Online Food Delivery Services Market Size and Forecast 2025 to 2034

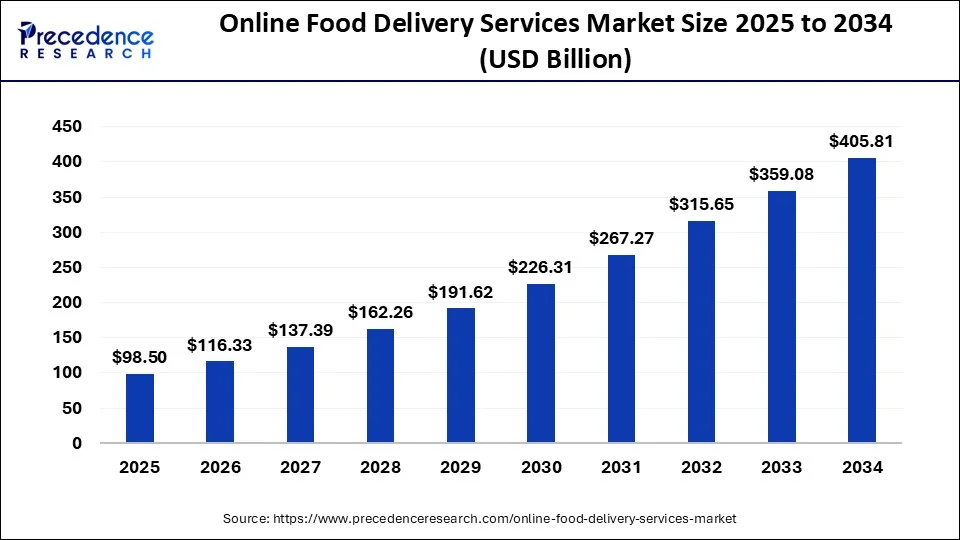

The global online food delivery services market size was valued at USD 83.41 billion in 2024, accounted for USD 98.5 billion in 2025, and is expected to reach around USD 405.81 billion by 2034, expanding at a CAGR of 17.14% from 2025 to 2034.

Online Food Delivery Services Market Key Takeaways

- In terms of revenue, the market is valued at $98.5 billion in 2025.

- It is projected to reach $405.81 billion by 2034.

- The market is expected to grow at a CAGR of 17.14% from 2025 to 2034.

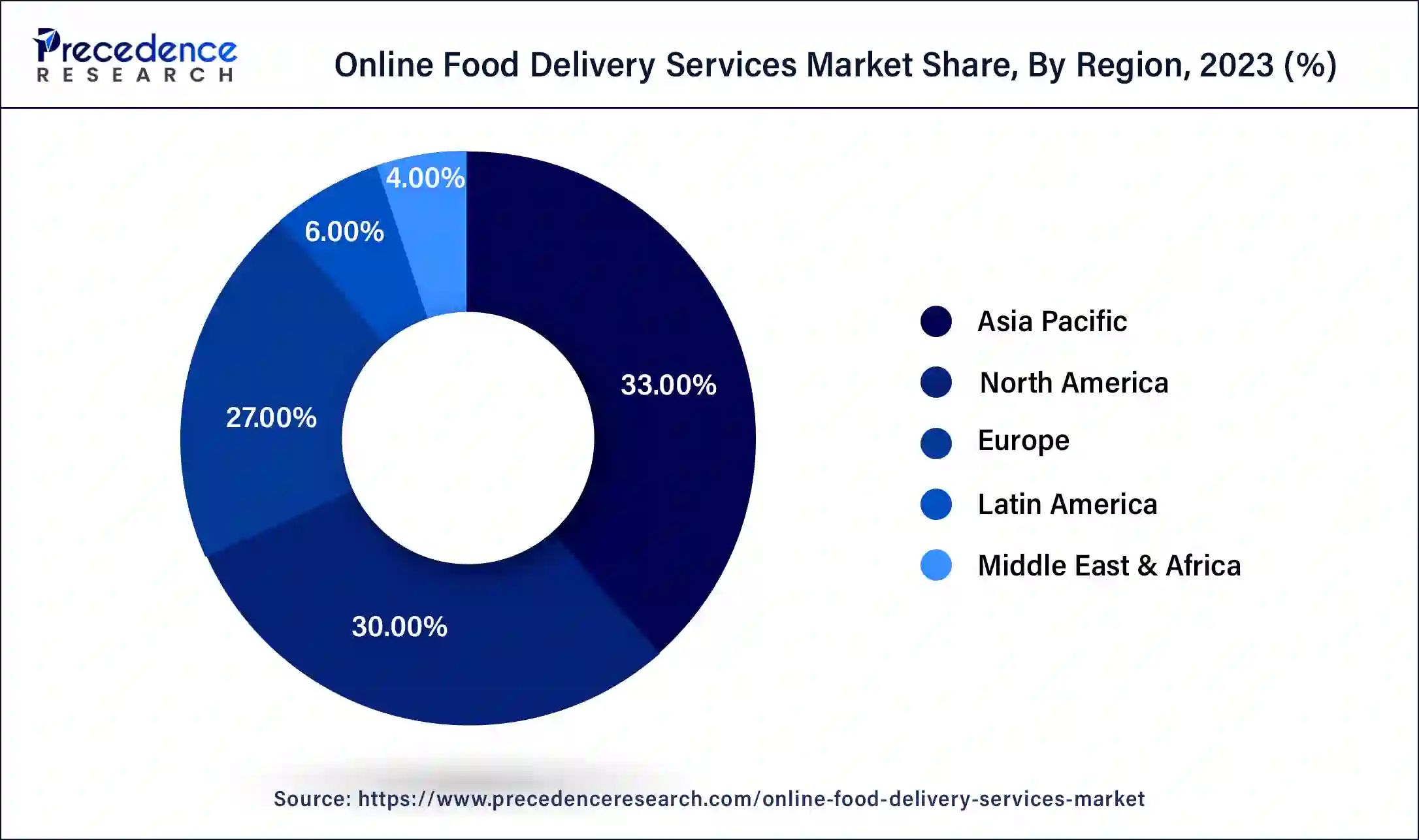

- Asia-Pacific has held the maximum revenue share of 33% in 2024.

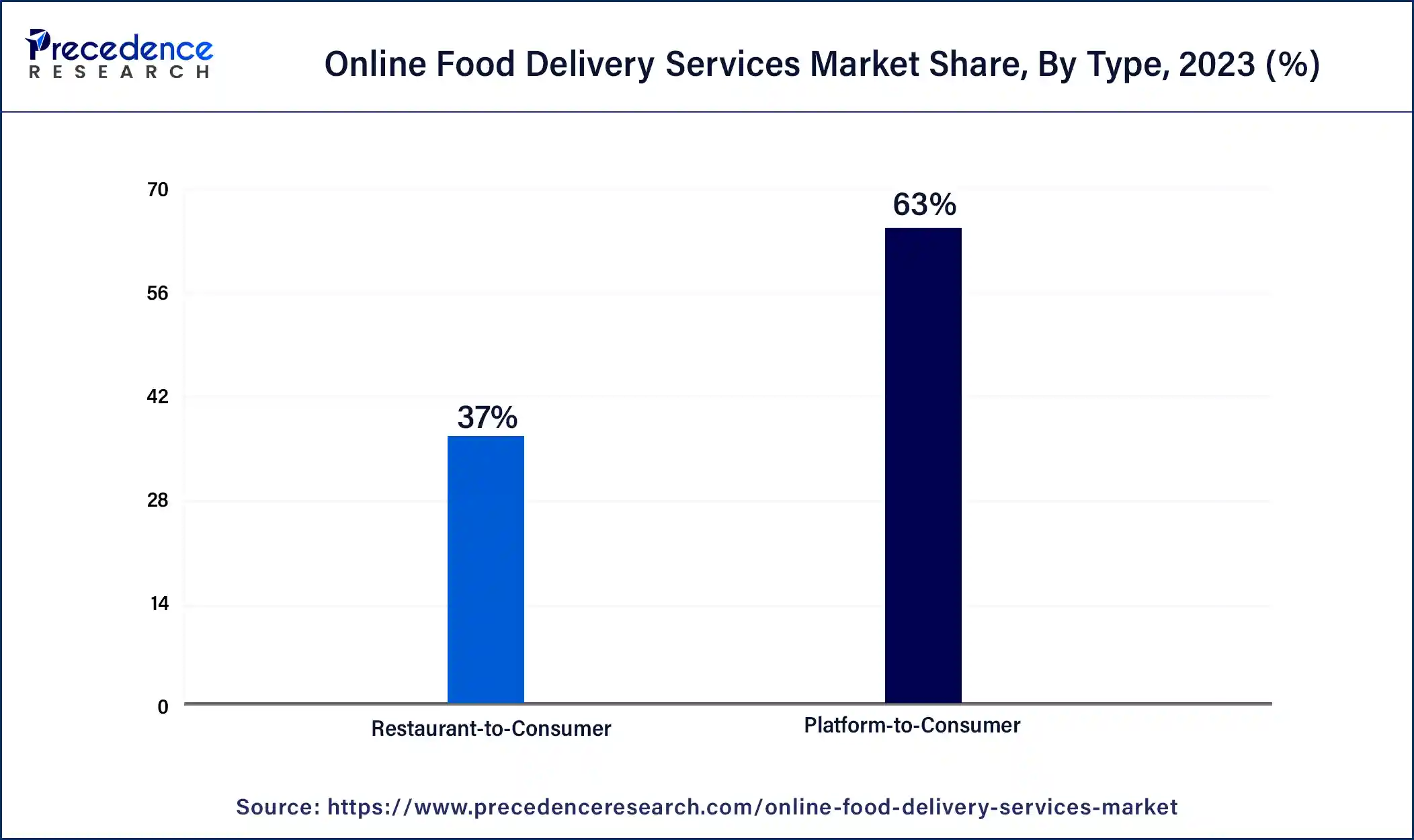

- By Type, the platform-to-consumer segment has captured more than 63% revenue share in 2024.

- By Type, the restaurant-to-consumer segment is expected to expand at a remarkable CAGR of 18.7% between 2024 and 2034.

- By Channel Type, the mobile application segment contributed more than 55.8% of revenue share in 2024.

- By Channel Type, the desktop segment is anticipated to grow at the fastest CAGR over the projected period.

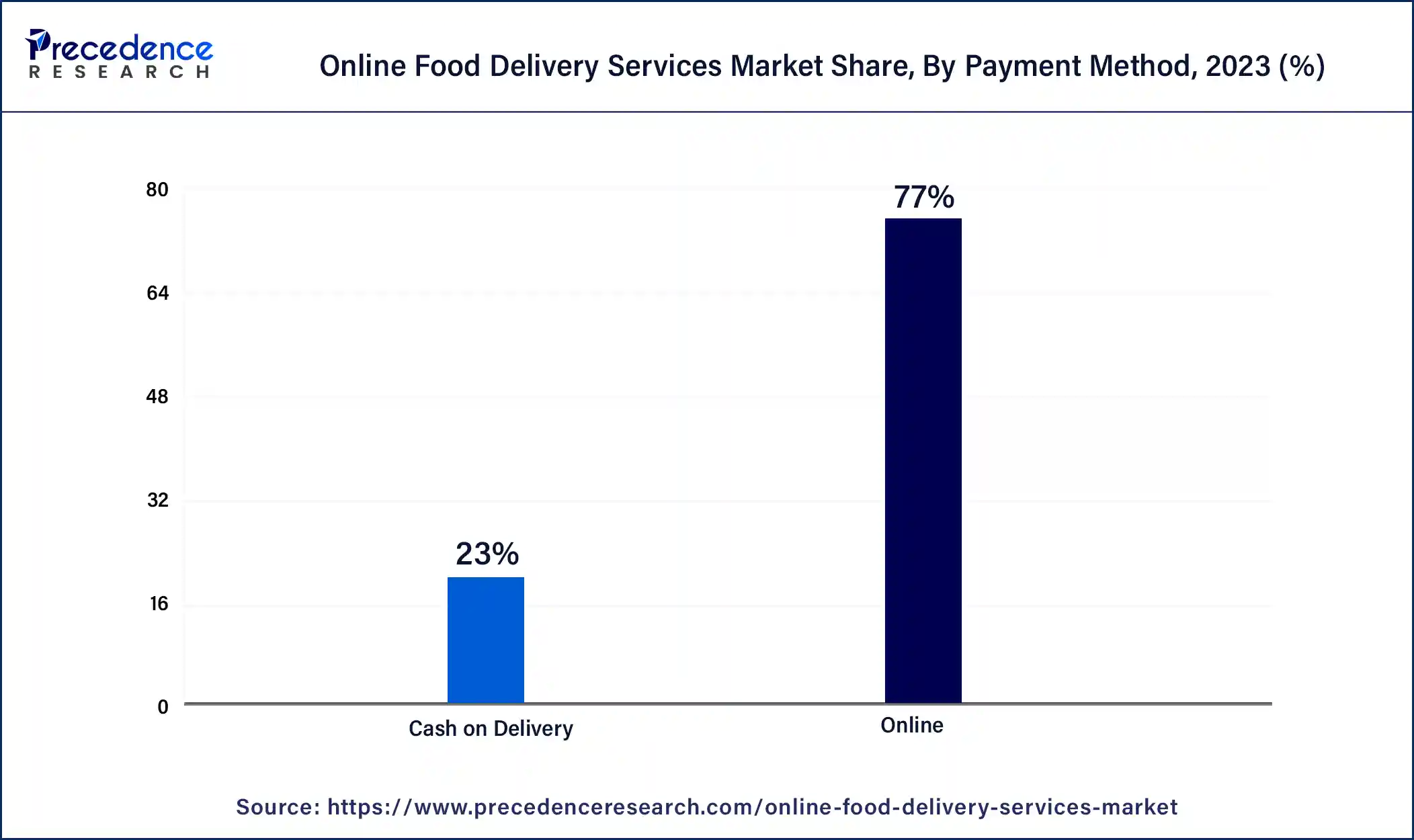

- By Payment Method, the online segment has generated around 77.9% of revenue share in 2024.

- By Payment Method, the cash on delivery segment is projected to grow at a noteworthy CAGR of 15.9% between 2025 and 2034.

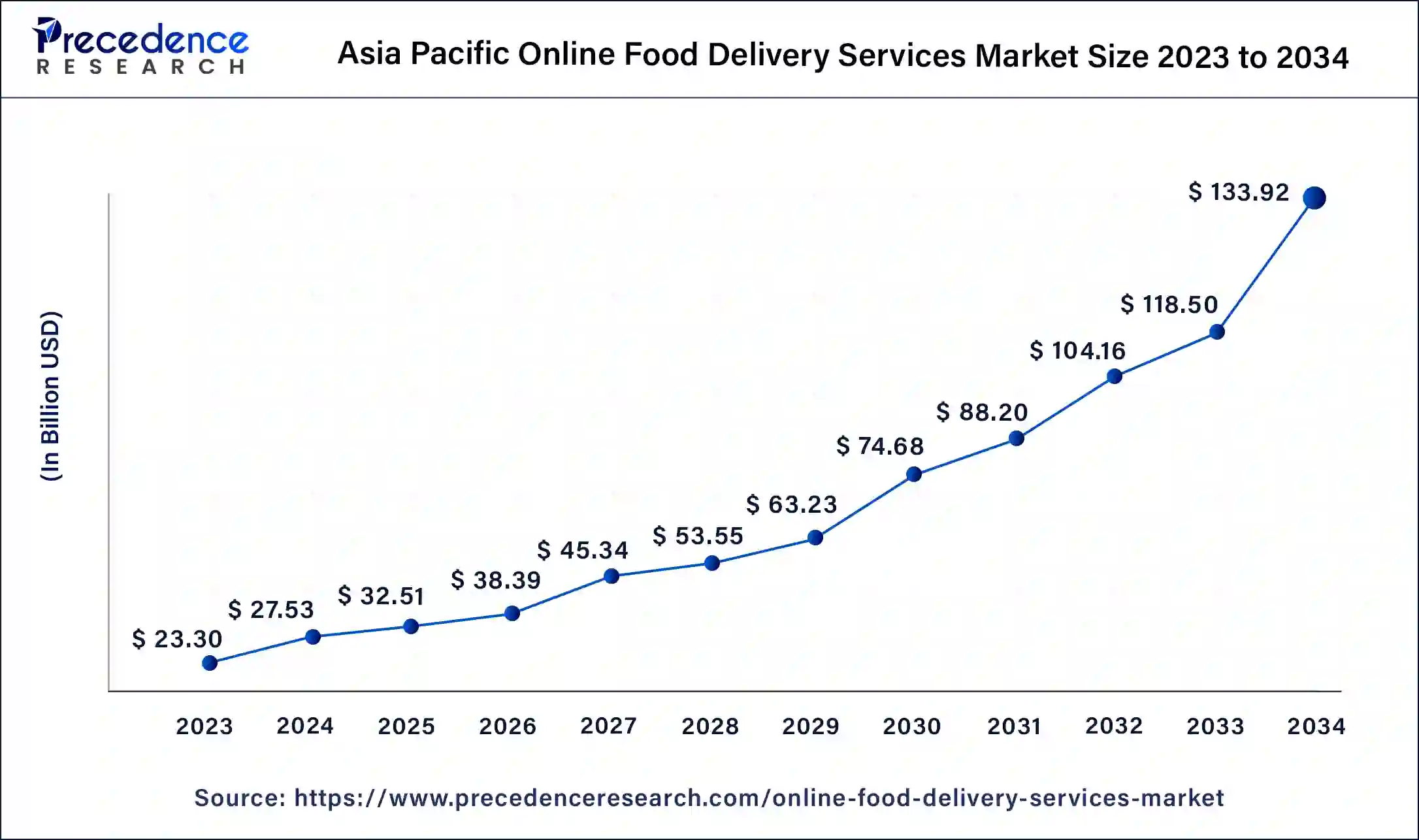

Asia Pacific Online Food Delivery Services Market Size and Growth 2025 to 2034

The Asia Pacific online food delivery services market size is estimated at USD 32.51 billion in 2025 and is predicted to be worth around USD 133.92 billion by 2034, at a CAGR of 17.14% from 2025 to 2034.

Asia-Pacific has held the largest revenue share 33% in 2024.

- The Asia-Pacific region commands a significant share in the online food delivery services market due to a multitude of distinctive factors. Its extensive and densely populated urban areas, coupled with the expanding middle-class demographic, have created a robust demand for convenient dining solutions.

- Furthermore, the ubiquity of smartphones and the steady rise in internet accessibility have facilitated easy access to online food delivery platforms for consumers. The region's culinary landscape, characterized by a diverse array of regional cuisines, further bolsters the appeal of these services. These distinct elements, alongside the rapid urbanization and evolving consumer preferences unique to the Asia-Pacific region, contribute to its substantial market dominance.

The rapid urbanization has led to an increase in the demand for online food delivery services, significantly fuel the market's revenue in the coming years. For instance, according to the article published by the World Bank Group in January 2024, India is urbanizing rapidly. By 2036, its towns and cities will be home to 600 million people, or 40% of the population, up from 31% in 2011, with urban areas contributing almost 70% to GDP.

North America is estimated to observe the fastest expansion.

- The region's robust digital infrastructure, high smartphone penetration, busy urban lifestyles, and a strong culture of dining out contribute to the market's success. Additionally, the COVID-19 pandemic accelerated the adoption of online food delivery as a safer dining alternative. Major players like Uber Eats, DoorDash, and Grubhub have established a strong presence, offering a wide range of cuisines. Overall, North America's favorable market conditions and consumer preferences have positioned it as a key driver of the industry's growth and innovation.

Market Overview

The online food delivery services sector is a rapidly burgeoning market that streamlines the process of ordering and delivering meals through digital platforms and mobile applications. This industry has experienced a remarkable expansion in recent times, primarily fueled by shifting consumer preferences, increasingly hectic lifestyles, and the sheer convenience offered by these platforms.

Prominent contenders in this domain, such as UberEats, DoorDash, Grubhub, and Just Eat Takeaway, engage in fierce competition to bridge the gap between diners and a diverse array of restaurants and culinary offerings.

The market's growth trajectory has been further catalyzed by the COVID-19 pandemic, as many individuals have embraced online food delivery as a safer and more convenient dining alternative.

Sustainability Trends

Carbon Neutral and Low-Emission Deliveries Rise

More and more food delivery services are making the switch to electric cars, bikes, and e-bikes to become carbon-neutral. Just Eat Takeaway promised to use zero-emission delivery methods for all deliveries in major European cities by 2025. Similarly, to increase its green

fleet and drastically reduce emissions in urban areas. Swiggy teamed up with EV rental startups in India. To offset the environmental impact, these programs frequently come with carbon offsets.

Waste Reducing Through Smart Inventory & AI

To tackle food waste, delivery companies are leveraging AI to forecast demand and optimize kitchen operations. Cloud kitchen operators and partner restaurants are using data analytics to reduce overproduction. Some platforms are also collaborating with food redistribution networks or apps like Too Good To Go, which resell unsold meals at discounted prices, thus cutting food waste and improving accessibility.

Online Food Delivery Services Market Growth Factors

The online food delivery services market is a dynamic and rapidly evolving sector that has witnessed tremendous growth in recent years. This industry capitalizes on the digital age's convenience, connecting consumers with a wide array of culinary options through mobile applications and online platforms.

Several compelling trends and growth drivers are shaping the online food delivery services market. Firstly, changing consumer preferences, marked by a growing appetite for diverse cuisines and restaurant experiences, have fueled the industry's growth. Additionally, the COVID-19 pandemic has had a profound impact, with safety concerns and lockdowns prompting a surge in demand for contactless food delivery.

The online food delivery services market's growth is also propelled by factors such as robust marketing strategies, partnerships with restaurants, and technological advancements. Market leaders are continuously innovating to enhance user experiences, offering features like real-time tracking and seamless payment options. Furthermore, strategic alliances with local restaurants and chains expand the variety of available cuisines, attracting a broader customer base. Additionally, the introduction of subscription-based models and loyalty programs has boosted customer retention and engagement.

Despite its rapid growth, the online food delivery services market faces several challenges. Intense competition among service providers has led to thin profit margins and costly marketing campaigns to acquire and retain customers. Furthermore, the reliance on a network of drivers can lead to logistical and quality control issues. Managing food safety and quality standards, especially during peak demand periods, remains a significant challenge. Additionally, regulatory compliance and labor issues, such as driver classification and wage disputes, pose legal and operational challenges for industry players.

Amid the challenges, the online food delivery services market continues to offer promising business opportunities. Expanding into underserved regions, partnering with local businesses, and exploring niche markets are avenues for growth. Moreover, leveraging data analytics and artificial intelligence for personalized recommendations and efficient logistics can enhance competitiveness. As consumers seek sustainability, integrating eco-friendly practices and packaging can tap into a growing market segment. Overall, the industry's future growth hinges on adaptability, innovation, and effectively addressing evolving consumer demands.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 314.3 Billion |

| Market Size in 2025 | USD 98.5 Billion |

| Market Size in 2024 | USD 83.41 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 17.14% |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Channel Type, Payment Method and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Digitalization and smartphone penetration

The online food delivery services industry is experiencing robust growth, largely propelled by the pervasive influence of digitalization and the widespread adoption of smartphones. These two interconnected trends have radically altered the landscape of how individuals order and relish their meals. The ubiquitous presence of smartphones, complemented by the availability of user-friendly mobile applications, has fundamentally reshaped consumer behavior. It has exponentially broadened the reach of online food delivery services, effectively tapping into an extensive and diverse customer base seeking hassle-free dining solutions.

The intuitive and easy-to-navigate interfaces of food delivery apps provide customers with a seamless experience, simplifying menu exploration, order placement, and real-time delivery tracking. This accessible and efficient system appeals not only to tech-savvy users but also to a wider demographic, including those previously less inclined to embrace digital dining platforms. Furthermore, smartphones have opened up opportunities for targeted marketing, personalized promotions, and the implementation of loyalty programs, thereby enhancing customer interaction and driving recurring patronage. Ultimately, the symbiosis between digitalization and the proliferation of smartphones has cemented online food delivery services as an integral facet of modern dining culture, fueling the industry's continuous expansion.

- According to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, China's smartphone market shipped 71.6 million units in 1Q25, a 3.3% year-on-year (YoY) increase.

- According to the data published by the Ministry of External Affairs, Government of India. India's mobilephone exports surged 40.5% in FY24. India's mobile phone exports increased from US$11.1 billion in FY23 to US$15.6 billion in FY24, a US$4.5 billion rise.

Restraints

Logistical challenges

Logistical challenges represent a significant restraint on the growth of the online food delivery services industry. The complexity of efficiently delivering food from a diverse range of restaurants to customers' doorsteps poses multifaceted issues. Timely and safe transportation of meals, especially during peak demand periods, requires robust logistics infrastructure and meticulous coordination. Ensuring that food remains fresh and of high quality throughout the delivery process is a constant struggle. Additionally, last-mile delivery, which involves getting orders to customers' precise locations, presents challenges in terms of route optimization and driver allocation. The cost implications of maintaining a reliable and efficient logistics network, including vehicle maintenance and fuel expenses, can erode profit margins. Overall, these logistical hurdles not only increase operational costs but also impact the customer experience. Overcoming these challenges demands innovative solutions and investments in technology and infrastructure, which can strain the resources of market players and hinder market growth.

Opportunity

Partnerships with local businesses

Partnerships with local businesses have emerged as a strategic avenue, creating significant opportunities within the online food delivery services sector. Collaborating with neighbourhood restaurants and smaller culinary establishments expands the diversity of available cuisines and attracts a broader customer base. These partnerships foster a sense of community engagement, supporting local businesses and enhancing the platform's appeal to consumers who value supporting their neighbourhood eateries.

Furthermore, such alliances contribute to a wider geographical reach, as local restaurants often have loyal customer followings that can be tapped into. These partnerships can also lead to exclusive menu items or discounts, incentivizing customers to choose the online delivery platform. By fostering symbiotic relationships, online food delivery services gain access to a treasure trove of culinary expertise and local flavors, providing customers with an authentic and diverse dining experience. Overall, partnering with local businesses not only enriches the platform's offerings but also strengthens its position in the market and fosters goodwill within communities.

- In February 2025, Yango introduced a food delivery service in Senegal, adding to its existing ride-hailing and parcel delivery services within the SuperApp. This move not only enhances Yango's presence in Senegal's digital economy but also intensifies competition in the country's burgeoning online food delivery market.

Type Insights

According to the Type, the Platform-to-Consumer sector has held 63% revenue share in 2024. The platform-to-consumer (P2C) segment holds a significant share in the online food delivery services market primarily due to its role as a marketplace connecting consumers with a wide range of restaurants and cuisines. P2C platforms offer convenience, choice, and ease of access, making them popular among users. They also benefit from partnerships with local eateries and national chains, expanding their offerings and attracting a diverse customer base. Additionally, the COVID-19 pandemic accelerated the demand for contactless dining, further boosting the P2C segment's prominence as consumers sought a safer and more convenient way to enjoy restaurant-quality meals at home.

The Restaurant-to-Consumer sector is anticipated to expand at a significant CAGR of 18.7% during the projected period. It offers a seamless and personalized dining experience, bolstered by partnerships with local and popular eateries. Moreover, the direct connection between consumers and restaurants provides greater menu choice and ensures that customer preferences are met, making it a dominant and preferred segment in the market.

Channel Type Insights

In 2024, the mobile application sector had the highest market share of 55.8% on the basis of the Channel Type. The dominance of the mobile application segment in the online food delivery services market can be attributed to its unparalleled convenience and widespread accessibility. Mobile apps offer users an intuitive and user-friendly platform to peruse menus, place orders, and track deliveries, all with the ease of their handheld devices. With the pervasive adoption of smartphones, these applications cater to a diverse and expansive customer base, offering real-time updates, tailored recommendations, and incentivizing loyalty programs. Furthermore, the COVID-19 pandemic accelerated the transition towards mobile apps as they provided a secure and contactless means of food ordering, solidifying their prominent position within the market landscape.

The desktop segment is anticipated to expand at the fastest rate over the projected period. The desktop segment holds a significant share of the market due to several reasons. Firstly, desktop platforms offer a larger and more detailed interface, making it easier for users to browse menus, customize orders, and track deliveries. Secondly, many customers still prefer the convenience of ordering food from their computers, especially for group or office orders. Additionally, desktop usage tends to be more prevalent in office environments, contributing to higher order volumes during work hours. Lastly, desktops provide a stable platform for accessing online food delivery services, which is particularly appealing for users who value consistency and reliability in their orders.

Payment Method Insights:

The online segment held the largest revenue share of 77% in 2024. The online segment commands a substantial portion of the online food delivery services market primarily due to its unparalleled convenience, widespread accessibility, and expansive reach. With the ubiquitous presence of smartphones and intuitive mobile applications, customers can seamlessly peruse menus, initiate orders, and monitor deliveries. The digital platform's adaptability empowers users to explore an extensive array of restaurants and culinary choices, establishing it as a comprehensive solution for diverse dining preferences. Moreover, the COVID-19 pandemic expedited the transition to online ordering as consumers actively sought secure and contactless dining alternatives, further cementing the online segment's dominant position in the market and its enduring appeal to a broad customer base.

The cash on delivery segment is anticipated to grow at a significantly faster rate, registering a CAGR of 15.9% over the predicted period. The Cash on Delivery (COD) segment holds a major growth in the online food delivery services market due to its appeal to a wide range of customers, including those who prefer not to use digital payment methods. COD offers a sense of security and trust as customers pay upon receiving their orders, reducing concerns about online fraud. It caters to regions with lower digital payment penetration and addresses consumer hesitation regarding online transactions. However, as digital payment adoption grows and safety concerns decrease, this segment's dominance may gradually shift toward digital payment methods.

Online Food Delivery Services Market Companies

- Deliveroo PLC

- DoorDash Inc.

- Delivery Hero Group

- Just Eat Limited

- Uber Technologies Inc.

- Swiggy

- Zomato

- Delivery.com LLC

- Yelp Inc.

- Amazon.com Inc.

- Rappi Inc.

Recent updates on online food delivery services- 2025

Uber Eats Launches Delivery Robots in U.S. Cities

In July 2025, Uber Eats began deploying autonomous sidewalk delivery robots across U.S. cities through a partnership with robotics startup Avride. These robots, which can carry up to 55 pounds of food, use cameras, LIDAR sensors, and AI-based mapping to navigate sidewalks and deliver meals without human drivers. The move aims to cut labor costs, improve delivery efficiency, and enhance last-mile delivery logistics. Expansion plans include rolling out hundreds of units by the end of the year.

(Source:https://nypost.com)

Swiggy Pushes 10-Minute Deliveries and Value Meals to Drive Growth

Swiggy declared in early 2025 that it would increase its 10-minute delivery services while concentrating on reasonably priced value meal options in response to a slowdown in demand for its core food delivery services. Rohit Kapoor, the CEO of Swiggy, claims that these tactics are intended to increase the frequency of orders placed by loyal customers and entice infrequent users to return. To increase order value, the company is also experimenting with combining meal deliveries with daily necessities and snacks.

(Source: https://economictimes.indiatimes.com)

Uber Eats Expands into Whitsunday Region, Australia

In April 2025, Uber Eats officially expanded its operations into Queensland's Whitsunday region, covering areas like Airlie Beach and Bowen. The move is expected to boost local restaurants' visibility and give tourists and residents greater access to convenient dining options. Uber Eats noted that the expansion supports local economic development and provides an opportunity for small hospitality businesses to tap into app-based food delivery revenue streams.

Recent Developments

- In January 2025, Swiggy announced its partnership with Blue Tokai Coffee Roasters for its "SNACC" app. The app is designed to meet the diverse needs of its users and will offer breakfast staples, baked goods, healthy food options, a variety of beverages, and quick snacks. Customers can select from a variety of coffee options and have them delivered to their door in 15 minutes.

- In February 2025, HungerRush, a leading provider of integrated restaurant technology solutions, is proud to announce a strategic partnership with Backofhouse.io, a venture owned by Gordon Food Service. This partnership empowers restaurants across the U.S. with access to HungerRush's industry-leading point-of-sale (POS) and online ordering platforms.

- In January 2025, food delivery giant Zomato took another shot at speedy food deliveries by introducing a new 15-minute delivery tabon its main app. The feature appears in the explore section, giving customers access to restaurants located within a short radius, nearly 1.5 kilometres, so the food can arrive within 15 minutes.

- In 2022:Eat Takeaway.com, Europe's largest online food ordering service delivery, entered into a partnership with McDonald's to expand delivery.

- In 2021:Uber Technologies Inc. acquired Drizly, and the two companies will begin integrating their complementary delivery apps and services. The purchase consideration was approximately USD 1.1 billion, consisting of approximately 18.7 million newly issued shares of Uber common stock plus cash.

- In 2021:Southeast Asia's biggest ride-hailing and food delivery firm Grab Holdings, announced a merger with Altimeter Growth Corp., valued at USD 40 billion.

Segments Covered in the Report

By Type

- Restaurant-to-Consumer

- Platform-to-Consumer

By Channel Type

- Websites/Desktop

- Mobile Applications

By Payment Method

- Cash on Delivery

- Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content