January 2025

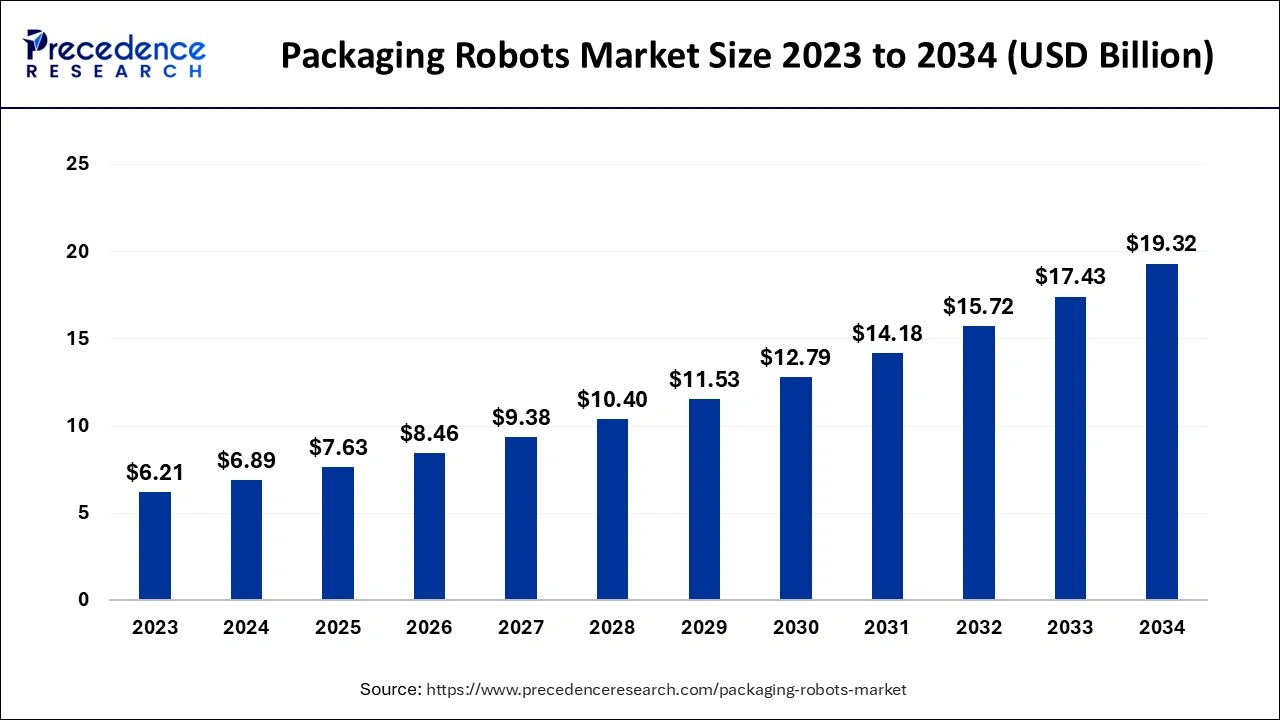

The global packaging robots market size accounted for USD 6.89 billion in 2024, grew to USD 7.63 billion in 2025 and is projected to surpass around USD 19.32 billion by 2034, representing a healthy CAGR of 10.87% between 2024 and 2034.

The global packaging robots market size is estimated at USD 6.89 billion in 2024 and is anticipated to reach around USD 19.32 billion by 2034, exapnding at a CAGR of 10.87% between 2024 and 2034.

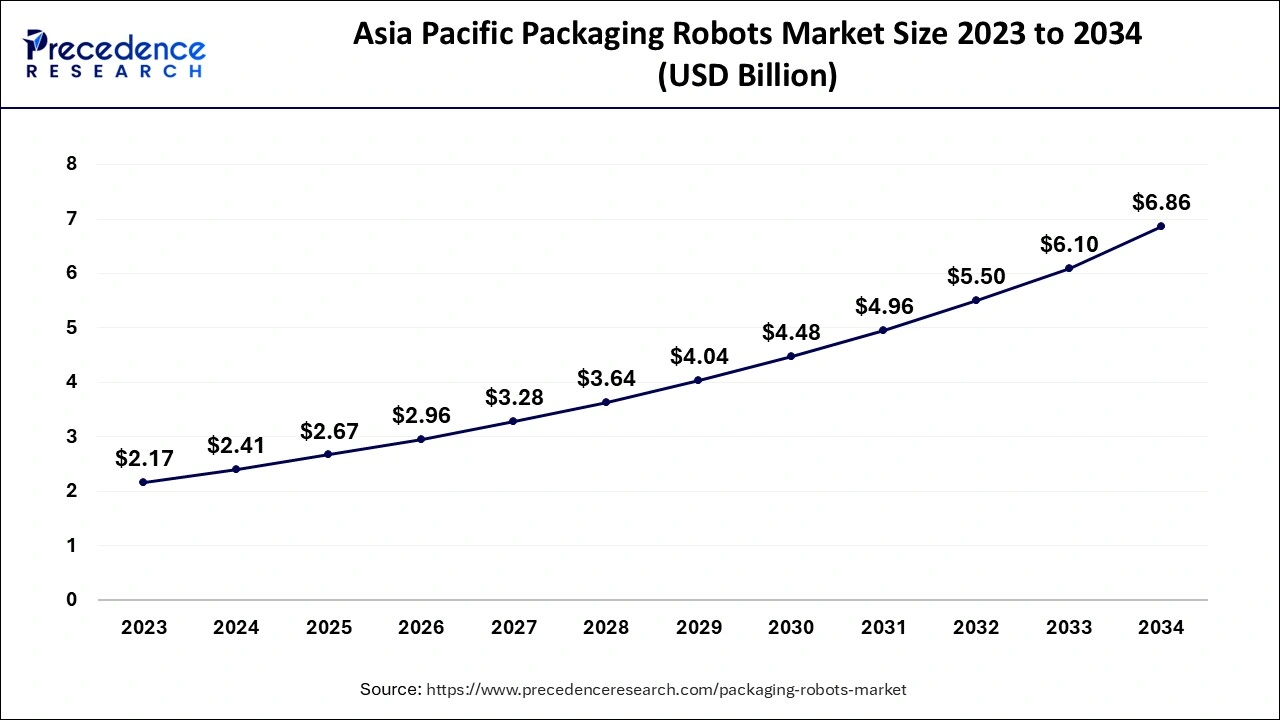

The Asia Pacific packaging robots market size accounted for USD 2.41 billion in 2024 and is expected to be worth around USD 6.86 billion by 2034, growing at a CAGR of 11.03% from 2024 to 2034.

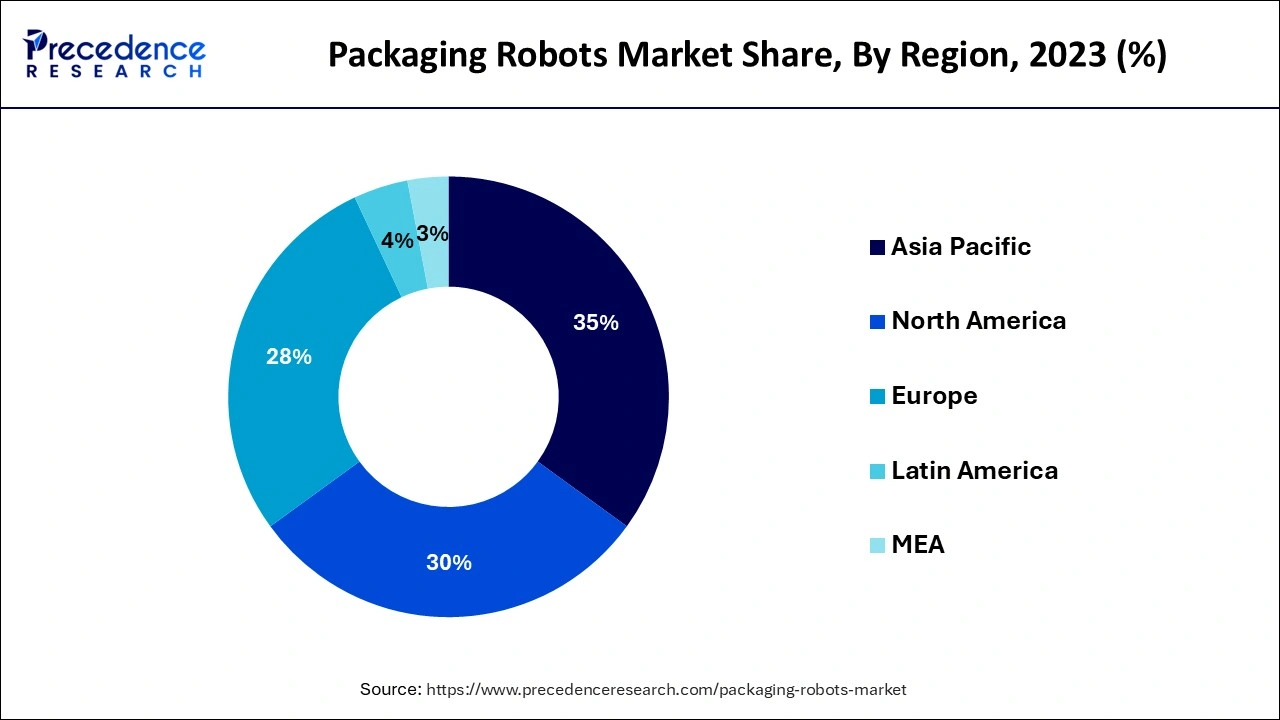

Asia Pacific region has held a 35% revenue share in 2023. In manufacturing facilities, especially those that create goods for the consumer market, the packing process is crucial. The addition of a robotic packaging system increases flexibility and raises the overall production of the packaging line. Packaging robots can work at a range of temperatures and use significantly less floor space than humans. Robotic packaging is commonly used in the food, beverage, and pharmaceutical sectors for both primary and secondary packaging applications.

In consequence, it is projected that this would hasten the worldwide market for packaging robots in the near future. The following, planned operations, and transportation portion is relied upon to acquire from, while food and drink sections will acquire from changing way of life of the metropolitan populace. Despite the late but extremely clear entrance of web-based business in the arising economies in the Asia Pacific, for example, India, which houses an enormous population.

The research divides the global market for packaging robots by application into picking, pressing, which includes plate and case pressing, and palletizing, which includes sack palletizing, case palletizing, and de-palletizing. As a result of changing lifestyles among the urban population, the picking packaging robot segment accounted for 39% of interest in 2020, reflecting the growing usage of consumer goods, food, and beverages.

The packaging sector in Japan is consistently growing. The popularity of packaged foods and beverages has led to a rise in the demand for ridged packaging throughout the nation. The growing processed food industry in Japan is predicted to be a major growth factor for the packaging automation market.

Additionally, the Industrial Internet of Things (IIoT) is being more and more widely used in the local packaging business. Through new options for improved equipment, machine infrastructure, and operators, this advancement may not only boost the efficiency of packing lines but also pave the way for such a digital future of packaging equipment over the next 10 years.

The flexibility, precision, and consistency of robots in packaging are its major advantages. Robots are capable of a wide range of tasks in the packaging industry, including picking and placing, boxing, palletizing, depinning, detesting, and warehousing. Robot packaging is preferred by many firms due to its enhanced supply chain efficiency, higher packaging effectiveness, and decreased operating costs. To finish any kind of packing operation, they employ the right end of arm tooling. They come in different robot sizes, payloads, reaches, and mounting configurations. The integration of packaging robots into any type of workstation is simpler.

With an automated production line, there is no concern about contamination as hygiene in the food business improves. The use of robotic packaging gives you the chance to make the most of your workforce while maintaining or raising productivity. Producers and industry leaders are creating new software and technology to emulate human activities.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.89 Billion |

| Market Size by 2034 | USD 19.32 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.87% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Gripper Type, By Service and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Packaging robots benefits.

Reliable packaging robots provide excellent branding information on labels. An individual identifying code is produced once items are packed to help with supply chain tracing. Robotics' biggest advantage in the packaging industry is without a doubt their versatility. Because of their narrow arms with a broad reach, great repeatability, and precision tooling, robotic packaging systems, like pick-and-place robots, may also be very accurate and exact. They are excellent for a range of packaging and supply chain jobs because to their high level of accuracy. Additionally, product quality and cycle time may be increased with the utilization of robot packaging equipment.

The quality of the packaging is increased since robotic activities are controlled and the outputs are constantly consistent. The packing procedures can run smoothly because to this precision. The advantages of robotic packaging have been the primary driving force behind market development. These robots can operate at a high pace for at least 70,000 hours without needing any maintenance. Entrepreneurs are increasingly conscious about their time, money, and sales. A competitive product needs to be developed in order to flourish on the market. Automation of manufacturing lines enables companies to maximize innovation without compromising productivity or quality.

There is an increasing need for highly automated packaging processes.

In manufacturing facilities, especially those that create goods for the consumer market, the packing process is crucial. The addition of a robotic packaging system increases flexibility and raises the overall production of the packaging line. Packaging robots can work at a range of temperatures and use significantly less floor space than humans. Robotic packaging is commonly used in the food, beverage, and pharmaceutical sectors for both primary and secondary packaging applications. In consequence, it is projected that this would hasten the worldwide market for packaging robots in the near future.

Automation of the packaging process is more costly than conventional packaging.

The high development and maintenance expenses of these devices are impeding the expansion of the packaging automation market. Due to the use of cutting-edge technology and the need for skilled labor, the overall cost of these machines will increase. The machines must also have proper and consistent maintenance in order for them to continue operating as intended, which raises the expense. Furthermore, severe government regulations relating to worker safety when automated packaging methods are utilized are impeding the industry's growth.

Technological advancements.

The need for packaging equipment connected to IoT as well as smart embedded technologies is increasing due to the field's accelerating rate of technological development. With such advanced technology, desktop PCs, mobile devices, and laptops can easily monitor packaging equipment from any place. Thanks to these cutting-edge technology, production line workers can now evaluate the efficiency and consistency of such automated systems more easily. They also assist in locating and correcting flaws by enabling remote control, which transmits essential instructions to activate or deactivate a machine's function from a distance.

The pharmaceutical business is expected to expand significantly.

The pharmaceutical industry's tremendous growth in the future years will increase the demand for sustainable packaging solutions. The International Federation of Pharmaceutical Manufacturers and Association estimates that by 2020, the global pharmaceutical market would be worth USD 1,430 billion (IFPMA). As the industry grows, more sophisticated packaging will be required to protect drugs from the elements and prevent changes in their chemical properties.

Packaging using automated machines reduces human error, improves product quality, and increases patient safety for tiny plastic parts such as catheters, inhalers, bottles, caps & closures, disposables, syringes, and other medical devices. The market will become more in need of packaging automation as a result of these factors.

On the basis of gripper type, the market is classified into vacuum, clamp, claw, and others. The clamp and clows segment dominated the global packaging robot market in terms of revenue and is expected to expand at the fastest CAGR during the forecast timeframe. The segment is growing rapidly due to a growing demand from food & beverage and pharmaceutical sectors.

During the projection period, Pick & Place is anticipated to see the greatest CAGR growth. The e-commerce sector's explosive growth and the need for packaging robots from this sector are credited with driving the market's expansion. Picking robots are increasingly preferred by e-commerce firms for the order fulfillment process over manual item picking. The efficiency and cost of item picking have improved because to automation. Robot automation enables simple integration, enhanced flexibility, and excellent dependability throughout the packing phase of the packaging process.

Top loading of boxes, unloading and mixing, and feeding of materials to end loaders or film wraps are all tasks that a robot that is developed and optimized for packaging applications can do with ease. Packaging robots are frequently used for the optimization of packing applications such race track packing and monitoring of moving conveyors because they have a broad variety of robots, controller equipment, vision technology, and software.

The food and beverage segment captured the largest market share in 2022 because to the rise in demand for fresh food and beverage items, is the end-user that uses packaging robots the most. The need for automation solutions is rising as a result of the various governments taking action to ensure the safety of the food supply. The food processing and production sectors need the assistance of packaging robot technology to maintain consistency in the quality of their output. Automation systems like articulated, parallel, SCARA, and cylindrical are being developed as a result of the industry's need for operational efficiency and rapid technological advancement.

Segments Covered in the Report:

By Gripper Type

By Service

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025