The global perfume market size is calculated at USD 60.73 billion in 2025 and is forecasted to reach around USD 101.47 billion by 2034, accelerating at a CAGR of 5.88%% from 2025 to 2034. The Europe perfume market size surpassed USD 22.47 billion in 2025 and is expanding at a CAGR of 6.02% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global perfume market size was estimated at USD 57.33 billion in 2024 and is predicted to increase from USD 60.73 billion in 2025 to approximately USD 101.47 billion by 2034, expanding at a CAGR of 5.88%% from 2025 to 2034. The perfume market is driven by the expanding popularity of self-expression and personal care.

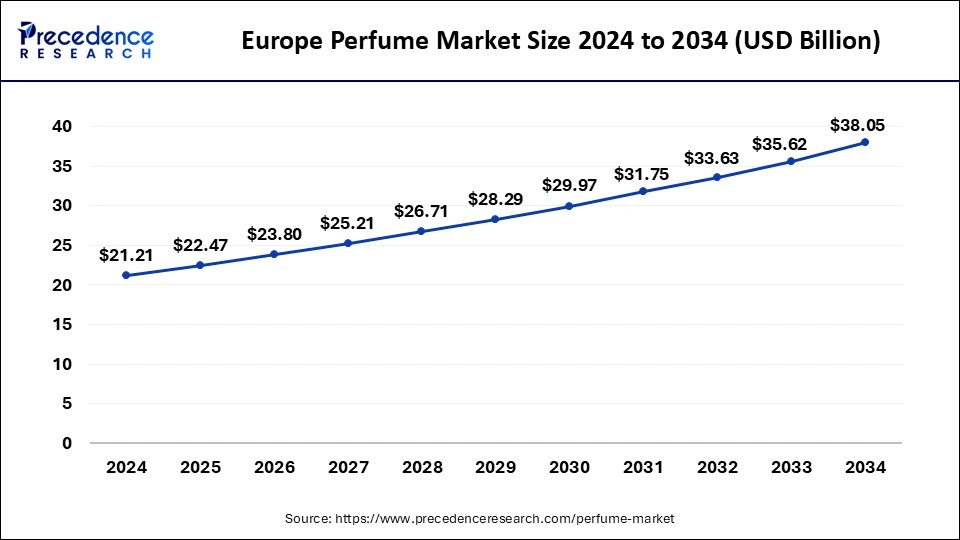

The Europe perfume market size was estimated at USD 21.21 billion in 2024 and is predicted to be worth around USD 38.05 billion by 2034 with a CAGR of 6.02% from 2025 to 2034.

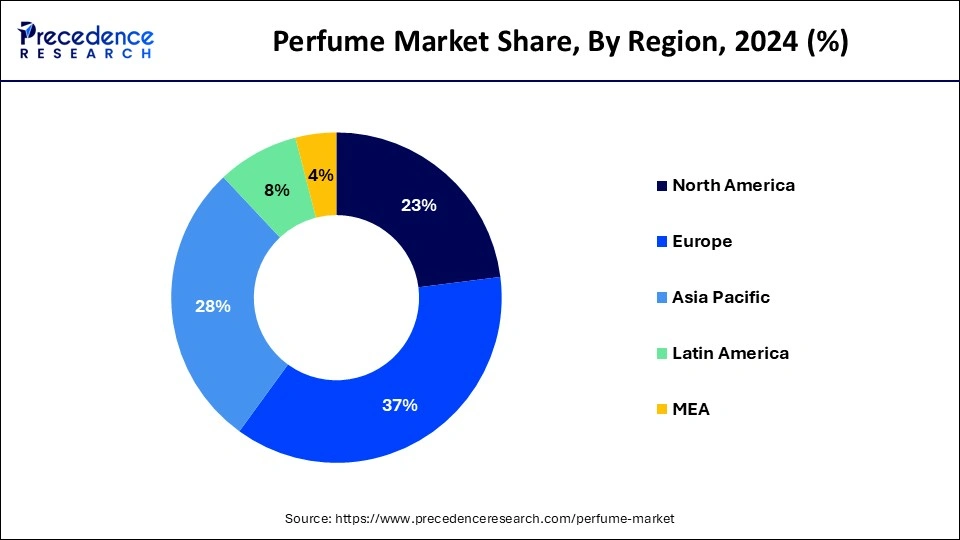

Europe had the largest market share in 2024 in the perfume market. In Europe, creating perfumes became a sophisticated profession passed down through families and monastic organizations for centuries. Perfumers developed complex processes to extract essential oils from flowers, spices, and other botanicals and mix them into wonderful perfumes. Due to these artisanal procedures, European perfumers produced sophisticated and nuanced aromas appealing to a discerning customer. The significance of aroma in everyday life has long been praised in European literature, art, and fashion.

Perfume's association with ideas of luxury, romance, and individuality sustained its appeal to European buyers. Legendary individuals such as Marie Antoinette, Coco Chanel, and Christian Dior, through their connection to distinctive fragrances and opulent lifestyles, added to the aura of mystery surrounding European perfumery.

The giant farms of plants yield fragrances in Provence and the French Riviera. The most well-known attraction in the area is undoubtedly the town of Grasse. It is known as the "perfume capital of the world" and gained notoriety through the film "Perfume: The Story of a Murderer."

Asia-Pacific is the fastest growing perfume market during the forecast period. A greater focus is being placed on personal grooming and self-expression as lifestyles in the area change. These days, perfumes are regarded as a daily luxury and a way to express one's style rather than a luxury item saved for exceptional occasions. This mentality change has dramatically increased the demand for perfumes in Asia-Pacific. Though mass-market fragrances still rule the industry, affluent customers' desire for niche and luxury scents is rising. The growing number of boutique perfume companies and luxury fragrance houses in the region can be attributed to this trend, driven by a demand for exclusivity and distinctive scent experiences.

Perfume is used to give a person's body a pleasing and alluring aroma, usually to boost confidence and self-esteem. Scents are said to improve mood, lessen stress and anxiety, sharpen cognitive function, and promote restful sleep, among other aspects of health and well-being. The impact of olfactory stimulants, such as perfumes and air fresheners, on human psychophysiology has long been recognized, and their importance is progressively growing within the healthcare and cosmetic sectors.

Perfume Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2025 | USD 60.73 Billion |

| Market Size by 2034 | USD 101.47 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.88% |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Product, End-user, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Natural fragrances gaining momentum

Consumers nowadays are more concerned about their health than ever. There is a noticeable trend toward goods consumers believe to be safer and healthier due to an increased understanding of the possible adverse effects of artificial chemicals. Compared to their synthetic counterparts, natural fragrances made from essential oils and botanical extracts are less prone to trigger allergic reactions and other health problems. Customers are influenced by this idea to favor natural personal care goods, such as scents.

The perfume business has tapped into the natural trend through focused branding and marketing initiatives. Natural scents are frequently linked to luxury, purity, and well-being in marketing campaigns, which aligns with more general lifestyle trends. Brands emphasize hand-picked, uncommon, and exotic materials while highlighting the artisanal aspects of natural scent manufacturing through narrative. This builds an emotional bond with customers and raises the perceived value of natural perfumes. This drives the perfume market growth.

Growth of the upper middle class in emerging economies

Premium and niche fragrances are becoming increasingly popular among the upper middle class. There is a growing demand for luxury perfumes since this market is willing to spend more on upscale, exclusive goods. Consumers in the emerging upper middle class are becoming more aware of brands. The demand for products that mirror their social standing and correspond with worldwide fads propels the prominence of well-known global fragrance labels.

Contact allergic dermatitis in sensitized individuals

Perfumers may have fewer options for ingredient palettes if they avoid allergies. Several beloved and iconic fragrance notes originate from standard allergy components. Restructuring items to eliminate allergies or use hypoallergenic substitutes may increase production expenses. Safe substitutes could cost more or perform worse at producing the intended aroma profile. Avoiding triggers is the mainstay of treatment for contact dermatitis; while it does not "cure" the condition (allergy-induced sensitization lasts a lifetime), it does shield against incapacitating sickness. The patient needs to know that abstaining from perfume does not only mean avoiding scented products. This limits the growth of the perfume market.

Shift towards personalization

More and more customers are looking for goods that represent their individuality and distinctive preferences. As a personal commodity, perfume is the perfect blank canvas for personalization. Brands can obtain more profound insights into the desires of their customers by gathering and examining consumer preferences and behavior data. This data-driven strategy makes More precise customization possible, increasing the possibility of consumer pleasure and repeat business. Customers' ongoing input can assist firms in improving their customization tactics. Due to this iterative approach, the target audience will continue to find the product offers exciting and relevant.

Integration of cultural elements into fragrance products

Emotions and memories are closely associated with perfumes. A deeper connection between businesses and consumers can be made by using fragrance cultural components. For example, nostalgia and a sense of identity might be evoked by a fragrance that recalls traditional components and fragrances from a particular culture. Increased recurring business and consumer loyalty may result from this emotional connection. Sustainable and ethical sourcing procedures are becoming increasingly significant to consumers and are connected to many cultural scent components. Bringing attention to fair trade methods, locally sourced products, and sustainably harvested components can enhance a brand's reputation and attract people who value ethics.

The perfume segment dominated the perfume market in 2024. Since perfume makes up 20–30% of the scent, it is usually the priciest. Compared to the other types, it is typically a heavier, oilier product applied less frequently. The odor lingers for a considerable amount of time, up to 24 hours on average.

Customers are choosing more and more natural and organic perfumes as they become more conscious of environmental and health concerns. Specific scent categories will become even more appealing due to this trend, which supports the larger lifestyle and wellness movement. Brands emphasizing sustainable practices, like ecologically friendly packaging and materials produced ethically, have grown in popularity among consumers who care about the environment, which has increased their market share.

The eau de perfume segment is the fastest growing in the perfume market during the forecast period. Eau de perfume has a 15-20% scent concentration. It is typically less expensive than perfume and has a higher alcohol and water content. It lasts only four to five hours and is a lightweight product. Eau de perfume is the most popular and the foundation for other scent categories.

Premium and luxury goods are becoming increasingly popular as consumers' disposable incomes rise. Within the perfume industry, EDPs are positioned as higher-end goods. Their premium positioning fits well with the desires of buyers who are prepared to pay more for superior quality and a more abundant scent experience. Customers in the millennial and Gen Z generations, who place a high value on luxury travel and personal grooming, are especially drawn to this trend.

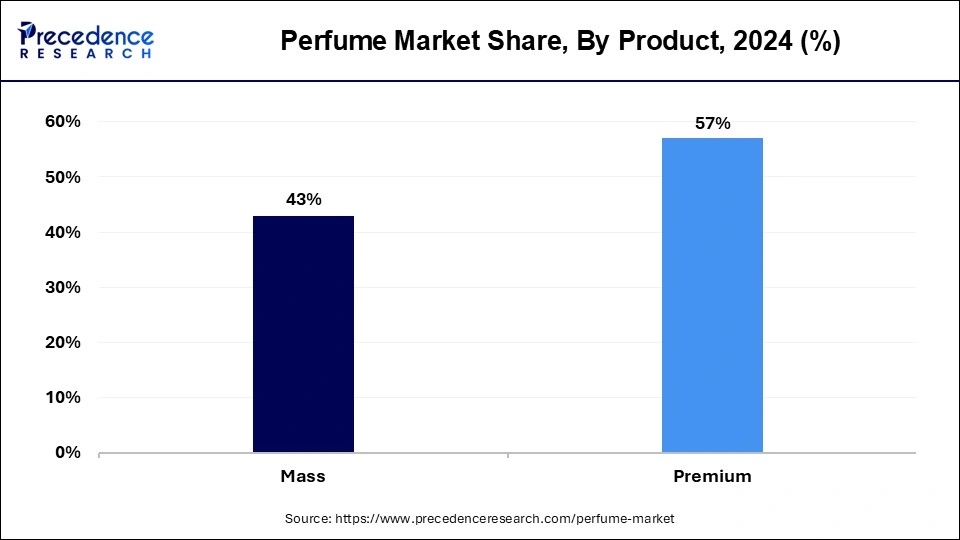

The mass segment dominated the perfume market in 2024. To meet the diverse needs of customers, mass perfumes are more affordable and come in various forms, including body mists, body splashes, cologne body sprays, and others. The state of the economy dramatically influences consumer spending behavior. During uncertain or down turning economic times, consumers prefer more reasonably priced options, such as mass-market perfumes. Because these scents are less expensive, customers can continue with their personal care habits without breaking the bank.

The premium segment is the fastest growing in the perfume market during the forecast period. The last few years have seen growth that has outpaced mass-market fragrance items because of a stronger focus on exclusivity, individuality, and quality. Furthermore, manufacturers are concentrating on expanding their product lines to include luxury goods.

Customers are becoming pickier and more conscious of the components and caliber of the goods they purchase. Compared to mass-market perfumes, premium perfumes frequently have better ingredients, elegant packaging, and scents that stay longer. Customers willing to spend a higher price for a superior product are drawn to this quality distinction.

The women segment dominated the perfume market in 2024. With the help of perfumes, women can create a distinctive scent all day long. Changes in body odor during the day may make women feel self-conscious or suspicious. Applying perfume could help them feel less anxious and smell confident and fresh. The market share of women's scents in the perfume industry is consistently higher than men's. According to reports and business evaluations, between 60 and 70 percent of market revenue comes from women's perfumes. Higher demand and a greater selection of goods geared at female consumers are the main drivers of this significant percentage.

The men segment is the fastest growing in the perfume market during the forecast period. Fragrances were traditionally linked chiefly with women, but a significant shift in societal conventions and attitudes has occurred. Men increasingly consider fragrances a luxury and a necessary component of their grooming regimen. Men's acceptance of fragrances is expanding, which has increased demand for a wide range of scents catered to their tastes. Manufacturers of fragrances are always coming up with new ideas and expanding the range of products they offer to suit the changing tastes of men.

This encompasses a variety of scent categories, each suitable for specific preferences and situations, including citrus, woody, aquatic, and oriental. The availability of other grooming products, such as body sprays, deodorants, and aftershaves, complements the usage of perfumes and contributes to expanding the men's market.

The online segment is observed to grow at the fastest rate during the forecast period in the perfume market. Customers may shop with unmatched accessibility and convenience when they shop online. Customers can peruse an extensive selection of perfumes from the comfort of their homes or while on the go using mobile devices by making only a few clicks. The preference for online shopping is expanding, and a big part is ease. While you can't smell perfumes when shopping online, many platforms provide easy ways to sample products, such as travel-sized bottles, virtual try-on tools, or fragrance samples. Through these efforts, the risk of buying smells that haven't been seen in person is reduced, and customers can sample aromas before deciding to buy a full-sized bottle.

Precisely 95% of consumers who buy perfumes do it online since they can compare prices this way. The price sensitivity of perfume buyers, particularly about discounts, drives the appeal of online shopping among this demographic.

The offline segment shows a significant growth in the perfume market during the forecast period. Customers who purchase perfume offline get a more immersive, multi-sensory experience than they can get online. Consumers can get up close and personal with the fragrances, feeling their textures and odors. Customers are frequently more emotionally satisfied after engaging in this physical way, encouraging them to purchase.

By Type

By Product

By End-user

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client