May 2025

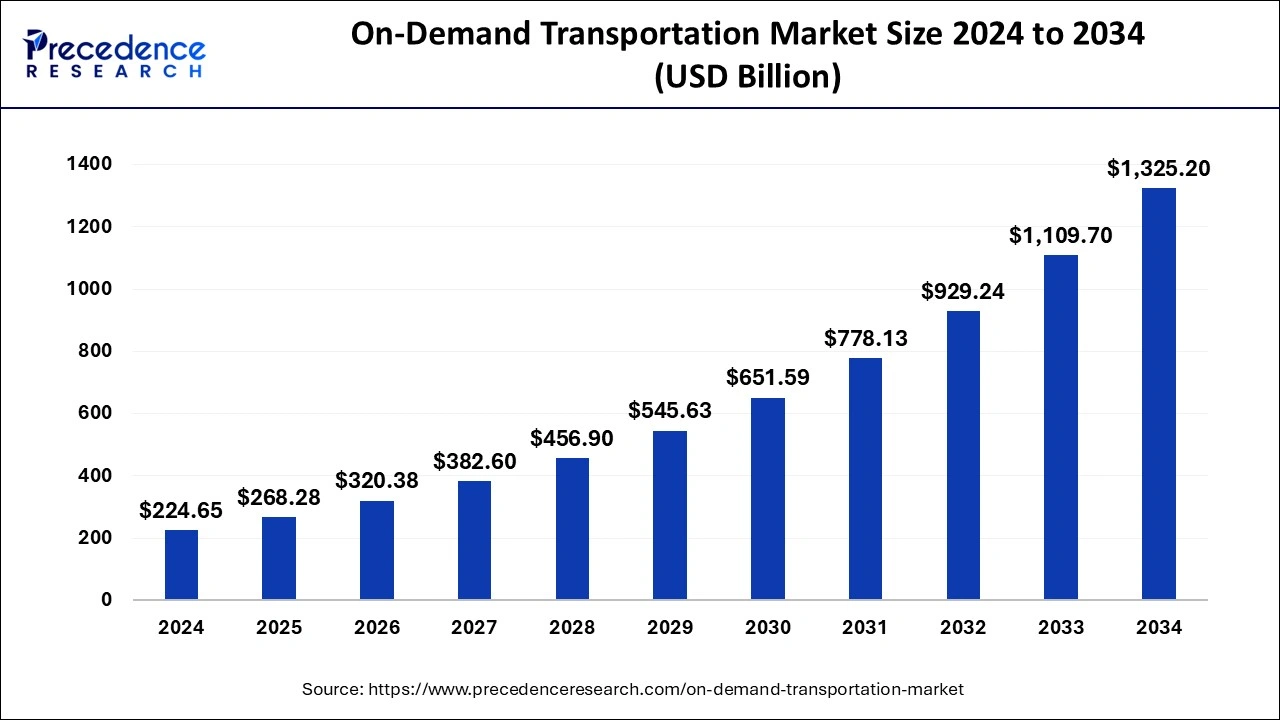

The global on-demand transportation market size is calculated at USD 268.28 billion in 2025 and is forecasted to reach around USD 1325.20 billion by 2034, accelerating at a CAGR of 19.42% from 2025 to 2034. The North America on-demand transportation market size surpassed USD 92.11 billion in 2024 and is expanding at a CAGR of 19.56% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global on-demand transportation market size was estimated at USD 224.65 billion in 2024 and is anticipated to reach around USD 1325.20 billion by 2034, expanding at a CAGR of 19.42% from 2025 to 2034. The rising demand to improve accessibility and flexible transportation, along with reducing emissions is contributing to the expansion of the on-demand transportation market.

Integrating artificial intelligence into on-demand transportation is revolutionizing both passengers and drivers. AI in transportation offers smart traffic management, predictive maintenance, autonomous vehicles, smart parking, and sharing optimisation. AI has the potential to transform on-demand transportation by managing and optimizing routes, predicting passenger demand, and improving fleet management. Ride-sharing companies such as Uber and Lyft utilize artificial intelligence to watch riders with drivers for better effectiveness, reducing delays and improving customer experience. Additionally, AI detects high-demand areas, allows for better fleet distribution, and minimises idle time for drivers.

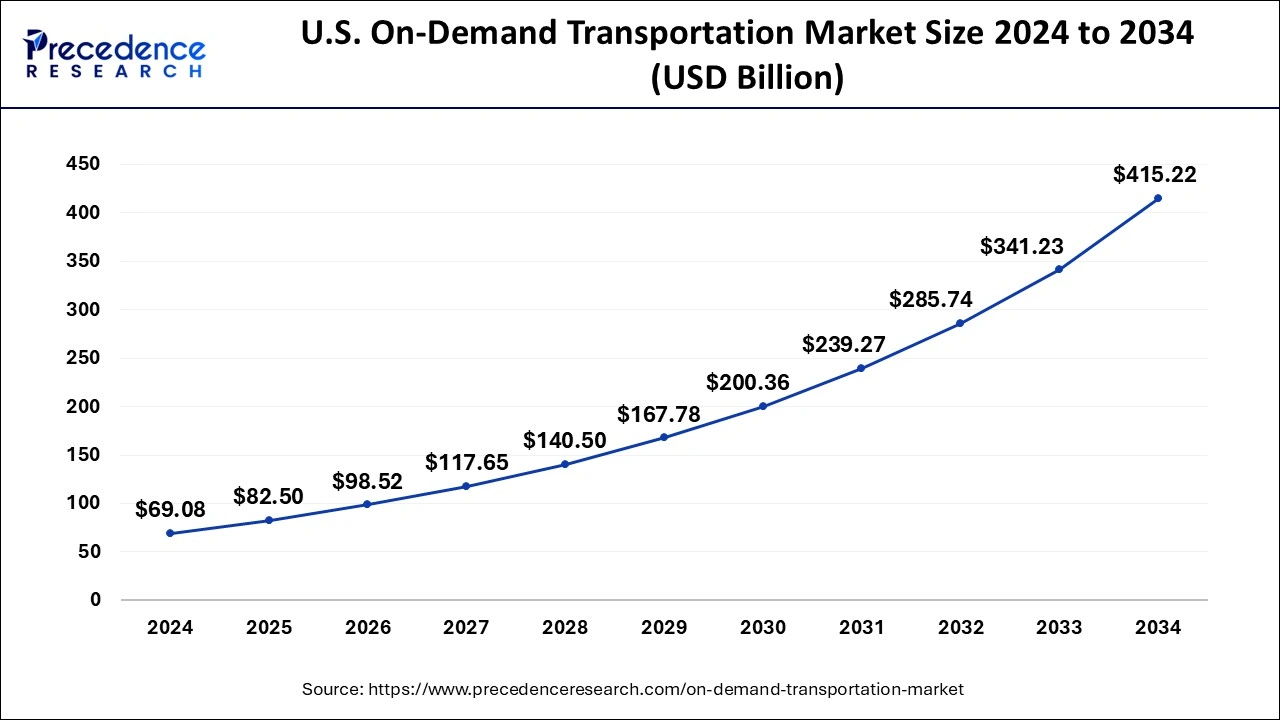

The U.S. on-demand transportation market size was evaluated at USD 69.08 billion in 2024 and is predicted to be worth around USD 415.22 billion by 2034, rising at a CAGR of 19.64% from 2025 to 2034.

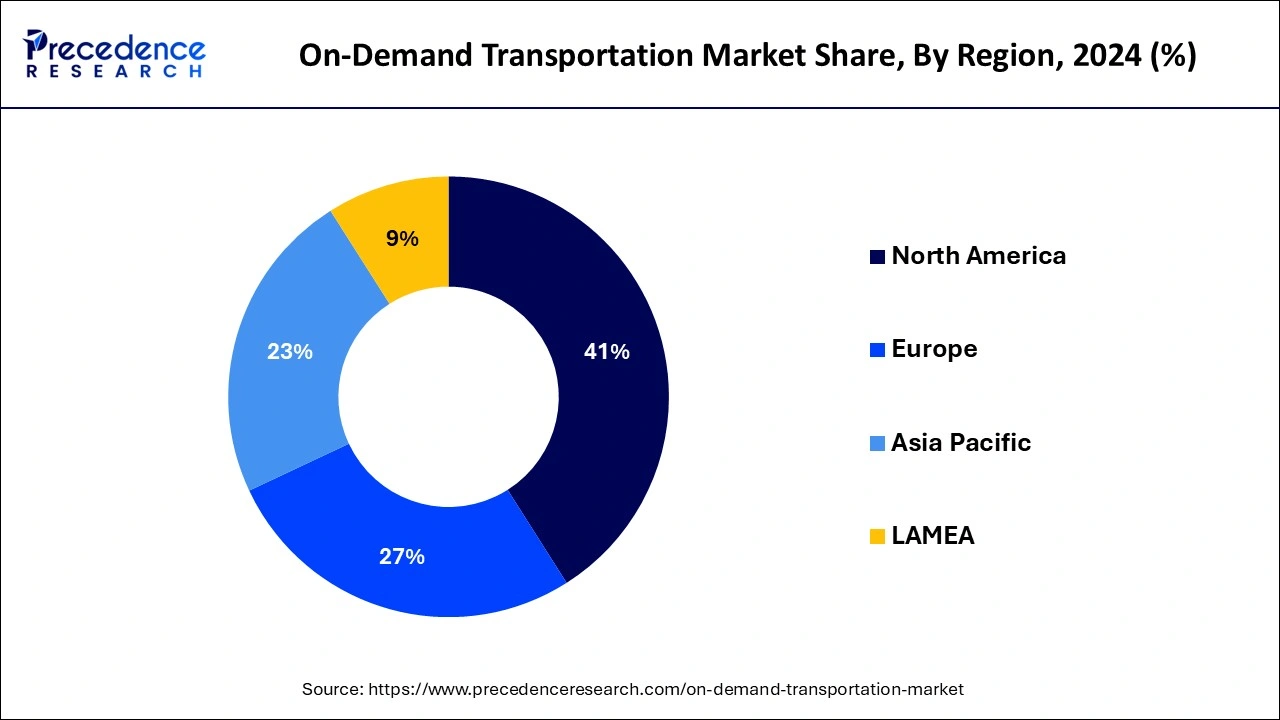

During the forecast period, North America is expected to hold the largest share of the On-Demand Transportation market with the largest market share of 41% in 2024. The North America region act as a platform for reporting on transportation infrastructure and services provision, regional, urban, and rural connectivity difficulties; and public health issues such as road safety and pollutant emissions.

Advances in IT infrastructure, as well as millennials' increased use of car-sharing services, are expected to drive the adoption of on-demand transportation services in Europe. Due to increased traffic and fuel prices, Asia Pacific is expected to grow significantly over the forecast period. Government initiatives, such as the Land Transport Authority of Singapore's Smart Mobility 2032 plan, are also expected to boost market growth.

| Report Highlights | Details |

| Market Size By 2034 | USD 1325.20 Billion |

| Market Size in 2025 | USD 268.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 19.42% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Vehicle Type, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Convenient and Efficient Transportation

The on-demand transportation market is primarily driven by the convenience and efficient transportation it offers. The service includes a dial-a-ride shuttle, taxis and app-based pick-up and drop-off options which make the life of the public easier for commuting. On-demand transportation provides a ride for users at their convenient time, whenever needed which is ultimately fulfilling customer satisfaction. In the majority of cities around the world, the ride is booked through the user’s smartphone at the desired location, this saves time for the customer and offers flexible and effective transportation.

Higher Fare

Despite the plenty of advantages of on-demand transportation, the major drawback associated with it is the higher costs of transport. The fare prices of micro-transit are 3 times higher in comparison with public transport which creates an affordability issue for the general public. On-demand transportation is a personalised transit solution that serves lower passenger loads for longer trip distances. Hence, it has to compensate for the entire fuel and labour charge.

Zero-emission Vehicles

The adoption of zero-emission vehicles in on-demand transportation is expected to be beneficial for operational performance and to meet the public’s changing demands and habits. The decreasing price of batteries is making ZEVs more affordable over time. With the help of incentive funding, installment payment plans for vehicles’ batteries and the support of government agencies the market of on-demand transportation is expected to rise with a significant number towards zero-emission vehicles.

Car rental is expected to be the largest segment in terms of market share among various on-demand transportation services in 2024.

The ride sharing is emerging as the new trend in the on-demand transportation market in addition to ride-hailing. The Uberpool and Lyft provides such platform which will be beneficial for the customers due to low costing. In most geographic areas, e-hailing solutions (ride-hailing platforms) are ubiquitous. Although they still represent a small percentage of trips taken in cities – ride-hailing trips are reported to account for only about 1% of total kilometers travelled worldwide – they are expected to grow rapidly and have a growing impact on urban mobility systems as users adapt to the new paradigm. E-hailing has grown much faster in recent years than other forms of shared mobility, such as car sharing, bike sharing, and carpooling.

In Los Angeles, for example, the average travel time is 53.68 minutes. Britons have the longest commute in Europe, lasting up to 45 minutes. As a result, several governments are pushing ridesharing systems.

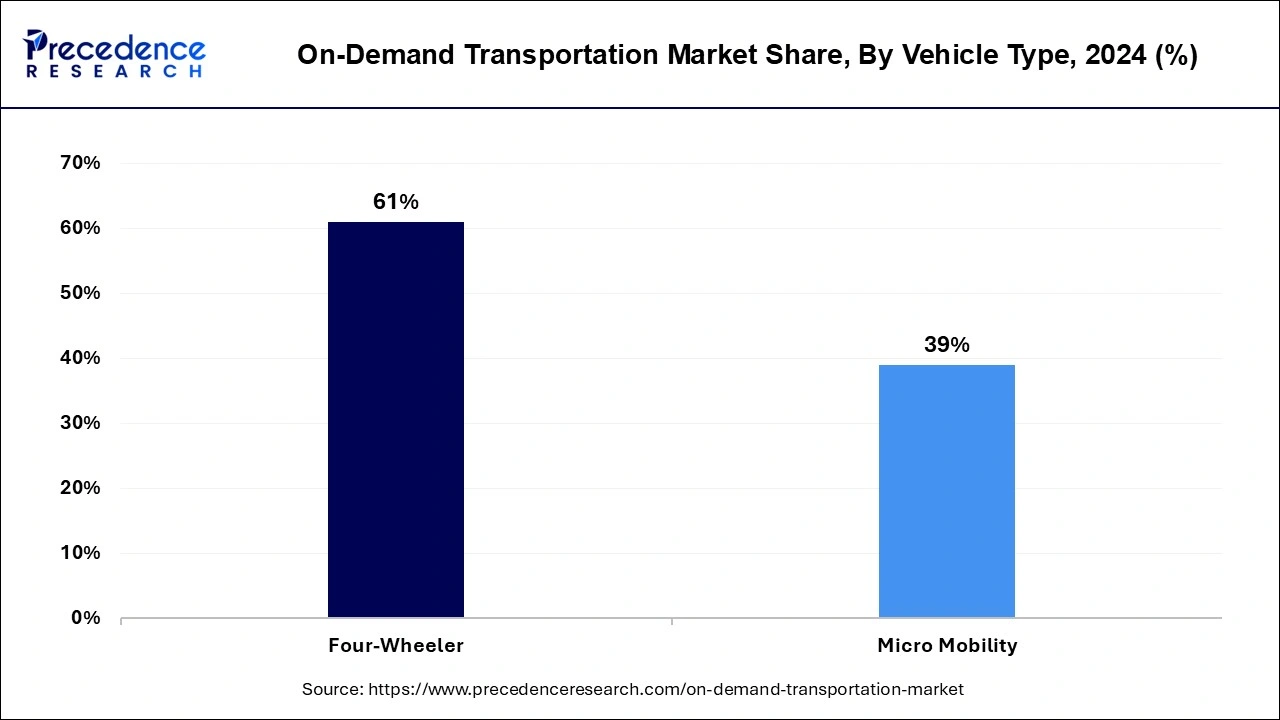

The four-wheeler segment contributed the highest market share of 61% in 2024. The four-wheeler segment provides advantages such as reduced noise pollution and a more comfortable driving experience, which is critical in developed countries. Rising consumer disposable income in countries such as India and China are also helping to drive growth. Thus, the four-wheeler segment has the major share in the on-demand transportation market.

Micro mobility has numerous advantages, including lower fuel consumption and greater mobility flexibility. Furthermore, it allows for improved cost and energy efficiency, which encourages users to choose this vehicle type. Over the forecast period, users are expected to adopt micro-mobility as environmental regulations become more stringent and traffic congestion worsens. As a result, the segment is expected to grow at the fastest CAGR between 2025 and 2034. Micro-mobility sharing, such as two-wheeler, e-bike, and e-scooter sharing, is gaining traction in developing countries such as China and India. Several new companies are entering the on-demand transportation sector by providing car booking services via smartphone. On the other hand, global corporations such as BMW Group, Daimler AG, Uber Technologies, and OLA dominate the market.

With increasing competition in the transportation sector, companies involved must deploy new existing technologies and significantly improve the quality of their services in order to stay in business. The rise of mobility-as-a-service has primarily manifested the need to make travel easier and less stressful (MaaS). However, a number of new transportation industry trends, when combined and aimed at minimizing stoppages or checkpoints, result in this one major shift to integrated travel and transportation. Several players have introduced driver-training and development programs, as well as incentive packages. Uber's EV champion effort, a pilot program to reward its drivers to utilize EVs or plug-in hybrids, is a nice example. In exchange, the project provides drivers with monetary subsidies and instructional initiatives. Lyft's collaboration with Avis gives Lyft drivers with on-demand Avis car rentals at discounted pricing, allowing people to become Lyft drivers without the cost and hassle of car ownership.

By Service Type

By Vehicle Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

March 2025

January 2025

March 2025