November 2024

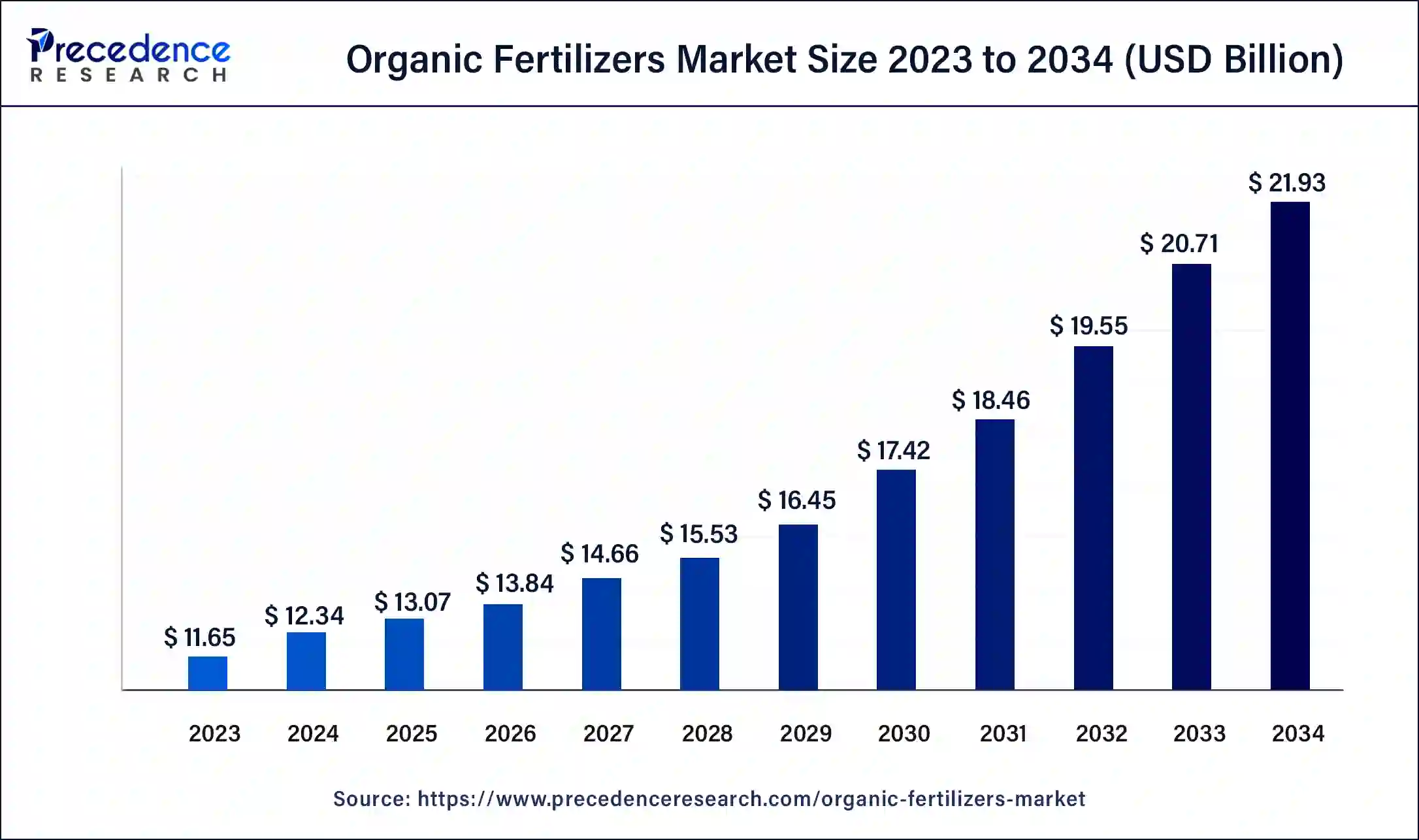

The global organic fertilizers market size was USD 11.65 billion in 2023, estimated at USD 12.34 billion in 2024 and is anticipated to reach around USD 21.93 billion by 2034, expanding at a CAGR of 5.92% from 2024 to 2034.

The global organic fertilizers market size is projected to be worth around USD 21.93 billion by 2034 from USD 12.34 billion in 2024, at a CAGR of 5.92% from 2024 to 2034.

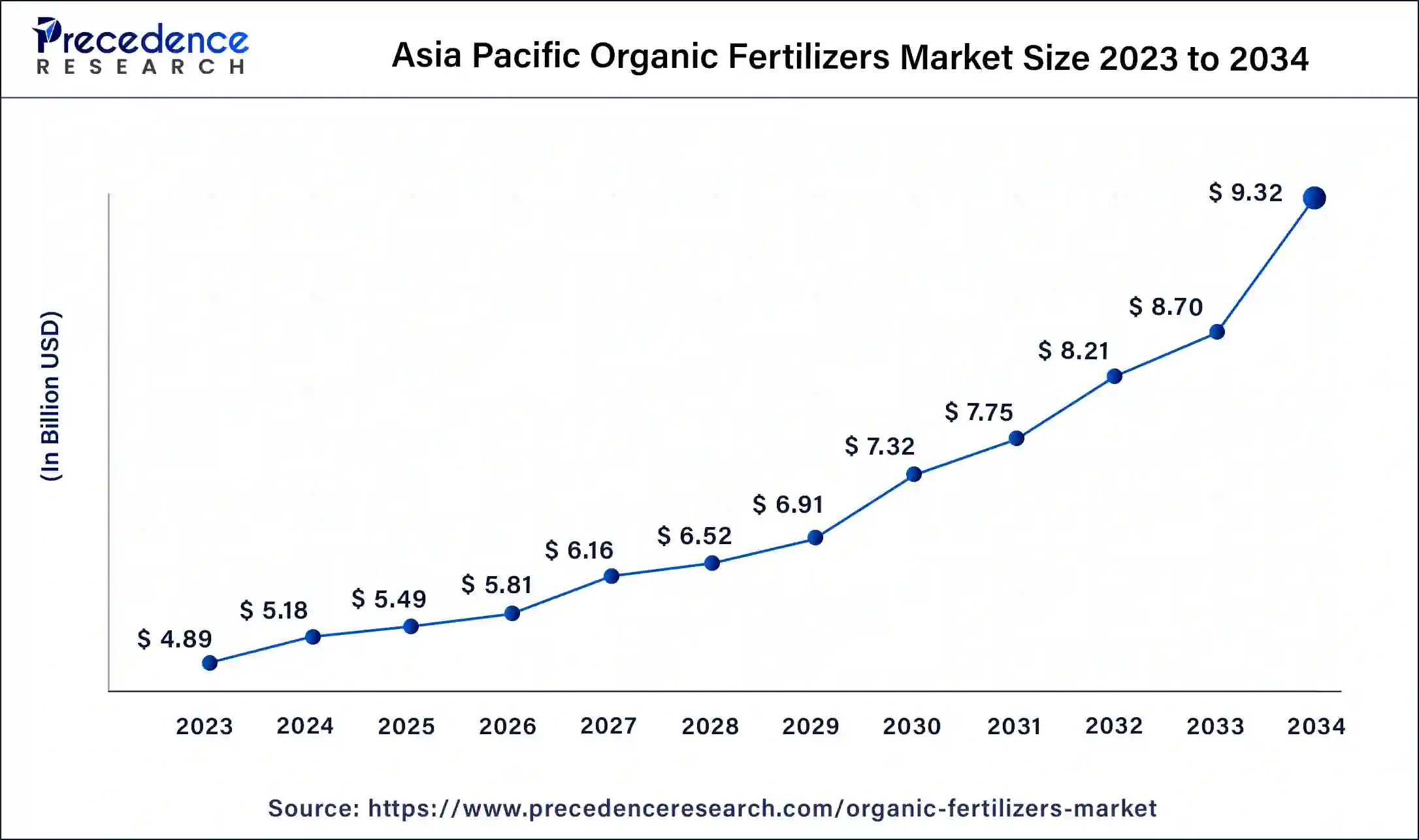

The Asia Pacific organic fertilizers market size was exhibited at USD 4.89 billion in 2023 and is projected to be worth around USD 9.32 billion by 2034, poised to grow at a CAGR of 6.03% from 2024 to 2034.

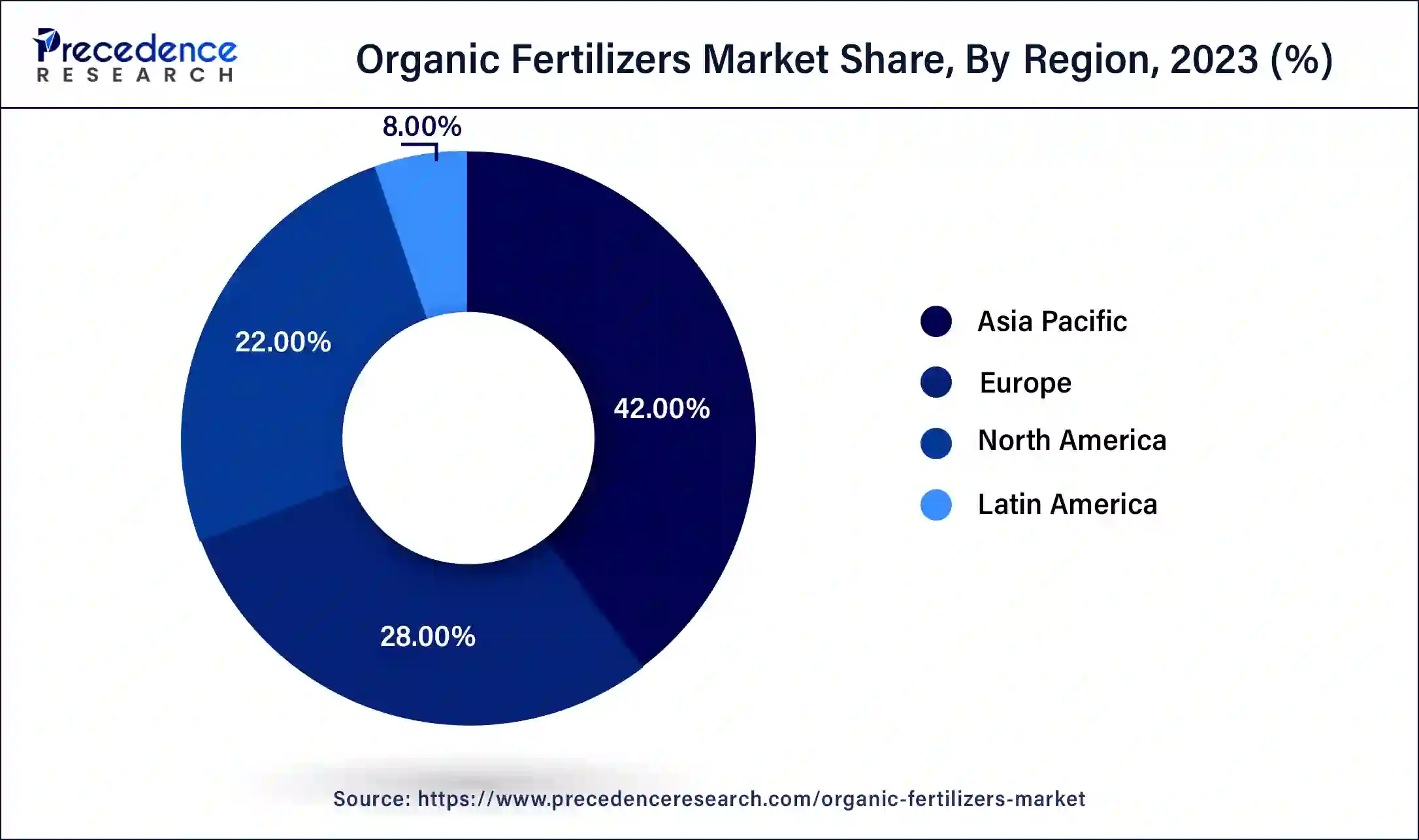

Asia Pacific dominated the organic fertilizers market in 2023. China and India are the leading contributors to the market. China and India have a long history of farming, and a huge rural population works in crop cultivation. China is a largely agricultural country, followed by India, endowed with rich agricultural resources. India and China are among the world's top producers of rice, wheat, corn, cotton pulses, and maize. These countries also specialize in the cultivation of a variety of fruits, vegetables, and particular crops such as tea, cotton, and tobacco. The Chinese and Indian governments have always placed a high priority on the development of agriculture. India and China’s agricultural productivity has significantly improved with enhanced product supply capacity.

Agriculture plays an integral part in the preservation of the ecosystem. The organic fertilizers market has witnessed the significant popularity of organic foods. Consumers are also willing to pay more for them, which is expected to boost the adoption of organic fertilizers. The rapid development of agricultural infrastructure enhanced the efficiency of grain production. The increasing use of organic fertilizers has positively influenced their notable environmental benefits. Therefore, the agriculture sector is anticipated to witness rapid expansion owing to the growing demand for organic food, particularly across North America and Europe, which heavily import food from the region.

According to the data published by the India Brand Equity Foundation in May 2024,

North America is observed to expand at a rapid pace in the organic fertilizers market during the forecast period, owing to increasing demand for organic products, rising agricultural expenses, favorable climatic conditions, rising usage of environmentally friendly farming techniques, and availability of abundant land for farming. Consumer demand for sustainable and chemical-free agricultural products led to an escalating demand for organic fertilizers, propelling the market’s growth in North America.

In the organic fertilizers market, the United States is the largest producer of agricultural products after China and India. The presence of advanced agricultural infrastructure and rapid technological innovations is expected to bolster the adoption of organic fertilizers among farmers. Moreover, partnerships or collaborations between prominent market players and research institutions to develop organic fertilizers tailored to North American soil and climate conditions. Therefore, these factors are important for market expansion in the region.

According to the data published by the U.S. Department of Agriculture

Soil fertility is considered an economical and efficient crop production. Soil assists in continuously supplying necessary nutrients, water, and other crucial factors that are needed for the growth and development of crops. The agriculture sector relies on fertilizers to boost soil production for better crop yields. Organic fertilizers are natural materials that are extensively used to provide nutrients to plants and improve soil fertility. There has been a paradigm shift towards the usage of organic fertilizers in the agriculture sector as people are increasingly becoming more aware of the adverse impacts of chemical fertilizers on both the environment and people to increase crop production.

What is the role of AI in the Organic Farming Industry?

The integration of artificial intelligence into organic farming has significant potential for optimizing sustainable agriculture practices. Application of AI-based technologies enhances resource efficiency by optimizing the use of water, fertilizers and pesticides. AI is also being used in crop monitoring, yield prediction, and mitigation of pests for data-driven decision making that contributes to higher yields. The technology is also being deployed to optimize organic farming supply chains by predicting harvest times and optimizing logistics.

| Report Coverage | Details |

| Market Size by 2034 | USD 21.93 Billion |

| Market Size in 2023 | USD 11.65 Billion |

| Market Size in 2024 | USD 12.34 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | source, form, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising popularity of organic products

The rising demand for organic products is expected to accelerate the growth of the organic fertilizers market. The increasing consumption of organic products has expanded the area of organic farming globally. Organic fertilizers are a critical agricultural approach. Farmers opt for organic farming to cultivate healthier foods while minimizing environmental pollution. Organic farming is increasingly becoming popular globally as the best substitute for farming methods like chemical fertilizers and other approaches.

The overuse of chemical fertilizers adversely affects the soil, leading to soil acidification and soil crust. Chemical fertilizers often contribute to land degradation and environmental pollution. The use of organic fertilizers enhances the nutritional quality of crops and maintains soil health. The acceptance of organic fertilizers aligns with the goal of eco-friendly and sustainable agricultural practices. Thus, it contributes to the organic fertilizers market expansion during the forecast period.

According to the data published by Eurostat

High Cost

The high cost of organic fertilizers is anticipated to restrain the market's expansion during the forecast period. Organic fertilizers are more expensive than synthetic fertilizers. Organic fertilizers require higher production costs and have a limited supply, which often impacts their affordability and availability. In addition, organic fertilizers comparatively have lower nutrient concentrations than synthetic fertilizers which results in lowering the yields and profitability of farmers. Such factors restrict the expansion of the global organic fertilizers market.

Supportive government regulations

The supportive role of government is projected to offer immense growth opportunities to the organic fertilizers market in the coming years. Over the years, the cultivable land area under organic farming has substantially increased owing to the constant efforts of the government. The overuse of chemical fertilizers harms the environment as they contaminate the soil.

Governments around the world recognize the significance of safeguarding agricultural land. They are committed to implementing corrective measures to mitigate the adverse consequences of chemical fertilizers, prevent land degradation, and ensure the long-term sustainability of agricultural land. Several governments mandate certification for organic fertilizer manufacturers to guarantee that the products meet organic farming standards and prevent the circulation of fake or substandard organic fertilizers. Therefore, such stringent government regulations ensure the quality and authenticity of organic fertilizers and are expected to fuel the organic fertilizers market growth.

The animal segment accounted for the dominating share of the organic fertilizers market in 2023 and is projected to continue its dominance over the forecast period. The use of animal-based organic fertilizers produces healthy and high yields. Animal-based organic fertilizers play an important role in the agriculture sector and are estimated to increase their market share due to the rising demand for animal manure-based organic fertilizers. The animal-based product is an excellent source of nitrogen and is well-suited for leafy plants.

The plant segment will experience considerable growth in the global organic fertilizers market over the forecast period. Organic fertilizers are derived from plants such as crop residues, compost, seaweed, cottonseed meal, cover crops, green manure crops, and others. These resources are generally abundant and can meet the ongoing rising market demand. Plant-based organic fertilizers contain essential nutrients that are considered crucial for plant development. Thereby fueling the segment’s growth.

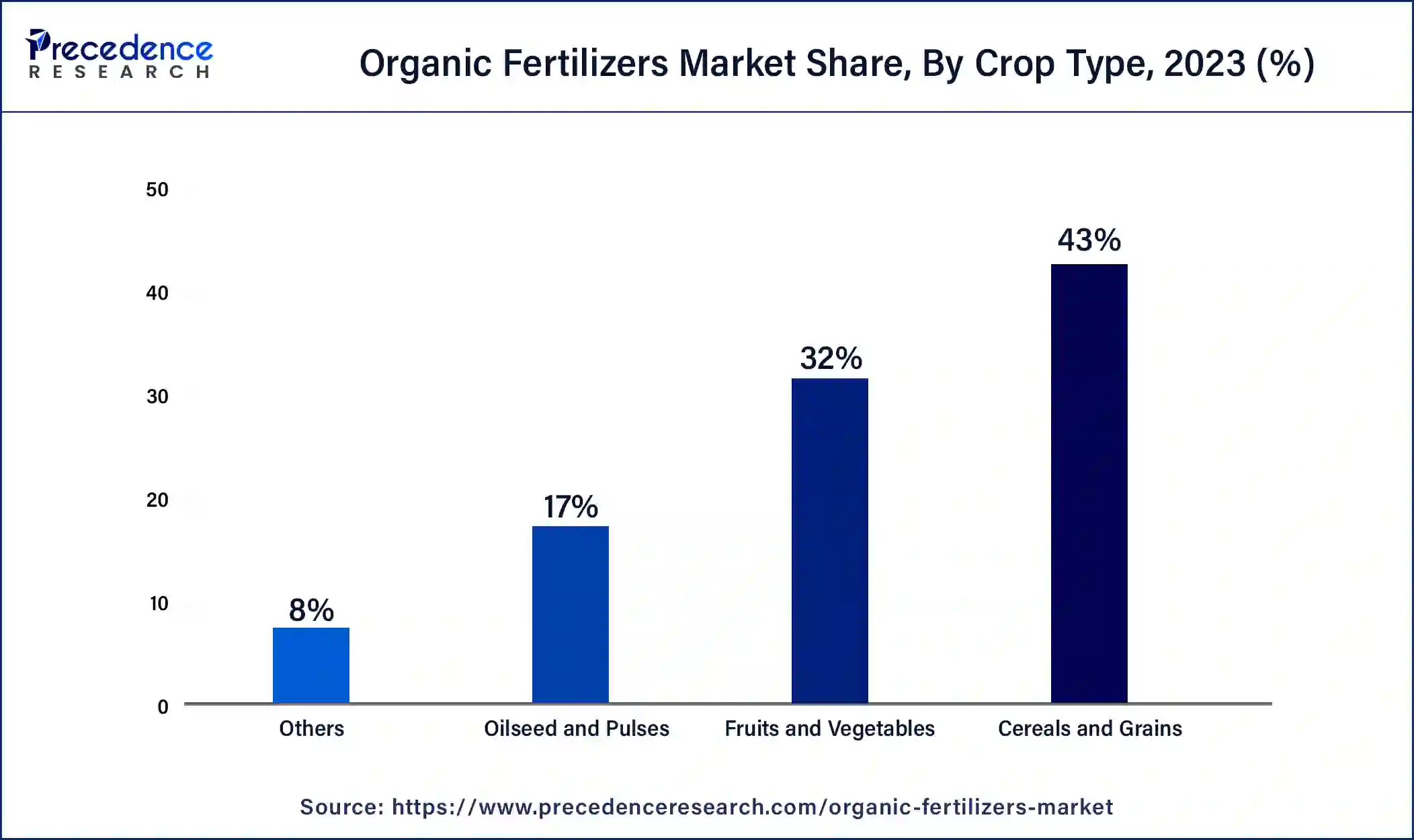

The cereals & grains segment held the largest segment of the organic fertilizers market in 2023 and is expected to sustain its position throughout the forecast period, owing to the rising production of cereals & grains, which is anticipated to increase usage of organic fertilizers. The cereals & grains are largely produced by India, Russia, China, and the U.S. The demand for products has increased due to the rising global consumption of cereal and grains like wheat, rye, oats, rice, barley, millet, rye, triticale, sorghum, and maize. They are the staple foods. Thus boosting the segment's growth.

The fruits & vegetables segment is expected to grow significantly in the organic fertilizers market during the forecast period. The market has witnessed a rise in consumer preference for organic fruits and vegetables among health-conscious people. Organic fruits and vegetables offer more nutrients and antioxidants than conventional cultivation. The consumption of organic fruits and vegetables could increase antioxidant intake by 20-40%. Over the years, consumers have recognized the importance of organic farming methods and are willing to pay premium prices for organic fruits and vegetables. Therefore, these factors underscore the expected rise in demand for organic fertilizers in the fruits and vegetables segment during the forecast period.

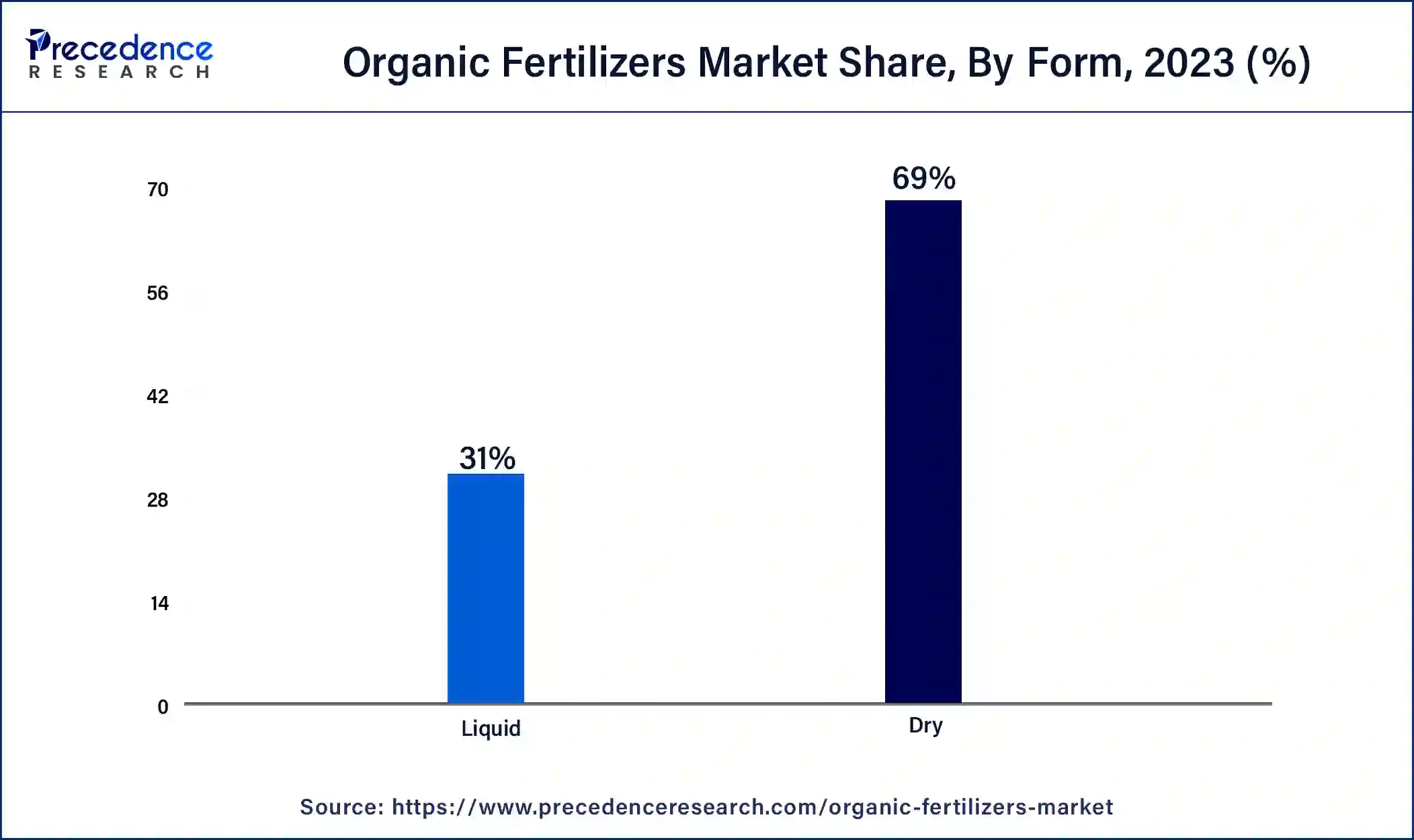

The dry segment held the dominating share of the organic fertilizers market in 2023. Dry organic fertilizers have an immense market opportunity owing to the rising demand for organic foods and services. Farmers prefer dry fertilizers as they offer several benefits, such as longer shelf life, ease of storage, cost-effectiveness, and convenience for application and transport. Dry organic fertilizers reduce the risk of spoilage and waste compared to their liquid form. Additionally, dry organic fertilizers encompass numerous products, including powders, granules, and pellets, catering to various crop types, improving the soil structure, and promoting best agricultural practices. Such factors are expected to increase the adoption of dry organic fertilizers during the forecast period.

The liquid segment is expected to grow at a notable rate in the organic fertilizers market over the forecast period. The liquid fertilizers penetrate quickly in the soil and give faster access to nutrients. This form of organic fertilizers can be precisely applied through several methods, such as drip irrigation and foliar spraying, supporting precision farming practices. The integration of digital technologies is likely to enhance the efficiency and effectiveness of liquid organic fertilizer applications. Thereby driving the segment’s growth in the coming years.

Organic Fertilizers Market Companies

Segments Covered in the Report

By source

By form

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

August 2024

February 2025

December 2024