October 2024

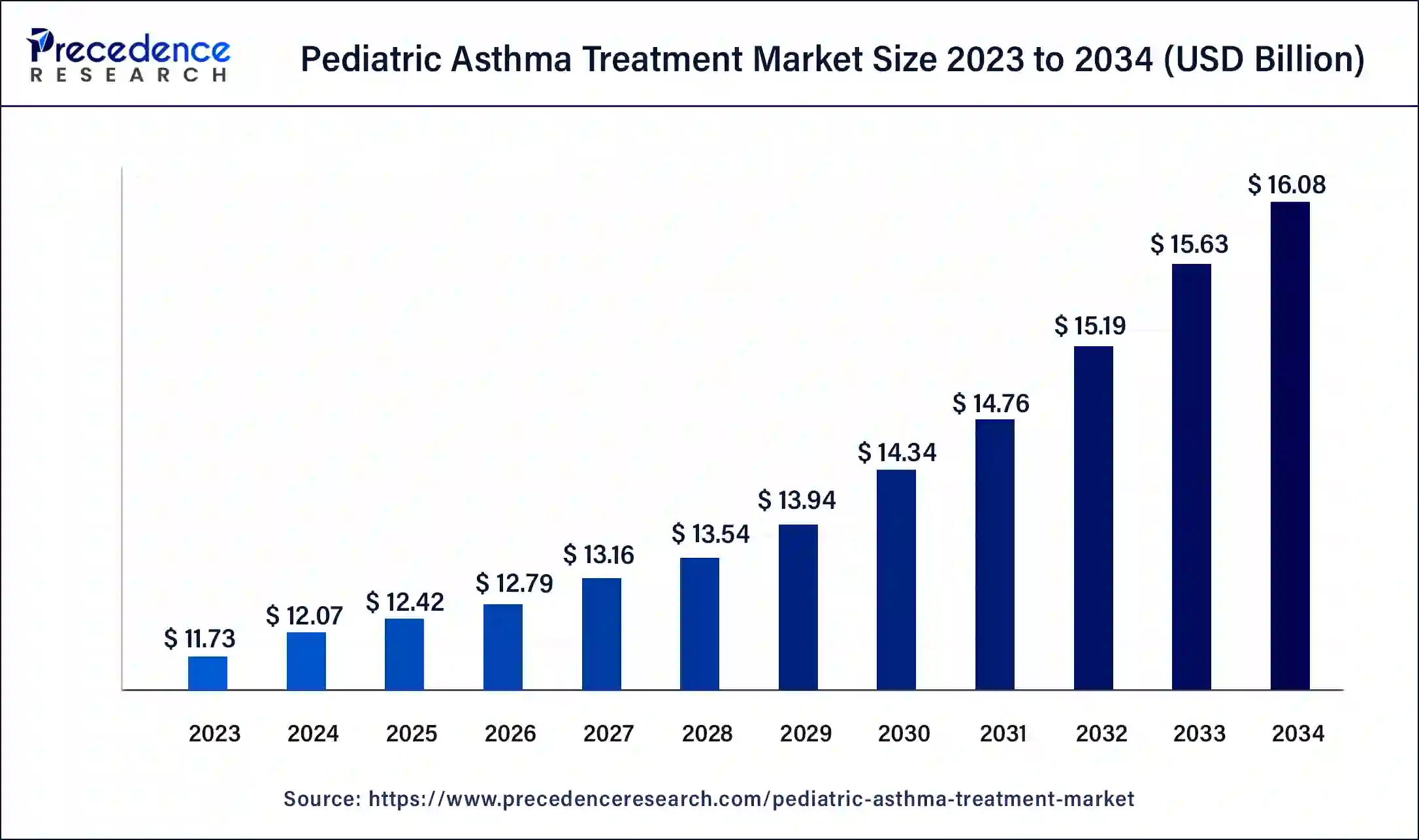

The global pediatric asthma treatment market size surpassed USD 11.73 billion in 2023 and is estimated to increase from USD 12.07 billion in 2024 to approximately USD 16.08 billion by 2034. It is projected to grow at a CAGR of 2.91% from 2024 to 2034.

The global pediatric asthma treatment market size is projected to reach around USD 16.08 billion in 2034 from USD 12.07 billion in 2024, at a CAGR of 2.91% between 2024 and 2034. The worldwide pediatric asthma treatment market is driven by growth in the incidence of asthma and an increase in allergy cases.

Pediatric asthma treatment involves a medical approach aimed at managing asthma in children to enhance their quality of life and minimize the risk of complications associated with poorly controlled asthma. Key aspects of managing asthma include promoting physical activity and improving air quality. Symptoms of pediatric asthma include wheezing during breathing, rapid and labored breathing, chest pain, persistent coughing, and fatigue. While pediatric asthma cannot be cured, its prevention is possible through regular monitoring, avoiding smoking around children, managing acid reflux, and addressing other contributing factors.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.08 Billion |

| Market Size in 2023 | USD 11.73 Billion |

| Market Size in 2024 | USD 12.07 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 2.91% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancements in research technology

The landscape of the pediatric asthma treatment market is influenced by a range of dynamic factors. Market trends are shaped by advancements in research, technology, and evolving healthcare policies. Variations in patient demographics, such as differences in prevalence rates and geographic Distribution, also affect market behavior.

The competitive environment is further intensified by the introduction of new therapies and emerging market players. Innovation is propelled by collaborations between pharmaceutical companies and research institutions, driving progress in the field. Additionally, changes in regulations and reimbursement policies significantly impact treatment accessibility and affordability and play an important role in shaping market growth.

Escalated costs of asthma medications

The high expense associated with asthma medications, especially inhalers, has been a significant barrier to the pediatric asthma treatment market growth in recent years. This cost can restrict access to pediatric asthma treatments, particularly in low- and middle-income countries where many individuals suffer from asthma symptoms. Without sufficient insurance coverage, patients face a substantial financial burden. However, the elevated costs of these medications stem from the complexities of their development and manufacturing processes, as well as the additional expenses related to research, development, clinical trials, and regulatory approvals.

Development of biologics and telehealth

Recent advancements in asthma medications have created lucrative opportunities for key players in the pediatric asthma treatment market. A notable example of such advancements is the development of biologics, which are drugs created from living organisms like bacteria or mice and designed to target specific human molecules. Another emerging trend is the growing adoption of telehealth for remote consultations and asthma management. Furthermore, digital therapeutics, including educational apps and self-management tools, are empowering both children and parents to gain a better understanding of and manage their asthma more effectively.

The long-term control medications segment dominated the pediatric asthma treatment market in 2023. The surge in demand for combination inhalers has been a major driver for this segment. Alongside combination inhalers, long-term medication products such as corticosteroids, leukotriene modifiers, and theophylline have also seen increased patient demand. Key drug classes within the long-term control medication segment include a combination of corticosteroids, anticholinergics, immunomodulators, and leukotriene modifiers.

The other segment is expected to show the fastest growth in the pediatric asthma treatment market over the forecast period. The emerging medications with significant growth potential in asthma treatment include biological therapies and combination inhalers. These innovations are aimed at addressing specific asthma phenotypes in children. Biological therapies work by targeting cells or blocking specific molecules that contribute to airway inflammation following exposure to triggers. This exposure activates immune system molecules, leading to swelling in the airways. Hence, this factor can expand segment Growth.

The hospital segment led the pediatric asthma treatment market in 2023. Advanced therapeutics and personalized care improve patient outcomes and accelerate recovery times in hospitals and clinics. When prescribed by trained healthcare professionals, patients are more likely to adhere to treatment protocols and receive accurate, safe administration of essential therapeutics, particularly those delivered via subcutaneous injections. Hence, these factors contribute to more effective control of asthma symptoms.

The clinics segment is expected to grow at the fastest rate in the pediatric asthma treatment market during the forecast period. This can be attributed to the convenience of refilling asthma prescriptions, such as inhaled corticosteroids, at these locations, which significantly contributes to their appeal. Also, the ease of accessing critical asthma medications enhances patient satisfaction and leads clinics to be projected as experiencing the highest rate during the forecast period. Pediatric asthma treatment is not only advancing health outcomes but also driving economic growth across sectors by integrating technology and focusing on patient-centered approaches.

North America dominated the pediatric asthma treatment market in 2023. The surge in asthma prevalence and the increase in research and development activities aimed at creating innovative devices are contributing to the growth of the asthma treatment market in countries like the U.S. and Canada. The presence of sophisticated healthcare infrastructure and leading industry players in North America is expected to further drive market expansion in the coming years.

Furthermore, technological advancements in asthma treatment and the growing number of asthma patients in the region are key factors propelling the North American market. Companies such as Johnson & Johnson and Merck are at the forefront, focusing on cutting-edge therapies and digital health solutions.

Asia Pacific is anticipated to register the fastest growth in the pediatric asthma treatment market over the period studied. The emphasis on respiratory management and improved understanding of pediatric asthma care in countries like India and China are driving significant growth in the Asia Pacific market. Expected to experience rapid expansion in the coming years, the region’s market growth is fueled by an increase in asthma cases, rising disposable incomes, worsening environmental pollution, a growing smoking population, and advancing healthcare infrastructure.

The burgeoning economies and expanding demographics in developing countries such as India and China are likely to boost the pediatric asthma treatment market in Asia Pacific. Additionally, increasing pollution and lifestyle shifts are contributing to this growth. Innovative, cost-effective treatment solutions from emerging market players, along with the extensive access initiatives by major companies like GlaxoSmithKline, are accelerating market development further.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

February 2025

January 2025