List of Contents

Zero Emission Vehicle (ZEV) Market Size and Forecast 2024 to 2034

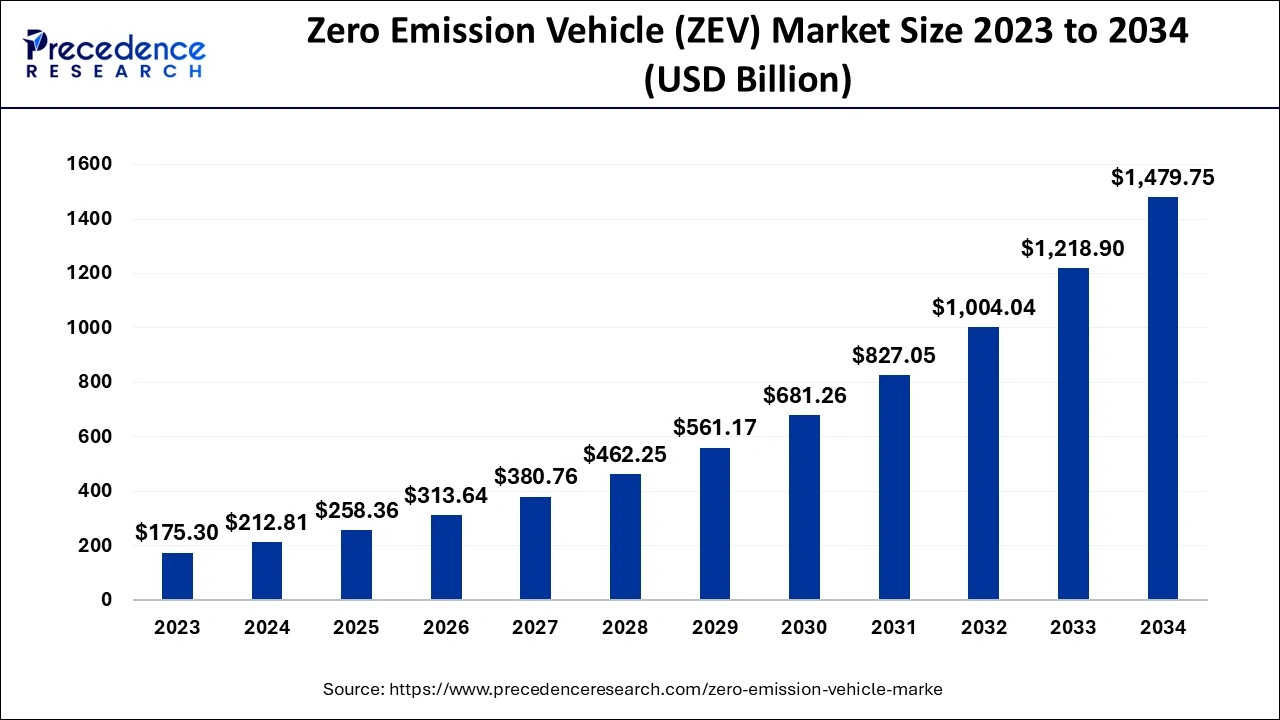

The global zero emission vehicle (ZEV) market size is estimated at USD 212.81 billion in 2024 and is anticipated to reach around USD 1,479.75 billion by 2034, expanding at a CAGR of 21.40% between 2024 and 2034.

Zero Emission Vehicle (ZEV) Market Key Takeaways

- On the basis of vehicle type, the fuel cell electric vehicle (FCEV) segment dominated the market in 2023.

- On the basis of vehicle type, the battery electric vehicle (BEV) segment is the fastest-growing segment from 2024 to 2034.

- On the basis of application, the commercial vehicle segment dominated the market in 2023.

- On the basis of application, the passenger vehicle segment is the fastest-growing segment from 2024 to 2034.

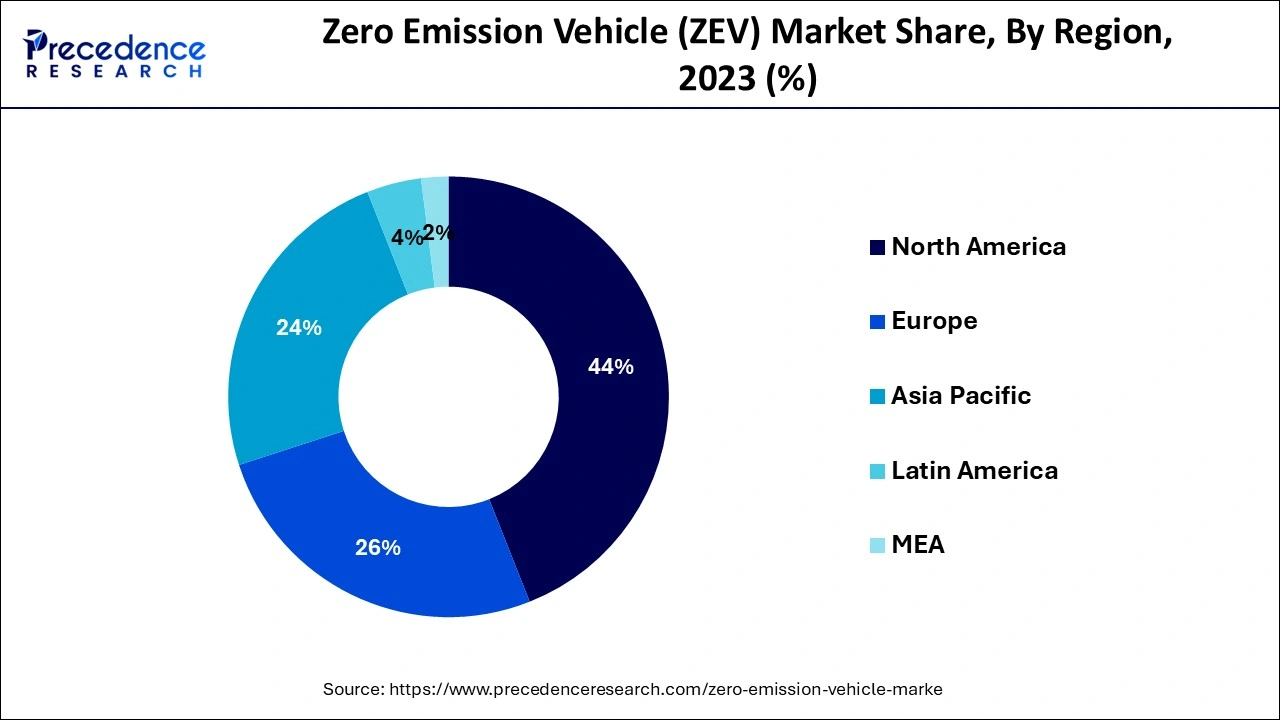

- On the basis of geography, the North America region dominated the market in 2023.

- On the basis of geography, the Asia-Pacific region is expected to develop the fastest from 2024 to 2034

U.S. Zero Emission Vehicle (ZEV) Market Size and Growth 2024 to 2034

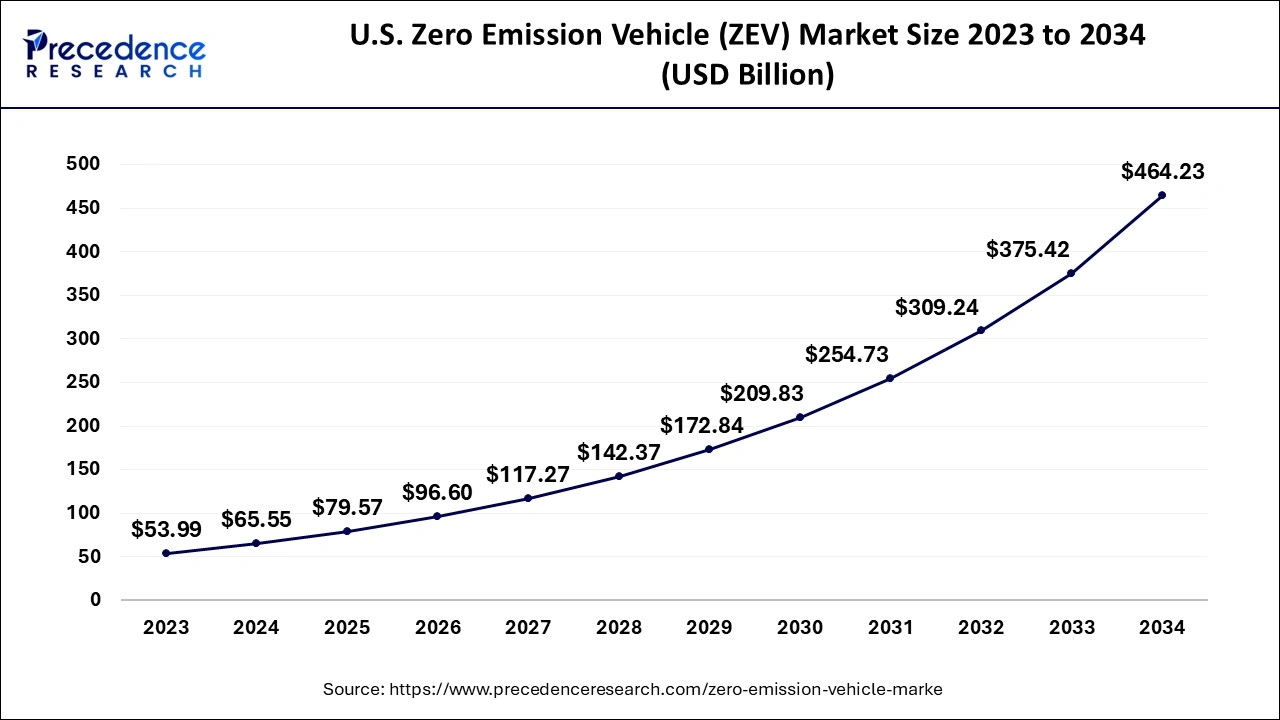

The global zero emission vehicle (ZEV) market size accounted for USD 65.55 billion in 2024 and is expected to be worth around USD 464.23 billion by 2034, growing at a CAGR of 21.60% from 2024 to 2034.

North America dominated the zero emission vehicle (ZEV) market in 2023. The North American zero emission vehicle (ZEV) market is partnering on a variety of fronts to raise zero emission vehicle (ZEV) awareness and, as a result, increase global demand.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. The Asia-Pacific region is heavily populated, with the bulk of residents falling into the middle class. They are the largest purchasers of zero emission vehicle (ZEV). As a result, the volume of zero emission vehicle (ZEV) sales in this region is likely to continue to climb. Customers are being pushed to choose zero emission vehicles (ZEV) due to rising gasoline prices. \

Zero Emission Vehicle (ZEV) Market Growth Factors

Vehicles that generate no pollutants through their exhaust are known as zero emission vehicles (ZEV). Vehicles that run on different types of fuels such as diesel, compressed natural gas (CNG), and gasoline produce a variety of pollutants from their tailpipes including carbon monoxide, particulates, and hydrocarbons. The pollutants emitted by gasoline-powered automobiles cause health problems like asthma and respiratory disorders, as well as environmental problems like global warming. Zero emission vehicle (ZEV) have lower emissions than traditional vehicles and run on alternative energy sources such as natural gas, battery electricity, and solar power. The zero emission vehicle (ZEV) market is still in its development phase, but it is predicted to grow at a rapid rate in the coming years.

Due to the need to meet future energy demands, the zero emission vehicle (ZEV) market has seen substantial growth. The necessity for environmentally friendly transportation is a major driver of zero emission vehicle (ZEV) demand. The zero emission vehicle (ZEV) market is emerging as an important sector of the automotive industry, representing a road to greater energy efficiency as well as lower emissions of pollutants and other greenhouse gases. The increasing environmental concerns, as well as favorable government initiatives, are some of the primary drivers of the zero emission vehicle (ZEV) market expansion. The zero emission vehicle (ZEV) market growth is also projected to be fueled by rising energy costs and competition among emerging energy efficiency technologies.

Government incentives and growing consumer awareness are driving the global zero emission vehicle (ZEV) market. Global warming is currently a source of concern, as it threatens both humanity and the environment. The rise in temperature is largely due to an increase in pollution levels, with vehicles being a major source of pollution. To prevent the rise in global temperature, governments are creating global collaborations and enacting severe emission standards. As zero emission vehicle (ZEV) do not use fossil fuel and generate no pollution, they are projected to remove pollution caused by fuel-powered vehicles. As a result, governments are supporting these vehicles by providing substantial subsidies and exemptions for zero emission vehicle (ZEV).

Consumers are preferring zero emission vehicle (ZEV) as a result of increased awareness of zero emission vehicle (ZEV) and global warming. In addition, rising gasoline prices, falling zero emission vehicle (ZEV) pricing, increased zero emission vehicle (ZEV) capacity and rising per capita income are all boosting demand for zero emission vehicle (ZEV) around the world. The lack of infrastructure facilities is a major impediment for the zero emission vehicle (ZEV) market.

Consumers are adopting battery electric vehicles (BEV) at a rapid rate around the world, due to government subsidies and improved knowledge about the products. To power electric motors, a battery electric vehicles (BEV) use a battery, usually a lithium-ion battery. As compressed air is used to push the vehicle, air-propelled vehicles are a popular means of transportation. Although the technology is still in the early stages of development, is projected to provide prospects for the zero emission vehicle (ZEV) market in the upcoming years.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 212.81 Billion |

| Market Size by 2034 | USD 1,479.75 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 21.40% |

| Largest Market | North America |

| Fastest Growing Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle Type,Application,Price,Vehicle Drive Type,Top Speed,Source of Power |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Zero Emission Vehicle (ZEV) Market Dynamics

Drivers

Rise in demand for efficient vehicles

Since gasoline is a fossil fuel, it is not a renewable energy source and will be depleted in the future. To support sustainable development, it is critical to develop and use alternative fuel sources. This necessitates the use of zero emission vehicle (ZEV), which do not require gasoline and are less expensive than conventional vehicles. An electric vehicle converts more than half of the grid's electrical energy to power at the wheels, whereas a gas-powered vehicle only converts about 17–21% of the energy stored in gasoline. The recent increase in the price of gasoline and diesel has increased demand for fuel-efficient vehicles. Thus, the rise in demand for efficient vehicles is driving the growth of the zero emission vehicle (ZEV) market during the forecast period.

Restraints

High cost of production

Zero emission vehicle (ZEV) are preferable to conventional vehicles, though they are more expensive. The lack of charging infrastructure associated with the development of zero emission vehicle (ZEV)has proven to be a barrier to market growth. Similarly, manufacturers require a substantial amount of capital and assets, which may stifle market expansion. The cost of batteries is expected to fall in the coming years as a result of increased production of zero emission vehicle (ZEV) batteries in large quantities and technological advancements. As a result, the production of zero emission vehicle (ZEV) necessitates a significant investment, is restricting the market growth.

Opportunities

Technological advancements

Automobile manufacturers are focusing on the development of improved zero emission vehicle (ZEV) systems that are expected to emit fewer pollutants while costing less. The companies have also begun developing smaller engines for use in automobiles, as smaller engines help meet pollution standards.The compactness and low cost of these engines add another dimension to their utility. As a result, the future development of advanced gasoline direct injection systems opens up numerous opportunities for market players.

Challenges

Lack of charging infrastructure

The lack of infrastructure to support the growth of zero emission vehicle (ZEV) has proven to be a market barrier. Many countries around the world have a scarcity of zero emission vehicle (ZEV) charging stations. As a result, public zero emission vehicle (ZEV) charging becomes less accessible, lowering market demand for zero emission vehicle (ZEV). Despite the fact that many governments are attempting to establish charging infrastructure for zero emission vehicle (ZEV), most countries have not been able to develop an adequate number of charging stations. Thus, this factor is a major challenge for the zero emission vehicle (ZEV) market growth.

Vehicle Type Insights

The fuel cell electric vehicle (FCEV) segment dominated the zero emission vehicle (ZEV) market in 2023. The segment is growing as consumers become more aware of the benefits of good air quality and the negative effects of automobile emissions. The fuel cell electric vehicle (FCEV) segment will grow due to rising government initiatives and investments to improve the infrastructure for electric vehicle charging outlets.

The battery electric vehicle (BEV) segment is a fastest growing segment from 2023 to 2032. The electric vehicle battery (EVB) is growing due to rising demand for environmentally friendly mobility solutions to reduce pollution levels and the availability of tax refunds. The battery electric vehicle (BEV) segment will grow as a result of government programs and schemes that encourage the adoption of sustainable mobility solutions in order to reduce car pollution.

Application Insights

The commercial vehicle segment dominated the zero emission vehicle (ZEV) market in 2022. The zero emission vehicle (ZEV) is used as a commercial vehicle. Commercial vehicles are four-wheeled cargo vehicles. The mass difference between small vehicles and heavy trucks is measured in tons. Buses and coaches are used to transport passengers with more than eight seats plus the driver's seat and a maximum mass greater than light vehicles. Various governments are also developing and securing commercial vehicles on the road. In the world of commercial vehicles, technological advancements are continually being made, and some of these technologies are soon becoming required.

The passenger vehicle segment is the fastest growing segment during the forecast period. The zero emission vehicle (ZEV) is used as a passenger vehicle. Passenger vehicles are the most frequent means of transportation in industrialized countries, and their numbers are growing in underdeveloped countries as per capita income rises. Due to increased leisure and travel activities around the world, demand for special utility vehicles has risen in recent years. Small automobiles are also developing at a rapid rate, owing to the fact that they encounter less traffic than large passenger vehicles on the road. All these factors are boosting the growth of the zero emission vehicle (ZEV) market during the forecast period.

Zero Emission Vehicle (ZEV) Market Companies

Key Developments

Mergers and acquisitions, partnerships, new product development, business expansions, collaborations, supply contracts, agreements, and contracts are some of the important marketing strategies used by the major market players to maintain their market position. BMW, for instance, debuted the BMW X5 plug-in hybrid electric vehicle in 2016.

Segments Covered in the Repor

By Vehicle Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

By Application

- Commercial Vehicle

- Passenger Vehicle

- Two Wheelers

By Price

- Mid-Priced

- Luxury

By Vehicle Drive Type

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive

By Top Speed

- Less Than 100 MPH

- 100 to 125 MPH

- More Than 125 MPH

By Source of Power

- Gasoline

- Diesel

- CNG

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client