January 2025

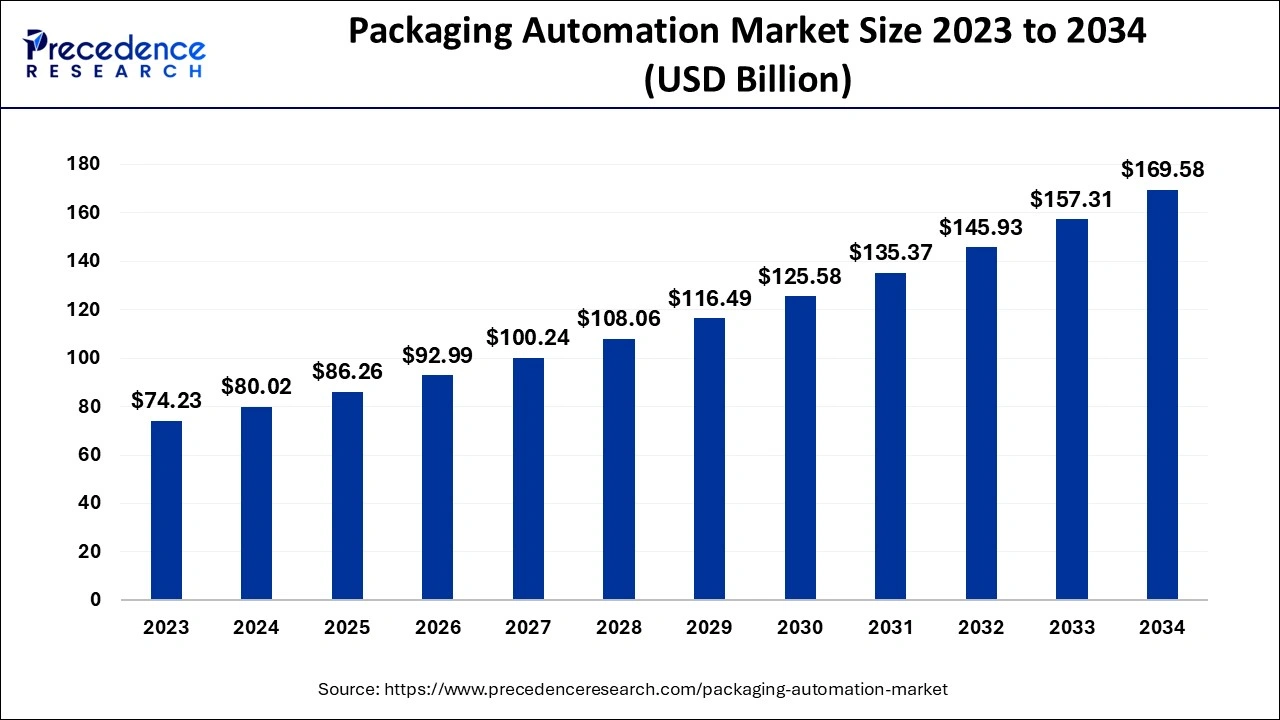

The global packaging automation market size accounted for USD 80.02 billion in 2024, grew to USD 86.26 billion in 2025 and is predicted to surpass around USD 169.58 billion by 2034, representing a healthy CAGR of 7.80% between 2024 and 2034.

The global packaging automation market size is estimated at USD 80.02 billion in 2024 and is anticipated to reach around USD 169.58 billion by 2034, expanding at a CAGR of 7.80% from 2024 to 2034.

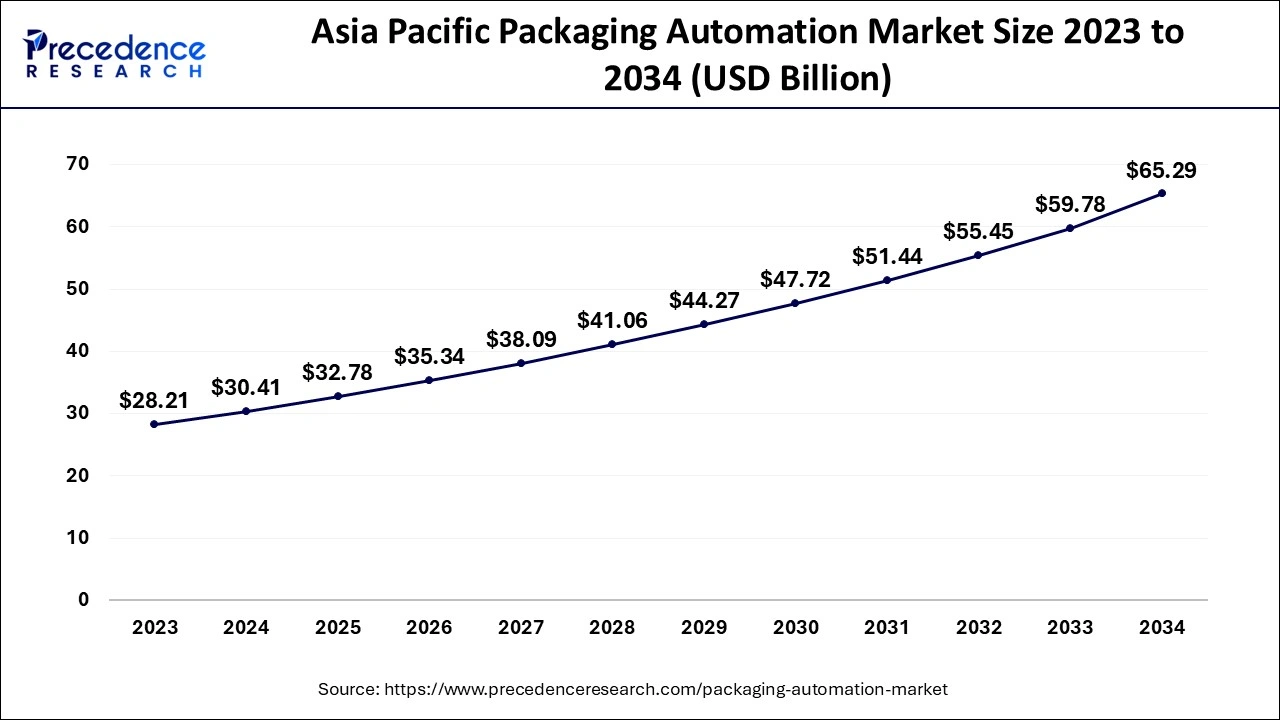

The Asia Pacific packaging automation market size is evaluated at USD 30.41 billion in 2024 and is predicted to be worth around USD 65.29 billion by 2034, rising at a CAGR of 7.93% from 2024 to 2034.

The Asia Pacific holds a sizable market share due to the region's high level of packing machinery adoption. Key manufacturers in the area are collaborating and forming strategic partnerships to boost the industry.

With the disastrous spread of the COVID pandemic, automation became increasingly common. Given the rising investments and expanding retail market sector, China is anticipated to be the most crucial market for the industry. Increased packaging requirements are accelerated by increased consumer spending, which affects the market for packaging robots.

Japan's packaging industry is expanding steadily. The country's demand for ridged packaging has increased as packaged food and beverages have become more popular. A key driver for the packaging automation market is anticipated to be Japan's expanding processed food sector.

Additionally, the adoption of the Industrial Internet of Things (IIoT) in the packaging industry is growing in popularity in the region. This development could not only increase the productivity of packaging lines but also pave the way for such digital future of packaging equipment over the coming ten years by providing new opportunities for upgraded machinery, machine infrastructure, and operators.

Packaging without any human aid is referred to as packaging automation. Eliminating pointless jobs is a clever strategy that enables manufacturing or packaging businesses to do more work with less resources. The adoption of packaging automation reduces reliance on labor, boosts packaging efficiency and repeatability, and therefore results in greater floor space usage. Additionally, it lowers the cost of packaging as a whole and raises package quality. Production operations are more productive and efficient thanks to automated devices.

Because automated machines are efficient and may cut labor costs and time, manufacturers are increasingly using them to package commodities and products. Automation is being used in the manufacturing industry because of its many advantages, including more flexibility, safer working conditions, rigorous quality, less waste, and inexpensive prices. Furthermore, based on the demands of product labeling and presentation needs, the introduction of the programming feature in these machines allows diversity and non-repetitiveness of the duties and activities.

The rise in demand for improving productivity, industrialization, and manufacturing processes as well as the expanding use of automation in several industries, including food and beverage, pharmaceuticals, and cosmetics, is credited with driving the growth of this market. However, the adoption of packaging automation solutions in the industrial sector is being hampered by the high initial costs involved with establishing automated systems. The increased demand for bespoke packaging and government measures to assist digital transformation in APAC are also anticipated to open up considerable potential prospects for market participants. But one of the biggest obstacles to this market's expansion is a shortage of trained personnel to operate automation equipment.

The demand for robust packaging solutions to guarantee the endurance and durability of the items during transit has increased as a result of the rise in disposable incomes along with the development in living standards. These considerations are enticing producers in the healthcare, e-commerce, and logistics, as well as the food and beverage sectors, to adopt sophisticated packaging solutions to speed up their production and adopt the idea of mass manufacturing.

The development in discretionary income, which is resulting in an improvement in the level of life, has raised the demand for durable packaging solutions to assure the products' long-term durability throughout transit. Due to this feature, businesses in the e-commerce, logistics, food, and beverage, and healthcare industries are enticed to embrace cutting-edge packaging solutions in order to accelerate their manufacturing to a mass market. Due to the growing need for supply chain integration, several firms are also purchasing cutting-edge technology for the packaging of goods. These technologies improve the productivity of production line operations and assist businesses in reducing the workforce on production lines, saving both labor costs and production time.

| Report Coverage | Details |

| Market Size in 2024 | USD 80.02 Billion |

| Market Size by 2034 | USD 169.58 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.80% |

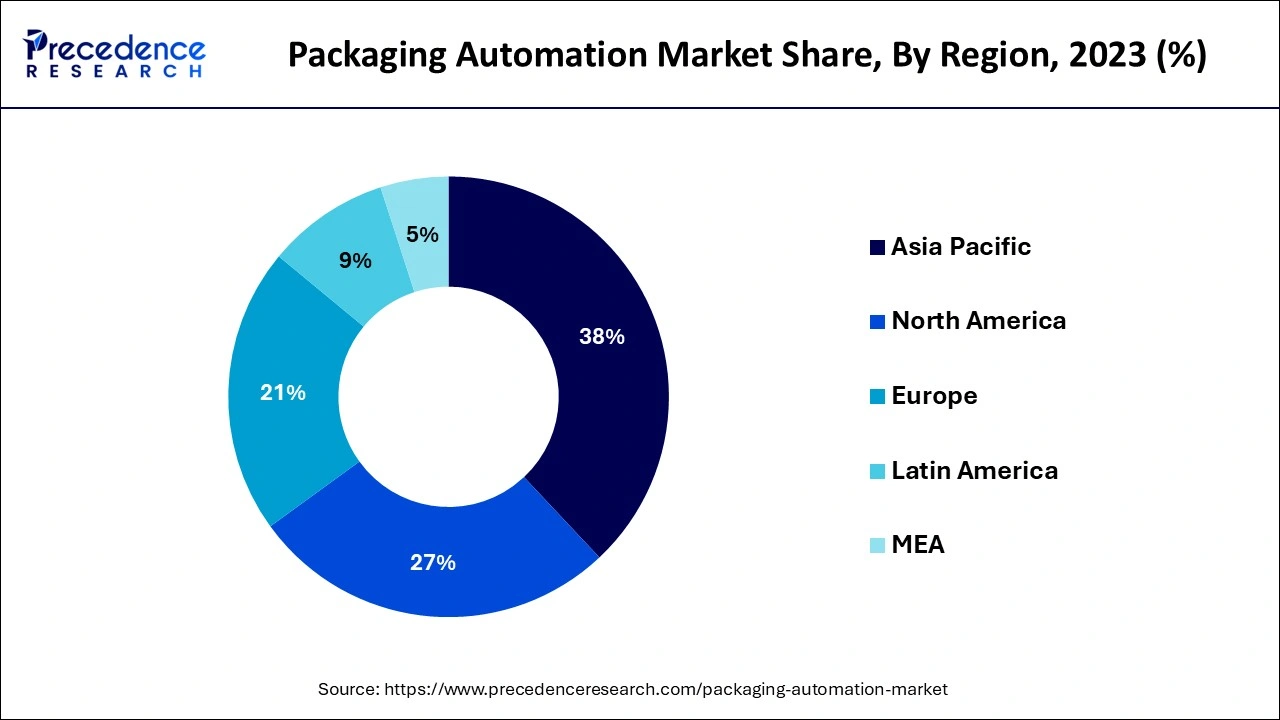

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

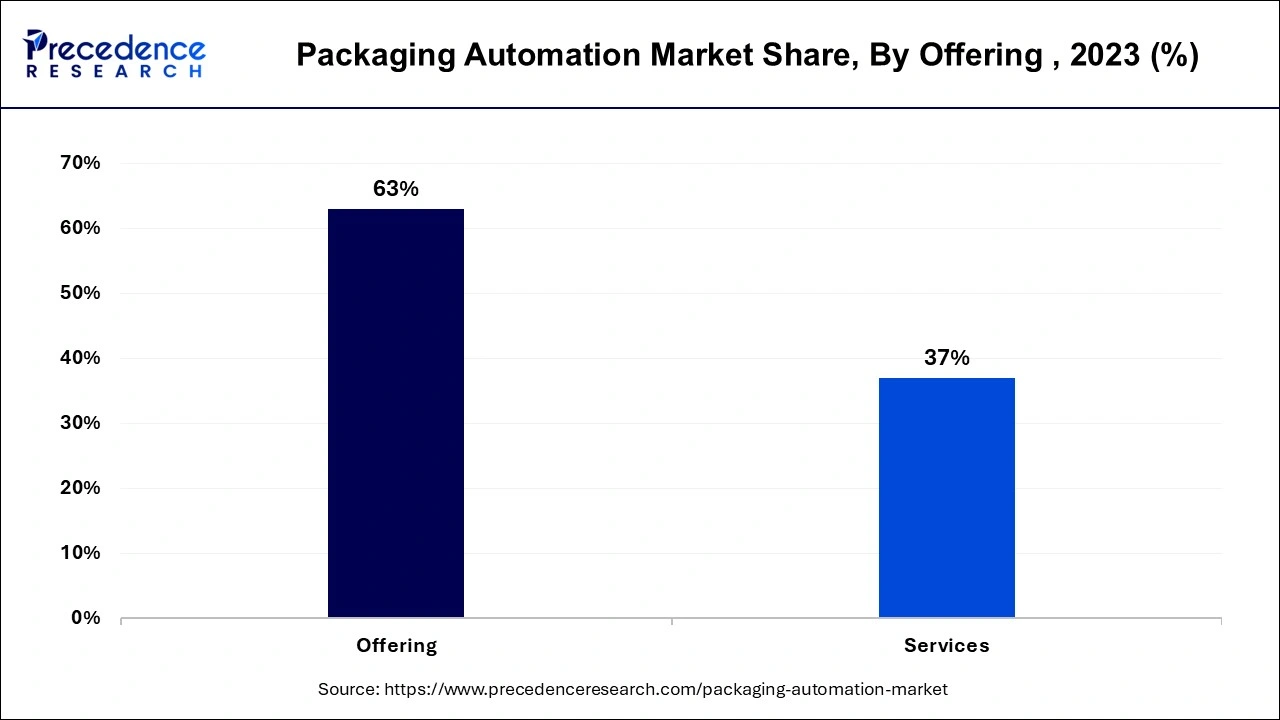

The solution category has anticipated having the greatest market share in 2023. The growth of this sector of the packaging automation market is being driven by the need to decrease unplanned downtime through optimized maintenance scheduling and failure prevention, maximize throughput by identifying performance bottlenecks, reduce production and manufacturing defects, and enhance overall product quality. During the projection period, the solution category is also anticipated to have the greatest CAGR.

The market for packaging automation is anticipated to be dominated by the robotic pick & place automation segment in 2022. This market's expansion is attributable to elements like better product handling, variety, and adaptability as compared to traditional automation. It also minimizes the need for human assistance when inserting items into a packaging machine. This lowers labor expenses and boosts an industry's production, which justifies the accompanying investment. However, it is anticipated that the tertiary & palletizing category would grow at the largest CAGR throughout the projection period.

The e-commerce & logistics sector was the largest revenue holder in 2023. This market's expansion is due to advantages including better-completed goods quality, inventory monitoring technologies built on the Internet of Things that can connect with one another, and growing data availability and transparency. However, it is anticipated that throughout the projection period, the healthcare & pharmaceuticals, and food & beverage industries would both record the greatest CAGRs.

By Offering

By Automation Type

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025