January 2025

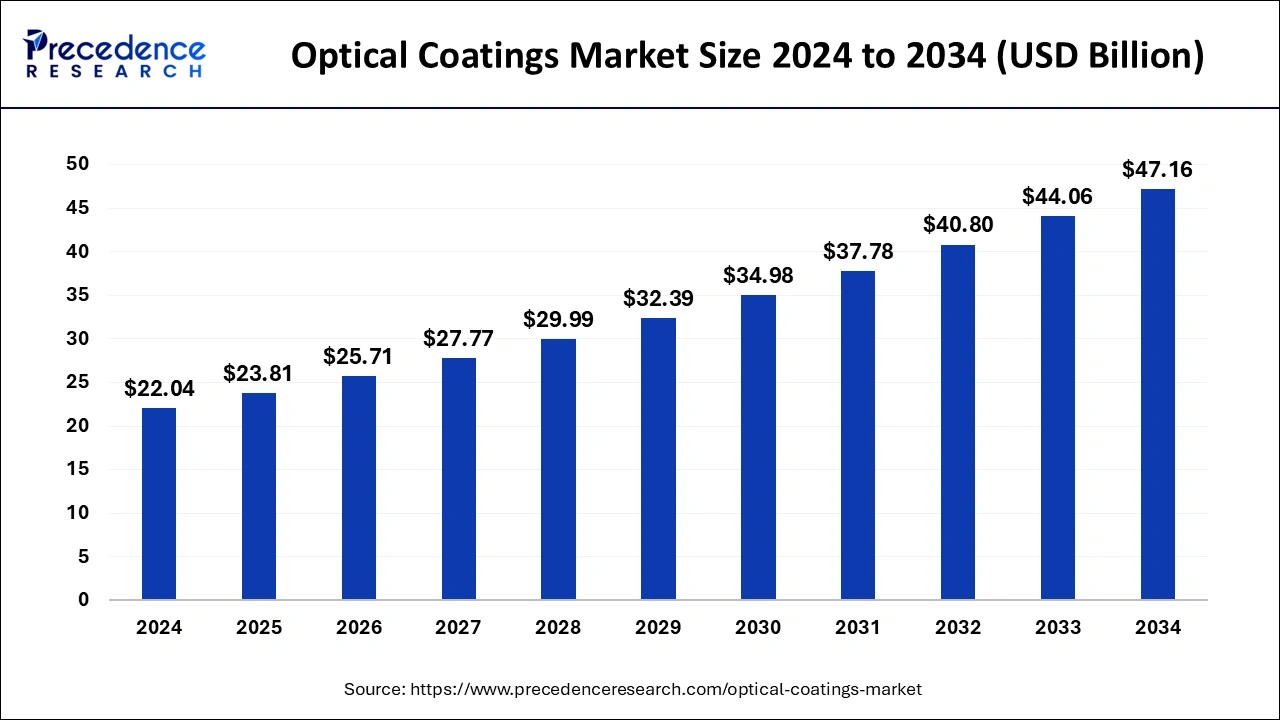

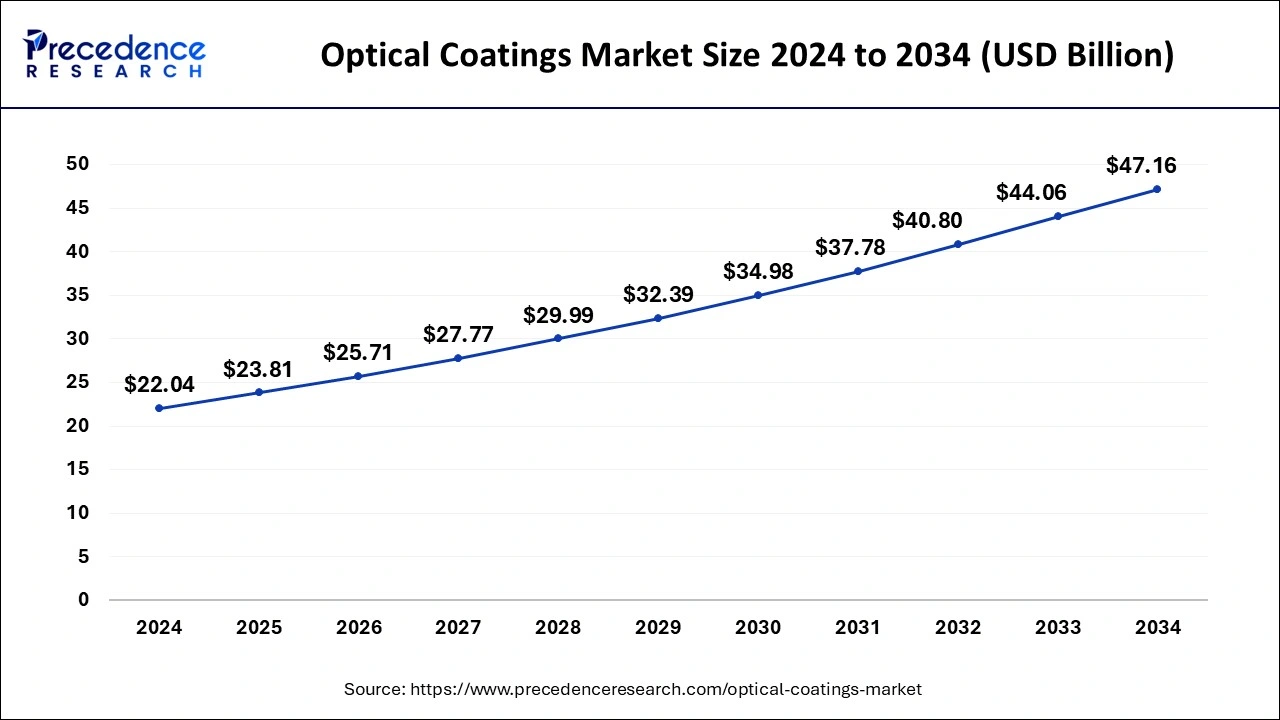

The global optical coatings market size estimated at USD 23.81 billion in 2025 and is anticipated to reach around USD 47.16 billion by 2034, expanding at a CAGR of 7.90% from 2024 to 2034. The North America optical coatings market size surpassed USD 8.60 billion in 2024 and is expanding at a CAGR of 8.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global optical coatings market accounted for USD 22.04 billion in 2024 and is predicted to reach around USD 47.16 billion by 2034, with at a CAGR of 8% from 2025 to 2034.

The U.S. optical coatings market size was estimated at USD 22.04 billion in 2024 and is predicted to be worth around USD 47.16 billion by 2034, at a CAGR of 8.20% from 2025 to 2034.

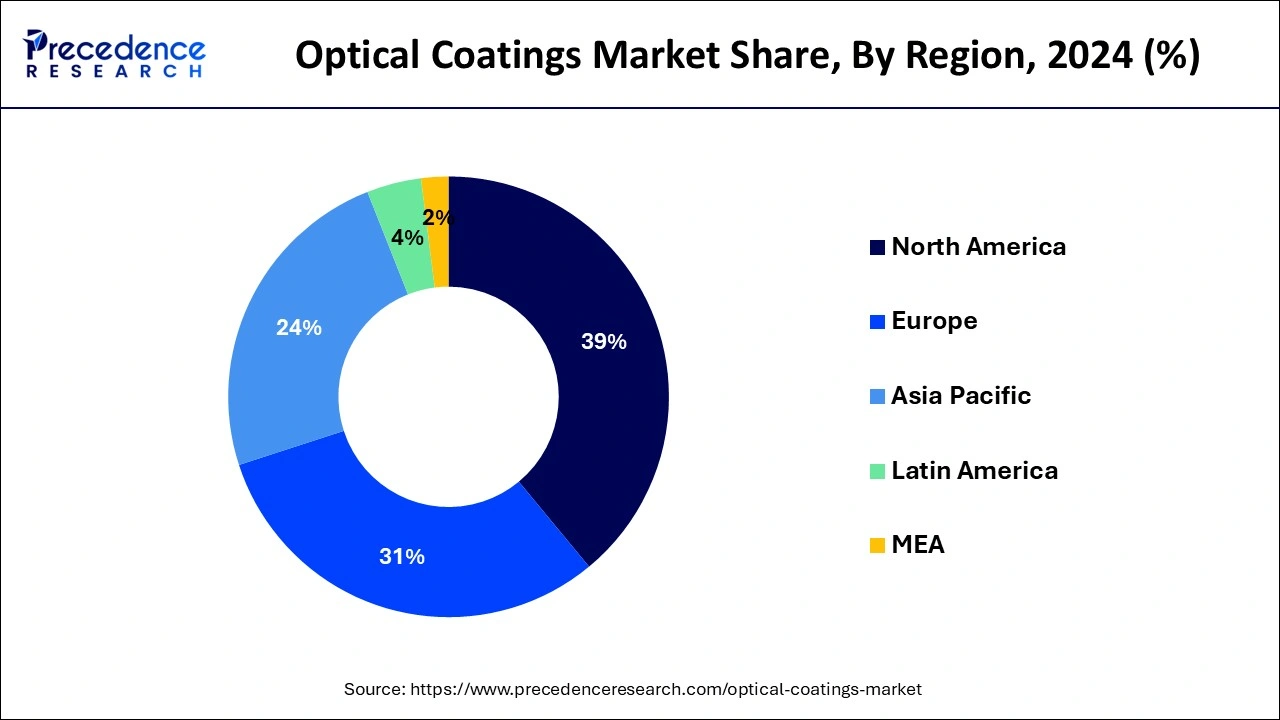

North America led the overall market in the year 2024 with revenue share of 39%. Significant growth of solar industry particularly in the U.S. along with increased focus towards the development of domestic industries in the region is some of the key factors that anticipated to drives the demand for the product. Further, increase in the defense budget for the U.S. creates immense growth potential especially for reflective coating products in the industry.

Besides this, the Asia Pacific estimated to exhibit significant growth over the upcoming years. Rising demand for consumer electronics that include tablets, mobiles, LED screens, cameras, personal computers, and video games console expected to propel the market growth for the region over the analysis period. Further, the region estimated to have immense opportunity for automotive and manufacturing sectors that further anticipated to proper the market growth in the region.

Recent advancements in the sector of optical deposition techniques & fabrication along with increasing demand for efficient and more effective optical devices from various end-use applications expected to prosper the market growth. Optical coatings are prominently used in diverse range of applications that includes consumer electronics, architecture, automotive, solar panels, telecommunication, medical, and military &defense. Further, increasing focus towards clean energy generation in order to curb the alarming rise in pollution is majorly responsible for the rapid growth of solar photovoltaic (PV) market that in turn propel the market growth for optical coatings.

Additionally, increasing demand for reflective coatings mainly in green buildings in order to reduce energy consumption and retain heat inside the building estimated to thrive the product demand during the analysis period. Apart from this, reflective coatings are largely used in telecommunication, construction, and space applications. Moreover, increasing demand for consumer electronic products most prominently across the Asia Pacific is likely to boost the market growth over the upcoming years. Increasing usage for handheld consoles along with growing demand for portable electronic products expected to fuel the market growth during the upcoming years.

| Report Coverage | Details |

| Market Size in 2024 | USD 22.04 Billion |

| Market Size in 2025 | USD 23.81 Billion |

| Market Size by 2034 | USD 47.16 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

The anti-reflective product segment dominated the market in the year 2024. Anti-reflective coatings referred as thin-film optical coatings that comprises of multiple layers of coatings with dissimilar refractive indexes between every layer. Thickness of each layer is designed as to provide a self-extinguishing interference for the beam of light that are reflected by the surface. Hence, this feature of the product makes it suitable for camera lenses, display screens, magnifying lenses, and eyeglasses. Further, increasing demand for anti-reflective optical coatings mainly for the construction of automotive displays, photovoltaic solar panels, GPS navigation systems, and windows projected to fuel the market growth over the analysis period.

On the other hand, conductive coatings segment estimated to exhibits lucrative growth over the forthcoming years because of its large-scale application in solar panels. Furthermore, growing emphasis for the development of alternate sources for energy generation together with rise in investments for solar energy generation across various countries, such as the U.S., India, and China predicted to prosper the growth of the segment.

Consumer electronics captured major market share in the global optical coatings industry in 2024. Rapid growth in demand for smartphones coupled with rising disposable income of consumers anticipated to drive the growth of the segment over the upcoming years. Furthermore, on-going technological advancements in smart consumer devices and smart televisions, such as smartphones and smartwatches estimated to positively influence the market growth during the forthcoming years. In addition to this, surge in demand for multi-functional devices as well as their manufacturers expected to drive the demand for optical coatings in the coming years.

Automotive industry is the other most important application segment for the market owing to its application in speedometer display due to its properties such as high abrasion resistance and impact resistance. Similarly the optical coatings are largely used in numerous components of automobile. Abrasion-resistant and UV resistant coatings are the commonly used products in the automotive components.

By Product

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

February 2025