April 2025

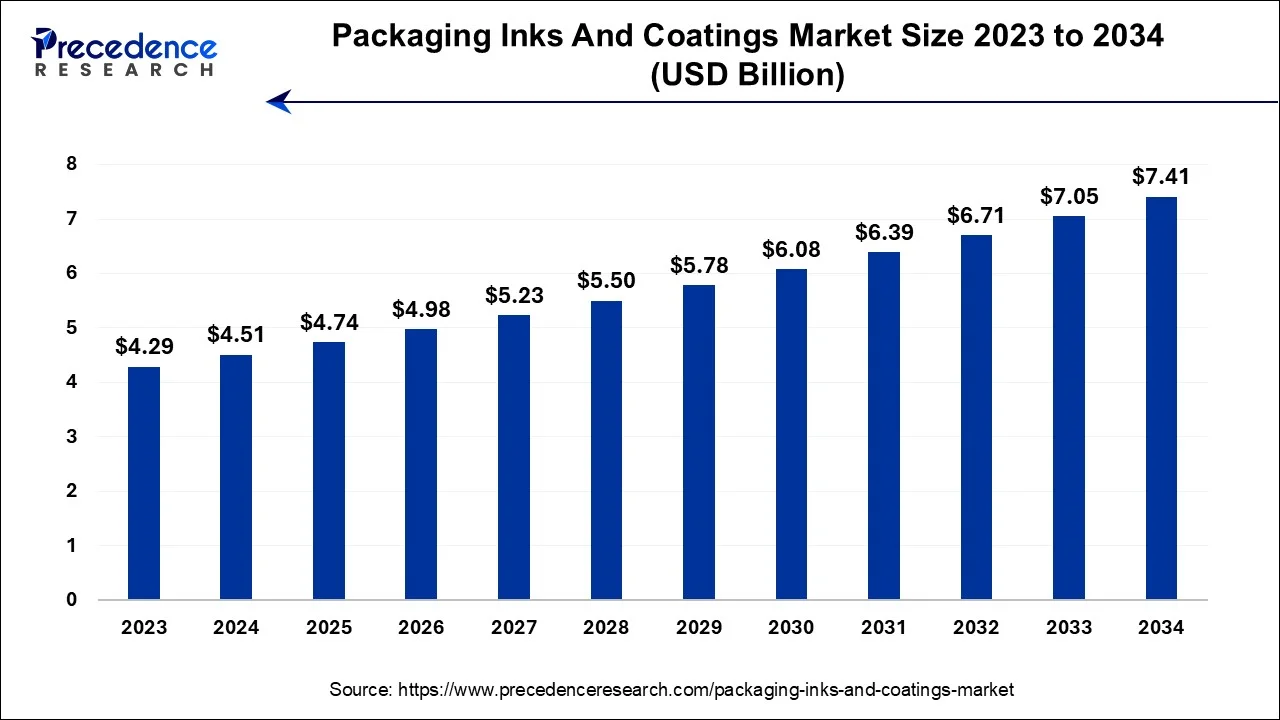

The global packaging inks and coatings market size is predicted to increase from USD 4.51 billion in 2024, grew to USD 4.74 billion in 2025 and is anticipated to reach around USD 7.41 billion by 2034, poised to grow at a CAGR of 5.10% between 2024 and 2034. The North America packaging inks and coatings market size is calculated at USD 1.54 billion in 2024 and is estimated to grow at a fastest CAGR of 5.12% during the forecast year.

The global packaging inks and coatings market size is calculated at USD 4.51 billion in 2024 and is projected to hit around USD 7.41 billion by 2034, registering a CAGR of 5.10% during the forecast period from 2023 to 2032.

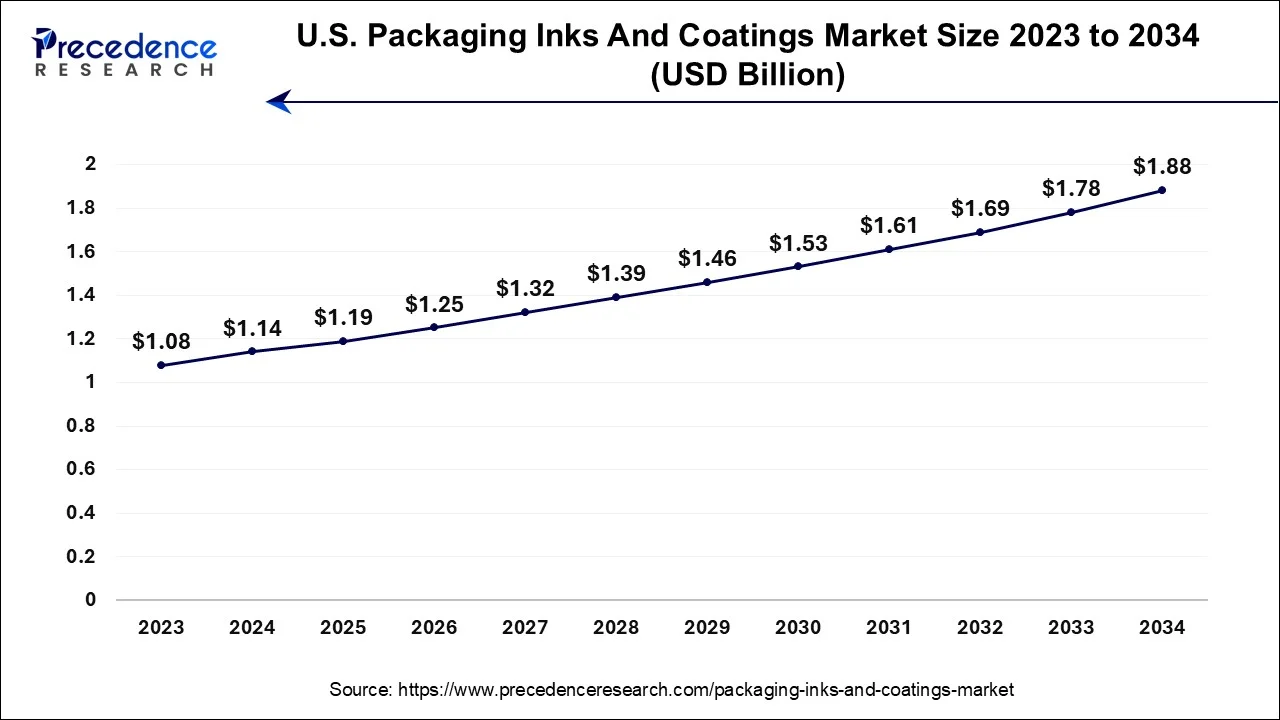

The U.S. packaging Inks and coatings market size is exhibited at USD 1.14 billion in 2024 and is projected to be worth around USD 1.88 billion by 2034, growing at a CAGR of 5.13% from 2024 to 2034.

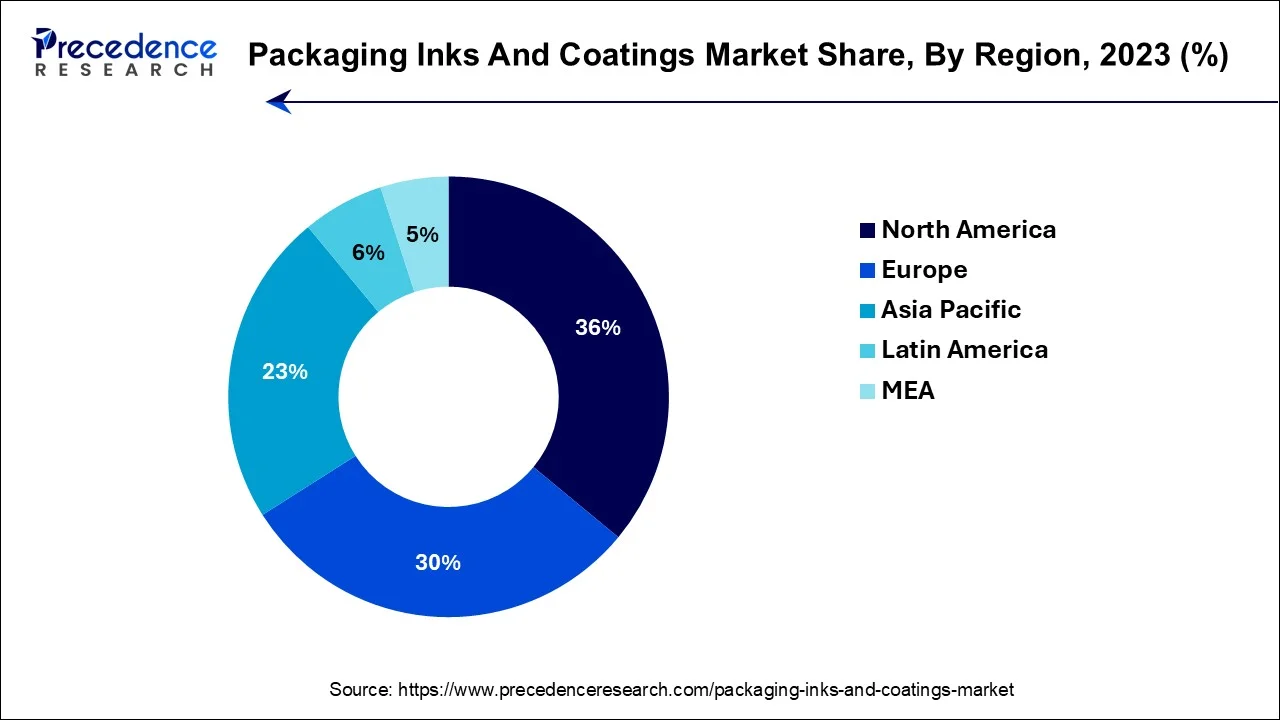

North America has held the largest revenue share 36% in 2023. In North America, the packaging inks and coatings market is characterized by several notable trends. There's a growing emphasis on sustainable and eco-friendly solutions, driven by consumer awareness and regulatory pressures. Secondly, the adoption of advanced digital printing technologies is on the rise, allowing for greater customization and shorter print runs.

Additionally, heightened concerns about product safety and counterfeit prevention are driving the incorporation of anti-counterfeiting features into packaging. Lastly, the COVID-19 pandemic accelerated the demand for e-commerce-friendly packaging in the region, necessitating durable and protective coatings for online sales.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the packaging inks and coatings market is witnessing notable trends. The growing e-commerce sector is driving demand for high-quality, durable inks and coatings that can withstand the rigors of transportation.

Additionally, the emphasis on sustainable packaging solutions is pushing manufacturers to develop eco-friendly inks and coatings to align with the region's environmental concerns. As brands prioritize unique packaging designs, digital printing technologies are gaining prominence, further boosting the market's growth in the Asia-Pacific region.

In Europe, the packaging inks and coatings market is witnessing notable trends. There is a growing emphasis on sustainability, with increased demand for eco-friendly inks and coatings to align with the region's strong environmental awareness. Furthermore, stringent regulations related to food safety and labeling have fueled the need for compliant and safe packaging solutions. Digital printing technologies are gaining traction for their customization capabilities. The European market is also seeing a rising interest in anti-counterfeiting features to protect brands and consumers.

Packaging inks and coatings are specialized materials applied to various packaging substrates, such as paper, plastic, or metal, to enhance both aesthetics and functionality. Inks provide color and graphic elements for branding, product information, and visual appeal. Coatings, on the other hand, offer protective layers that can enhance durability, barrier properties, and tactile qualities.

They serve vital functions like preserving product freshness, preventing moisture or gas intrusion, and ensuring label and package integrity. Additionally, these inks and coatings play a crucial role in meeting regulatory requirements, especially for food and pharmaceutical packaging, by ensuring safety and compliance with industry standards.

The packaging inks and coatings market is experiencing robust growth, driven by several key factors. Firstly, the increasing demand for attractive and informative packaging across various industries, including food, beverages, pharmaceuticals, and cosmetics, has fueled the need for high-quality printing inks and protective coatings.

The emphasis on branding and visual appeal is a significant growth driver. Moreover, the growing consumer preference for eco-friendly and sustainable packaging materials has led to innovations in environmentally friendly inks and coatings. This aligns with the industry's trend toward greater sustainability. However, the market faces challenges such as volatile raw material prices, stringent regulatory requirements related to food safety and labeling, and the need to keep pace with rapidly evolving printing technologies.

In terms of opportunities, the packaging inks and coatings sector can explore advancements in digital printing technologies, enabling shorter print runs, customization, and reduced waste. Additionally, catering to the surging e-commerce market by developing inks and coatings that are resilient during shipping and handling presents a lucrative prospect. The packaging inks and coatings market is thriving due to increased demand for visually appealing and sustainable packaging solutions, but it must navigate challenges related to regulations and technological advancements while capitalizing on emerging opportunities.

| Report Coverage | Details |

| Market Size by 2034 | USD 7.41 Billion |

| Market Size in 2024 | USD 4.51 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.10% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Branding, product information and transparency

In today's highly competitive consumer market, packaging is often the first point of interaction between a product and a potential customer. Eye-catching packaging with vibrant colors, intricate designs, and high-resolution graphics can significantly influence purchasing decisions. Brands are leveraging packaging inks and coatings to create visually appealing and memorable packaging that stands out on crowded store shelves or in online marketplaces. As a result, the demand for premium printing inks and coatings has surged, driving growth in the packaging industry.

Moreover, Consumers are becoming increasingly conscious of what they consume, demanding clear and comprehensive product information. Packaging inks and coatings play a pivotal role in conveying essential details such as nutritional facts, ingredient lists, and product origin. Additionally, they enable QR codes and augmented reality features, allowing consumers to access additional information and interactive content.

As transparency and information-sharing become industry standards, the packaging inks and coatings market experiences growth due to the need for accurate and informative packaging that fosters trust between brands and consumers. This shift is particularly evident in the food and pharmaceutical sectors, where safety and transparency are paramount.

Raw material price volatility, health, and safety concerns

One of the significant restraints in the packaging inks and coatings market is the volatility in raw material prices. The industry heavily relies on various chemicals, solvents, and pigments. Price fluctuations of raw materials can disrupt production costs, diminishing profit margins and impeding competitive pricing.

Manufacturers may find it challenging to absorb abrupt cost surges, potentially resulting in elevated prices for end-users. This scenario could curtail market demand, particularly within cost-sensitive sectors like packaging. Health and safety regulations are stringent in the packaging inks and coatings industry due to the potential risks associated with chemical exposure. Compliance with these regulations often necessitates costly investments in safety measures, training, and equipment.

Additionally, concerns about the environmental impact of certain chemicals used in inks and coatings can lead to regulatory changes and increased scrutiny, which may further constrain market growth. The packaging inks and coatings market faces challenges related to raw material price volatility, which affects pricing and profitability, as well as health and safety concerns, which demand ongoing investments in compliance and sustainability, potentially impacting market demand, especially among companies unable to adapt to these challenges.

Digital printing advancements and anti-counterfeiting features

Digital printing technologies have revolutionized the packaging industry by offering greater flexibility and customization. Brands can now create unique and eye-catching packaging with shorter print runs and reduced setup times. Small and medium-sized enterprises (SMEs) have notably leveraged digital printing advancements, enhancing their competitiveness.

Furthermore, the market has experienced heightened demand due to the rising concern over counterfeit products. To safeguard consumer safety and brand integrity, companies are now integrating anti-counterfeiting features into their packaging. These security features necessitate specialized inks and coatings that are challenging to replicate, reinforcing their significance in the packaging industry. Such security measures include holograms, QR codes, tamper-evident seals, and invisible inks, which have become essential for pharmaceuticals, cosmetics, and high-value consumer goods.

This heightened focus on product security has created a substantial demand for specialized inks and coatings with anti-counterfeiting properties. In combination, these advancements and security features are driving a strong demand for innovative and specialized packaging inks and coatings, making them indispensable components of modern packaging solutions.

The flexible plastic segment has held 38% revenue share in 2023. Flexible plastics, often defined by their cost-effectiveness, versatility, and durability, are widely used in packaging. They encompass materials like polyethylene and polypropylene, offering malleability and resistance to external factors, making them ideal for various packaging applications. In the packaging inks and coatings market, the trend is toward sustainable solutions, with water-based and UV-curable coatings gaining popularity.

These eco-friendly options reduce emissions and waste, aligning with the growing demand for environmentally responsible packaging. Additionally, the market is witnessing increased investments in digital printing technologies, enabling customized and vibrant packaging designs at competitive costs.

The paper segment is anticipated to expand at a significant CAGR of 8.1% during the projected period Paper in the packaging inks and coatings market refers to the substrate used for various packaging applications. It offers a cost-effective option compared to other materials, making it a preferred choice for eco-conscious consumers and businesses.

As sustainability gains prominence, there's a growing trend towards using paper-based packaging, which is recyclable and biodegradable. Brands are increasingly seeking water-based and eco-friendly inks and coatings compatible with paper packaging to align with these trends and meet consumer demands for environmentally responsible packaging solutions.

The advertising segment held the largest market share of 39% in 2023. In the packaging inks and coatings market, advertising refers to the use of printed visuals and information on packaging to communicate brand identity, product features, and marketing messages. A key trend in this area involves the growing importance of eye-catching packaging that stands out on crowded shelves, driving brand recognition.

Additionally, there is a rising demand for interactive packaging, such as QR codes or augmented reality features, which engage consumers digitally. These trends underscore the significance of packaging inks and coatings in facilitating effective advertising and consumer engagement.

The retail segment is projected to grow at the fastest rate over the projected period. In the retail sector, packaging inks and coatings play a vital role in enhancing product presentation and consumer appeal. Key trends include a growing emphasis on sustainable packaging solutions, with eco-friendly inks and coatings gaining traction.

Additionally, customization and personalization are on the rise to create unique and eye-catching retail packaging. Brands are also incorporating anti-counterfeiting features to ensure product authenticity and safety. Overall, the retail segment is witnessing a shift towards innovative, sustainable, and visually appealing packaging solutions to capture consumer attention and loyalty.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

March 2025