January 2025

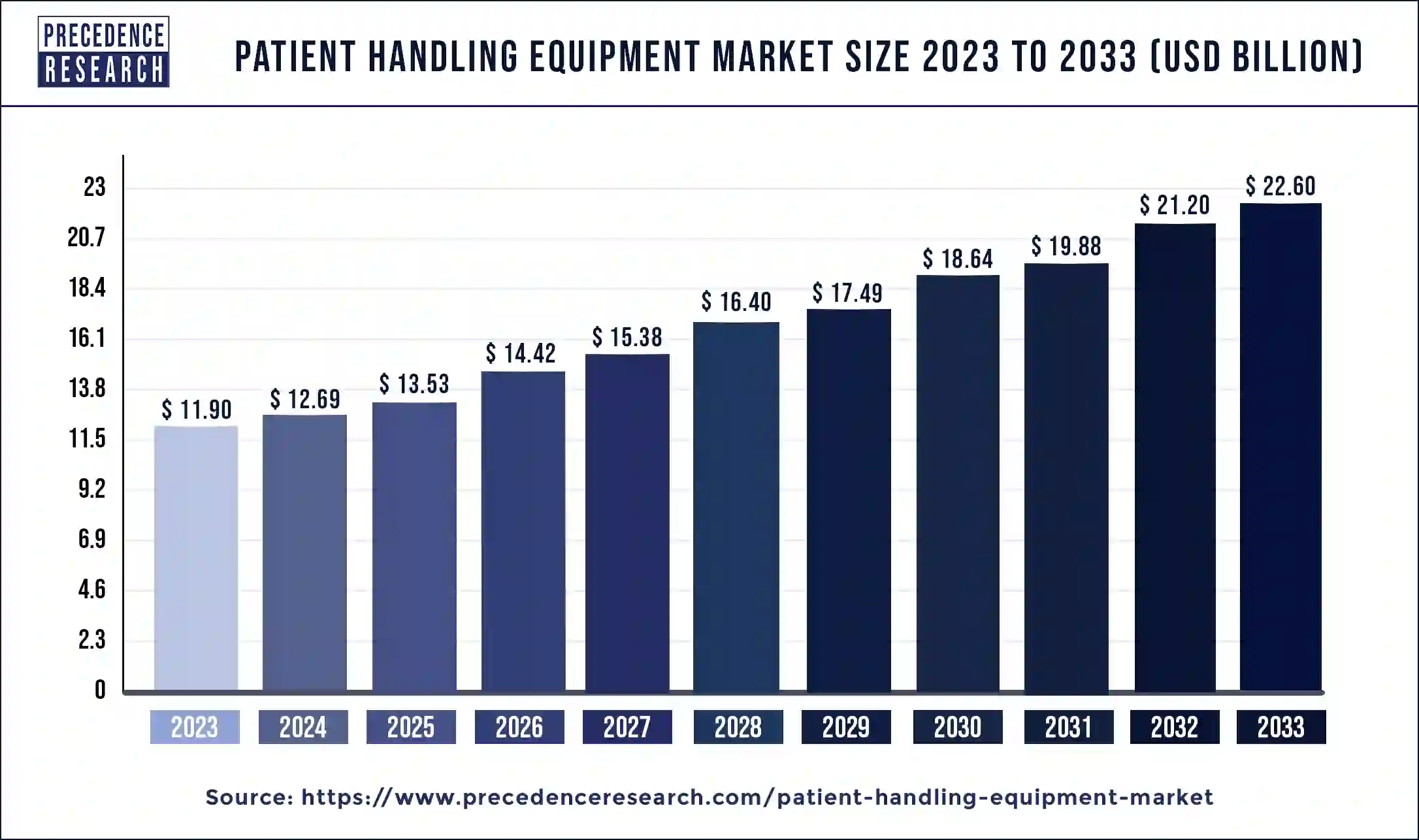

The global patient handling equipment market size is calculated at USD 13.53 billion in 2025 and is forecasted to reach around USD 23.95 billion by 2034, accelerating at a CAGR of 6.56% from 2025 to 2034. The North America patient handling equipment market size surpassed USD 4.70 billion in 2024 and is expanding at a CAGR of 6.69% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global patient handling equipment market size was USD 12.69 billion in 2024, estimated at USD 13.53 billion in 2025 and is anticipated to reach around USD 23.95 billion by 2034, expanding at a CAGR of 6.56% from 2025 to 2034. The patient-handling equipment market is driven by the number of older people increasing. As they get older, people are increasingly likely to need assistance with everyday tasks and mobility. The use of patient-handling equipment enhances the safety and well-being of patients and caregivers.

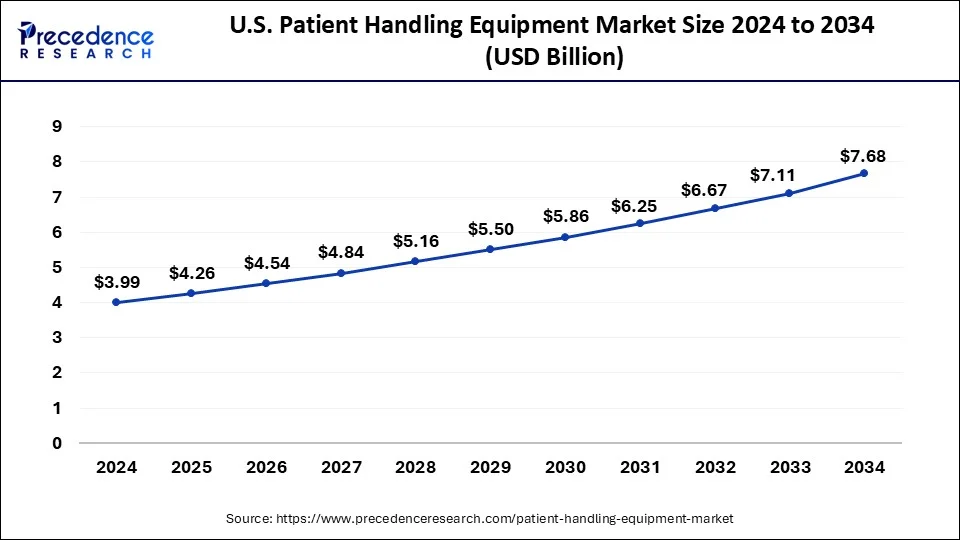

The U.S. patient handling equipment market size was estimated at USD 3.99 billion in 2025 and is projected to surpass around USD 7.68 billion by 2034 at a CAGR of 6.77% from 2025 to 2034.

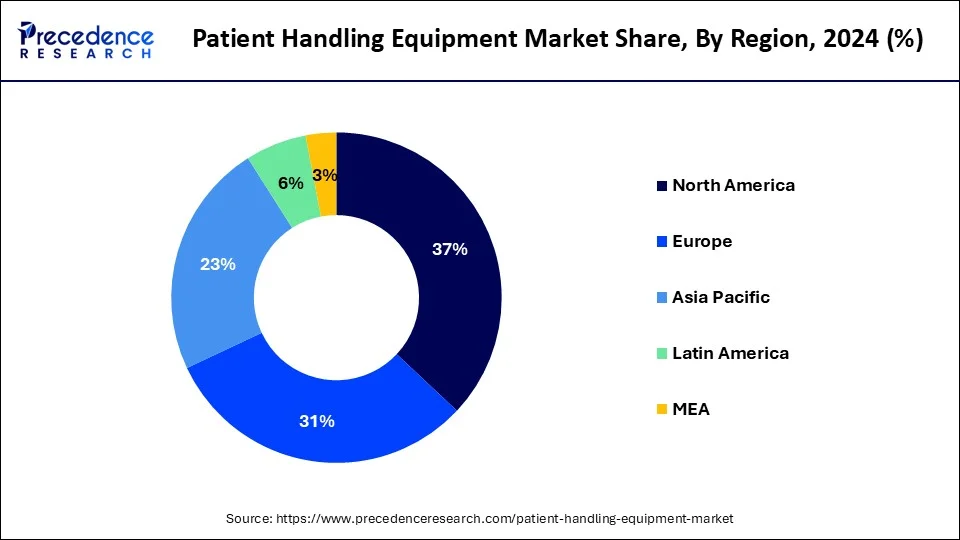

North America, held the dominating share in the patient handling equipment market in 2023 and is observed to sustain the position throughout the predicted timeframe. Healthcare institutions in this area are subject to strict safety laws and standards to ensure patient safety and reduce the possibility of injuries occurring during patient handling and transport. To comply with these rules, you must employ top-notch patient handling equipment. Furthermore, North American manufacturers make significant R&D investments to develop cutting-edge, ergonomic, user-friendly products that improve caregiver productivity and patient comfort. These technological developments encourage the healthcare industry to invest in new equipment, which propels market expansion even more.

Asia-Pacific is the fastest growing patient handling equipment market during the forecast period. Patient handling equipment is seeing fast technological improvements in the Asia-Pacific healthcare business. Electric beds, motorized wheelchairs, and sophisticated transfer devices are examples of innovations that increase patient comfort, lessen the risk of injury to patients and caregivers, and boost operational effectiveness in healthcare institutions.

Healthcare workers and other caregivers are becoming more conscious of the importance of appropriate patient handling procedures to reduce injuries and enhance patient outcomes. Patient handling equipment safety is the focus of training programs and educational activities, which promotes higher acceptance and market growth.

The patient handling equipment market seeks to supply specialized equipment and tools that make patient movement, transfer, and positioning within healthcare environments safe and effective. From basic items like hospital beds and stretchers to more sophisticated options like patient lifts, transfer help, and mobility aids, this equipment has it all.

| Report Coverage | Details |

| Global Market Size in 2024 | USD 12.69 Billion |

| Global Market Size in 2025 | USD 13.53 Billion |

| Global Market Size by 2034 | USD 23.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.56% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing hospital admissions due to outbreak of COVID-19 pandemic

Intensive care is frequently needed for COVID-19 patients because of severe respiratory problems. This has raised the demand for equipment such as mechanical ventilators, ICU beds, and patient lifts to guarantee the best possible care and assistance for critically sick patients. Healthcare personnel safety is just as important as patient care. Patient handling equipment, such as powered patient lifts and transfer devices, helps lower the risk of musculoskeletal injuries among healthcare professionals by enabling safe and effective patient transfers and movements.

Insufficient training to caregivers for operating patient handling equipment

Equipment used to handle patients may become inefficient due to inadequate training. The equipment may be complicated for caregivers to use effectively, which could cause delays in patient transfers or make it more difficult to move patients securely. Both patients and caregivers may become frustrated as a result, which could lower the general standard of patient care. Furthermore, caregivers' lack of confidence in using patient handling equipment might be attributed to inadequate training. This lack of confidence could deter caregivers from using the equipment when necessary, resulting in risky manual handling techniques that could endanger the patient and the caregiver.

Escalating incidence of disabilities across the globe

The demand for patient handling equipment, such as mobility aids, patient lifts, and transfer aids, rises with the aging population and chronic diseases. Disabilities frequently call for particular care and equipment to protect the comfort and safety of patients and caregivers. Hospitals, assisted living facilities, and rehabilitation facilities are in high demand in developing regions like Asia, where the population is aging quickly. It is necessary to purchase patient handling equipment to accommodate the needs of an increasing number of patients with impairments.

Ergonomic design and injury prevention techniques in patient handling procedures are becoming increasingly critical in healthcare institutions. This involves implementing tools like ceiling lifts and ergonomic transfer aids that lower the incidence of musculoskeletal injuries among caregivers.

The wheelchairs and scooters segment dominated the patient handling equipment market in 2024. The need for mobility assistance among the elderly and crippled has increased due to the world's population aging at an accelerated rate. For those with restricted mobility, wheelchairs and scooters offer vital support that helps them keep their independence and enhances their quality of life. The desire to age in place, growing healthcare expenditures, and technological advances have all contributed to a notable move towards home healthcare services. To enable patients to receive treatment in familiar surroundings and move around their homes independently, wheelchairs and scooters are essential tools for home-based care.

The ambulatory aids devices segment is the fastest growing in the patient handling equipment market during the forecast period. Government and healthcare organization subsidies, reimbursements, and funding support encourage the use of ambulatory aids, especially among marginalized groups, propelling market expansion. Ambulatory aids are becoming increasingly popular as the healthcare environment changes, and decentralized care delivery models and remote monitoring solutions become increasingly important to healthcare systems.

The acute & critical care segment dominated the patient handling equipment market in 2024. Due to the severe nature of the patient's ailments, acute and critical care units, including emergency departments and intensive care units (ICUs), need specialist patient handling equipment. These units frequently treat patients in severe conditions who have been hurt or require emergency care. Therefore, there is a great need for sophisticated patient handling equipment, such as ICU beds, patient lifts, stretchers, and transport chairs, to meet these requirements.

The mobility assistance segment is observed to grow significantly in the patient handling equipment market during the forecast period. Globally, chronic illnesses like obesity, diabetes, and cardiovascular disease are growing more common. Mobility aid devices are necessary due to the mobility difficulties caused by these illnesses. The need for patient handling devices intended to promote mobility is anticipated to increase with the ongoing growth in the prevalence of chronic diseases.

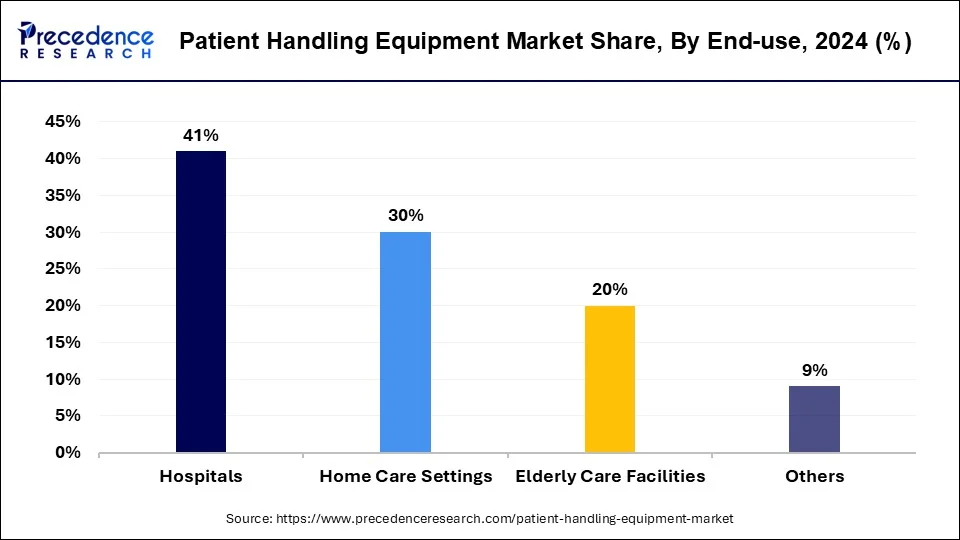

The hospitals segment dominated the patient handling equipment market in 2024. Strict regulatory requirements are in place for hospitals to guarantee patient safety and high-quality care. To comply with standards established by regulatory bodies like the Food and Drug Administration (FDA), patient handling equipment must be approved and meet particular safety and performance requirements. Hospitals, therefore, prioritize purchasing equipment from reliable suppliers recognized for upholding legal requirements, further solidifying their position as industry leaders.

The home care settings segment is the fastest growing in the patient handling equipment market during the forecast period. Most patients and healthcare providers find home care an appealing alternative to institutional care since it is frequently more affordable. Healthcare providers can minimize expenses while maintaining high-quality patient care by reducing the need for hospital admissions or extended stays in facilities by investing in patient handling equipment for home care settings. The COVID-19 epidemic has expedited the trend towards home-based care, as people aim to decrease their visits to medical institutions and lessen the strain on healthcare systems.

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

September 2024

January 2025