July 2024

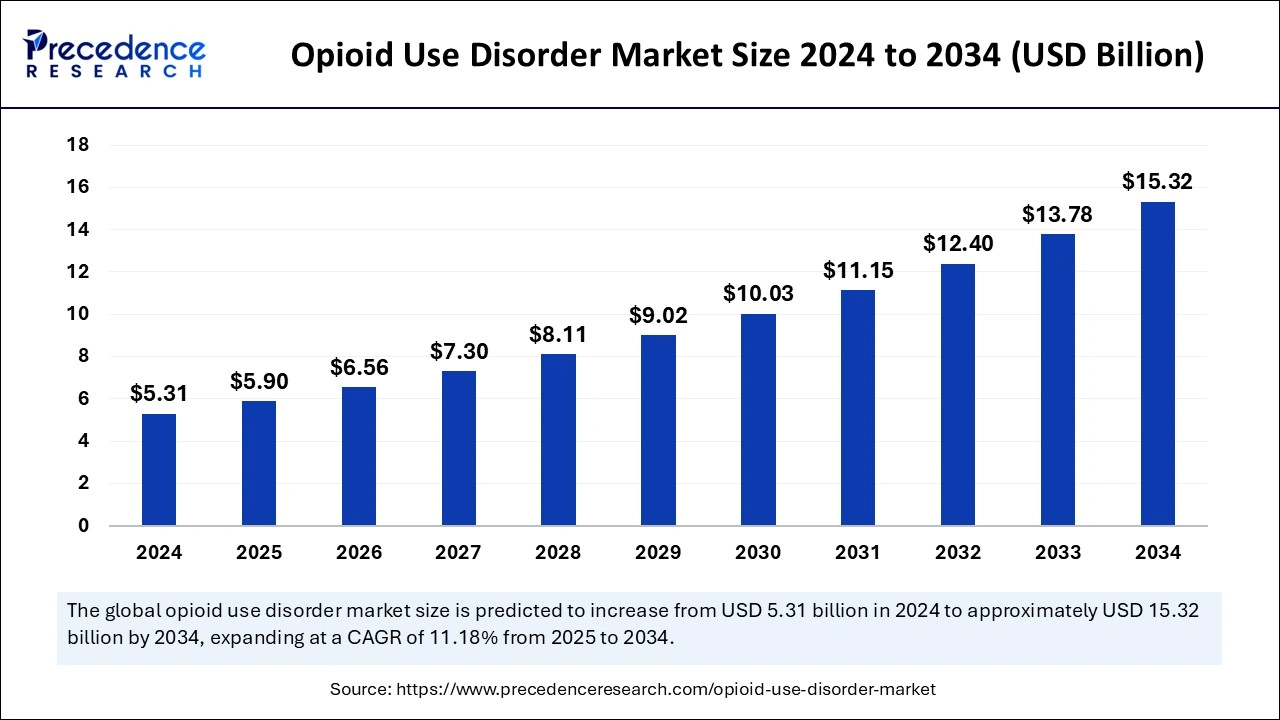

The global opioid use disorder market size is calculated at USD 5.90 billion in 2025 and is forecasted to reach around USD 15.32 billion by 2034, accelerating at a CAGR of 11.18% from 2025 to 2034. The North America market size surpassed USD 3.66 billion in 2024 and is expanding at a CAGR of 11.27% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global opioid use disorder market size accounted for USD 5.31 billion in 2024 and is expected to exceed around USD 15.32 billion by 2034, growing at a CAGR of 11.18% from 2025 to 2034. The increasing rates of substance use disorders are the key factor driving the market growth. Also, rising government efforts to deal with these disorders, coupled with the increasing awareness of opioid use conditions, can fuel market growth shortly.

Artificial Intelligence models can help to detect the highest risk person for opioid addiction and can also implement insightful resources for the opioid use disorder market. This is useful for better management of pain among the population suffering from opioid addiction. Furthermore, GenAI can offer a more holistic approach to forecasting many outcomes based on patterns discovered from wide patient datasets.

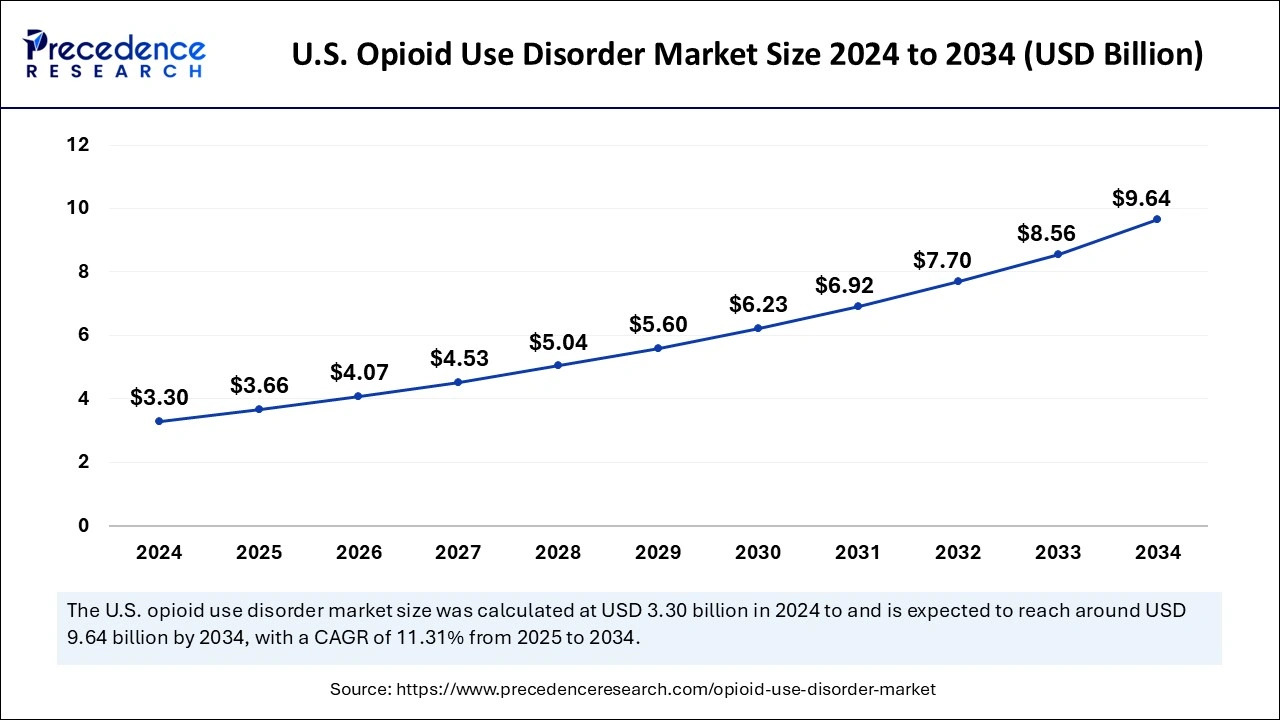

The U.S. opioid use disorder market size was exhibited at USD 3.30 billion in 2024 and is projected to be worth around USD 9.64 billion by 2034, growing at a CAGR of 11.31% from 2025 to 2034.

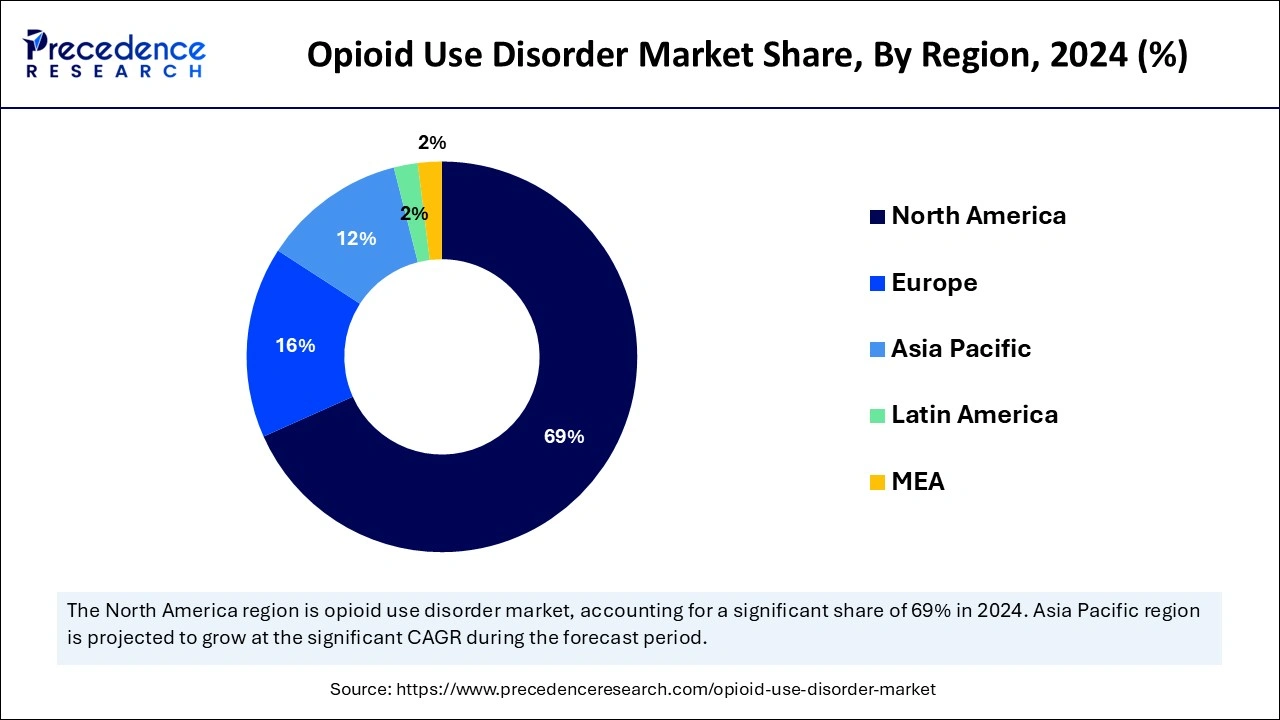

North America dominated the global opioid use disorder market in 2024. The dominance of the region can be attributed to the increasing incidence of OUD, which fuels the substantial demand for new treatment options. The region also benefits from innovative healthcare infrastructure, development capabilities, and wide research. Furthermore, in North America, the U.S. led the market owing to the growing awareness among medical professionals regarding available treatments along with the surge in disease prevalence.

Asia Pacific is expected to show the fastest growth in the opioid use disorder market over the studied period. The growth of the segment can be credited to the increasing collaborations between local and international organizations. These partnerships are boosting innovation and other management strategies. In Asia Pacific, China dominated the market due to increasing government support for enhancing healthcare facilities and increasing adoption of opioids in pain management.

Opioids are a set of painkillers that contain drugs that reduce pain, relax muscles, and relieve stress. Drugs such as oxycodone, codeine, hydrocodone, methadone, fentanyl, and other pharmaceutical medications are generally prescribed to treat severe or moderate pain. The excessive use of these drugs for pain treatment or any other purposes can lead to an illness called opioid usage disorder (OUD). Opioid drugs are mainly used to treat immediate pain after surgery. This factor can result in driving the opioid use disorder market.

Drug abuse statistics 2020

| Substance | First-Time Users |

| Alcohol | 4.9 million |

| Marijuana | 3.1 million |

| Pain killers | 1.9 million |

| Tobacco | 1.8 million |

| Hallucinogens | 1.1 million |

| Report Coverage | Details |

| Market Size by 2024 | USD 5.31 Billion |

| Market Size in 2025 | USD 5.90 Billion |

| Market Size in 2034 | USD 15.32 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug, Route Of Administration, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising admiration for buprenorphine patches

Buprenorphine patches for tackling opioid addiction are increasingly becoming popular, as they are more effective in treating OUD. These patches have benefits such as decreased discomfort and enhanced drug delivery. They are the key choice for current opioid therapy, particularly for individuals who require continuous medications. In addition, the increasing prevalence of disease conditions like heart and cancer disease necessitates frequent use of opioids and other painkillers.

Side-effects from drug intake

The key factor that might hinder the opioid use disorder market growth is the side effects that can arise from the administration of drugs used for OUD treatment. The general side effects of these drugs are abdominal cramps, vomiting, diarrhea, respiratory complications, and constipation. Moreover, in severe cases of multiple side effects, the patient can also suffer from psychological disorders like anxiety and depression, hampering market growth further.

Rising R&D of novel drugs

The opioid use disorder market is witnessing substantial growth owing to the rising incidence of substance use conditions such as opioid addiction. Hence, the market players are working on developing innovative novel therapies to treat this addiction. These treatment solutions provide benefits over offering fast and strong rises in plasma levels, effectively inhibiting opioid receptors. Furthermore, digital therapeutics such as telecommuting and cognitive behavioral therapy are also gaining traction because of their effectiveness.

The buprenorphine segment dominated the global opioid use disorder market in 2024. The dominance of the segment can be attributed to the effectiveness of this drug as a partial opioid agonist; this helps in increasing cravings and withdrawal symptoms while reducing euphoria and other associated risks. Additionally, the combination of naloxone and buprenorphine can deter opioid abuse further. The research also shows that raised buprenorphine doses can improve treatment results, especially in patients using fentanyl.

The naltrexone segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to its numerous benefits. As an opioid antagonist, it efficiently blocks opioid receptors, protecting from relapses by cutting the adverse effects of opioids. In addition, growing awareness and rising insurance coverage will likely fuel its adoption.

The injectable administration segment led the global opioid use disorder market in 2024. The dominance of the segment can be credited to the advantages this route of administration provides. The injectable route can be used to deliver medications more rapidly and supplement calories. Furthermore, this route enables the drug to reach the bloodstream rapidly, which results in a quick onset of action. This is essential in controlling opioid withdrawal symptoms and also offers quick pain relief.

The oral administration segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment is due to the convenience it provides as it is non-invasive. Which in turn increases patient compliance and adherence. Medications like naltrexone and buprenorphine are much easier to manage and administer and require no specialized procedures or equipment. Also, oral medications can be administered at home easily.

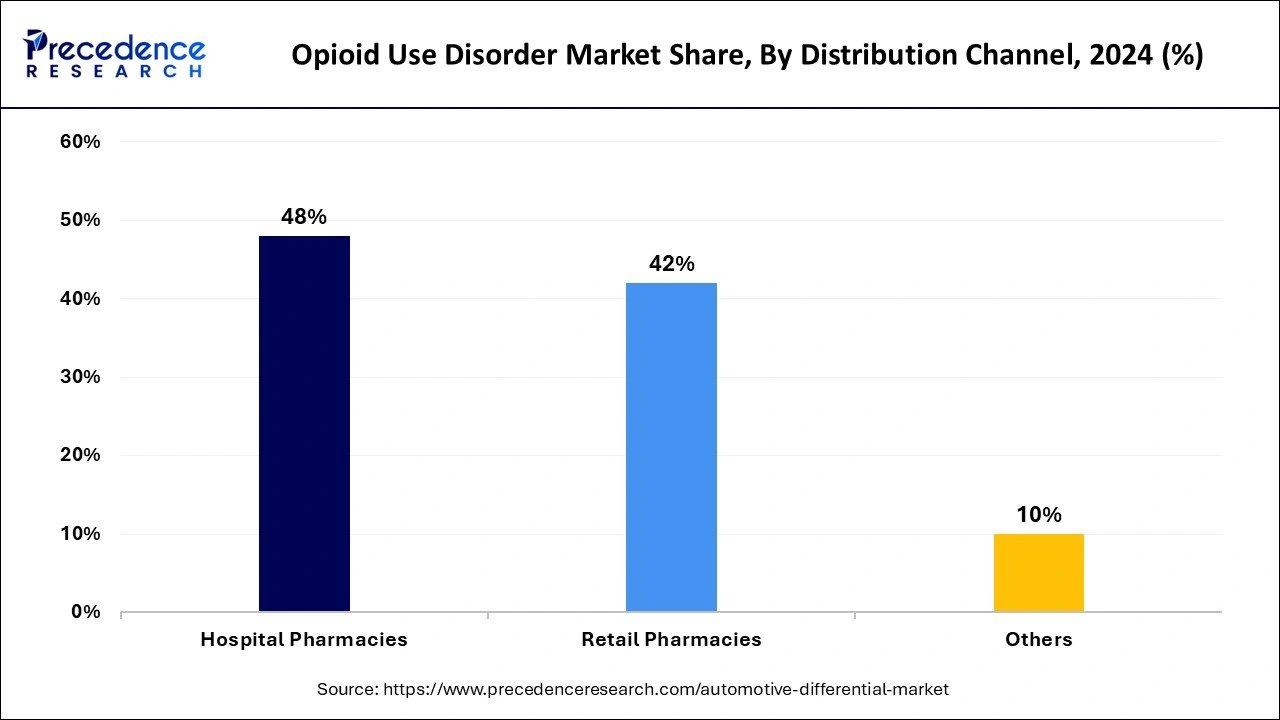

In 2024, the hospital pharmacies segment held the largest share of the opioid use disorder market. The dominance of the segment can be driven by the ability of hospital pharmacies to monitor and distribute specialized medications, like extended-release drugs and methadone. They also provide a controlled environment where drugs can be taken under stringent supervision, which is important for ensuring safety and adherence, especially for injectables.

By Drug

By Route Of Administration

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

December 2024

December 2024

November 2024