February 2025

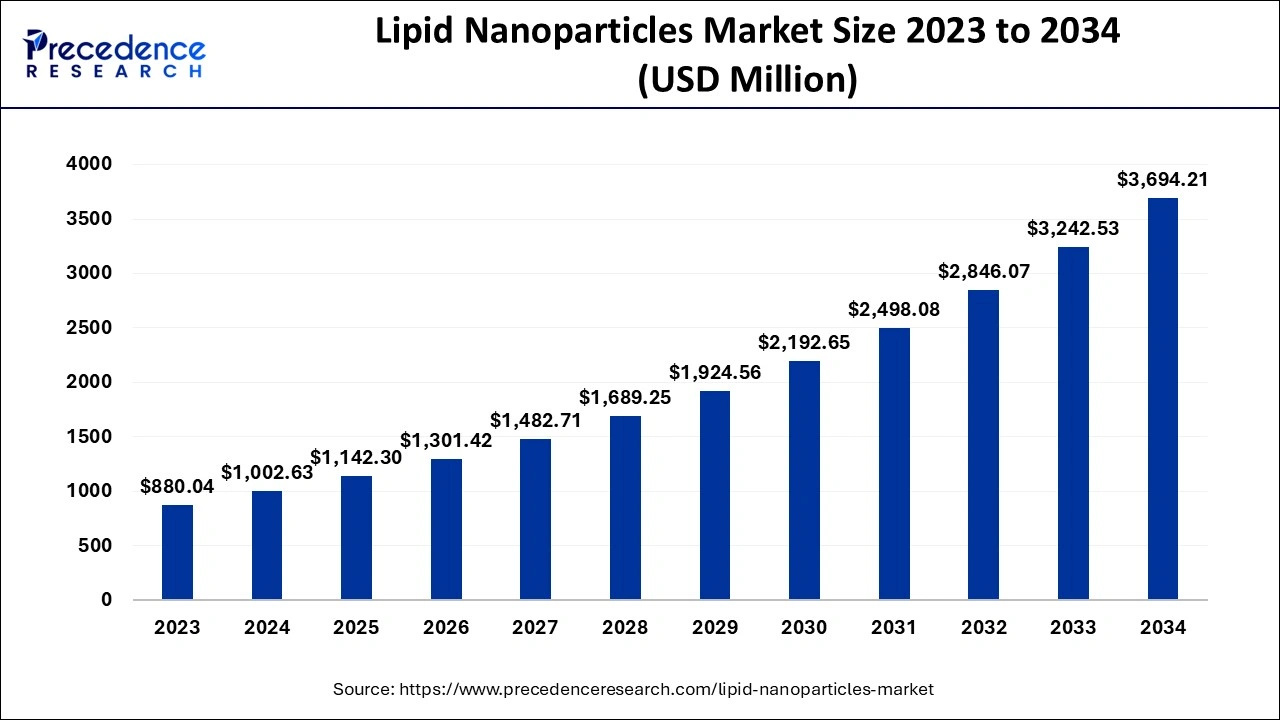

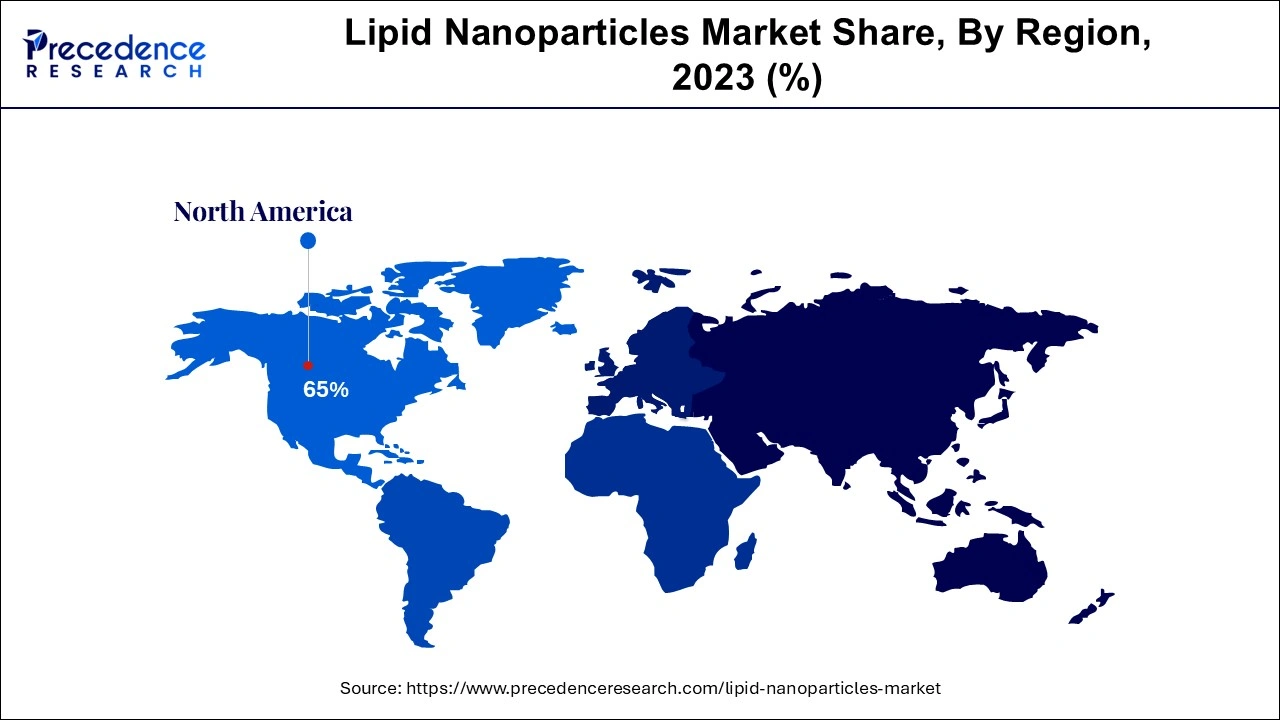

The global lipid nanoparticles market size accounted for USD 1,142.30 million in 2025 and is projected to surpass around USD 3,694.21 million by 2034, representing a CAGR of 13.93% between 2025 and 2034. The North America lipid nanoparticles market size was calculated at USD 651.71 million in 2024 and is expected to grow at a CAGR of 14.02% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lipid nanoparticles market size was valued at USD 1,002.63 million in 2024 and is anticipated to reach around USD 3,694.21 million by 2034, growing at a CAGR of 13.93% from 2025 to 2034. The lipid nanoparticles market is driven by the developments in mRNA therapies as well as the rise in chronic illnesses like cancer and heart disease.

Manufacturing processes including the creation of the lipid nanoparticles market products, the effectiveness of encapsulation, and production scaling are all optimized using AI algorithms. AI can make recommendations for enhancements that lower costs, boost yields, and enhance the quality of the finished product by examining previous data from industrial processes. LNPs were essential for mRNA vaccines following the COVID-19 pandemic. By predicting how various formulations would act in vivo, artificial intelligence is helping to improve the design and optimization of LNPs for vaccine administration. To determine which LNPs are most effective at delivering mRNA and other therapeutic substances, AI can also evaluate biological data.

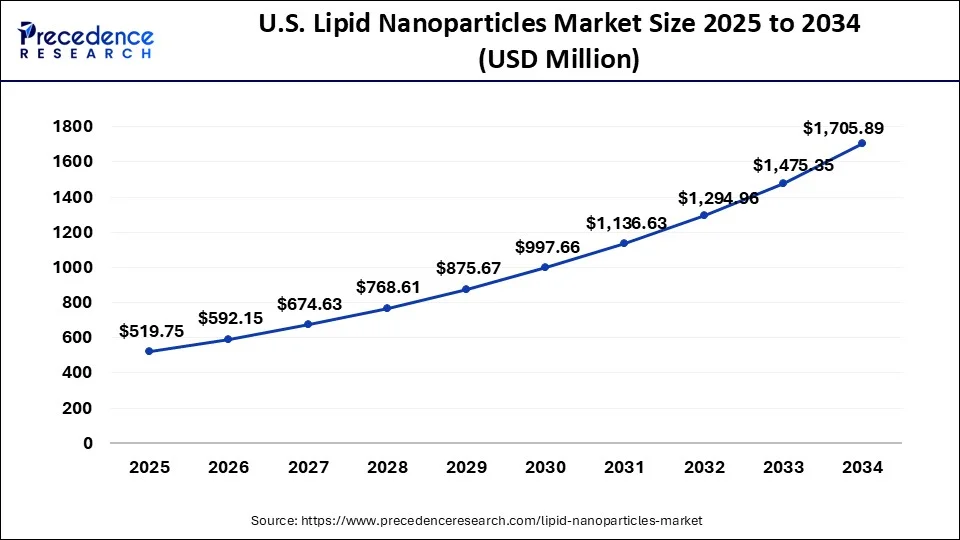

The U.S. lipid nanoparticles market size was exhibited at USD 456.20 million in 2024 and is expected to be worth around USD 1,705.89 million by 2034, growing at a CAGR of 14.10% from 2025 to 2034.

North America accounted for the largest share of the lipid nanoparticles market in 2024. North America is at the forefront of investigating LNPs in mRNA-based treatments other than COVID-19, such as immunotherapies for cancer and cures for uncommon genetic illnesses. Innovative treatments, including those utilizing lipid nanoparticles, are subject to streamlined clearance procedures and clear criteria from regulatory bodies such as the U.S. FDA and Health Canada.

North America remains the global leader in the LNP market, with the United States serving as a central hub for biotechnology innovation, state-of-the-art research facilities, and large pharmaceutical companies. The increase in LNP demand during the pandemic prompted federal programs like Operation Warp Speed, which accelerated the rapid production of LNP-based vaccines. Meanwhile, Canada is making significant contributions by providing substantial funding for biomedical innovation.

United States: Advanced R&D, federal funding, mRNA vaccine leadership.

Canada: Government-backed research funding, university-led innovation.

Asia Pacific is observed to host the fastest-growing lipid nanoparticles market during the forecast period. Lipid nanoparticles' effectiveness in delivering mRNA vaccines during the COVID-19 epidemic has brought attention to how crucial they are. Due to its dense population, Asia Pacific has seen extensive immunization campaigns, which have increased the uptake of LNP. The area is seeing an increase in the prevalence of diseases like diabetes, heart disease, and cancer. The need for sophisticated drug delivery methods, such as LNPs, which are employed in targeted and precision therapeutics, has increased as a result of this trend.

Asia Pacific has emerged as the fastest-growing market for lipid nanoparticles, thanks to rapid urbanization, evolving healthcare systems, and growing pharmaceutical and biotech manufacturing capacity. Countries such as China, India, and Japan are taking the lead, supported by strong government policies favoring innovation in healthcare and technology. China’s deep focus on mRNA research, India’s large-scale pharmaceutical production, and Japan’s precision-driven biotech landscape are shaping the future of LNP applications in this region.

Major Growth Factors in Asia Pacific:

Lipids are fatty compounds that makeup lipid nanoparticles, which are tiny particles. Because of their capacity to encapsulate and transport therapeutic compounds, they are employed in a variety of industries, including biotechnology and pharmaceuticals, for medication delivery, gene therapy, and vaccine production. Drug delivery, gene therapy, and vaccine development are just a few of the uses for these nanoparticles. They aid in enhancing therapeutic compounds' stability, bioavailability, and targeted distribution to bodily regions or cells.

The market for lipid nanoparticles is experiencing significant growth, primarily driven by advances in RNA therapies and a growing dependence on lipid nanoparticles (LNPs) for effective drug delivery solutions. These nanoparticles play a crucial role in developing treatments that involve genetic components like mRNA and siRNA, particularly highlighted during the worldwide distribution of mRNA vaccines.

| Report Coverage | Details |

| Market Size by 2034 | USD 3,694.21 Million |

| Market Size in 2024 | USD 1,002.63 Million |

| Market Size in 2025 | USD 1,142.30 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.93% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increased investment in gene therapy

For nucleic acids like mRNA, DNA, or RNA-based medicines to be delivered into cells efficiently, lipid nanoparticles are essential. LNPs are essential in ensuring that these nucleic acids are effectively transported to the target cells or tissues while also being shielded from enzyme breakdown. The transfer of genetic material is facilitated by LNPs, which are tiny, spherical lipid-based structures that evade the immune system's defense mechanisms. They aid in enhancing gene treatments' stability, bioavailability, and targeted delivery.

Improved drug delivery systems

The surface characteristics of lipid nanoparticles, which may be altered to attach selectively to cells or tissues, make them very useful for targeted medication administration. For instance, the LNPs can be guided to certain receptors on the target cells by surface modification using targeting ligands, antibodies, or peptides. This focused strategy reduces the drug's systemic exposure, which lowers toxicity and adverse effects and improves the drug's overall safety profile.

Regulatory challenges

To assess the possible dangers posed by LNPs, such as tissue buildup, allergic reactions, or other unanticipated side effects, regulatory bodies require comprehensive preclinical and clinical research. Testing becomes more difficult since, for example, the lipid components utilized in these nanoparticles can behave differently in the human body than conventional pharmacological drugs.

Stability issues

Inconsistent particle size or encapsulation efficiency may result from minute changes in the lipid composition, solvent quality, or mixing circumstances during the production process. In the lipid nanoparticles market, formulations that don't fulfill the necessary stability characteristics may be the result of this discrepancy. To preserve their structural integrity, lipid nanoparticles are frequently synthesized at temperatures. In large-scale manufacturing, any departure from ideal production temperatures can result in instability and lower product quality.

Advances in mRNA-based therapeutics

The enormous potential of the lipid nanoparticles market in medicinal applications has been shown by the success of mRNA vaccines. The demand for sophisticated LNP formulations is rising because of this success, which is spurring investment and research into other mRNA-based treatments. The demand for sophisticated lipid nanoparticles for drug administration is anticipated to rise as long as pharmaceutical and biotechnology businesses continue to invest in mRNA technology. It is anticipated that this will encourage research and development of new LNP formulations, such as those that decrease immunogenicity, increase payload capacity, and improve tissue targeting.

Global health challenges

The most common use of lipid nanoparticles market services is in vaccines, but they are also increasingly being used in gene therapies, RNA-based medicines, and cancer immunotherapies. LNPs make it possible to administer RNA treatments for the treatment of genetic illnesses such as sickle cell disease and cystic fibrosis. LNPs provide for the safe and efficient delivery of therapeutic RNA to body cells, allowing for the genetic treatment of illnesses.

LNPs are being investigated for the delivery of mRNA-based vaccines in cancer therapy, which prime the immune system to identify and combat cancer cells. To more precisely target cancer cells, they are also being utilized to deliver messenger RNA (mRNA) or small interfering RNA (siRNA) for gene silencing and protein expression regulation.

The solid lipid nanoparticles (SLNs) segment dominated the global lipid nanoparticles market in 2023. In contrast to other lipid-based systems like liposomes or liquid lipid nanoparticles, SLNs have a stable and strong structure since they are made of solid lipids that do not change their structure at room temperature or body temperature. Because SLNs allow for focused and sustained drug release, they are appropriate for treatments that need to take effect over an extended period of time. When it comes to maintaining the bioactivity of sensitive biomolecules like insulin or monoclonal antibodies, SLNs are especially helpful.

The nanostructured lipid carriers (NLCs) segment will show significant growth in the lipid nanoparticles market during the forecast period. Antibiotics, gene treatments, and anticancer medications are only a few of the many therapeutic substances that are being delivered using NLCs. Because they may encapsulate hydrophilic and lipophilic medications, they are very useful in treating conditions including cancer, neurological disorders, and infectious diseases. The effectiveness of lipid-based nanoparticles, such as NLCs, as nucleic acid carriers has been highlighted by the success of mRNA-based vaccines, especially during the COVID-19 pandemic. The delivery of mRNA, siRNA, and other genetic elements via NLCs is being investigated.

The therapeutics segment dominated the global lipid nanoparticles market in 2024. Since lipid nanoparticles may encapsulate both hydrophilic and hydrophobic medicines, they are extremely effective drug delivery methods. They are therefore perfect for delivering therapies including peptides, proteins, nucleic acids (mRNA, siRNA, and DNA), and small molecule medications. LNP-based treatments are the subject of several clinical trials, especially in fields like immunology, metabolic disorders, and oncology. This has stimulated investment and innovation, strengthening the therapeutic segment's popularity.

The pharmaceutical & biotechnology companies segment dominated the lipid nanoparticles market in 2024. These vaccines were developed, researched, and produced mostly by pharmaceutical and biotechnology businesses. These companies collaborated with suppliers of nanoparticle technology, which increased demand for LNPs as nucleic acid carriers. In order to stabilize mRNA, improve cellular absorption, and guarantee efficient transport without degradation, lipid nanoparticles were essential. To enhance targeted medication delivery, lower toxicity, and extend drug release, biotechnology companies have concentrated on creating lipid-based nanocarriers.

The academic & research institutes segment will witness significant growth in the lipid nanoparticles market during the forecast period. Academic efforts are being supported by increased financing for nanotechnology and enhanced medication delivery research from both public and private entities. For example, organizations concentrating on LNP-based solutions for unmet medical needs are receiving grants and subsidies. More strong research outputs are made possible by the expanding trend of public-private partnerships, which makes it easier to access cutting-edge facilities and equipment.

Expansion of LNPs in next-gen drug delivery systems

Formulation advancements improve precision and scalability

By Type

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

February 2025