January 2025

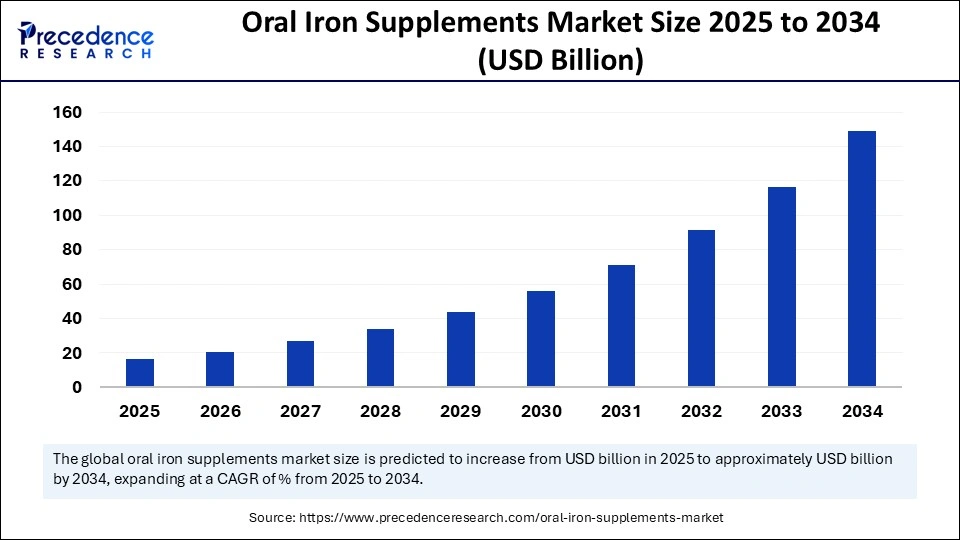

The oral iron supplements market is expanding due to rising anemia cases, growing health awareness, and better healthcare access globally. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The oral iron supplements market is growing as demand rises due to higher anemia rates, increased health consciousness, and broader healthcare accessibility. The market growth is attributed to the increased demand for safe, effective, and easily absorbable iron formulations across diverse age groups for treating health conditions like IDA.

Artificial Intelligence (AI) has the potential to revolutionize the market for oral iron supplements. The healthcare sector uses AI to improve medical diagnosis while upgrading the supply chain. AI can optimize the manufacturing process for oral iron supplements. Manufacturers can leverage AI analytics to examine market data to boost consumer interaction. Furthermore, AI analyzes individual health data and dietary preferences, which helps in developing personalized supplements.

The oral iron supplements market is growing at a significant rate due to the growing prevalence of anemia. According to the World Health Organization (WHO), anemia affects 1.62 billion people worldwide. Iron deficiency is the main cause of anemia, with the highest proportion in low- and middle-income countries. The ongoing health crisis has led national governments and health organizations to create iron supplementation programs. The consumer demand for iron supplements continues to rise because people have become more aware of proper iron consumption. The rising demand for dietary supplements further contributes to market growth, as iron is included in dietary supplements.

| Report Coverage | Details |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Form, Distribution Channel, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Burden of Iron Deficiency Anemia

The rising burden of iron deficiency anemia (IDA), especially in developing countries, is a major factor driving the growth of the oral iron supplements market. IDA is a major public health concern in low and middle-income countries, affecting a large portion of the population. Many people in these countries lack access to adequate healthcare services, including iron supplements, leading to a high prevalence of IDA. Healthcare authorities are expanding their nutritional programs to protect people by utilizing these supplements. Supplement programs introduced by governments, alongside non-government organizations, focus especially on rural populations. In addition, the prevalence of IDA is increasing among pregnant women and children, which is expected to drive the growth of the market. According to the WHO, 40% of children 6–59 months of age and 37% of pregnant women worldwide faced anemia in 2023 due to iron deficiency.

Limited Awareness in Rural Areas and Potential Side Effects

The lack of awareness in rural areas is anticipated to hamper the growth of the oral iron supplements market. People in low-income countries have an insufficient understanding of the symptoms of iron deficiency and the long-term effects associated with it. In addition, the overdose of iron supplements leads to side effects like nausea, constipation, and stomach upset. This, in turn, limits the adoption of oral iron supplements and restrains market growth.

Growing Demand for Plant-based and Personalized Iron Supplements

The increasing interest in plant-based and vegan iron supplements is expected to create immense opportunities for the players competing in the market. People are increasingly preferring natural and organic health solutions. This encourages supplement manufacturers to develop innovative formulations using plant-based ingredients. In addition, the rising demand for personalized supplements opens new avenues for market growth. The preference for personalized supplements is rising with the changing dietary patterns and rising health consciousness.

The ferrous sulfate segment dominated the oral iron supplements market with the largest share in 2024. This is mainly due to its widespread clinical acceptance, affordability, and high iron content. Public and private healthcare professionals use ferrous sulfate as a preferred treatment for iron deficiency. Furthermore, global health organizations promote ferrous sulfate as the leading oral iron supplement to treat IDA.

The iron bisglycinate segment is expected to grow at the fastest rate during the projection period. It delivers improved bioavailability along with reduced gastrointestinal intolerability. This iron chelation method hooks up to amino acid molecules. Iron bisglycinate is widely preferred due to its reduced gastrointestinal side effects. The FDA introduced new guidelines in 2024, allowing the use of iron bisglycinate in medical foods to improve specific absorption problems while strengthening scientific evidence.

The iron deficiency anemia (IDA) treatment segment held a considerable share of the oral iron supplements market in 2024. This is mainly due to the increased prevalence of IDA across the globe. According to the World Health Organization (WHO) and Centers for Disease Control and Prevention (CDC), IDA stands as a significant nutritional deficiency, requiring iron supplements to reduce long-term effects. The public health programs of India, Brazil, Nigeria, and Indonesia made efforts to distribute iron supplementation to population groups at risk. Furthermore, the heightened demand for oral iron products in anemia management bolstered the segment’s growth.

The sports nutrition segment is expected to expand at the highest CAGR during the forecast period due to the rising awareness of iron’s importance in athletic performance and endurance. Female runners and triathletes commonly experience iron depletion, which affects their performance and endurance. Iron supplements are incorporated into sports nutrition to address iron deficiency.

The tablets segment dominated the oral iron supplements market in 2024. Healthcare providers choose tablet formulations mainly for their precise dosage control and extended shelf life. Tablets are more stable than capsules and resistant to environmental factors, making them suitable for long-term treatment. Furthermore, tablet iron supplements are in high demand due to their affordability and ease of use.

The liquid segment is projected to expand rapidly in the coming years. Liquid forms of oral iron supplements serve the expanding requirements of pediatric patients and patients with gastrointestinal sensitivity. Liquids deliver flexible dosage options with fast absorption rates that benefit people with pill-swallowing difficulties. According to the National Institutes of Health (NIH), liquid iron supplements better treat anemia in infants and elderly patients because they result in less gastric irritation than standard iron tablets.

The pharmacies segment held the largest share of the oral iron supplements market in 2024. This is mainly due to the easy availability of wide availability of OTC iron supplements. Customers tend to buy iron supplements at pharmacies because these establishments provide OTC options as well as prescription medications. Pharmacists play a crucial role in implementing anemia awareness initiatives. Moreover, pharmacists provide guidance regarding dosage, reducing the need for hospital visits and thus attracting a large number of people.

The online retailers segment is projected to grow at the fastest rate during the projection period. This is mainly due to the availability of a wide range of oral iron supplements from multiple brands. Online pharmacies offer discounts and doorstep delivery, attracting more people. The World Health Organization (WHO) recorded a significant increase in direct-to-consumer health product demand in 2024. Additionally, the rising popularity of online shopping is expected to drive the segment’s growth.

North America led the oral iron supplements market by capturing the largest share in 2024. This is mainly due to the increased prevalence of IDA. A large number of people have recognized the importance of dietary supplements as a remedy for iron deficiency anemia. There is also a high demand for personalized supplements. The National Institutes of Health (NIH) reported an escalating trend of personalized nutrition in 2024. Customers are increasingly seeking iron supplements compatible with their health requirements such as following vegan or gluten-free lifestyles. The rising health consciousness among consumers and increasing focus on preventive healthcare further bolsters the growth of the market.

Asia Pacific is anticipated to witness the fastest growth in the market during the forecast period. The growth of the market in the region can be attributed to the increasing burden of iron deficiency anemia. According to the World Health Organization (WHO), iron deficiency anemia is the leading public health concern in Southeast Asia, affecting women and children. Governments around the region are making efforts to reduce the prevalence of malnutrition. However, iron supplements are crucial in malnutrition management.

Europe is observed to grow at a considerable growth rate in the upcoming period. The growth of the oral iron supplements market in Europe can be attributed to the increasing awareness of iron deficiency among pregnant women and older adults. The European Union supports food fortification with iron and health interventions to combat widespread anemia. There is a high demand for plant-based supplements, contributing to market growth.

By Product Type

By Application

By Form

By Distribution Channel

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2023

December 2024