April 2025

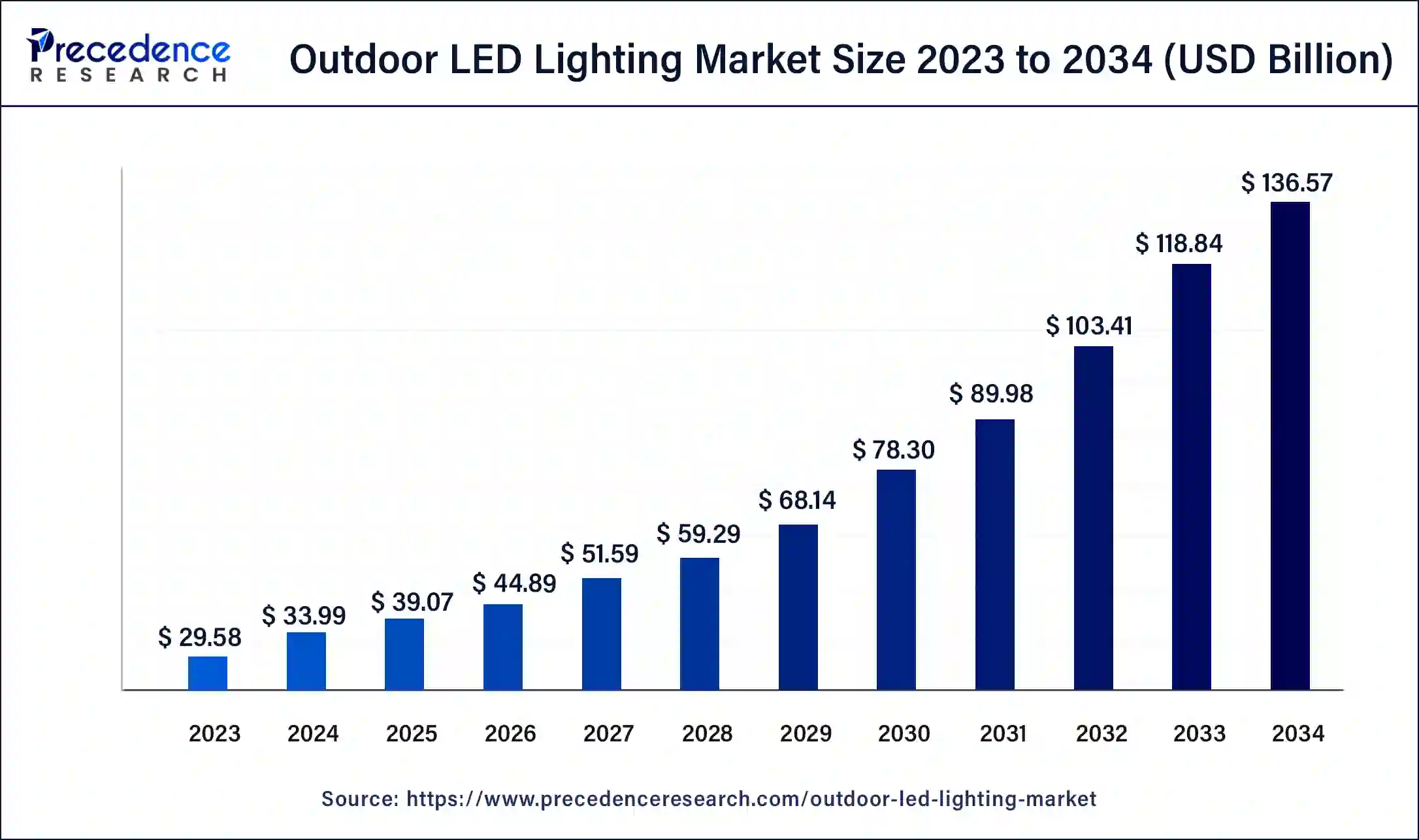

The global outdoor LED lighting market size surpassed USD 29.58 billion in 2023, estimated at USD 33.99 billion in 2024 and is expected to reach around USD 136.57 billion by 2034, expanding at a CAGR of 14.92% from 2024 to 2034.

The global outdoor LED lighting market size is worth around USD 33.99 billion in 2024 and is anticipated to reach around USD 136.57 billion by 2034, growing at a CAGR of 14.92% from 2024 to 2034. LED lighting is being widely adopted globally for outdoor lighting purposes due to its energy-efficient, eco-friendly nature, long lifespan, and durability, which makes it ideal for operation under extreme outdoor temperatures.

A light-emitting diode is a small electronic device that emits light powered by the electricity that passes through it. It consists of a semiconductor that emits photons when electric current passes through. Outdoor LED lighting is exterior lighting that utilizes LED technology to create artificial light sources to illuminate areas. While high-pressure sodium and metal halide technologies continue to improve, LED technology is going through breakthroughs rapidly in terms of continuously optimizing for luminous efficacy, color quality, optical design, thermal management, and cost. Fixtures are also becoming more compact with developments like chip-scale packaging (CSP), LEDs that don’t need a package or a casing that encapsulates an LED chip and phosphor. The initial higher cost of LED lights can discourage smaller and medium-level businesses and public sector undertakings from purchasing through outdoor LED lighting market companies.

How Artificial Intelligence Is Transforming the Lighting Market?

Artificial intelligence has made an impact on the outdoor LED lighting market with the implementation of the Internet of Things in lighting. This form of connected lighting integrates sensors and smart chips with lighting infrastructure to analyze information such as energy use, temperature, and more. LED lights dim smoothly with minimal flickering or distortion of color. This makes them suitable for various lighting applications where adjustable brightness is desired. This technology will also lead to more personalized light usage; with apps connected to the bulbs, individuals will be able to automate the lights based on their tastes and preferences. Internet of Things technology in lighting has the potential to LED lighting with LiFi capabilities.

| Report Coverage | Details |

| Market Size by 2034 | USD 136.57 Billion |

| Market Size in 2023 | USD 29.58 Billion |

| Market Size in 2024 | USD 33.99 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 14.92% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Installation, Offering, Sales Channel, Wattage, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Unique features of LED lights compared to alternatives

LED lights have a long lifespan, are energy-efficient, and are compact compared to high-pressure sodium and metal halide alternatives. LED lights do not contain lead, mercury, and other hazardous metals, making them cleaner sources of light. The many advantages of LED technology are driving growth in the outdoor LED lighting market. LEDs are commonly used in lighting fixtures for outdoor spaces such as streetlights, floodlights, garden lights, displays such as digital signage, and others. They are resistant to extreme weather conditions.

Prohibitive costs and functional limitations of LED lighting

LED lights are relatively expensive compared to fluorescents and other alternatives, making the cost of acquisition prohibitive for public sectors of emerging economies and small and medium infrastructure organizations. LED lights, while resilient to extreme temperatures, are vulnerable to moisture. The low heat-dissipation in LED lights means moisture does not dry out quickly, compared to traditional, less energy-efficient lighting. Further research and development are necessary to address the restraints in the outdoor LED lighting market posed by limitations of the technology.

Developments in perovskite light-emitting diodes

Research and development efforts taking place in the LED space have led to technological innovations like perovskite light-emitting diodes (PeLEDs), touted as the next-generation of LEDs due to their capacity to emit high color pure light in narrow bandwidths. Green, blue, red, and white perovskite light-emitting diodes have been developed with increased efficiencies. Innovations such as pixel pitches optimize the clarity of LEDs for high-octane uses. The ability to adjust pixel pitches allows businesses to customize their lighting options and find tailored solutions for their needs. Advances in LED technology, such as Perovskite Light-emitting diodes, are making them more efficient, presenting opportunities to scale the new technology for applications in the outdoor LED lighting market.

The new installations segment dominated the global outdoor LED lighting market for 2023. There has been a surge of demand in the outdoor LED lighting market due to a global push towards sustainable development. LED lights consume less energy compared to their traditional counterparts. In emerging economies where rapid industrialization and urbanization are taking place, large-scale private and public infrastructure projects are currently underway. This has led to several federal public projects globally to adopt outdoor LED lighting.

The retrofit segment is set to see notable growth in the outdoor LED lighting market during the forecast period as established economies integrate LED lights into older retrofitted infrastructure to preserve cultural heritage. In the United States, efforts to retrofit LED lights started last decade, with big cities like Las Vegas replacing 6,600 lights, leading to approximately 2.2 million fewer kWh consumed. Smaller towns, such as Boulder City, Nevada, have been working toward retrofitting lighting. The city got the go-ahead for the installation of 2,560 light pollution-reducing lighting fixtures and a $1.9 million grant from the U.S. Economic Development Administration for the retrofitting.

The hardware segment accounted for the largest share of the outdoor LED lighting market in 2023. The rising adoption of LED lights for outdoor infrastructure is generating demand for LED tube lights, lamps, luminaires, and control systems on a massive scale for floodlights, landscape lights, spotlights, and more.

The services segment is expected to grow at the fastest rate in the outdoor LED lighting market over the forecast period between 2024 and 2033. The services segment is expected to grow as public sectors outsource the retrofitting and installation to firms specializing in outdoor LED lighting.

The retail/wholesale segment dominated the outdoor LED lighting market in 2023. The development of robust retail and wholesale distribution channels has streamlined supply chains to the high demand generated by rapid infrastructure development, especially in emerging economies. Meanwhile, the e-commerce segment is gaining traction with a climbing compound annual growth rate. The rise of disposable incomes and changing tastes and preferences in emerging economies are driving demand in the market space.

The 50-150W segment made up the largest share of the outdoor LED lighting market in 2023. LED lights ranging from 50-150W are ideal for installation in large outdoor spaces where light has to be dispersed from height and be bright enough to illuminate an area properly. The higher the wattage, the brighter the light output.

The above 150W segment is expected to grow at the fastest rate in the outdoor LED lighting market in the forecast period. LED lights above 150W are the fastest-growing wattage segment with the boom of commercial infrastructure. 150W LED lights can produce up to 20,000 lumens, providing clear and bright lighting for large areas such as warehouses, factories, gyms, or auditoriums.

The streets & roads segment dominated the global outdoor LED lighting market in 2023. Demand for LED lighting is spurred by numerous global smart city projects procuring eco-friendly, cost-effective alternatives. LED alternatives.

The sports segment is expected to see the fastest growth in the outdoor LED lighting market over the forecast period between 2024 and 2033. With the construction of several sports venues for the Olympics and existing venues retrofitting to LED lights, there is a growing demand for outdoor LED lighting in sports.

Asia Pacific dominated the outdoor LED lighting market in 2023. The rapid urbanization and infrastructure development in emerging economies of Southeast Asia are driving growth in the space. LED lights are being adopted across public spaces like highways, streets, sports stadiums, commercial spaces, schools, and hospitals in newly developing smart cities across China, India, Japan, and South Korea.

Government incentives to switch to more eco-friendly and cost-effective LED alternatives from traditional lighting have caused a transformation. China’s 13th Five-Year Plan had set goals for reducing energy consumption by 15% across the country by 2020, spurring demand for LED lighting solutions. Countries like Japan boast the world's highest penetration rate of LED lighting in developed countries. The Japanese lighting industry is expected to switch to 100% LED products by 2030.

Technological advancements in LED lighting are further boosting Asia Pacific's dominance in the industry. Asia is home to some of the largest LED lighting manufacturers, including Panasonic, Nichia Corporation, and Everlight Electronics. As a result, research and development investment for LED lighting is robust in the region.

Europe is expected to grow at the fastest rate in the outdoor LED lighting market during the period studied. The region is expected to have a steady compound annual growth rate during the forecast period between 2024 and 2033. Major road and highway infrastructure projects currently underway in the continent are expected to drive demand for LED streetlights in the coming years. Several public-private partnerships in the region have raised funds, especially for eco-friendly outdoor solar LED lighting.

Segments Covered in the Report

By Installation

By Offering

By Sales Channel

By Wattage

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

August 2024

August 2024