February 2025

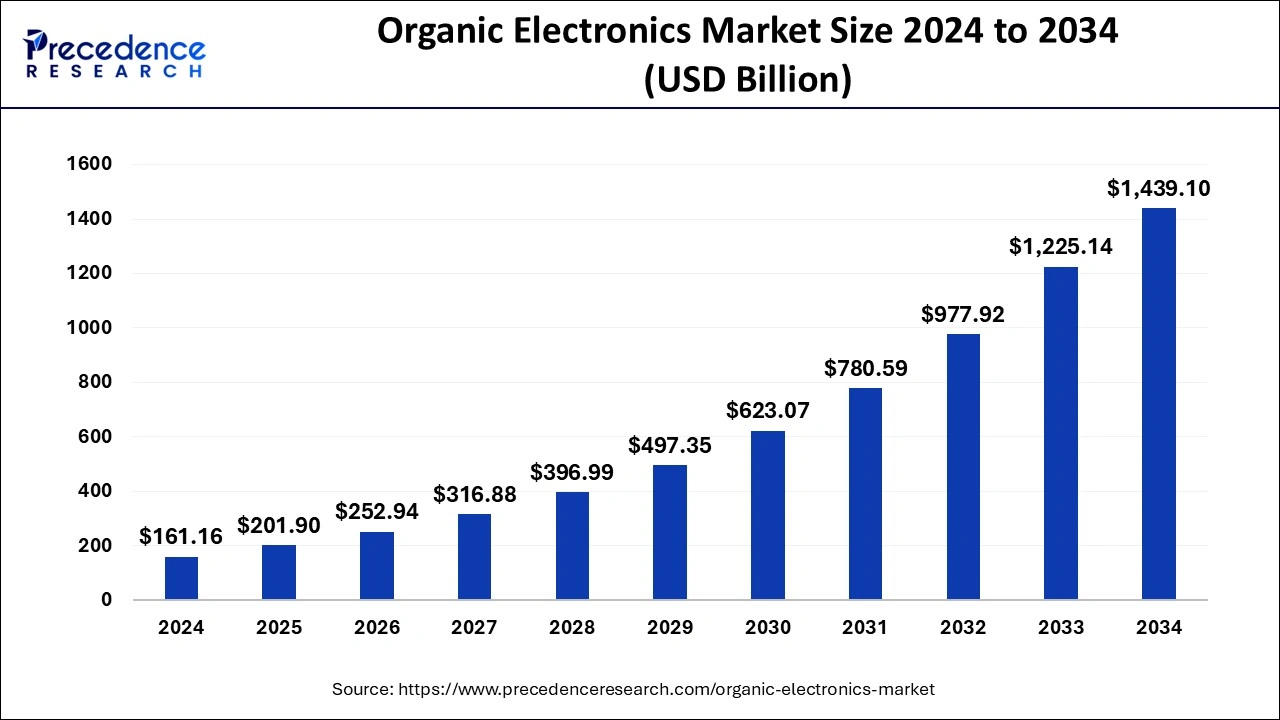

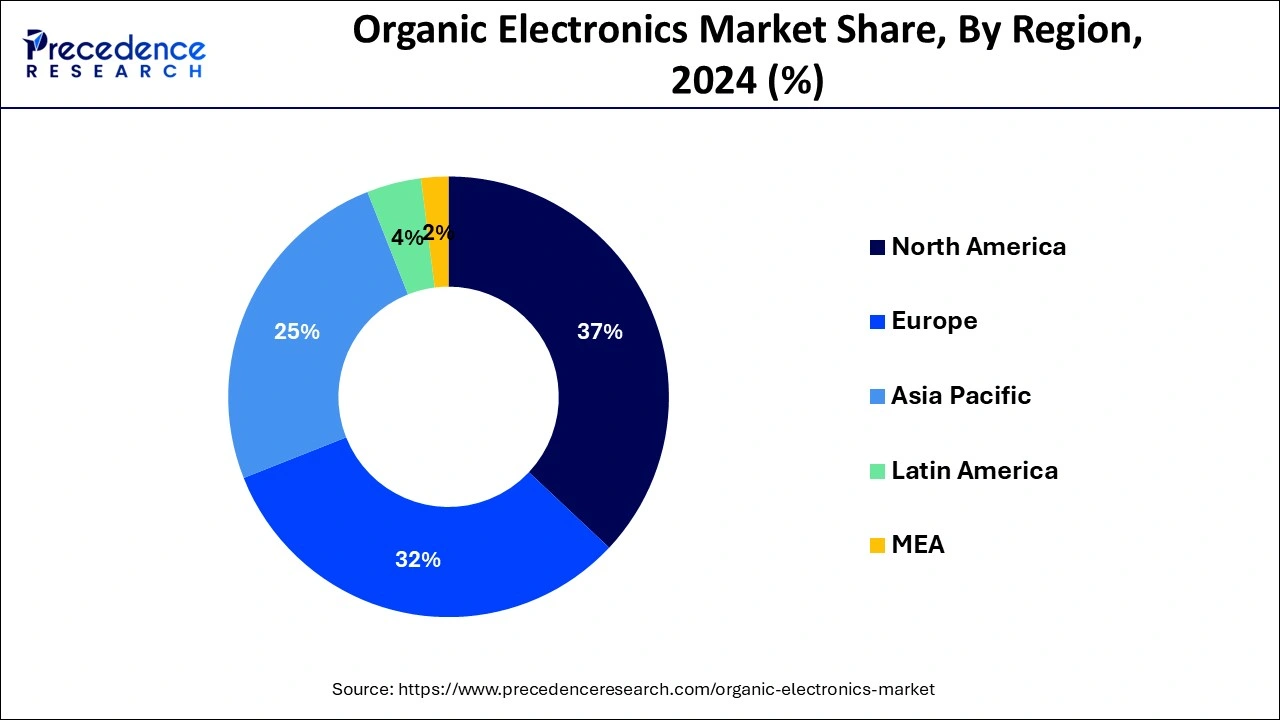

The global organic electronics market size is calculated at USD 201.90 billion in 2025 and is projected to surpass around USD 1,439.10 billion by 2034, expanding at a CAGR of 25.30% from 2025 to 2034. The North America organic electronics market size reached USD 59.63 billion in 2025 and is expanding at a CAGR of 25.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global organic electronics market size accounted for USD 161.16 billion in 2024 and is expected to be worth around USD 1,439.10 billion by 2034, at a CAGR of 25.30% from 2025 to 2034.

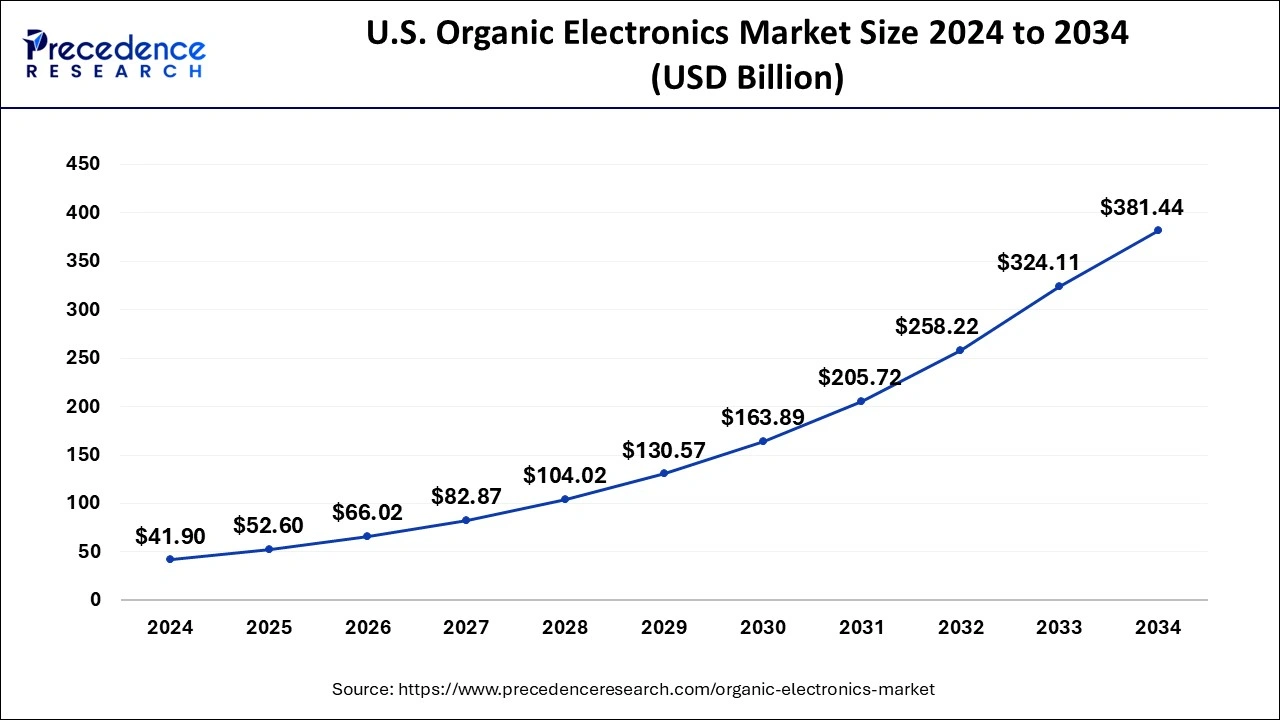

The U.S. organic electronics market size was estimated at USD 41.90 billion in 2024 and is predicted to be worth around USD 381.44 billion by 2034, at a CAGR of 25.50% from 2025 to 2034.

North America showed prominent growth in the global organic electronics market accounting for a significant market share in 2024. The region is technologically advanced coupled with a prior adopter of advanced technologies such as AI, machine learning, and IoT that contributed positively towards its growth. Further, the region is a prominent adopter of digital signage and other advanced display technologies in its consumer electronic products that again propel the market growth.

However, the Asia Pacific being the largest market for consumer electronics exhibits a rapid growth rate over the forthcoming years. A large consumer base along with rapid technology integration in the sector has propelled the growth of the market. China is the front-runner in the Asia Pacific region attributed to the availability of low-cost raw materials and labor in the country.

Advancements in display technologies create significant demand for organic electronic devices such as Organic Light Emitting Diodes (OLEDs) that is among the latest and most advanced display technologies. OLED displays are prominently used in televisions, laptops, mobile phones, and other display electronic devices. Hence, the aforementioned factor is likely to impel market growth over the forthcoming years.

Further, organic electronics are preferred over inorganic electronics because of simple processing methods and low material utilization during the manufacturing process. In accordance with the same, high-end technological products are manufactured using organic materials such as dielectric, semiconductor, and conductive materials.

Additionally, the shifting trend from conventional posters and signage towards digital signage has created immense opportunities for organic electronics manufacturers to strengthen their foothold in the target market. Hence, increasing penetration towards digital signage as it proved as a more effective marketing tool as well as visualized to enhance the product sale through its interactive features. As a part of a survey conducted in the United States, the percentage jump in unplanned purchases particularly in restaurants is around 80%. Similarly, rising demand for digital signage at various platforms is expected to boost the growth of organic electronics over the coming years.

| Report Coverage | Details |

| Market Size in 2024 | USD 161.16 Billion |

| Market Size in 2025 | USD 201.90 Billion |

| Market Size by 2034 | USD 1,439.10 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 25.30% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Vertical, and By Application |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Semiconductor led the global organic electronics market accounting for more than half of the total market value in 2024 and is expected to grow at the fastest rate over the forthcoming years. The prominent growth of the segment is mainly due to a unique feature offered by the semiconductor material is no insulating oxide formed on the surface when they are exposed to air. This helps the material to form a clean interface with the other materials.

An organic semiconductor is a non-metallic material that provides semiconducting properties. These materials have numerous advantages compared to inorganic semiconductors that include lightweight, mechanical flexibility, and low cost which in turn offers an opportunity for developing devices by using low-cost fabrication methods. An increase in awareness related to sustainable development along with the fact that organic semiconductors are biodegradable has significantly increased its preference over their counterparts; thus, increasing the market demand for organic electronics.

However, dielectric materials have gained significant importance over the past few years owing to their increasing demand and opportunity in applications such as automotive, consumer electronics, medical, digital signage, and security.

Display applications captured a significant market share in the global organic electronics market in 2024 because of the rising demand for advanced display technologies in various applications that include smartphones, laptops, television, and other electronic products with display screens. The advancement in display technology such as organic LED (OLED) displays is expected to offer huge demand for organic electronics over the upcoming years. OLED display offers numerous advantages to the users are enhanced image quality related to better contrast, fuller viewing angle, higher brightness, much faster refresh rates, wider color range, and lower power consumption. Hence, significant advantages offered by the OLEDs have transformed the display screens to be foldable, flexible, ultra-thin, and transparent displays.

Besides this, lighting is the other most important application of organic electronics because of the increasing demand for more efficient and cost-effective lighting technology. LED lights have gained significant importance over the past decade owing to less consumption of energy along with the integration of advanced technologies such as IoT and artificial intelligence to upgrade their performance and user experience.

By Material

By Vertical

By Application

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

December 2023

April 2025