February 2025

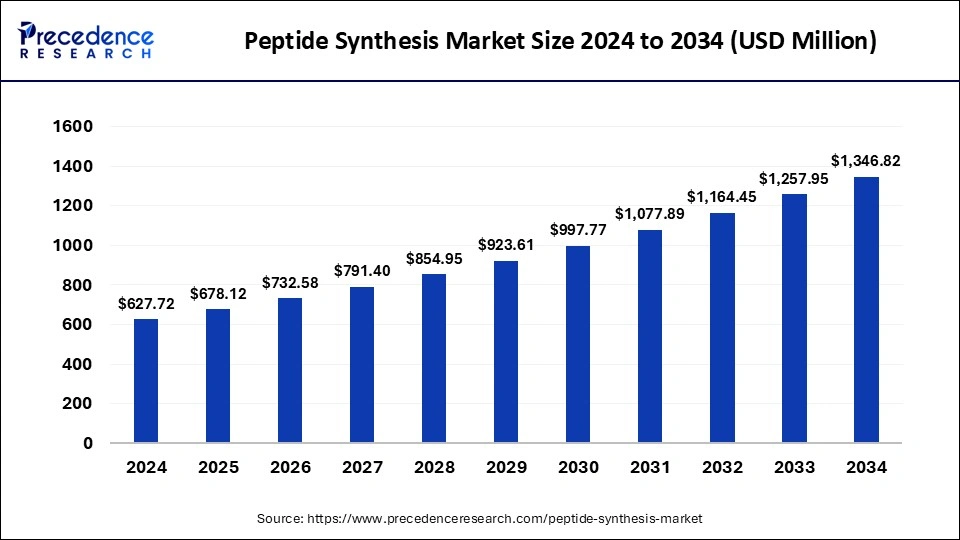

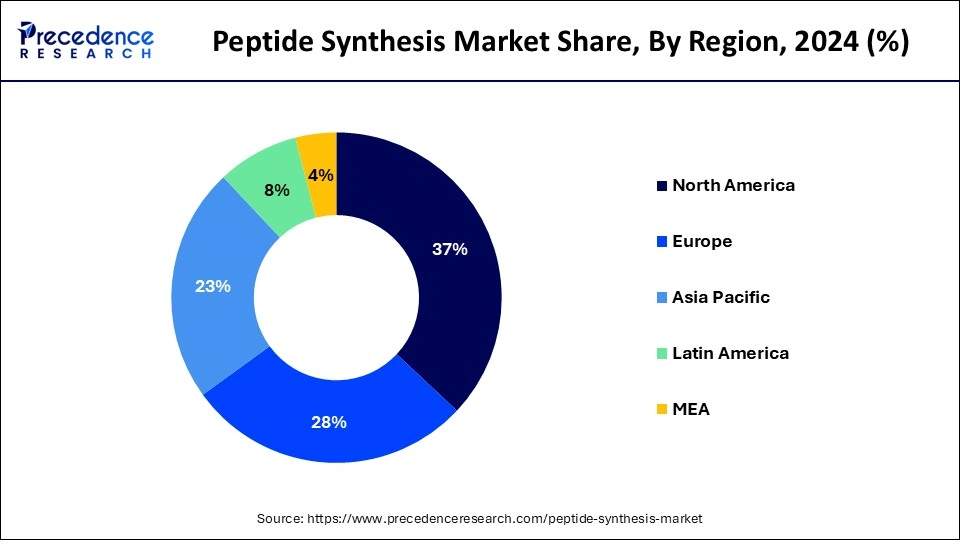

The global peptide synthesis market size is calculated at USD 678.12 million in 2025 and is forecasted to reach around USD 1,346.82 million by 2034, accelerating at a CAGR of 7.93% from 2025 to 2034. The North America peptide synthesis market size surpassed USD 232.26 million in 2024 and is expanding at a CAGR of 7.96% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global peptide synthesis market size was estimated at USD 627.72 million in 2024 and is predicted to increase from USD 678.12 million in 2025 to approximately USD 1,346.82 million by 2034, expanding at a CAGR of 7.93% from 2025 to 2034. The benefits of peptide synthesis include it helps to design new vaccines, drugs, and enzymes and is also used to prepare enzyme binding sites, epitope-scientific antibodies, and map antibody epitopes. These factors help to the growth of the market.

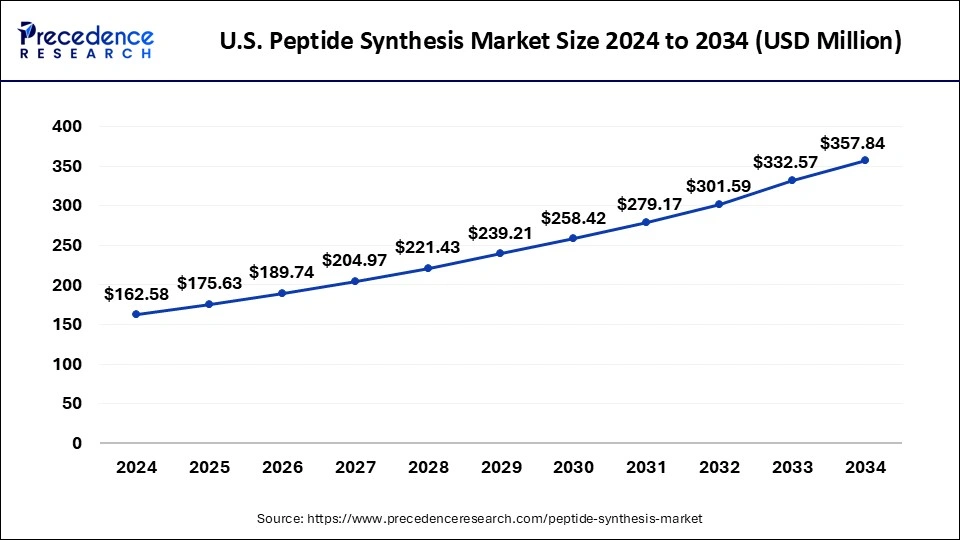

The U.S. peptide synthesis market size was exhibited at USD 162.58 million in 2024 and is projected to be worth around USD 357.84 million by 2034, poised to grow at a CAGR of 8.21% from 2025 to 2034.

North America dominated the peptide synthesis market in 2024. Increased focus on peptide-based drugs and rising awareness about peptide synthesis technologies help the market growth in the North American region. The United States is the leading country for the growth of the market in the North American region. In the United States, Bachem is a leading company specializing in the manufacture and development of oligonucleotides and peptides.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034. Increasing incidences of chronic disease conditions, rising healthcare spending, increased awareness of new peptide-based treatments, and increased investment by market players help the growth of the peptide synthesis market in the Asia Pacific region. China is the leading country for the growth of the market in the Asia Pacific region.

The peptide synthesis market deals with pharmaceutical & biotechnology companies, academic research & institutes, and CRO/CMO for the applications of therapeutics, diagnosis, and research. Peptide synthesis is the production of compounds and peptides, where multiple amino acids are linked by amide bonds. The benefits of peptide synthesis include customization and flexibility, scale and efficiency, unnatural amino acids, D-proteins, and industrial production. The applications include helping with the identification and characterization of proteins, making easy protein expression services or protein functions, and creating epitope-specific antibodies against pathogenic proteins. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,346.82 Million |

| Market Size in 2025 | USD 678.12 Million |

| Growth Rate from 2025 to 2034 | CAGR of 7.93% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Technology, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased use of peptides in pharmaceutical treatments

The benefits of developing and using pharmaceutical peptides include a lower production amount and lower cell prices. Peptides have good membrane penetration ability, and oral administration helps with easy delivery to patients. The benefits of peptide drugs include having fewer side effects and being safer because their byproducts are amino acids than other drugs. Peptides are highly used in pharmaceutical treatments due to their beneficial properties, which include antithrombic (or anticlotting), antioxidant, and antimicrobial properties. In pharmaceuticals, peptides are referred to as therapeutic peptides and are commonly used for the treatment of diseases. In pharmaceutical treatments, lab-processed peptides are growth hormones and human insulin. Both of these are life-saving for people living with specific conditions. These factors help the growth of the peptide synthesis market.

Challenges in peptide synthesis

The main challenge in peptide synthesis includes the development of efficient and sustainable catalytic methods. SPPS (Solid phase peptide synthesis) depends on the effective amide bond formation between amino acids. Limitations of peptide synthesis include it requires the use of a large amount of peptide, a time-consuming process, labor-intensive purification steps for each intermediate compound to make the solution phase, and labor-intensive, which finally yields a limited number of desired products. The solid phase peptide synthesis requires high temperatures and strict reaction conditions. This requires the use of specialized reaction conditions and equipment like high-temperature atmospheres and high-temperature furnaces. These factors can restrict the growth of the peptide synthesis market.

Future scope of the peptide synthesis

In the future, peptide synthesis will find an increased use in treating type-2 diabetes, obesity, and metabolic syndromes. Increasing use of cyclic peptides, synthesizing long peptides, microwave-assisted peptide synthesis, and solid phase synthesis. In medicines, peptides are used because they include cell-penetrating, multifunctional peptide drug conjugates, and technologies focusing on alternative routes of administration. Peptides offer growth opportunities as future therapeutics. These factors help the growth of the peptide synthesis market.

The reagents & consumables segment dominated the market in 2024. Peptides are highly used for reagents & consumables because of their benefits, including the prevention of the formation of blood clots, killing microbes, acting as antioxidants and antitumors, reducing inflammation, lowering blood pressure, and improving immune functions. It also helps to support bone health and promote muscle growth due to its wound healing and anti-aging effects properties. The most important advantage of peptide reagents & consumables is helping to reduce wrinkles and fine lines, improve skin elasticity, and ability to stimulate collagen production in the skin. These factors help the growth of the reagents & consumables segment and contribute to the growth of the peptide synthesis market.

The peptide synthesis equipment segment is expected to be the fastest-growing during the forecast period. In peptide synthesis, peptide synthesis equipment plays an important role. The manual solid-phase peptide synthesis is carried out with the help of standard laboratory glass wares like sintered glass funnels, round bottom flasks, etc. It also includes overhead mechanical stirrers, wrist action shakers, or orbital shakers. The applications of peptide synthesis equipment include food preservation, medical visualization, peptide therapeutic, the production of proteins, and the production of antibodies. These factors help the growth of the peptide synthesis equipment and contribute to the growth of the peptide synthesis market.

The liquid phase peptide synthesis (LPPS) segment dominated the market in 2024. The benefits of the liquid phase peptide synthesis (LPPS) segment include flexibility in chemistry for the choice of chemical reagents and reactions, which helps with the high range of coupling chemistries and functional group manipulations. It also includes facilitating modifications and labeling, reduction of side reactions, scale-up capabilities, and high purity and yield. These factors help the growth of the liquid phase peptide synthesis (LPPS) segment and contribute to the growth of the peptide synthesis market.

The solid phase peptide synthesis (SPPS) segment is anticipated to be the fastest-growing during the forecast period. Solid-phase peptide synthesis (SPPS) has benefits that include high efficiency, increased speed, and simplicity. The use of excess reagents in this reaction may be driven to completion and high yields. Building blocks are protected in this method for all reactive functional groups. These factors help the growth of the solid phase peptide synthesis (SPPS) segment and contribute to the growth of the peptide synthesis market.

The therapeutics segment dominated the market in 2024. Peptide synthesis advances and their therapeutics exploration have opened the direction for their use in tissue engineering, gene therapy, molecular and biosensing recognition, nano-delivery systems, drug delivery, and disease diagnosis. Peptide has high tunable and high purity profile properties, which are used in the discovery of non-imaging and imaging-based diagnostics agents like positron emission, peptide-based ELISA, and single-photon emission computed tomography (SPECT).

Peptides are used in drug development to treat many pathologies, including cancer, microbial infections, and obesity, as well as to improve cell-penetrating properties and develop cell-targeting platforms. Chemical peptide synthesis development by SPPS accelerated the therapeutics peptide development. Some recombinant peptide drugs like teriparatide and oxytocin use chemical synthesis for the production of (API) active pharmaceutical ingredients. These factors help the growth of the therapeutics segment and contribute to the growth of the peptide synthesis market.

The diagnosis segment is anticipated to be the fastest-growing during the forecast period. The use of peptide synthesis in diagnosis increased to get accurate and specific information about disease due to their ability to get modified chemically and high purity profile. Peptide synthesis is used for imaging or non-imaging-based diagnostics. In non-imaging-based diagnostics, peptide synthesis is used, and techniques like LC-MS/MS or microarray are used for direct analysis of biofluids, point-of-care testing, and enzyme-linked immunosorbent assay (ELISA). In clinical and scientific research, peptide synthesis is highly used for diagnostics applications; for diagnosis of infectious and non-infectious diseases, peptide-based products are used. These factors help to the growth of the diagnosis segment and contribute to the growth of the peptide synthesis market.

The pharmaceutical & biotechnology companies segment dominated the peptide synthesis market in 2024. In pharmaceutical & biotechnology companies, the use of peptide synthesis plays an important role. In pharmaceutical manufacturing, chemical, and recombinant peptide synthesis are the two basic processes for amino acids, which offer many benefits for different applications. In pharmaceuticals, peptides are referred to as therapeutic peptides. Peptide synthesis is used to design new vaccines, drugs, and enzymes, and to prepare enzyme binding sites, map antibody epitopes, and epitope-specific antibodies. In pharmaceutical & biotechnology companies, peptide synthesis is used in research, drug development, and diagnostics purposes. These factors helped the growth of the pharmaceutical & biotechnology companies segment and contributed to the growth of the market.

The contract development & manufacturing organization (CMO)/contract research organization (CRO) segment is expected to be the fastest-growing during the forecast period. CMO takes preformulated drugs, which are developed by CRO, and manufactures them on a larger scale. CRO companies provide clinical trial services for the medical device, pharmaceutical, and biotechnology industries. The benefits of CRO & CMO include it helps to understand and segment users to guide them towards purchasing the services and products that best meet their needs. CRO provides a broad spectrum of services, including clinical research, laboratory & lifecycle management, and drug development. These factors help the growth of the contract development & manufacturing organization (CMO)/ contract research organization (CRO) segment and contribute to the growth of the peptide synthesis market.

By Product

By Technology

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

January 2025

January 2025

November 2024