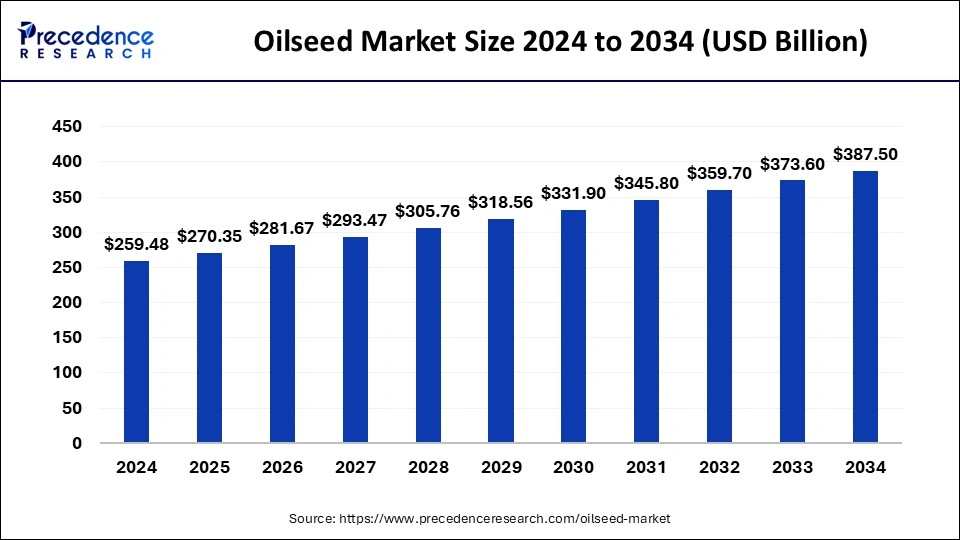

The global oilseed market size is evaluated at USD 270.35 billion in 2025 and is forecasted to hit around USD 387.50 billion by 2034, growing at a CAGR of 4.08% from 2025 to 2034. The Asia Pacific market size was accounted at USD 91.76 billion in 2024 and is expanding at a CAGR of 4.81% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global oilseed market size accounted for USD 259.48 billion in 2024 and is predicted to increase from USD 270.35 billion in 2025 to approximately USD 387.50 billion by 2034, expanding at a CAGR of 4.08% from 2025 to 2034.

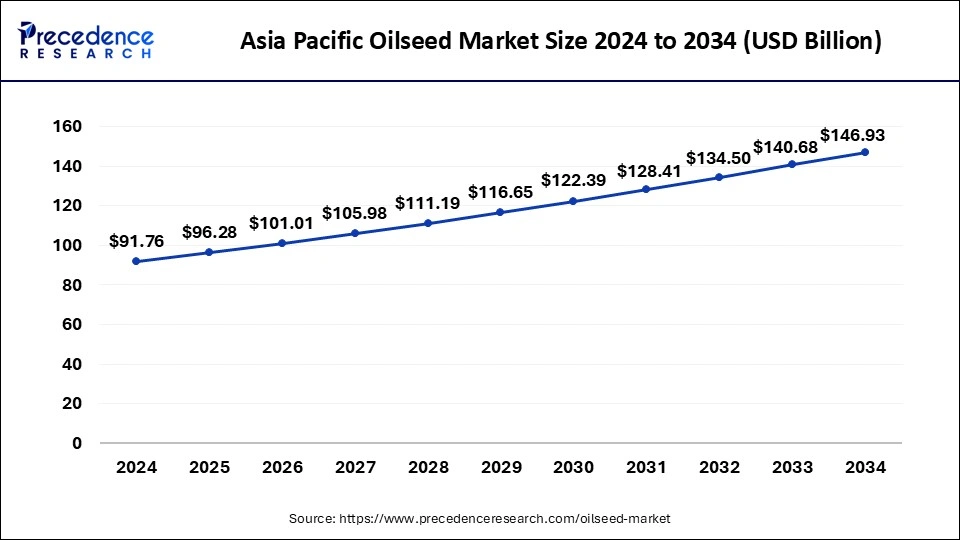

The Asia Pacific oilseed market size was evaluated at USD 91.76 billion in 2024 and is projected to be worth around USD 146.93 billion by 2034, growing at a CAGR of 4.81% from 2025 to 2034.

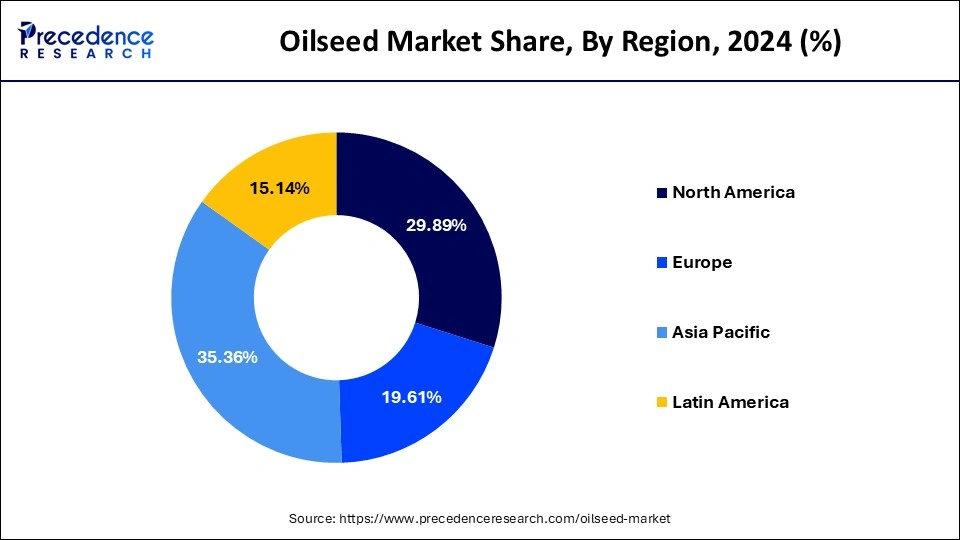

Asia-Pacific leads the oilseed market with a large market share of 35.12% in 2024 due to the growing food processing industry and increasing soybean production. India is considered the 4th largest producer of oilseeds and about 39.46 million tons of oilseeds were produced in 2018. Furthermore, soybean is the most important crop grown in India and hit 95% of the total production, which increases the use of soybean oil and thus drive the growth of the market.

However, North America held a market share of 29.89% in 2024. This is due to the increased use of cooking oil in regular cooking, which increases oilseed production. Moreover, soybean production in the United States has increased, so the growth in soybean oil consumption is continuing to accelerate the growth of the market. The United States is the world's largest soybean producer and second largest exporter. Soybeans hit about 90% of US oilseed production.

Oilseeds like sunflower, groundnut and soybean are mainly used as vegetable oil in households. People use these oilseeds as they are very beneficial to health and also they generate income and employment. These crops are not only limited to domestic use; they can also be applied in various other industry sectors like food, pharmaceuticals, cosmetics and animal feed. Because of this versatility of oilseeds, they are now in more demand and for that reason the market is booming worldwide. The oil produced from oilseed is used in human food products, while the oil residue is used as animal feed.

Vegetable oil is an invaluable product in the whole world. Due to increased acceptance and a vast area under cultivation anticipate the market to be augmented. Soybeans contain fiber, protein and are cholesterol free. Cottonseed oil is cooking oil made from the seeds of Gossypium hirsutum and gossypium herbarium cultivated for cotton plants, especially cotton fibre and animal feed, and like other oilseeds, such as sunflower seeds, cotton seeds have and oily core surrounded by a hard outer shell. Oil is removed from the grain during processing. Oil is extracted from soybean to use it as a vegetable oil. It is the second most consumed oil. Soybean is not only used for extracting oil but also for consumption as a seed legume in human diet. Soybean meal is an important component of formulated poultry and fish meals. Soybean protein is referred to as a complete protein because of its amino acid content. It is well known for its nutritional significance in the treatment of heart disease and diabetes.

Printing inks (soy ink) and oil paints use processed soybean oil as a foundation for drying oils. Sesame seed is one of the world’s oldest oilseed crops, having been domesticated over 3,000 years. Many other species of Sesame exist, the majority of which are wild and native to Sub-Saharan Africa. The cultivated type, S. indicium, is from India. It thrives in drought-stricken areas, where other crops have failed. The oil content of sesame is among the greatest of any seed. It’s a common component in cuisines all across the world because of its rich, nutty flavor. It, like other foods, has the potential to cause allergic responses in some people. Japan imports the most sesame in the world. Sesame oil, peculiarly from roasted seeds, is a significant component of Japanese cuisine and has traditionally been the seed’s primary purpose. World’s second-largest importer of sesame is China, primarily oil-grade sesame. China sells food-grade sesame seeds at a reduced cost, primarily to Southeast Asia.

The market is booming as the production of soybean oil has increased as the result of its demand by the population due to its nutritional value. Some of the reasons driving the growth of the oilseeds market include the need for healthy and organic oilseed-processed goods, public-private collaborations in varietal development, and molecular breeding in oilseeds. Sunflower seeds are used for the purpose of producing sunflower oil.

Sunflower oil is extensively used as frying oil in food and as a lubricant in cosmetic applications. It contains linoleic acid, a polyunsaturated fat and oleic acid, a monounsaturated fat. It also consists of huge amounts of Vitamin E. Unrefined sunflower oil is used as a salad dressing in Eastern European cuisines as it contains omega-6 fatty acids and is very nutritious. It is generally used by the public for its health benefits. Sunflower butter contains sunflower oil as well. When sunflower oil is extracted, the crushed seeds are left behind, which are high in protein and dietary fibre and can be utilized as animal feed, fertilizer, or fuel. PEG-10 sunflower glycerides are the polyethylene glycol derivatives of mono- and diglycerides generated from sunflower seed oil with an average of 10 moles of ethylene oxide, and are a pale yellow liquid with a “slightly fatty” odour.

Sunflower glycerides PEG-10 are widely utilized in cosmetic compositions. When mixed with diesel in the tank, sunflower oil can be utilized to run diesel engines. In frigid temperatures, viscosity is enhanced due to the high quantities of unsaturated fats. Because it is a rich source of oil, ash calcium, carbohydrate and protein, the sunflower segment in this market is expected to grow at the quickest rate. Sunflower seeds are widely employed in the feed business as sunflower meal, which is increasingly being used as an alternative for soybean meal due to its higher price. Canola or rapeseed oil is produced by Rapeseed, which is also known as rape or colza, which is a mustard plant cultivated for its seeds. Canola oil is multifarious in nature as it is used for cooking, as a soap and margarine ingredient, and as a lamp fuel (colza oil). Jet engines use the liquefied form of the oil to lubricate and can also be converted to biodiesel.

Fodder is produced, as a result of the seeds which are left over after oil extraction. The plant can be used as a green manure and cover crop. After soybean and palm oil, rapeseed was the world’s third-largest source of vegetable oil in 2000. After soybean, it is the world’s second-largest source of protein meal. Rapeseed meal is produced as a byproduct of the oil extraction process. A high-protein animal feed is produced as a byproduct, which is competitive with soybean. The feed is mostly used for cattle, although it is also used for pigs and fowl. Natural rapeseed oil, on the other hand, includes 50% erucic acid and large quantities of glucosinolates, lowering the nutritional value of rapeseed press cakes for animal feed.

| Report Coverage | Details |

| Market Size in 2025 | USD 270.35 Billion |

| Market Size by 2034 | USD 387.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.08% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Breeding, Biotech Trait, End User, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

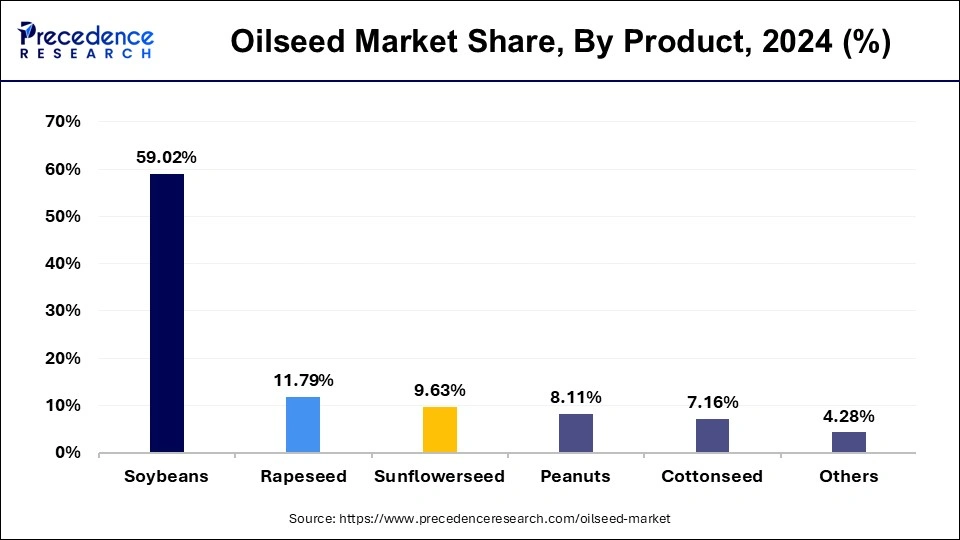

The soybean segment held the largest share in oilseed market. The global oilseed market, of which the soybean market is a major component, is essential to agricultural economies and food production systems across the globe. Together, the United States, Brazil, and Argentina are the world's top producers of soybeans, making up around 80% of the crop. Although it varies every year, the world produces 350–370 million metric tons of soybeans. Over time, improvements in biotechnology and agricultural methods have led to a consistent rise in yields. Soymeal is becoming more and more necessary as the world's need for meat grows, especially in poorer nations. The market for soy-based goods has grown as consumers' preferences for plant-based diets and protein sources have grown.

The peanuts segment is expected to be fastest growing market. The market for oilseeds is dominated by peanuts because of their many applications and health advantages. China and India are the top two importers and consumers of peanuts as of 2024; China uses almost half of its supply of peanuts for direct human consumption and the other half for the production of oil and meal. India is next, with significant domestic consumption and an increasing export market—especially in light of the development of new, high-yielding, drought-resistant cultivars. Global trade dynamics and production patterns continue to have an impact on the oilseed market as a whole, which includes the peanut market. According to USDA data, peanut production and consumption are steadily rising, especially in Asia-Pacific areas where peanut-based snacks and goods are very well-liked.

Oilseed Market Revenue, By Product, 2022-2024 (USD Billion)

| By Product | 2022 | 2023 | 2024 |

| Soybeans | 141.65 | 147.29 | 153.15 |

| Rapeseed | 27.90 | 29.22 | 30.60 |

| Sunflowerseed | 22.70 | 23.81 | 24.98 |

| Peanuts | 19.60 | 20.31 | 21.05 |

| Cottonseed | 17.07 | 17.81 | 18.59 |

| Others | 10.13 | 10.61 | 11.11 |

The animal feed segment held the largest share in oilseed market. The most widely utilized protein source in animal feed worldwide is soybean meal. In addition to being high in vital minerals required for animal growth and development, it has a balanced amino acid profile. Another important source of protein is canola meal, especially in areas where canola is farmed widely. In animal feed formulations, sunflower and cottonseed meals are also used, albeit less so than soybean and canola meals. Feed component pricing, dietary preferences, regulatory rules, and changes in livestock production all have an impact on the demand for oilseed meals in animal feed. The use of oilseed meals in animal feed is also impacted by the cost and accessibility of substitute protein components and rival protein sources like fish meal.

The edible oil is expected to be fastest growing market. The edible oil market is huge and diverse, especially when oilseeds are included. Oilseeds include crops including soybeans, rapeseed (canola), sunflower, palm kernels, and others that are farmed mainly for their oil content. After being crushed, the oil from these seeds is refined and used in a variety of industrial and culinary applications. one of the edible oils that is produced and consumed most frequently in the globe. It is a multipurpose ingredient that can be used in frying, cooking, salad dressings, margarine, and a number of processed goods. It is especially well-liked in Mediterranean cookery and comes in many grades, such as ultra virgin, virgin, and refined, each with unique flavor characteristics and culinary uses. Factors such as consumer preferences, health concerns, price changes, and agricultural policy impact the edible oil market.

Oilseed Market Revenue, By Type, 2022-2024 (USD Billion)

| By Type | 2022 | 2023 | 2024 |

| Animal Feed | 135.01 | 140.24 | 145.68 |

| Edible Oil | 104.03 | 108.81 | 113.81 |

The genetically modified segment held the largest share in oilseed market. Increasing the production of oilseed crops is one of the main goals of genetic modification. Higher yields per acre are a result of traits including enhanced tolerance to environmental conditions like drought and resilience to pests, diseases, and herbicides. Genes that confer pest resistance may also be included into genetically modified oilseed crops. For example, crops like cotton and soybeans frequently include Bt (Bacillus thuringiensis) characteristics, which offer protection against particular insect pests. From an economic perspective, farmers may experience cost reductions from GM oilseed crops. Higher yields, less need for pesticides, and more effective weed control all help to bring down production costs and possibly increase profits.

The conventional segment is expected to be fastest growing market. The term "conventional" in the oilseed industry usually refers to the conventional or non-genetically modified (non-GMO) oilseed varieties. These are seeds that have not undergone genetic alteration and have been cultivated using traditional farming techniques. Genetically modified (GM) or biotech oilseeds—varieties that have been genetically altered to have certain characteristics like insect or herbicide resistance—are frequently contrasted with conventional oilseeds. For generations, conventional oilseeds have been the standard, and they continue to account for a sizable share of the world oilseed market. Some customers value them because they like things that are thought to be more conventional or natural. The need for conventional oilseeds in those areas is further supported by the stringent laws governing the use and labeling of genetically modified organisms (GMOs) in several markets, namely in Europe.

The herbicide tolerant segment held the largest share in oilseed market. In the oilseed industry, genetic engineering of oilseed crops to confer resistance to specific herbicides is known as herbicide tolerance. This characteristic makes it easier for farmers to manage weeds and may even boost yields by enabling them to use certain herbicides to suppress weeds without endangering oilseed crops. Glyphosate tolerance is the most prevalent herbicide tolerance trait in oilseed crops. A common broad-spectrum pesticide in agriculture for weed control is glyphosate. Oilseed crops that have been genetically modified to withstand glyphosate allow farmers to apply the herbicide directly to the crops, eliminating weeds without harming the oilseed plants. Because over-reliance on a single herbicide can result in the establishment of resistant weed populations, the adoption of herbicide-tolerant crops has also sparked worries about herbicide resistance in weeds.

Households or residential areas. Oilseeds are used as a vegetable oil cooking. They are used in households as they are abundant in protein and fat, and they have a high fat content. As a result, they are not only high in protein, but also high in concentrated energy. The expanding demand for vegetable oils in an ever-increasing number of homes is driving demand for oilseeds. Furthermore, the growing need for biofuels in both developing and developed countries is propelling the oilseeds market forward. To meet the ever-increasing demand for oil around the world, farmers are increasingly turning to genetically engineered oilseeds to boost productivity.

In commercial sector, oilseeds are high in demand because of its various applications. Oilseeds like sunflower as a type of moisturizer in cosmetic products. Oil seeds are India’s second-largest agricultural export after food grains. As people are taking precedence over their health, they are choosing vegetable oil over animal fat. Linseed Oil, in addition to different vegetable oils, are extensively used for manufacturing of paints, varnishes, and lubricants. Employment is also booming as people are hired in factories to extract fit to be eaten oil from oil seeds. More than ten million people are hired in the oil sector. Oil-cake is used to feed cows and also as a fertilizer for vegetation which includes cotton, tobacco, tea, and sugarcane. Edible oils are essential part of our life as they provide health benefits.

Oilseeds are also used in Automobile sector extensively as a source of fuel. For example, sunflower oil is used in diesel engines to run it when mixed with diesel in the tank. In the automobile paint industry, castor seed oil has been evaluated as a plasticizer and film forming. The seed meal had a low moisture content, making it ideal for glossy auto paint.

Biodiesel uses rapeseed oil in engines as gas to power it in heated gas systems or mixed with cleansing petroleum. Biodiesel can be utilised in its Natural shape in contemporary in jeans without inflicting harm To the engine, and it’s far mechanically mixed with fossil gas diesel in ratios starting from 2% to 20% Biodiesel. Because rapeseed derived biodiesel from new oil is more costly than everyday diesel gas because of the expenses of cultivating, crushing, and refining rapeseed biodiesel, diesel fuels are usually crafted from vintage oils.

Rapeseed oil is the number one oil inventory for biodiesel manufacturing in maximum of Europe, accounting for over 80% of the feedstock. This is partially because of the truth that rapeseed produces greater oil according to unit of land region than different oil sources, together with palm oil. A 2018 study observed that rapeseed could turn out to be an unreliable supply of oil for biofuels due to environmental modifications associated with the aid of using weather change.

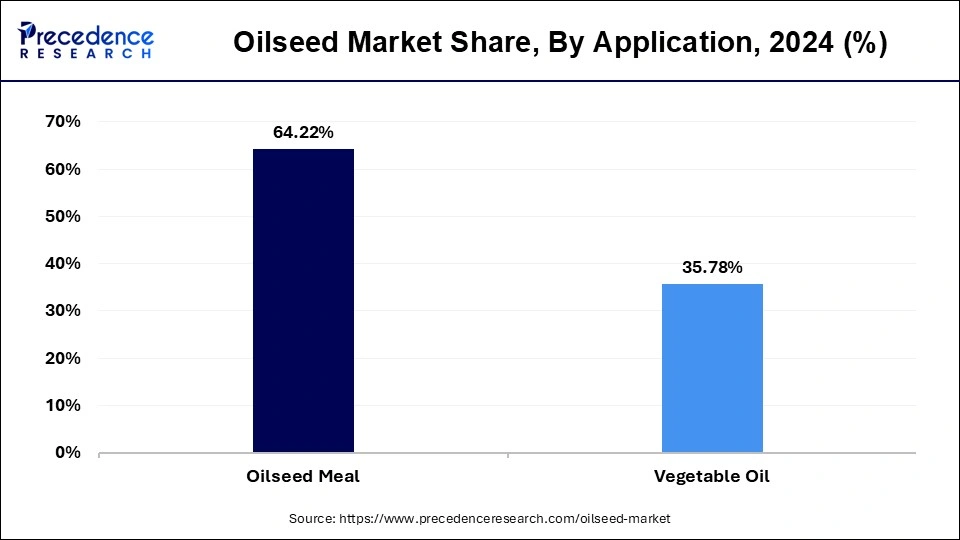

Oilseed Market Revenue, By Application, 2022-2024 (USD Billion)

| By Application | 2022 | 2023 | 2024 |

| Oilseed Meal | 154.14 | 160.27 | 166.65 |

| Vegetable Oil | 84.90 | 88.78 | 92.83 |

By Product

By Type

By Breeding

By Biotech Trait

By End User

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client