April 2025

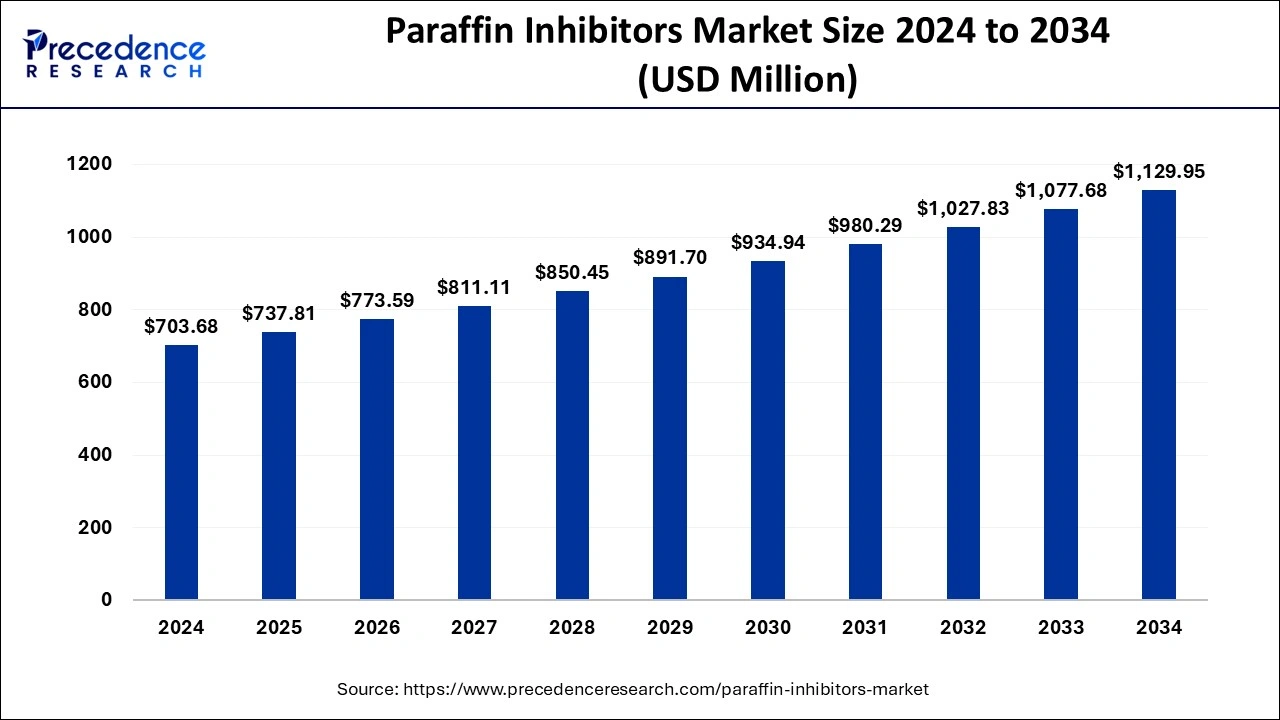

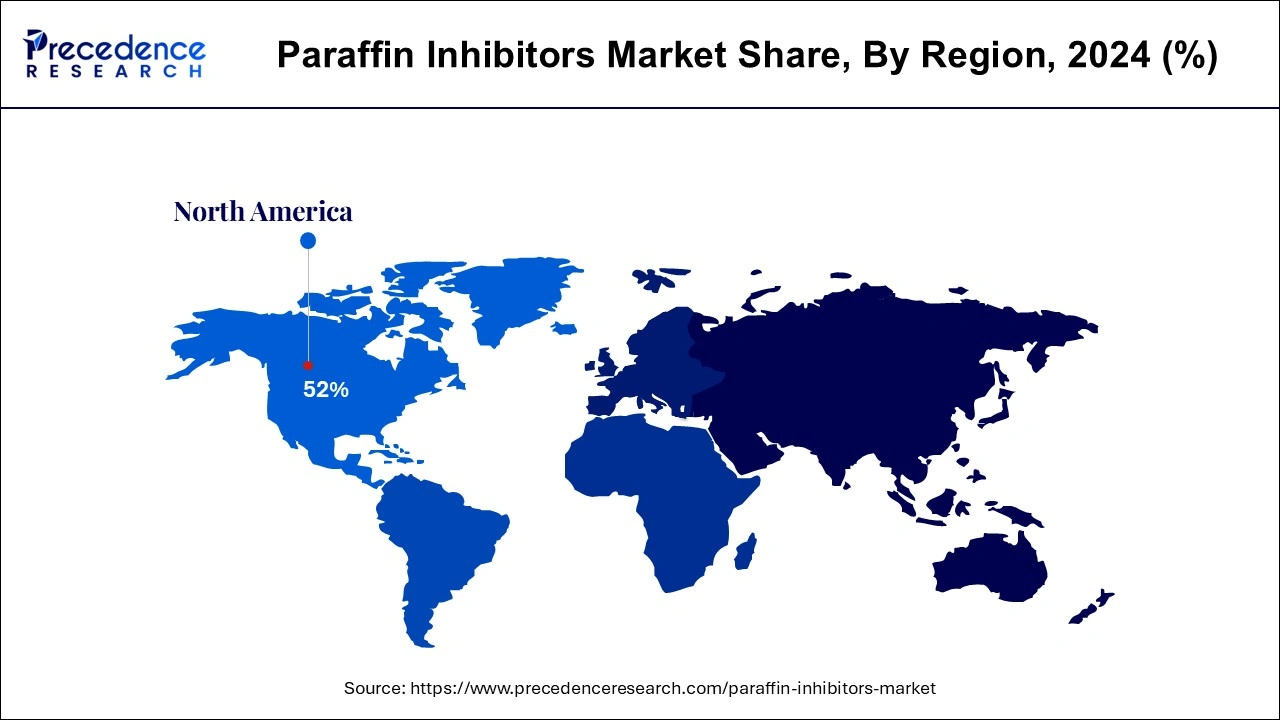

The global paraffin inhibitors market size is accounted at USD 737.81 million in 2025 and is forecasted to hit around USD 1,129.95 million by 2034, representing a CAGR of 4.85% from 2025 to 2034. The North America market size was estimated at USD 365.91 million in 2024 and is expanding at a CAGR of 4.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Million), with 2024 as the base year.

The global paraffin inhibitors market size was calculated at USD 703.68 million in 2024 and is predicted to reach around USD 1,129.95 million by 2034, expanding at a CAGR of 4.85% from 2025 to 2034. The demand for oil and gas explorations is the key factor driving the growth of the global paraffin inhibitors market. The surge in the development of sustainable and eco-friendly paraffin inhibitors is holding great market potential.

With the integration of artificial intelligence (AI), the paraffin inhibitors market is likely to witness extremely favorable changes in the upcoming years. The analytics of a broad amount of data and real-time monitoring and decision-making abilities are driving the integration of AI in major manufacturing and production industries, including the oil & gas industry and paraffin inhibitors production infrastructure. AI integration is not only helping to improve the effectiveness of products but also working to reduce production costs by minimizing production complexity and labor costs and providing real-time conditions of the market.

As the reduction of carbon emissions has become a crucial challenge in the paraffin inhibitors market, AI has become a significant solution to it. AI helps to reduce major energy consumption by analyzing consumption data and preventing sustainability as well as expenses. The ability of AI to improve health, safety, and environmental measures helps companies to comply with regulatory demands and requirements, further contributing to maintaining companies’ reputations and brand popularity. AI holds market potential by improving predictive maintenance, exploration, transportation, cost savings, and market dynamic measures.

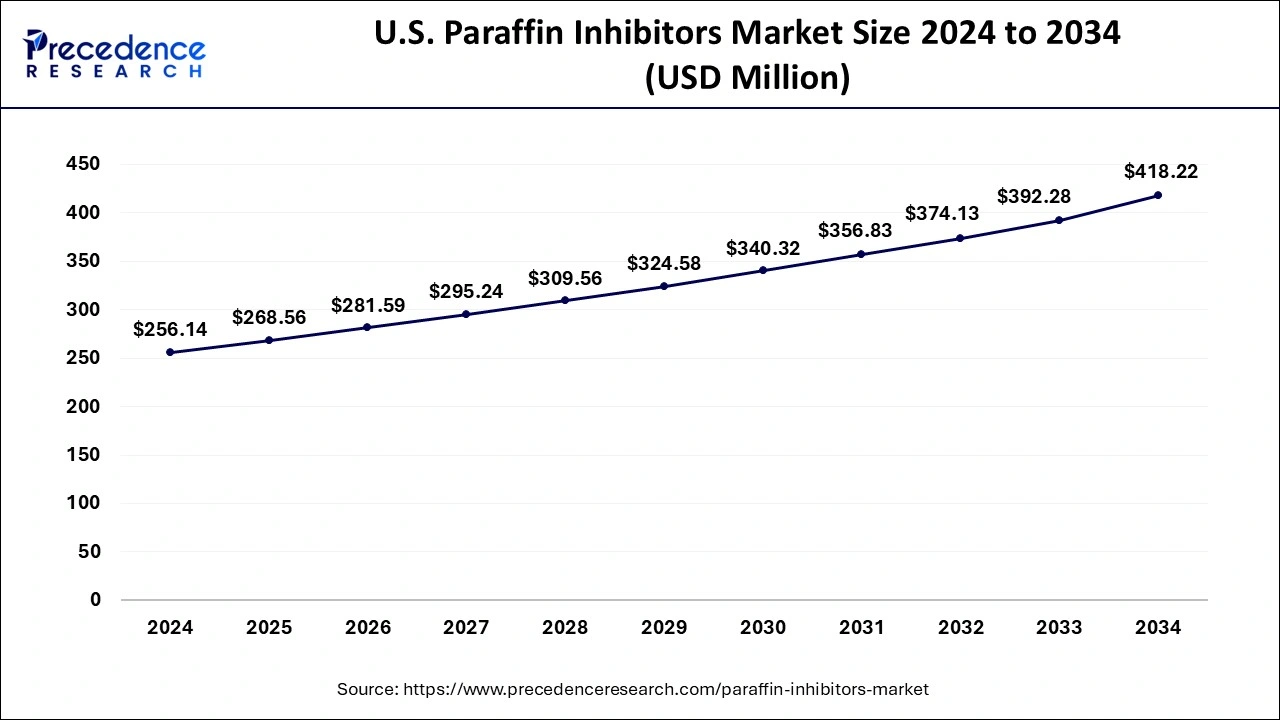

The U.S. paraffin inhibitors market size was exhibited at USD 256.14 million in 2024 and is expected to be worth around USD 418.22 million by 2034, growing at a CAGR of 5.03% from 2025 to 2034.

North America dominated the global paraffin inhibitors market in 2024. The presence of major oil and gas manufacturing companies to boost the North American market. North America has the availability of major oil and petrochemical businesses. The advanced oil & gas production is fueling the market growth. The region has the largest market share due to its world's largest opium production countries, like the United States, Canada, and Mexico.

The United States led the regional market due to the presence of major oil & gas production companies and strict regulation for environmental and safety standards. Early adoption of advanced technologies is playing a crucial role in countries' paraffin inhibitors market. Additionally, ongoing government promotions and investments in paraffin inhibitor technologies and research and development sectors are projected to continuously expand the market growth in the United States.

Asia Pacific will experience the fastest growth in the market during the forecasted years. Rising investment in infrastructure is helping the Asia Pacific market due to the rising adoption of oil and gas infrastructures and government investments. The rising refining capacity has increased the demand for paraffin inhibitors in the region. Countries like China, India, and Indonesia are driving the market expansion with increased oil and gas production in those countries.

China is leading the paraffin inhibitors market with countries rapidly growing oil & gas production and refining capacity. However, India is expected to lead the market in the forecast period due to the country's rising requirement for energy and government initiatives and investments in oil & gas production industries. Japan is expected to contribute a spectacular share in regional market growth due to countries raising strict environmental regulations and pressure for the development of sustainable and environmentally friendly paraffin inhibitors and the adoption of advanced technologies.

Paraffin inhibitors are used to reduce paraffin deposition in oil and gas pipelines, wells, and other equipment. The rapidly growing oil and gas production industries are significantly driving the adoption of paraffin inhibitors. Additionally, the growing global shift toward renewable energy due to the increased need for energy is surging the market. Increased government and regulatory focus on reducing carbon footprints has encouraged key companies to invest in sustainable solution developments. The paraffin inhibitors market has witnessed challenges like environmental regulations and continuously rising raw material prices. However, the rising innovation and developments of eco-friendly paraffin inhibitors and the adoption of advanced technologies are holding great market potential.

Upstream and downstream applications are emerging in the market. Developing countries have increased investments in oil & gas production industries, making a favorable impact on the paraffin inhibitors market growth. The increased need for oil & gas explorations has focused on reducing the cost of production and inhibitors, making them more popular in the market. North America is continuously leading the market with the presence of major companies. However, Europe and Asia Pacific accounted for the fastest-growing with European environmental regulation guidelines and Asian government initiatives and investments in infrastructure. The Middle East and Africa contribute significantly to the market due to the major availability of raw materials for the production of paraffin inhibitors in the region.

| Report Coverage | Details |

| Market Size by 2024 | USD 703.68 Million |

| Market Size in 2025 | USD 737.81 Million |

| Market Size in 2034 | USD 1,129.95 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.85% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chemistry, Operation, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising energy demands

The increased demands for energy worldwide are key drivers of the rapid growth of the paraffin inhibitors market. The rapidly growing population and industrialization are the major reasons behind increased energy demands in the globe. As the energy demands are rising, the oil and gas production are increasing. The energy demands have also increased the demand for refining capacity and petrochemicals like plastics and fertilizer. Additionally, the rising need for energy has driven government and business focus on energy security, which requires oil & gas transportation, where paraffin inhibitors are essential. The increased energy demands have led to the innovation and development of more effective and reliable paraffin inhibitors.

Adoption of advanced chemical formulation

The rising sustainability consciousness has driven the advancements in chemical formulation with improved effectiveness and sustainability goals. The improved solvency of chemical formulations leads to better dissolution of paraffin wax, which reduces the deposition and enhances the flow. Additionally, improved inhibitors with better efficiency help to reduce requirements, which further minimizes cost and carbon footprints. The ability of the advanced chemical formulation to improve performance, eco-friendliness, and biodegradable abilities is rapidly increasing its adoption.

Price fluctuations

The major restraint of the global paraffin inhibitors market is volatility in raw material prices and production costs. The production of paraffin inhibitors is linked to crude oil and chemicals. The high cost of such raw materials is impacting the production range of the paraffin inhibitors. Additionally, the raw material cost impacts the production cost, making paraffin inhibitors expensive, which can hamper the manufacturer's profit margin as well as market competition. The price fluctuations are limiting the adoption of paraffin inhibitors.

Developments of eco-friendly paraffin inhibitors

The rising environmental regulation pressures for the development of eco-friendly and sustainable paraffin inhibitors are holding opportunities for novel innovations and developments in the paraffin inhibitors market. The companies have increased their investment in sustainable solutions to reduce environmental impacts and carbon footprints. The growing focus on climate change has also contributed to the rise in demand for eco-friendly paraffin inhibitors. The rising global surge for renewable energy is creating room for improvement and development.

Additionally, the adoption of advanced technologies is helping to cut costs and improve eco-friendly paraffin inhibitors. The shift to the adoption of reduced environmental impacts and safe, affordable solutions is holding market potential. Moreover, with the rising market competition and companies’ determination to maintain their reputation and meet regulatory demands, the development of environmentally friendly paraffin inhibitors in the upcoming period.

The modified polycarboxylate segment captured the highest share of the market in 2024 due to its effectiveness in inhibiting paraffin dispositions. The segment growth is also attributed to the growing utilization of modified polycarboxylate in complex and difficult oilfields. The ability to maintain stability in high temperatures is the key factor for increased use of modified polycarbonates in deeper water and high-temperature oilfield environments. Modified polycarboxylates are great chemical resistant and also easier to apply in oilfield operations. Moreover, the cost-effectiveness of modified polycarboxylate compared to other solutions makes them more popular in the industry. The rising demands for customized solutions are expected to continue to expand the segment.

The upstream segment dominated the market in 2024. The segment growth is anticipated due to the increased utilization of paraffin inhibitors to prevent paraffin deposition in oil pipelines and wells. The increasing need for crude oil and gas, the rising complexity of deepwater operations in oilfields, and the segment are all attributed to continuously dominating the market. Moreover, the use of upstream operations in high-risk activities like production and drilling is making the segment more popular in the market. The need for paraffin inhibitors has increased in managing complexity in upstream oilfield environments, such as high-temperature and high-pressure situations, with the need for increasing productivity and operational reliability.

On the other hand, the downstream segment is anticipated to witness significant growth in the paraffin inhibitors market over the forecast period due to the rising utilization of paraffin inhibitors to prevent deposition in crude oil and petrochemical plants. The growing demand for petrochemical oil products and the requirement for paraffin inhibitors in refineries and pipelines.

By Chemistry

By Operation

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025