January 2025

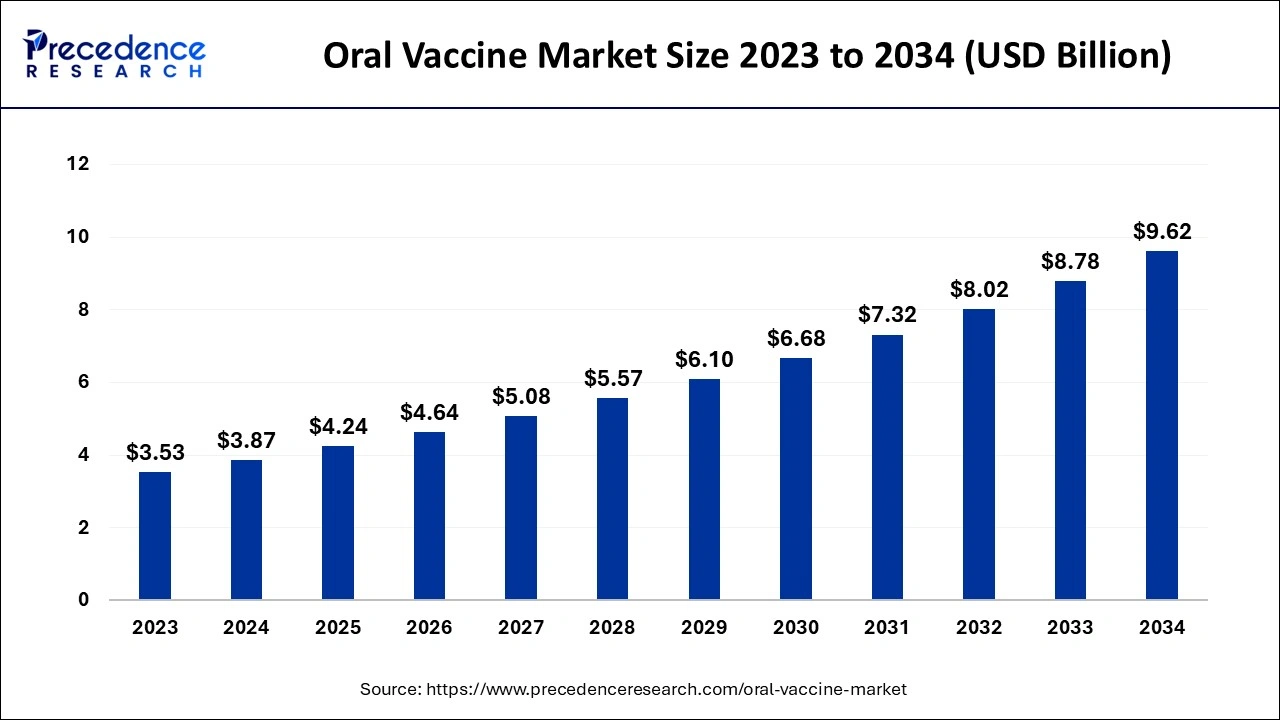

The global oral vaccine market size is estimated at USD 3.87 billion in 2024, grew to USD 4.24 billion in 2025 and is anticipated to reach around USD 9.62 billion by 2034, expanding at a CAGR of 9.54% between 2024 and 2034.

The global oral vaccine market size accounted for USD 3.87 billion in 2024 and is expected to exceed around USD 9.62 billion by 2034, growing at a CAGR of 9.54% from 2024 to 2034. The rising demand for oral vaccine market is attributable to the need for safer, easier-to-administrate, and more affordable vaccines than injectable vaccines.

The integration of artificial intelligence in the oral vaccine market has the potential to transform the development and distribution. The importance of artificial intelligence has recently been demonstrated during the COVID-19 pandemic. AI-based approaches were used to boost the mRNA vaccine antigen design and perform clinical trials. Moreover, it helps developers to go from a viral sequence to an approved product in less than a year. mRNA technology is creating the way a new vaccine that is quicker and easier to modify. Researchers employed a deep learning algorithm called Linear Design to design COVID-19 vaccines.

Oral vaccines are a gentle and convenient way to take medication and prevent infectious diseases, along with any invasive injections. The oral administration of active ingredients into the body induces the immune response for the ongoing treatments. The popularity of oral vaccines is credited to the ease of administration, zero-invasion, safety, and lower cost compared to injectable vaccines. Another advantage of oral vaccination over injectable vaccines is the simple manufacturing procedures. Additionally, oral vaccination is ideal for individuals with weakened immune systems. Currently, the vaccines available in the market for certain diseases such as Polio-Polio Sabin, cholera-dukoral, Vaxchora, Rotavirus-RotaTeq, Rotarix, Typhoid fever-Vivotif.

| Report Coverage | Details |

| Market Size by 2034 | USD 9.62 Billion |

| Market Size in 2024 | USD 3.87 Billion |

| Market Size in 2025 | USD 4.24 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.54% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vaccines Type, Application, Distribution Channel, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Routine immunization and system strengthening

Routine immunization is a recommended practice for everyone, depending on the age and vaccine history. The misconception people hold is vaccination needs to be taken only in childhood before starting school. However, they are recommended routine vaccines and boosters for adolescents and adults. Having some immunization helps people protect from chronic illness and sometimes death. It also protects against spreading disease among family members, colleagues, friends, classmates, and other communities. This practice has been made a priority for all countries in WHO South-East Asia.

Tolerance of the oral vaccine

The primary challenge behind hindering the oral vaccine market growth is the factor that an oral vaccine must tolerate the extreme environment of the highly acidic stomach, the wide range of pH values throughout the gastrointestinal tract, and the existence of proteolytic enzymes that can decompose proteins without reducing the potency. As there are various types of immune adjuvants used in injectable vaccines to boost the immune response, compared to that, there is a significant lack of mucous adjuvants for oral vaccinations. To settle this problem, novel oral vaccine adjuvants are developed that are safer and can withstand harsh environments.

Government, Industry, and organization development

The government across all nations is expected to establish early, evidence-informed strategic goals and leadership that serves global health interests. By investing in new vaccine technologies, regional research and development, and manufacturing hubs, the government will strengthen market readiness. The industries are anticipated to ensure their activities are aligned with WHO’s guidance, emphasizing research and development, particularly on the WHO-listed priority pathogens and target product profile, clinical trials in low-income countries, and target global policy needs and expedited data submission needed for regulatory approval.

The international organization and partners will be prioritizing the global public health immunization agenda in 2030. Bringing new country-driven initiatives and projects and calling for technology and application of resolutions on market transparency for health products. Strengthening routine immunization systems and services is essential to achieve high coverage and target global and regional disease elimination. Even the top-tier nations with immunization programs have unreached populations that are given special efforts.

The live attenuated segment contributed the highest share of the oral vaccine market in 2023. The dominance of this segment is observed due to its popularity of utilizing the weakened or attenuated form of the germ that causes a disease. These vaccines are homogenous to the natural infection. They create a strong and long-lasting immune response. Administering just one or two doses of live vaccines can provide lifetime protection against specific germs or diseases. Live attenuated vaccines are commonly given for diseases such as measles, mumps, rubella (MMR combined), rotavirus, smallpox, chickenpox, and yellow fever.

The inactivated vaccines segment is expected to grow at a significant CAGR in the oral vaccine market during the forecast period. The possibility of higher safety profiles, less reactogenicity, and technical feasibility contribute to the expansion of this segment. The inactivated vaccines contain pathogens that have been killed or inactivated, making them unable to replicate or cause diseases. Generally, they do not offer any immunity protection equivalent to live vaccines. They would require several doses to build immunity against disease. Currently, there are six licensed viral inactivated vaccines with either formaldehyde or BPL.

The infectious diseases segment accounted for the largest share of the oral vaccine market in 2023. The prevention of infectious disease through vaccination starts through the production of the same antibodies that make the real disease. This act helps the body to learn to recognize and fight the invasion of a particular virus or bacteria. The body learns to develop immunity and defend itself. Oral vaccines uncover the gut’s mucosal immune system to antigens.

The cancer segment is anticipated to grow with the highest CAGR in the oral vaccine market during the forecast period. This growth is due to the strategic treatment offered by oral vaccines, which trigger the body’s immune response to defend against cancer. Oral vaccines for cancer treatment are proven to be innovative administration routes to improve patient and medical staff experience and immunological results.

The hospital segment contributed the highest share of the oral vaccine market in 2023 due to the hospital-based immunization program held to prevent illnesses. The hospital distribution system (HDS) is responsible for managing the organizing framework and process design to distribute medical resources, healthcare supplies, and pharmaceuticals. The hospital's distribution staff ensures that the essential supplies are delivered to the right wards, clinics, and health centers.

The clinics segment is projected to grow significantly in the oral vaccine market during the forecast period, owing to the supply of vaccines for medical indications and to people who are at occupational risk. The role of the clinical stage is to manage vaccines, including storage, handling, and transportation. They also manage the temperature of the vaccine before, during, and after the clinic. Moreover, the clinical workers observe patients post-vaccination for syncope or allergic reactions, educate patients about vaccines, and provide information related to those.

The pediatric segment held the largest share of the oral vaccine market in 2023. The dominance of this segment is observed as children are exposed to thousands of germs every day, and it is essential to protect them by helping them build their natural defense system. There are several vaccines routinely recommended for infants and children younger than age 7. All children are made to be vaccinated against polio to avoid new outbreaks, and oral polio vaccines (OPV) are given in the majority of the countries. A healthy child younger than 5 years old with a healthy immune system is recommended to get COVID-19 vaccines, which are authorized by the Academy of Paediatrics (AAP). Additionally, there are two rotavirus vaccines licensed for infants as oral vaccines.

The adult segment is expected to grow at the fastest CAGR in the oral vaccine market during the projected period. The growth of this segment is noticed as vaccination enables adults to stay healthy and create a healthy environment for the surrounding people. Some vaccines are repeated as one grows older, and the vaccines taken in childhood get weaker with time. Commonly given oral vaccines to adults are rotavirus, adenovirus, cholera vaccines, and oral typhoid vaccines. Moreover, vaccines for hepatitis B are recommended for all adults above 50 years of age.

North America dominated the global oral vaccine market in 2023. The dominance of this region is driven by the robust healthcare facilities and investment made into the research and development of novel vaccines. State laws have established mandatory vaccination for both public and private school children. They have also made healthcare workers and patients/residents of healthcare facilities to be vaccinated. Due to the presence of FDA organizations, the vaccines are safe and effective for their intended use. They provide licensed vaccines from the manufacturing process to assure product quality and consistency.

Europe is projected to host the fastest-growing oral vaccine market in the forecast period. The expansion of this region is credited to the collaboration initiative taken by the European region to provide full coverage of vaccination and spread awareness regarding the same. The region aims to foster innovation and value recognition for immunization in Europe. The adult vaccine returns up to 19 times their initial investment to society. With changing global demographics and healthcare challenges, the adult immunization program is a powerful tool for policymakers to ease this pressure. The government is shifting to a prevention-first mindset to help calm the increased pressure on health services.

By Vaccines Type

By Application

By Distribution Channel

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

October 2023

November 2024