November 2024

Oleochemicals Market (By Products: Specialty Esters, Glycerol Esters, Alkoxylates, Fatty Acid Methyl Ester, Fatty Amines, Others; By Application: Personal Care & Cosmetics, Consumer Goods, Food & Beverages, Textiles, Paints & Inks, Industrial, Healthcare & Pharmaceuticals, Polymer & Plastic Additives, Others; By Form; By Feedstock) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023 – 2032

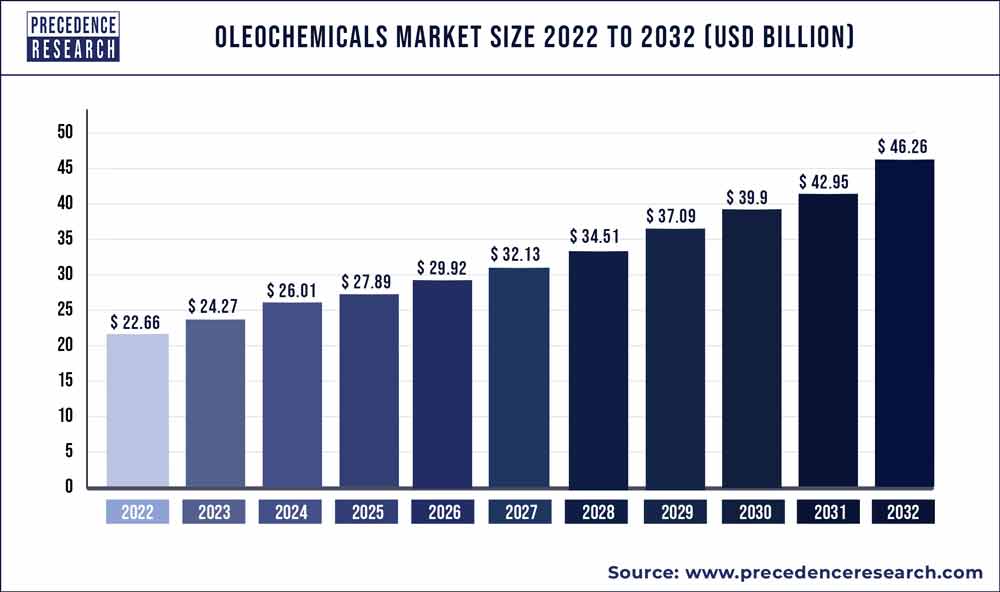

The global oleochemicals market size was estimated at USD 22.66 billion in 2022 and is expected to hit around USD 46.26 billion by 2032, registering a CAGR of 7.4% during the forecast period 2023 to 2032. Here are some insights about oleochemicals market:

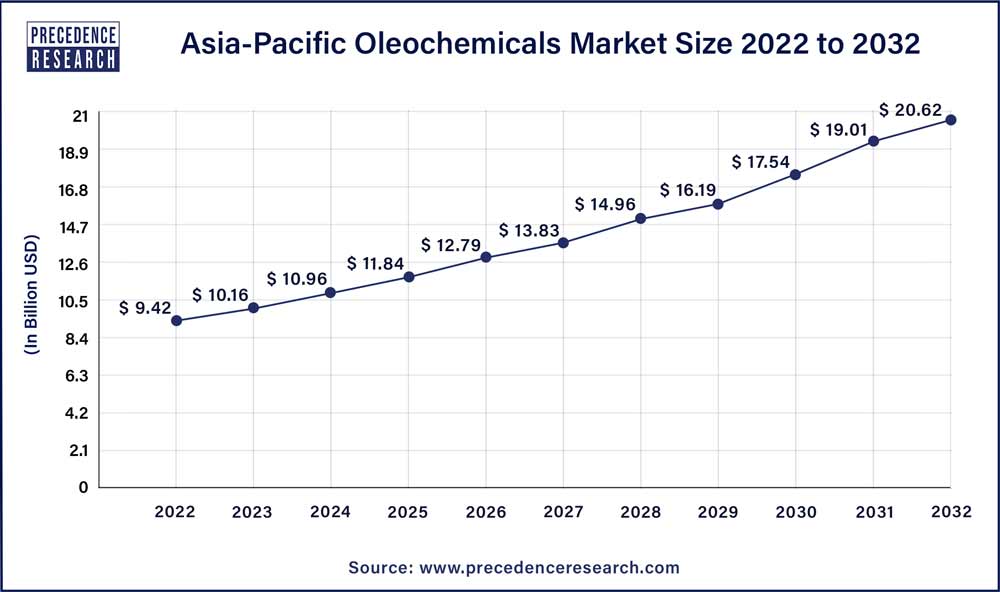

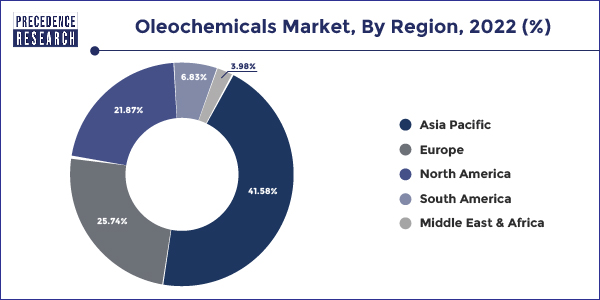

Asia Pacific market was accounted largest revenue share in 2023. There was an increased demand in various end user industries which had led to an increase in the market share. Increased use of raw materials like the biobased polymers and fatty acids in various industries led to a growth of the market. All the chemicals are majorly produced in Indonesia and Malaysia and Asia Pacific region is the largest consumer of this product. It consumes over half of the global production. Due to an easy availability of the feedstock and rising demand for this product, the market is expected to grow during the forecast. As the customers prefer natural products, the manufacturers are also using natural products in the production of oleochemicals.

The North American market is expected to grow well during the forecast period due to various industries in North America, like pharmaceutical, personal care and cosmetics that are expected to support the growth of the regional market.

Oleochemicals are mainly produced from plant oils, and they are used in cosmetics in other chemical products and lubricants. In order to provide high biodegradability, the oleochemical industry is now focusing on renewable feedstocks. There shall be an increase in oilseed production due to the increased demand for oleochemicals. Oils and fats are very important materials which are used in the production of oleochemicals. Due to a demand for renewable and sustainable biobased chemicals for the food and beverages or the personal care and cosmetics or the pharmaceutical industries the market for oleochemicals is expected to grow.

For the production of surfactants, detergents, soaps, and lubricants oleochemicals are consumed in the form of fatty acids. It is also used in the production of varnishes and pharmaceuticals. During the pandemic the demand for oleochemicals had dropped. The pandemic had shattered this sectors demand and supply chains. Rules and regulations by the government had triggered the impact to this industry. All the manufacturing activities had come to a halt. There was a temporary halt in the production of various chemicals. Due to the virus outbreak in Wuhan, the production of the chemicals was highly affected in China. China is the leading consumer and producer of the chemicals.

Delays and disruptions in the logistics services increase restrictions, limited staff and shortage of ttechnical personals had impacted the manufacturing process of the oleochemicals. Due to depletion of fossil fuels and increased global pollution there was a serious threat to environment. Increased use of biofuels, like that of biodiesel will help in resolving these problems. Biodiesel is manufactured from the natural feedstock which is obtained from oil and fat. And the adoption of these fuels is expected to provide a growth opportunity for this market.

It is anticipated that the overall product demand in the US shall rise with the use of all chemicals in the end user industries such as the personal care industries and the pharmaceutical industries. The demand for the olechemicals is also expected to grow as there is an increase in the demand for cleaning products industry which includes self acting soaps, etc. Procter and Gamble, which is a leading manufacturer in the cleaning products line, it is based in Europe and imports many oleochemicals from Malaysia and Indonesia.

The oleochemical segment is expected to grow in the forecast period as there is a demand for the use of natural organic skin care and hair care cosmetic products. As the environmental regulations are becoming stringent constantly and the renewable resources are getting depleted. There is an opportunity for the growth of the oleochemicals and they shall substitute the conventional petroleum based products. The market for green chemicals is rising and there's an increase in the demand for such products in the consumer markets.

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 7.4% |

| Market Size in 2023 | USD 24.27 Billion |

| Market Size by 2032 | USD 46.26 Billion |

| Asia Pacific Market Share in 2022 | 41.58% |

| Glycerol Esters Segment Revenue Share 2022 | 32.83% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | Products, Application, Form, Feedstock, Geography |

| Companies Mentioned | BASF, Evonik Industries AG., SABIC, Godrej Industries Limited, Emery Oleochemicals LLC., Oleon NV, KLK Oleo, Kao Corporation |

Various oleochemical products are fatty acids, methyl Ester and glycerol esters. Specialty esters accounted largest revenue share of around 32.83% in 2022. As it is used in the production of cosmetics, rubber and as a lubricant in the pharmaceutical applications.There is a greater demand for fatty acids in various cleaning agents like the surfactants, detergents, etc. The pharmaceutical and the cosmetic industries are also using fatty acids in the manufacturing of their products.

The fatty acids segment shall have the largest market share. Cetyl alcohol, which is a very commonly used product in the cosmetics is used widely in lipsticks, hair lotions and shaving creams. They are also used in antihistamine creams as there is an increased use of glycerin by various companies. There is research and development in order to find alternative methods in order to purify the crude glycerin. The purity of glycerin drives the market and makes it more appealing for potential buyers. The manufacturing of glycerin in a more refined manner is expected to help in the growth of the market.

The industrial application segment dominated the market with a revenue share of around 22.06% in 2022. However, the personal care & cosmetics segment is estimated to account for the highest revenue share by 2032 growing at the fastest CAGR over the forecast years.

The personal care and the cosmetic segment is expected to grow during the forecast period with the fastest CAGR until 2030, the Industrial application segment had the largest share. The growth of the personal Care and cosmetic segment is credited to the shift in the consumers demand for natural products and eco friendly products. The manufacturers have upgraded their technologies and have brought in more innovative technologies to meet the regulatory frameworks of the government. In the cosmetics industry there should be an increase in the overall product demand for the United States, as there is a growing need for this product in pharmaceuticals and personal care.

The pharmaceuticals and the food and beverages industry shall have a greater demand for glycerol derivatives. Due to an increase in the cleaning products industry the demand for oleochemicals will increase during the forecast. The use of bio based raw materials in the manufacturing of organic personal care products will lead to an increase in the oleochemicals market. With the increased use of stabilizers, biobased thickeners and food additives it is expected that the segment shall grow.

By Products

By Application

By Form

By Feedstock

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024