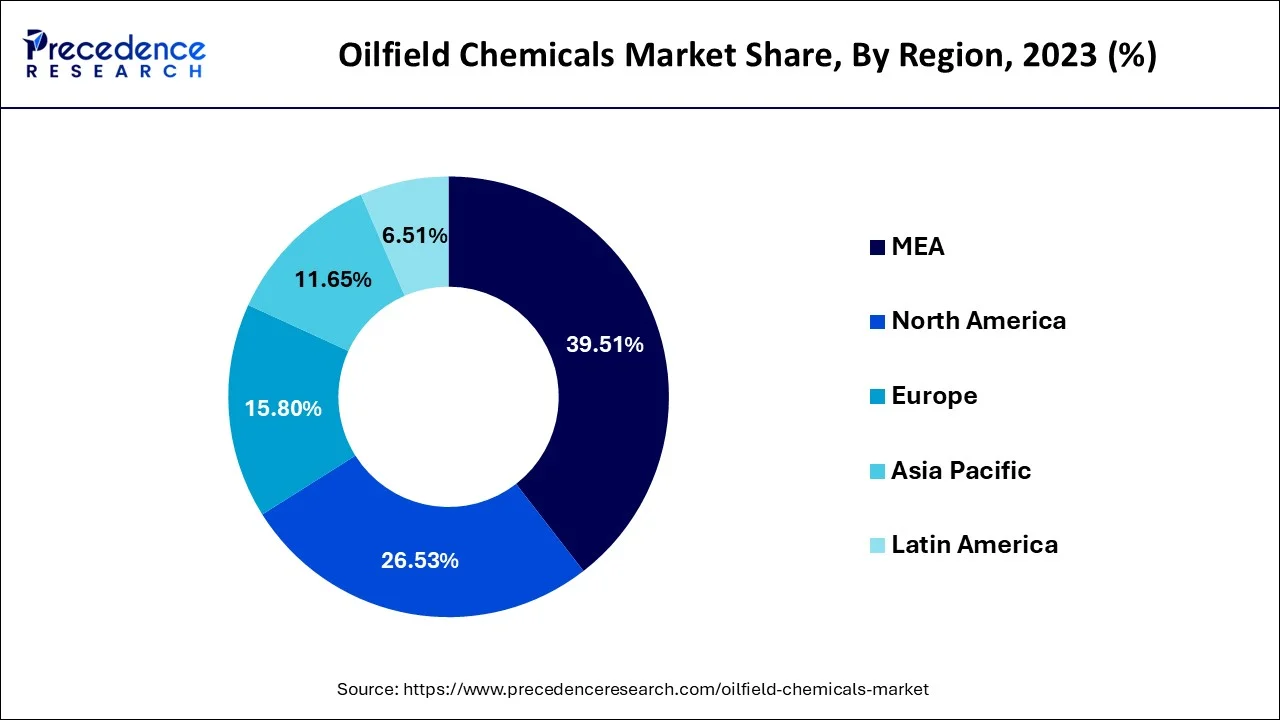

Middle East and Africa dominated the market with the largest share of 39.51% in 2023. Many countries in the Middle East, such as Saudi Arabia and Iraq, are among the world's top oil producers. The high production levels necessitate significant usage of oilfield chemicals to optimize production, maintain well integrity, and mitigate operational challenges such as corrosion, scaling, and wax deposition. Governments and national oil companies (NOCs) in the Middle East and Africa have made substantial investments in oil and gas exploration and production activities. These investments drive demand for oilfield chemicals to support drilling operations, well completion, and reservoir management efforts.

North America contributed 26.53% of revenue share in 2023. The regional growth is attributed to the growing oil & gas production. For instance, according to the Energy Information Administration (EIA), the average amount of U.S. crude oil produced daily in 2022 was 11.9 million barrels; the EIA predicts this year, in 2023, the crude oil production will set a new record with an average of 12.4 million barrels per day, only marginally more than last year.

Moreover, the expansion of the oilfield chemicals market is accelerated by an increase in onshore and offshore oil and gas development projects in the North American area. For instance, Driftwood LNG (Calcasieu Parish LNG Liquefaction Plant USA), an onshore natural gas project, will start operating in 2023. Additionally, Pemex, the state-owned oil and gas corporation of Mexico, said in March 2021 that it had found 1.2 billion barrels of oil and natural gas in an onshore complex in the state of Tabasco, near where the business wants to construct a new refinery. Oil and gas output will rise as a result, which is expected to enhance demand for oilfield chemicals.

The Asia Pacific region is witnessing significant growth in the oilfield chemicals market, driven by the region's high energy consumption and the need for efficient oil and gas operations. The growing population, rapid urbanization, and industrial development in countries like China, India, and Southeast Asian nations contribute to the increasing demand for oilfield chemicals. The region is home to several prominent oil and gas-producing countries, including China, India, Indonesia, Malaysia, and Australia. These countries have been actively exploring and developing their hydrocarbon resources, both onshore and offshore, leading to a higher demand for oilfield chemicals to support drilling, completion, and production operations. For instance, China's National Energy Agency established a domestic crude oil production target of around 1.5 billion barrels for 2022 after the government stressed the importance of crude oil exploration and production in May 2022. This goal is an increase of 2% from the plan for 2021.

Oilfield chemicals refer to a broad range of chemical substances used in the exploration, production, and refining of crude oil and natural gas. These chemicals play various roles in different stages of the oil and gas industry, including drilling, well stimulation, production, enhancement, corrosion prevention, and refining processes.

Oilfield chemicals can be categorized into several groups based on specific functions and applications, which include drilling fluid additives, production chemicals, and well stimulation. These chemicals are used in drilling muds to improve the efficiency of drilling operations. They may consist of viscosities, shale inhibitors, fluid loss control agents, and weighing agents to enhance the stability and lubricity of the drilling fluids.

The oilfield chemicals are also utilized during the production phase to optimize the flow of hydrocarbons from the reservoir to the surface. These chemicals are used in well-stimulation techniques like hydraulic fracturing to enhance the productivity of oil & gas reservoirs.

The oilfield chemicals market is expected to witness continued growth in the coming years. Key trends include the development of advanced chemicals with improved performance characteristics, adopting digital technologies for efficient chemical management and monitoring, and increasing investments in research and development activities to address evolving industry requirements.

| Report Coverage | Details |

| Market Size in 2024 | USD 32.07 Billion |

| Market Size by 2034 | USD 50.24 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.5% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Application, and By Location |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising production of oil & gas

The increase in oil and gas production worldwide is expected to boost the growth of the oilfield chemicals market. Oilfield chemicals protect equipment and pipes against corrosion. Scale inhibitors, biocides, surfactants, corrosion inhibitors, and friction inhibitors are widely used chemicals in oil production. They help to enhance productivity and recovery rates. They also prevent the formation of emulsions during the oil drilling process and help in the separation of oil and water. Moreover, the rising number of oil and gas exploration sites propels the market.

Changing regulations for the chemical industry

The key reason limiting the need for oilfield chemicals from growing is the evolution of chemical regulations. The criteria for enforcing chemical rules indicate that they are intricate and dynamic. Since many countries have their own set of rules and regulations, it is hard for international enterprises to adhere to them. Currently, nations like China, Japan, and Indonesia are striving to update their existing chemical regulations. As a result, the sector's growth is being constrained by evolving regulations and legislation.

Increasing technological advancements and focus on production optimization

Advances in oilfield technologies, such as horizontal drilling, hydraulic fracturing, and enhanced oil recovery techniques, have increased the complexity and efficiency of oil and gas operations. These advanced techniques often rely on specific chemical formulations and additives to optimize performance, resulting in a higher demand for oilfield chemicals. Additionally, Oil and gas companies aim to maximize production rates and recovery factors from existing wells and reservoirs. This drives the need for production chemicals that address challenges such as corrosion, scale deposition, emulsion formation, and flow assurance, leading to increased demand for oilfield chemicals. Therefore, the growing technological advancements and focus on production optimization are expected to provide a potential opportunity for the revenue growth of the oilfields chemical industry over the forecast period.

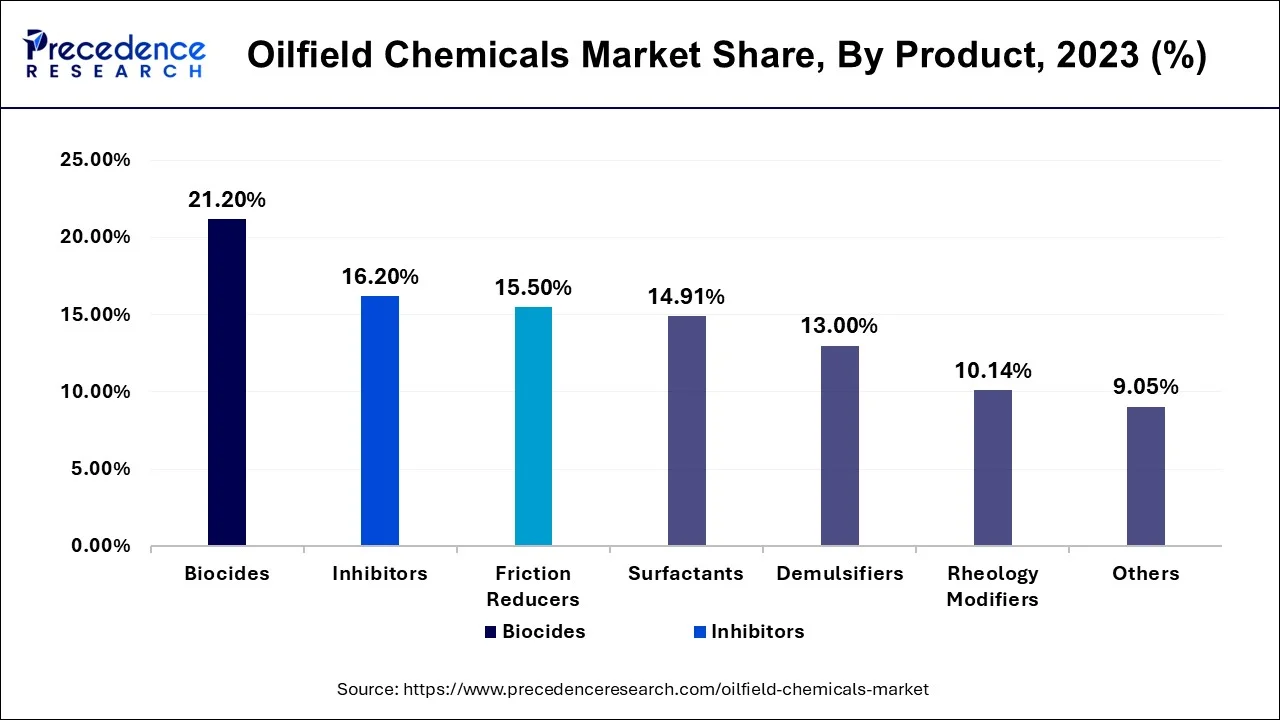

The biocides segment generated over 21.20% of revenue share in 2023 and it is expected to grow at the highest CAGR over the forecast period. The demand for biocides in the oilfield chemicals market is expected to continue growing as microbial control becomes increasingly important in the industry. There is a growing focus on developing environmentally friendly and biodegradable biocide formulations to meet regulatory requirements and address environmental concerns. Additionally, the development of advanced monitoring and control technologies to detect and manage microbiological issues is expected to influence the demand for biocides in the future.

The workover and completion segment held the largest share of 50.15% in 2023. Workover and completion operations involve various well intervention activities aimed at enhancing the productivity of oil and gas wells. These activities include cleaning, perforating, stimulating, and repairing wells to optimize production and extend their operational lifespan. Oilfield chemicals play a crucial role in facilitating these operations by addressing challenges such as scale formation, corrosion, and formation damage. The dominance of the workover and completion segment in the oilfield chemicals market is driven by the critical role these operations play in optimizing oil and gas production, maximizing resource recovery, and ensuring the integrity and reliability of oilfield assets.

The production chemicals segment is expected to grow at the highest CAGR over the forecast period. The increasing oil & gas production across the globe is one of the significant factors that propel the segment growth during the study timeframe. For instance, the OECD estimated that global crude oil output will be around 102.84 million barrels per day in 2023.

Global Oilfield Chemicals Market, By Application, 2021-2023 ($Million)

| Application | 2021 | 2022 | 2023 |

| Drilling Fluid | 5,399.3 | 5,574.9 | 5,761.5 |

| Production Chemicals | 5,742.2 | 5,990.0 | 6,254.4 |

| Cementing | 3,128.2 | 3,232.2 | 3,342.9 |

| Workover & Completion | 14,298.2 | 14,856.4 | 15,451.2 |

The onshore segment is expected to hold the largest market share during the forecast period. Onshore oil and gas projects frequently use oilfield chemicals like demulsifiers, corrosion inhibitors, and others because they quickly separate water from crude oil, lowering the expense of later water treatment stages. The need for oil field chemicals is rising as there are more onshore oil and gas projects underway across the world.

For instance, the Alaska LNG project in the United States and Sriracha Refinery Expansion & Upgrade in Thailand are expected to offer a plethora of opportunities for the oilfield chemicals sector by 2025 and 2024 respectively.

Global Oilfield Chemicals Market, By Location, 2021-2023 (USD Million)

| By Location | 2021 | 2022 | 2023 |

| Onshore | 20,011.8 | 20,787.1 | 21,613.2 |

| Offshore | 8,556.1 | 8,866.4 | 9,196.8 |

Segments Covered in the Report:

By Product

By Application

By Location

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

February 2025

April 2025

April 2025