October 2024

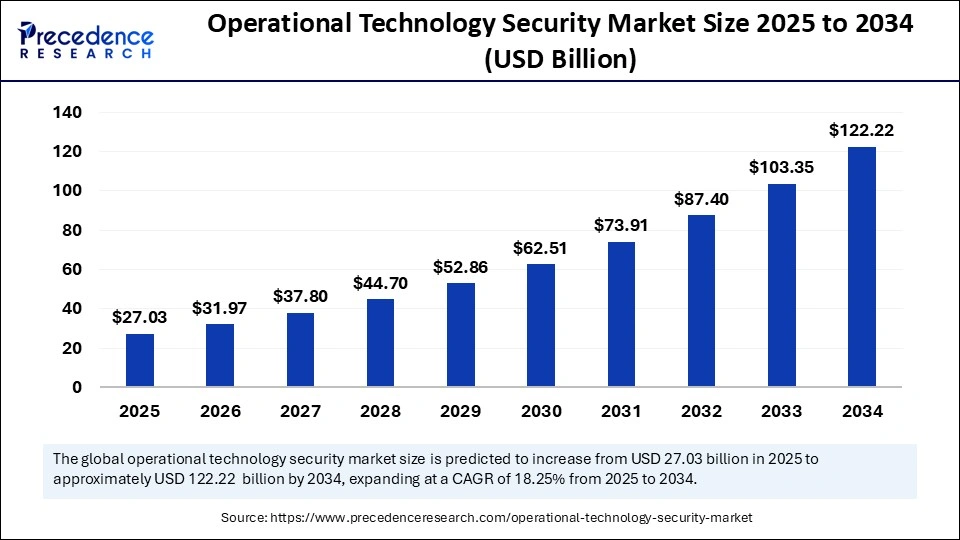

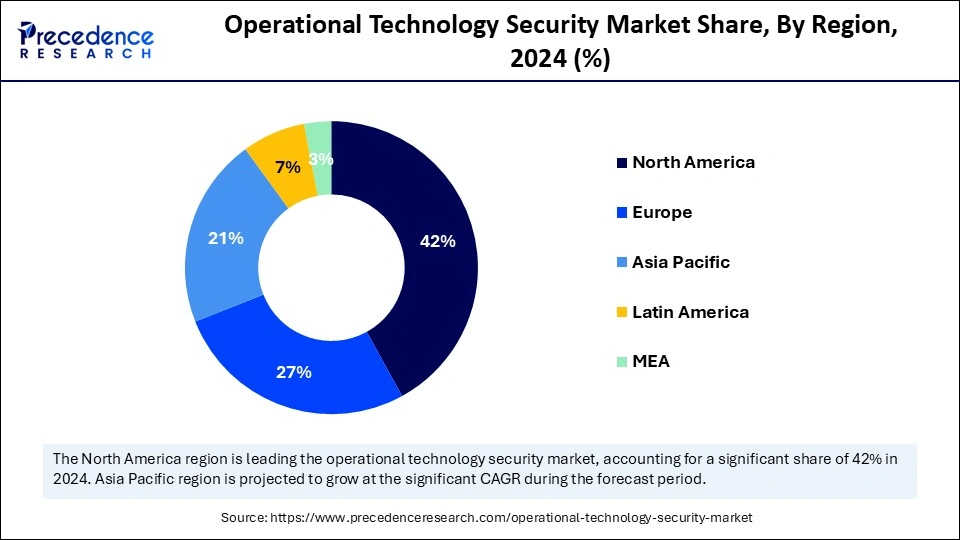

The global operational technology security market size is calculated at USD 27.03 billion in 2025 and is forecasted to reach around USD 122.22 billion by 2034, accelerating at a CAGR of 18.25% from 2025 to 2034. The North America market size surpassed USD 9.60 billion in 2024 and is expanding at a CAGR of 18.39% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global operational technology security market size accounted for USD 22.86 billion in 2024 and is predicted to increase from USD 27.03 billion in 2025 to approximately USD 122.22 billion by 2034, expanding at a CAGR of 18.25% from 2025 to 2034. The rising digitization and interconnectivity, the surge in regulatory pressures, the increasing convergence of IT and OT networks, rising cases of cyberattacks, and the rising cyber security laws are expected to drive the growth of the operational technology security market throughout the forecast period.

In the era of a rapidly evolving digital landscape, the integration of Artificial Intelligence emerges as a transformative force in modern OT security, positively impacting the growth of the operational technology security market. With the rise in technical and social engineering attacks in numerous industrial environments, the integration of AI holds great potential to enhance OT cybersecurity. AI integration in operational technology security is reshaping the landscape of the market, driven by the increasing need for more advanced and proactive security measures to prevent cyber threats. AI and Machine Learning algorithms can process massive amounts of data from various OT environments, including supervisory control and data acquisition (SCADA) systems, industrial control systems (ICS), and other critical infrastructure. AI can effectively analyze large amounts of data and detect patterns, which enhances the protection against cyberattacks and improves response times compared to conventional methods.

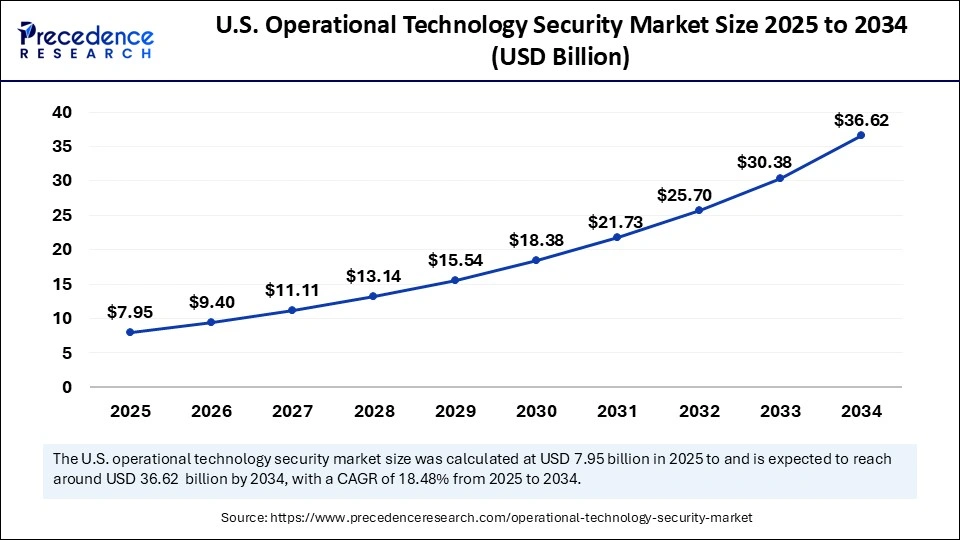

The U.S. operational technology security market size was exhibited at USD 6.72 billion in 2024 and is projected to be worth around USD 36.62 billion by 2034, growing at a CAGR of 18.48% from 2025 to 2034.

North America held the dominant share of the operational technology security market in 2024. The region’s market dominance is attributed to the presence of critical infrastructure, high demand for robust security measures, and increased focus on reducing cyberattacks. The increased convergence of IT and OT networks and heightened awareness regarding the benefits of AI-powered security solutions further bolstered the market growth in the region. The region has robust regulatory frameworks, such as North American Electric Reliability Corporation (NERC) Critical Infrastructure Protection (CIP) standards, which necessitate the implementation of comprehensive OT security protocols.

On the other hand, Asia Pacific is observed to expand at a rapid pace during the forecast period. The growth of the market in the region can be attributed to the increasing investments in digitization and automation. There is heightened awareness regarding the benefits of OT security solutions. With the increasing cases of cyberattacks, the need to protect critical infrastructure is rising. The growing adoption of cloud-based OT security solutions and increasing acceptance of Industry 4.0 further support regional market growth.

Europe is expected to grow at a notable rate. The growth of the operational technology security market in Europe is driven by the increasing investment in security solutions by businesses to safeguard their critical infrastructure against potential cyberattacks. Stringent security measures, a supportive government framework, and the growing popularity of AI-powered security solutions further support market growth. In addition, regional market players are widely adopting numerous strategies to enhance their market penetration rate and strengthen their position to gain a competitive edge in the industry, contributing to market growth.

Operational technology (OT) security refers to the cybersecurity practices that assist in ensuring operational integrity, continuity, and safety in critical infrastructures and industrial control systems (ICS). It is specifically designed to meet the unique security requirements of OT environments. The rising convergence of OT and information technology is likely to offer greater efficiency and automation in industrial systems, making OT security indispensable for critical infrastructure management. The operational technology security market is witnessing rapid growth due to the rising connectivity of OT systems and digitization.

| Report Coverage | Details |

| Market Size by 2034 | USD 122.22 Billion |

| Market Size in 2025 | USD 27.03 Billion |

| Market Size in 2024 | USD 22.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.25% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Enterprise Size, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Cases of Cyberattack

The rising frequency of cyberattacks boosts the demand for OT security solutions, driving the growth of the operational technology security market. Over the years, several industries have transitioned toward digital platforms, which necessitates them to store critical information related to finances and customers in their cloud servers. However, with the rapid evolution of technology, the cases of cyberattacks have also dramatically increased. According to the Ministry of Electronics and Information Technology, as reported by the Indian Computer Emergency Response Team (CERT-In), India has witnessed a significant rise in cyberattacks targeting government bodies, marking a 138% increase in the number of such incidents from 85,797 incidents in 2019 to 204,844 in 2023. As these operational technology (OT) systems become more commercialized due to the advent of Industry 4.0 and the Industrial Internet of Things (IIoT), their susceptibility rises. Therefore, the surge in the number of cyberattacks on vital infrastructure and industrial systems is anticipated to propel the growth of the market.

Shortage of Skilled Cybersecurity Professionals and High Costs

The lack of skilled cybersecurity professionals is anticipated to hamper the market's growth. There is a shortage of skilled cybersecurity professionals with expertise in OT security. This makes it challenging for organizations to find and retain qualified personnel to meet their OT security needs. Moreover, implementing OT security solutions requires substantial investment, limiting the growth of the market.

Increasing Adoption of Cloud-based OT Security Solutions

The rising adoption of cloud-based OT security solutions is projected to offer lucrative growth opportunities for the operational technology security market. Cloud-based OT security solutions offer real-time visibility and detect potential threats, which can assist organizations in responding to security incidents more quickly. The integration of cloud-based solutions enables organizations to collect and effectively analyze security data from various OT & IT systems, such as logs, security alerts, network traffic, and others in a centralized cloud-based platform. Moreover, increasing awareness regarding the benefits offered by cloud-based OT security solutions is expected to fuel the market expansion in the coming years.

The solutions segment dominated the operational technology security market with the largest share in 2024. The growth of the segment is driven by the rising organizations' need for OT security solutions to protect their critical infrastructure against cyberattacks. The are mainly two main types of OT security solutions, namely standalone and integrated. These solutions provide a comprehensive approach to addressing OT security challenges.

On the other hand, the services segment is expected to witness significant growth during the forecast period. The growth of the segment can be attributed to the rising organization's preference to outsource its OT security needs to third-party providers. Operational technology security services generally include incident detection, monitoring, response, and training & consulting services. These services help organizations in deploying OT security solutions.

The on-premises segment held the largest share of the operational technology security market in 2024. This is mainly due to the increasing acceptance of on-premises OT security solutions. On-premises deployment enables organizations to have thorough control over their OT security solutions. In addition, increased concerns regarding security and privacy significantly raised the demand for on-premises solutions.

The cloud segment is expected to grow significantly in the coming years. There is a high demand for robust security measures for OT systems due to the increase in cyberattacks. This encourages businesses to shift toward cloud-based OT security solutions. These solutions safeguard critical systems from malicious intrusions. Furthermore, the availability of a diverse array of cloud-based OT security solutions supports segmental growth.

The large enterprises segment held the largest share of the operational technology security market in 2024. This is mainly due to the increased adoption of OT security solutions by large enterprises to safeguard their critical infrastructure from cyber threats. Large enterprises often deal with large volumes of sensitive data and intellectual property, increasing the risk of cyberattacks. The cases of data breaches in large enterprises have increased in the last few years. Therefore, large enterprises are investing heavily in OT security solutions to protect against cyberattacks, bolstering the growth of the segment.

On the other hand, the SMEs segment is expected to witness remarkable growth during the forecast period. The growth of the segment is attributed to the surge in the number of small and medium-sized businesses in emerging economies. SMEs are investing heavily in enhancing their operational technology security to protect their infrastructure. In addition, SMEs increasingly prefer cloud-based OT security solutions for improving security and optimizing operations due to their cost-effectiveness.

The oil & gas operations segment led the operational technology security market with the largest share in 2024. OT security plays a pivotal role in managing oil & gas operations, which are primarily focused on preventing cyber threats. In the oil & gas industry, OT security assists in controlling and monitoring critical infrastructure and industrial operations, including oil and gas production, transportation, and storage.

On the other hand, the manufacturing segment is projected to grow at the fastest rate during the forecast period. The cyber adversaries are increasingly targeting the manufacturing industry. The automation and digitalization of manufacturing processes are enhancing their vulnerability to cyberattacks. The adoption of OT security solutions in the manufacturing industry assists in protecting infrastructure and assets from cyberattacks, ensuring the reliability and safety of operations. Moreover, stringent regulatory requirements compel manufacturers to allocate resources toward OT security to ensure compliance.

By Component

By Deployment

By Enterprise Size

By Vertical

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

April 2025

January 2025