April 2025

Peripheral Interventions Market (By Product: Catheters, Sheath, Stents, Bare Metal Stents, Drug-eluting Stents, Guide Wires, Atherectomy Devices, Embolic Devices, IVC Filters; By Application: Peripheral Artery Disease, Venous Thromboembolism, Others; By End-use: Hospitals, Catheterization Laboratories, Ambulatory Surgical Centers, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

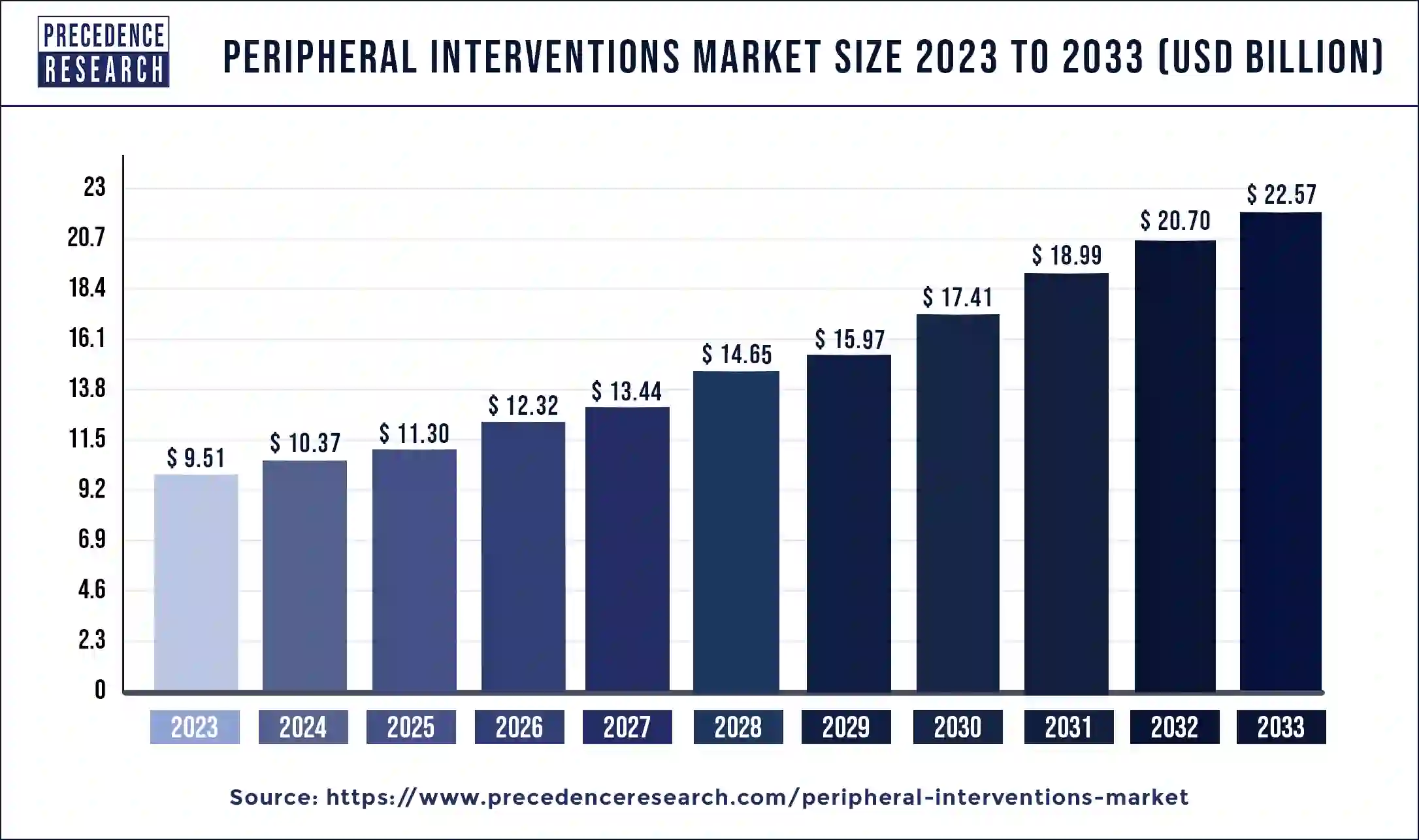

The global peripheral interventions market size was USD 9.51 billion in 2023, calculated at USD 10.37 billion in 2024 and is expected to reach around USD 22.57 billion by 2033. The market is expanding at a solid CAGR of 9.03% over the forecast period 2024 to 2033. The peripheral interventions market is driven by the elderly population proliferating, and peripheral vascular disorders are rising in parallel.

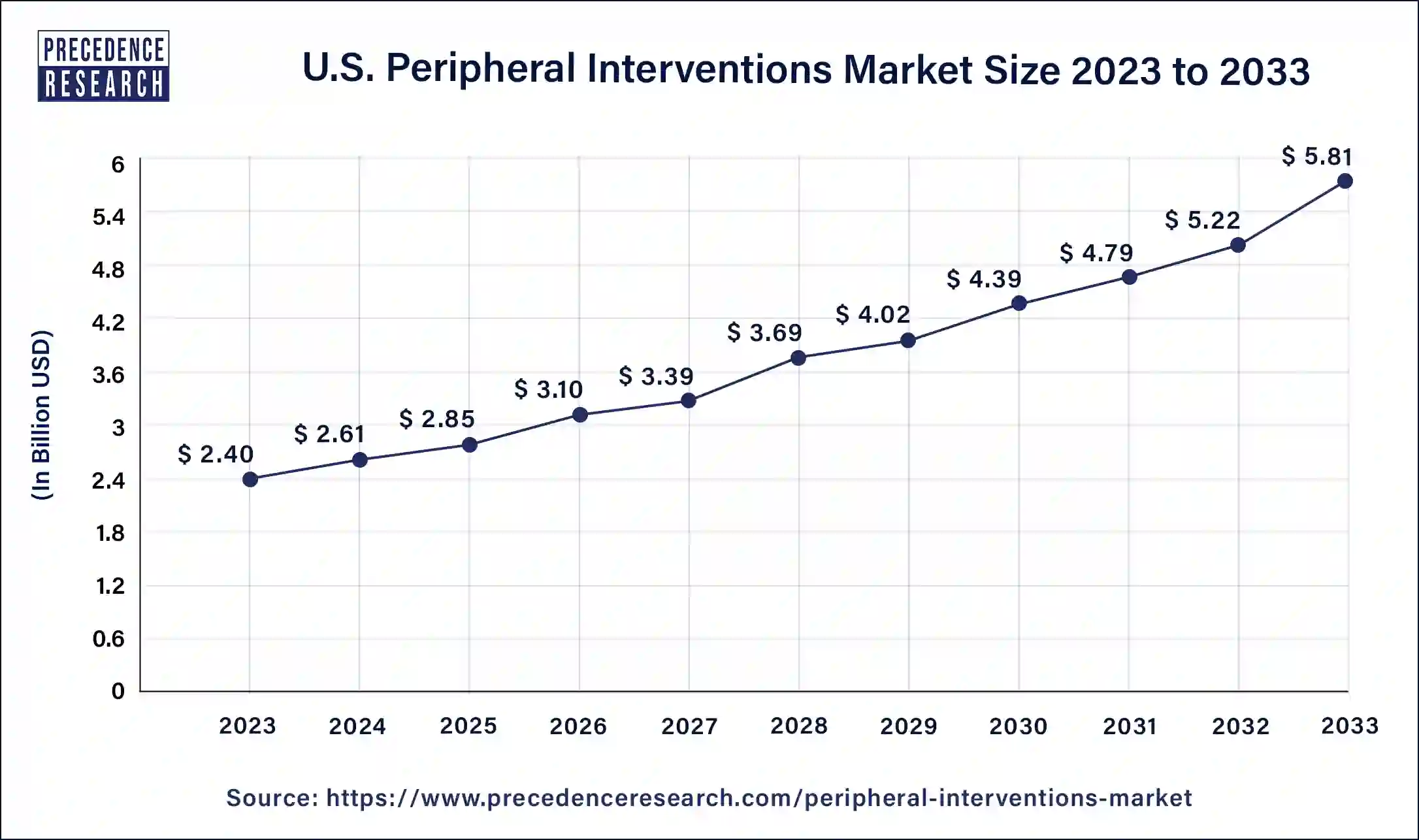

The U.S. peripheral interventions market size surpassed USD 2.40 billion in 2023 and is projected to attain around USD 5.81 billion by 2033, poised to grow at a CAGR of 9.24% from 2024 to 2033.

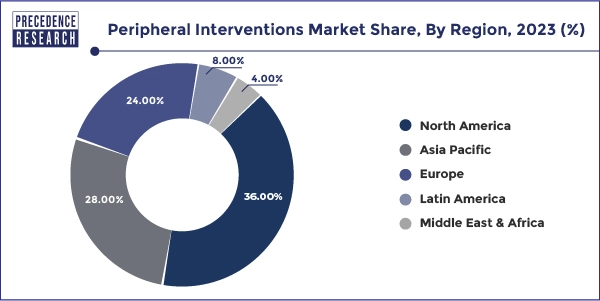

North America had dominated in the peripheral interventions market in 2023. North America has an abundance of cutting-edge hospitals and specialty clinics, especially in the U.S. and Canada. These facilities have highly qualified medical staff who can perform intricate peripheral operations and use cutting-edge medical equipment. Medical device regulations are overseen by Health Canada and the U.S. Food and Drug Administration (FDA). These authorities streamline the approval process for new devices, which offer precise standards and procedures. This facilitates the introduction of cutting-edge peripheral intervention technologies to the market.

Due to the high frequency of peripheral vascular illnesses in North America, which are fueled by risk factors like obesity, diabetes, and an aging population, there is a significant demand for cutting-edge medical therapies.

Asia-Pacific is the fastest growing in the peripheral interventions market during the forecast period. One major contributing factor is the increasing prevalence of cardiovascular illnesses, especially PAD. The rising incidence of these disorders is attributed to several factors, including aging populations, bad diets, sedentary lifestyles, and smoking. The need for peripheral interventions is rising as a result. These treatments are becoming safer and more successful thanks to developments in medical technology, which include the creation of new and improved instruments for peripheral interventions. Advances in imaging technologies, bioresorbable stents, and drug-coated balloons are among the innovations improving peripheral therapies' results.

Market Overview

Medical equipment, treatments, and processes for identifying and managing illnesses and ailments impacting the peripheral vascular system are all included in the peripheral interventions market. All blood vessels, including the arteries and veins in the arms, legs, and organs that are not part of the heart or brain, are included in this system. Deep vein thrombosis (DVT), varicose veins, and peripheral artery disease (PAD) are common disorders treated via peripheral procedures. Stents, angioplasty balloons, atherectomy, thrombectomy, and embolic protection devices are among the goods and services offered in this industry. Peripheral vascular disorders are on the rise due to an aging population and rising rates of risk factors like diabetes, obesity, and smoking. This fuels the need for efficient intervention technologies and processes. By averting serious problems and decreasing the need for more intrusive treatments, peripheral therapies can make treatment more affordable overall and sustainable.

Peripheral Interventions Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2023 | USD 9.51 Billion |

| Market Size in 2024 | USD 10.37 Billion |

| Market Size by 2033 | USD 22.57 Billion |

| Market Growth Rate from 2024 to 2033 | CAGR of 9.03% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing prevalence of chronic ailments

Peripheral consequences from chronic illnesses frequently arise and call for medical attention. For example, to restore blood flow in damaged arteries, procedures such as angioplasty, stenting, atherectomy, and peripheral bypass surgery are required for PAD, a prevalent symptom of atherosclerosis. In a similar vein, peripheral neuropathy and peripheral vascular disease are common in diabetic patients and may call for specific care. More early identification and diagnosis of chronic illnesses have resulted from increased access to healthcare services in various areas. As a result, there is a greater need for prompt therapies to stop the advancement of the disease and lessen its consequences. This increased knowledge and ease of access to healthcare are driving the market for peripheral interventions to grow. This drives the growth of the peripheral interventions market.

Lack of awareness regarding peripheral artery disease

The lack of knowledge regarding PAD directly impacts the demand for peripheral interventions. If the disease and its effects are not sufficiently recognized, there will be less patient demand for interventions and less incentive for healthcare systems and providers to invest in the infrastructure and resources required to enable comprehensive PAD management. Considering this, the market for peripheral therapies might expand and innovate more slowly than other branches of cardiovascular therapy. This limits the growth of the peripheral interventions market.

Technological advancements in peripheral intervention devices

Vascular architecture can be seen in detail due to developments in imaging technologies like optical coherence tomography (OCT) and intravascular ultrasonography (IVUS). These technologies lower procedural risks and enhance results by enabling more accurate device placement and navigation. To prevent restenosis, therapeutic drugs are released by drug-eluting stents and balloons, which has greatly increased the long-term success rates of peripheral procedures. Using biodegradable stents reduces the possibility of long-term issues related to permanent implantation because they eventually dissolve after providing structural support. This opens an opportunity for the growth of the peripheral interventions market.

The catheters segment dominated in the peripheral interventions market in 2023. Catheter material innovations, like hydrophilic coatings and biocompatible polymers, lessen the risk of problems, improve mobility, and reduce friction. Real-time visualization and accurate placement are made possible by incorporating imaging technologies like optical coherence tomography (OCT) and intravascular ultrasonography (IVUS) into catheter design. By releasing medication at the intervention site, these catheters lower the likelihood of restenosis and enhance patient outcomes.

The stents segment shows a notable growth in the peripheral interventions market during the forecast period. Considering drug-eluting stents to bare-metal stents, the former dramatically improves long-term outcomes by releasing medication that helps prevent restenosis (re-narrowing of the artery). Modern DES has more flexible designs and smaller struts, which provide better delivery to the target spot and more accessible travel through intricate artery structures. Self-expanding stents can adjust to the changing peripheral artery environment, offering reliable support even in highly mobile regions such as the ankle or knee.

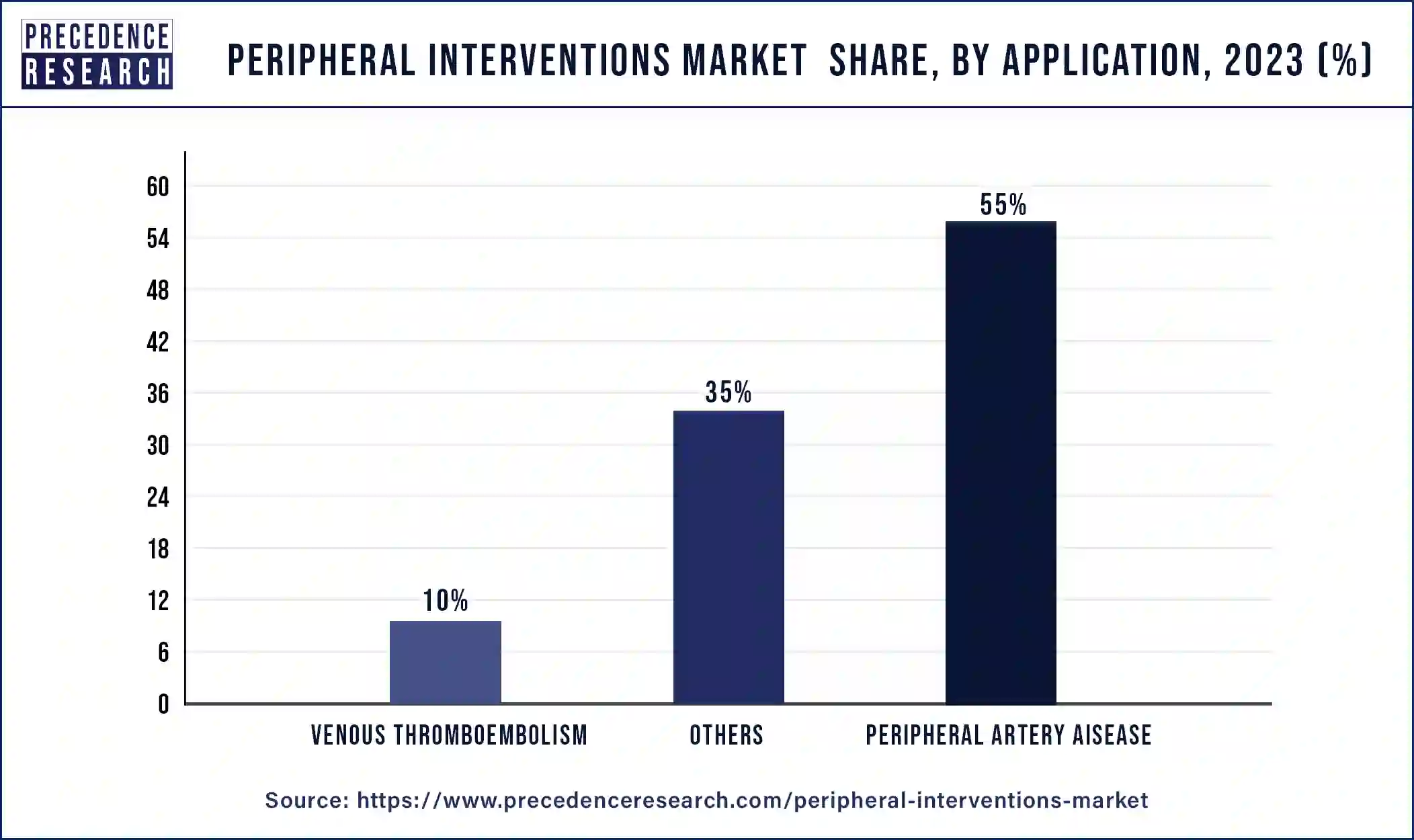

The peripheral artery disease segment dominated in the peripheral interventions market in 2023. Due to the high expenses of consequences such critical limb ischemia, amputations, and concomitant hospitalizations, untreated PAD has a significant financial impact. To lower the long-term expenses of managing PADs, governments and healthcare institutions are investing in early intervention techniques and preventive measures.

The diagnosis and treatment of PAD have improved thanks to the development of cutting-edge medical technologies and gadgets. Treatment outcomes have improved due to innovations such as minimally invasive angioplasty procedures, drug-eluting stents, and atherectomy devices. Introducing drug-coated balloons and bioresorbable stents has created new opportunities for efficient PAD therapy, improving patient compliance and lowering restenosis rates.

The venous thromboembolism segment is the fastest growing in the peripheral interventions market during the forecast period. Venous thromboembolism (VTE) is a dangerous illness that starts as a blood clot in a vein, usually in the lower leg, and travels to the lungs, where it causes a pulmonary embolism that can be fatal. After heart attacks and strokes, VTE is the third most prevalent vascular diagnosis in America, affecting between 300,000 and 600,000 people annually. Worldwide, the frequency of VTE, which includes pulmonary embolism (PE) and deep vein thrombosis (DVT), is rising. Ageing populations, sedentary lifestyles, and increased rates of obesity and chronic illnesses are all blamed for this increase.

Ultrasound, MRI, and CT scans are examples of advanced imaging technologies that have increased the precision and speed of VTE diagnosis. An accurate and timely diagnosis is essential for managing and treating conditions effectively. There is a positive correlation between higher rates of self-reporting and proactive healthcare-seeking behavior and increased patient education regarding VTE risks, symptoms, and treatments.

The hospitals segment dominated in the peripheral interventions market in 2023. Modern imaging technologies, including CT, MRI, and angiography scanners, are available in hospitals. These technologies are crucial for precise diagnosis and guiding during peripheral procedures. Intensive care units (ICUs) and post-anesthesia care units (PACUs) provide critical postoperative monitoring and treatment. Reimbursement policies for hospital procedures are generally better in government health programs and insurance plans than in outpatient settings. Patient outcomes are improved by applying strict safety regulations and infection control measures.

The ambulatory surgical centers segment shows a significant growth in the peripheral interventions market during the forecast period. Ambulatory surgical centers (ASCs) are renowned for being more affordable than conventional hospital settings. Due to decreased overhead and operating costs, procedures carried out in ASCs usually have lower total costs. ASCs are more appealing for patients and payers due to their cost advantage, encouraging more peripheral intervention procedures in these settings. Peripheral therapies are in high demand due to an aging population and rising rates of chronic illnesses, including peripheral arterial disease (PAD). ASCs can effectively manage these illnesses by providing specialized treatment, making them well-positioned to serve this expanding patient group.

Recent Developments

Segments Covered in the Report

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

June 2024