January 2025

Oral Transmucosal Drugs Market (By Product Type: Tablets, Films; By Route of Administration: Sublingual Mucosa, Buccal Mucosa, Others; By Indication: Opioid Dependence, Nausea & Vomiting, Erectile Dysfunction, Neurological Disorders, Others; By Distribution Channel: Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

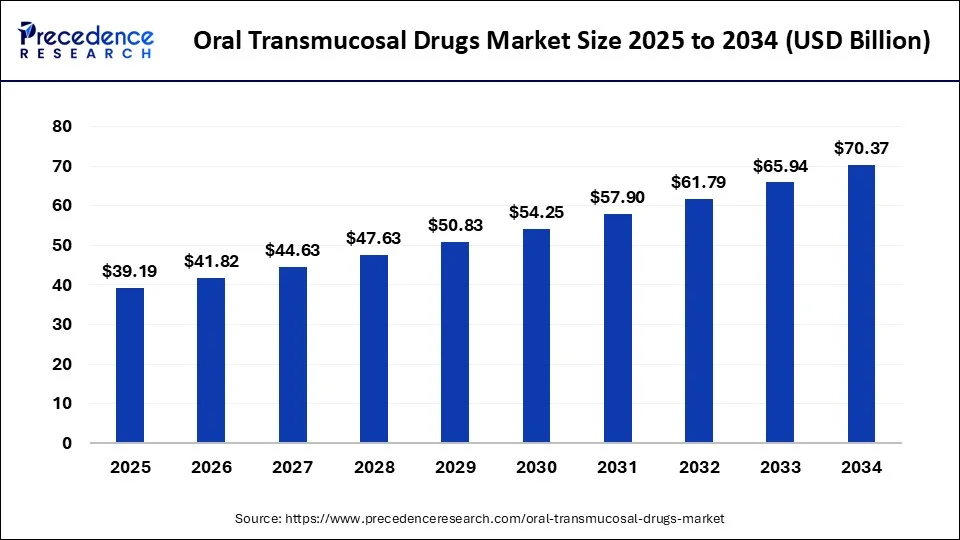

The global oral transmucosal drugs market size was USD 34.41 billion in 2023, calculated at USD 36.72 billion in 2024 and is expected to reach around USD 70.37 billion by 2034, expanding at a CAGR of 6.72% from 2024 to 2034. The North America oral transmucosal drugs market size reached USD 13.76 billion in 2023. The growth of the oral transmucosal drugs market is attributed to the increasing demand for efficient and rapid drug delivery systems, particularly for medications that require swift absorption into the bloodstream.

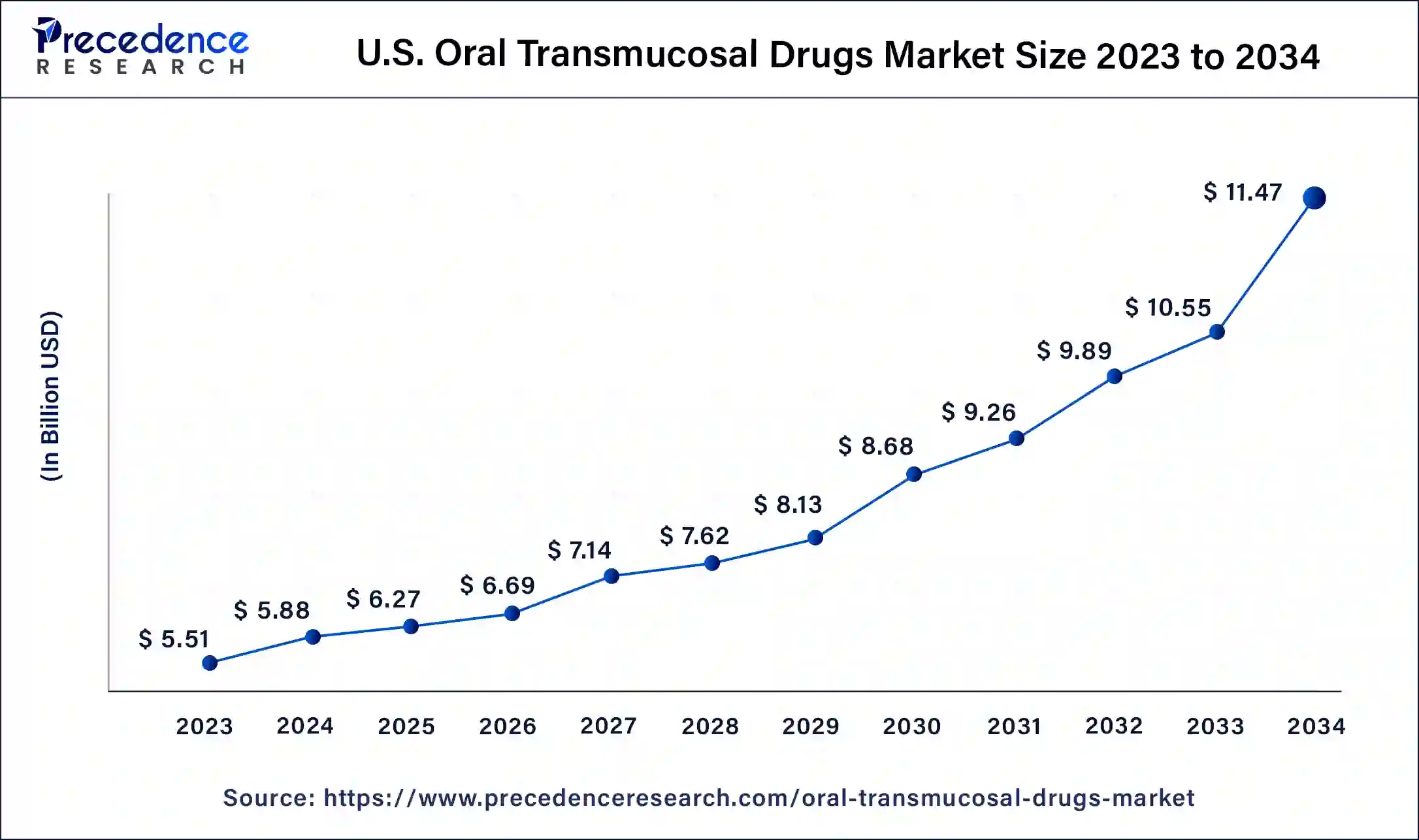

The U.S. oral transmucosal drugs market size was exhibited at USD 5.51 billion in 2023 and is projected to be worth around USD 11.47 billion by 2034, poised to grow at a CAGR of 6.89% from 2024 to 2034.

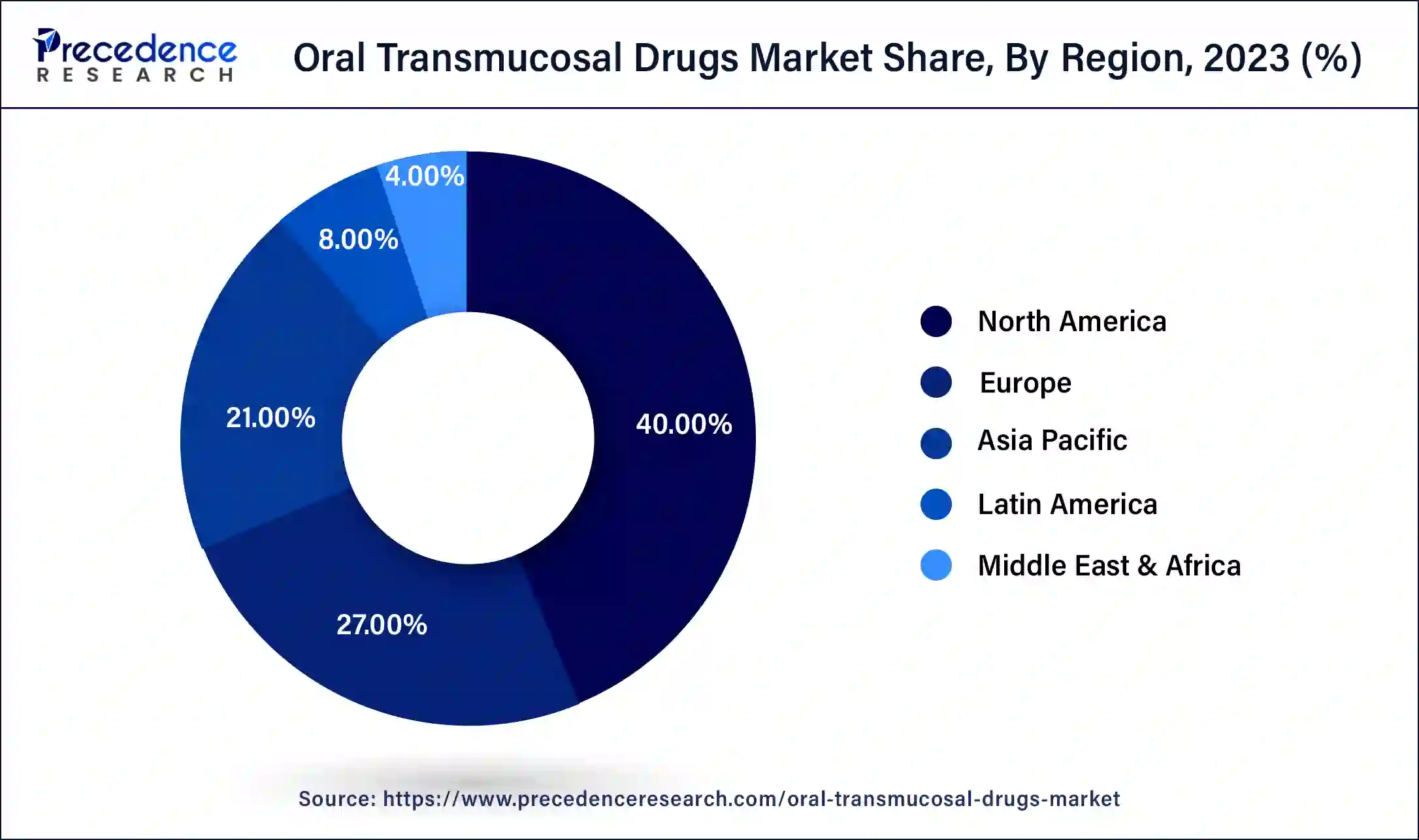

North America dominated the oral transmucosal drugs market in 2023. The widespread prevalence of Parkinson's, Alzheimer's, and dysphagia among target populations is driving market growth in the region. Additionally, the increasing geriatric population and a strong willingness to adopt new oral transmucosal medications are beneficial to the market. The region's expansion is further supported by the proactive efforts of local pharmaceutical companies and the availability of drugs designed to address opioid use disorders. This region has been particularly responsive to the ongoing global crisis of opioid use disorder and addiction, focusing on developing and providing effective treatment solutions.

Asia Pacific is expected to host the fastest-growing oral transmucosal drugs market in the upcoming years, with China, India, and Japan being the primary contributors. The region's drug delivery market is propelled by increased awareness of chronic disorders among the population, and a rising number of pharmaceutical and biotechnology companies aim to expand geographically and implement other strategies in Asia Pacific countries. Furthermore, the growth of research centers and increased government funding contribute to market expansion. The rising demand for therapeutics and the growth of medical tourism in Thailand, Singapore, and Malaysia also drive the market in this region.

The European oral transmucosal drugs market is set to grow significantly, driven by the aforementioned factors and trends. The market is expected to continue evolving with advancements in technology and increased focus on patient-centric drug delivery solutions. In Europe, the market is particularly robust in countries such as Germany, the UK, France, Italy, and Spain. Factors such as the increasing geriatric population, high prevalence of target diseases, and the presence of key market players contribute to the market's growth in these regions. The market is expanding due to the increasing demand for efficient and rapid drug delivery systems that offer quick absorption into the bloodstream, bypassing the gastrointestinal tract and avoiding first-pass metabolism in the liver. This is particularly advantageous for medications needed for pain management and other medical conditions requiring swift therapeutic effects​.

Transmucosal drug delivery devices, which administer medications through the mucous membrane for therapeutic purposes, provide an efficient alternative to oral, intravascular, subcutaneous, and transmucosal routes. As the demand for regular drug delivery devices for diagnosis and treatment increases among a wide audience, the oral transmucosal drugs market is expected to expand during the forecast period. One critical advantage of transmucosal drug administration is its ability to bypass the body's natural defense mechanisms. Transmucosal drug delivery offers numerous advantages over traditional administration methods, making it a lucrative market for companies in the value chain.

| Report Coverage | Details |

| Market Size by 2034 | USD 70.37 Billion |

| Market Size in 2023 | USD 34.41 Billion |

| Market Size in 2024 | USD 36.72 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.72% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Route of Administration, Indication, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The need for rapid drug delivery systems

In the oral transmucosal drugs market, the demand for efficient and smooth drug delivery systems is on the rise, driven by the need for medications that are quickly absorbed into the bloodstream. These drugs provide a more effective administration route, which makes them particularly valuable for pain management and specific medical conditions. Moreover, breakthroughs in pharmaceutical formulations and technology have led to the creation of innovative drug products and broadened their use across various therapeutic areas. This expansion mirrors the ongoing efforts within the pharmaceutical industry to improve drug delivery methods by offering patients more effective and convenient treatment options.

Potential Side Effects

The growth of the oral transmucosal drugs market is anticipated to be constrained by several disadvantages. Regulatory challenges and lengthy approval processes contribute to delays, while limited awareness among healthcare professionals and patients may also impede market expansion during the forecast period. Additionally, potential side effects or adverse reactions are factors that hinder market growth.

Rising R&D activities

The rising prevalence of diseases is driving increased research and development efforts to create new drugs with improved efficacy, leading to a surge in product launches for various conditions. This trend is expected to bolster market growth throughout the forecast period. Furthermore, the growing burden of diseases such as Parkinson’s and migraines, along with the increasing geriatric population requiring oral medications, is likely to propel the expansion of the oral transmucosal drugs market in the coming years.

The tablets segment accounted for the largest share of the oral transmucosal drugs market in 2023. Their solid form and versatility in accommodating various drug formulations have made tablets popular among both drug manufacturers and healthcare providers, which can contribute to their market dominance. Tablets are a preferred method for administering medication due to their ease of use and patient familiarity. Also, the rising number of approvals for oral transmucosal tablets is expected to drive segment growth. Innovations such as rapidly dissolving tablets have enhanced the convenience and efficiency of drug absorption. Tablets are extensively used to treat a range of medical conditions, including pain, and are prescribed by doctors for both clinical and at-home use.

The film segment is expected to grow at the fastest rate in the oral transmucosal drugs market over the forecast period. Pharmaceutical films are polymeric formulations that serve as delivery platforms for administering small and large-molecule drugs for both local and systemic effects. They can be produced using synthetic, semi-synthetic, or natural polymers through methods such as hot melt extrusion, solvent casting, electrospinning, and 3D printing. The choice of components and manufacturing techniques modulate drug release. Additionally, these films offer advantages that have sparked interest in their development and evaluation for applications on buccal, nasal, vaginal, and ocular mucosa.

The sublingual mucosa segment led the oral transmucosal drugs market in 2023. This is because Sublingual drugs provide faster and more efficient medication delivery compared to other methods. These drugs are absorbed through blood vessels that have a substantial blood supply and a thin mucosa and enable quicker entry into the bloodstream. This characteristic makes sublingual medications particularly beneficial for acute conditions such as pain, where rapid relief is essential. Continuous advancements in research and technology are expected to keep the sublingual mucosa segment at the forefront of the oral transmucosal medicines market.

The buccal mucosa segment is expected to show the fastest growth in the oral transmucosal drugs market over the forecast period. The buccal mucosa, which is richly supplied with blood vessels, offers greater permeability than the skin. This results in less frequent dosing, shorter treatment periods, and improved drug absorption. This site avoids first-pass metabolism, and its non-keratinized epithelium is relatively permeable to drugs. However, due to the flow of saliva and swallowing, substances in the buccal cavity have a short residence time. Therefore, this area is highly suitable for the development of bio-adhesive devices that adhere to the buccal mucosa and remain in place for an extended period.

The opioid dependence segment dominated the oral transmucosal drugs market in 2023. This can be attributed to the rise in opioid addiction, and the demand for more advanced and effective treatments is driving this segment. Oral transmucosal drugs, such as sublingual medications, have proven effective in delivering medication to individuals struggling with opioid dependence. Moreover, these drugs ensure rapid absorption through the mucosa under the tongue and provide smooth relief from withdrawal symptoms by decreasing the risk of relapse.

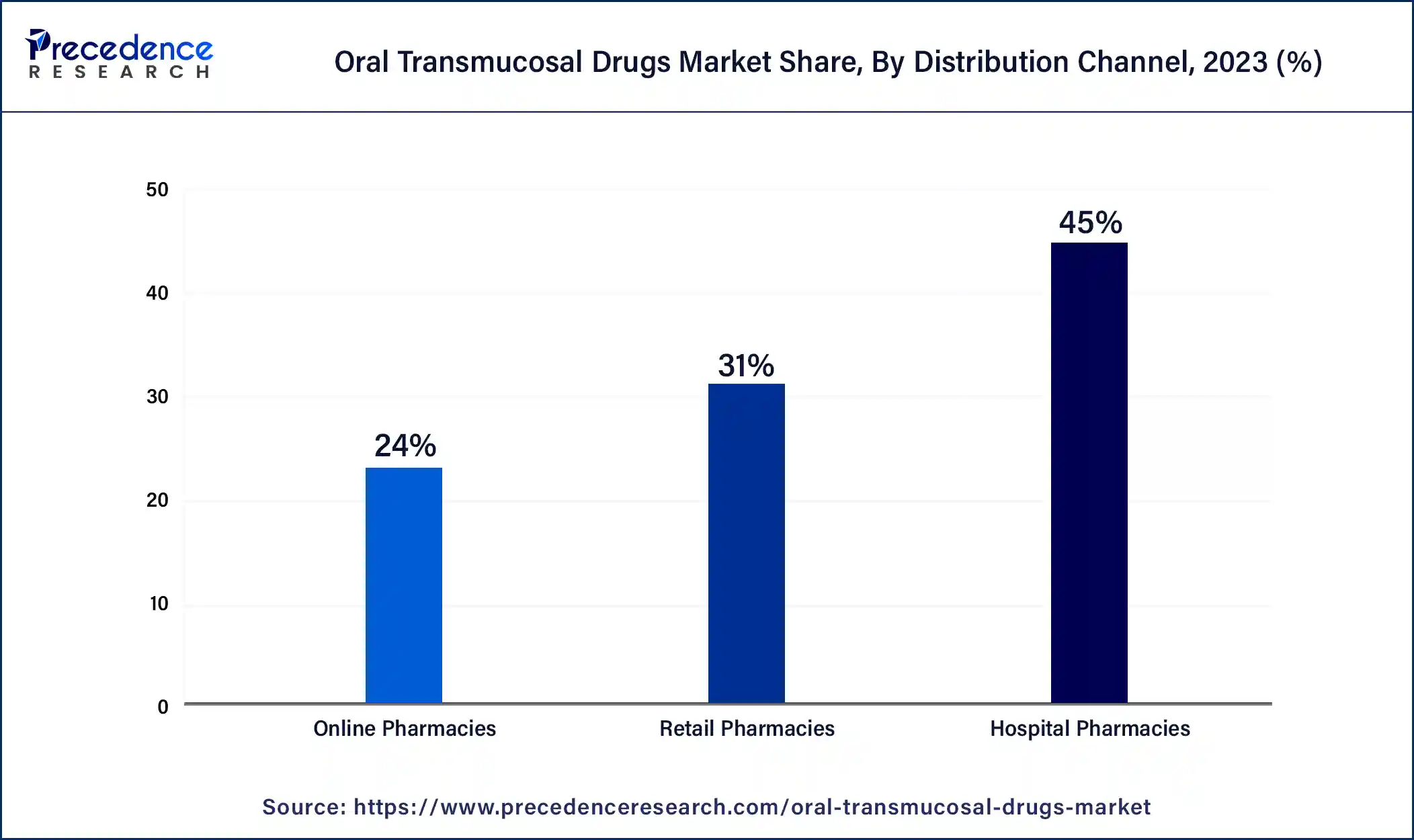

The hospital pharmacies segment accounted for the largest share of the oral transmucosal drugs market in 2023. Hospital pharmacies play an important role in distributing medications, including oral transmucosal drugs and providing pharmaceutical services. Healthcare professionals rely on these pharmacies to dispense medications in a controlled and well-monitored environment. Serving a diverse patient population, including those with acute medical conditions, hospital pharmacies are essential in managing patients' medication needs. This key role establishes hospital pharmacies as leaders in the distribution of oral transmucosal drugs.

The retail pharmacy segment is expected to grow at the fastest rate in the oral transmucosal drugs market over the projected period. Retail pharmacy is a platform where customers can physically see and evaluate their purchases, unlike online stores. This setup allows customers to experience instant gratification as they leave with them items immediately. In today's changing environment, retail pharmacies can strive to understand and meet consumers' needs to become a preferred shopping destination.

Segments Covered in the Report

By Product Type

By Route of Administration

By Indication

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2023

December 2024