September 2024

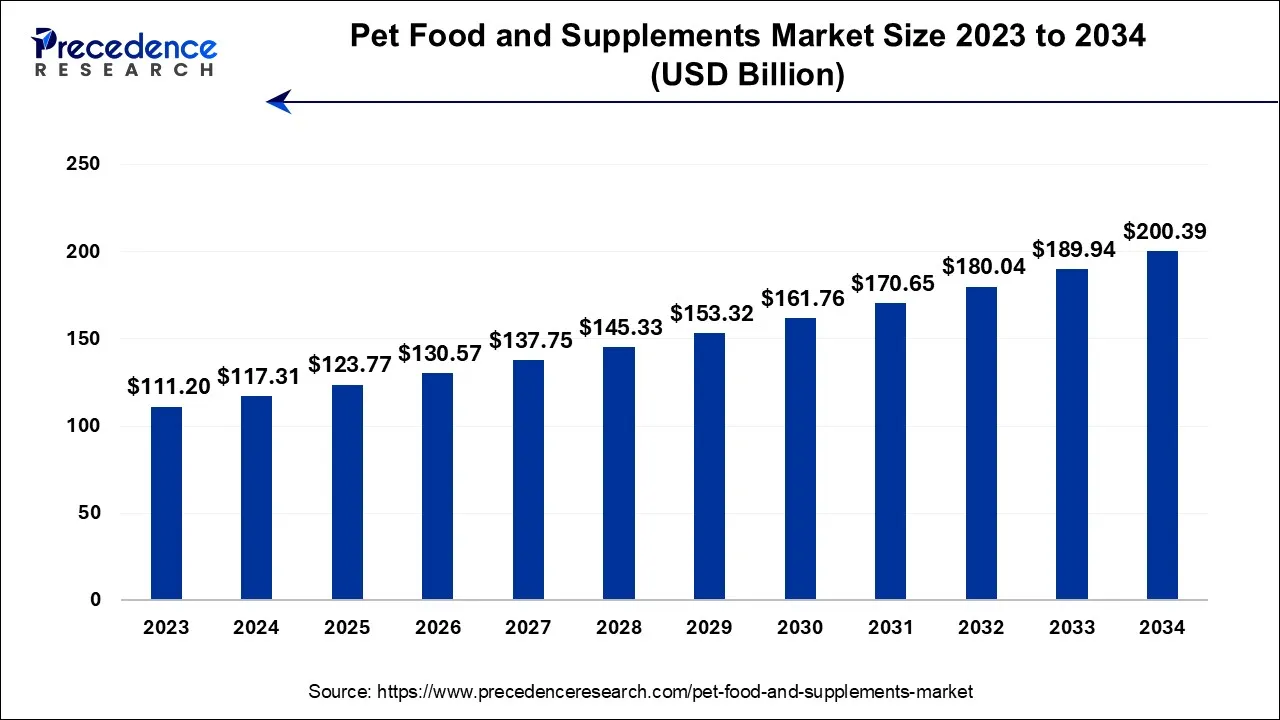

The global pet food and supplements market size accounted for USD 117.31 billion in 2024, grew to USD 123.77 billion in 2025 and is projected to surpass around USD 200.39 billion by 2034, representing a CAGR of 5.5% between 2024 and 2034. The North America pet food and supplements market size is calculated at USD 51.62 billion in 2024 and is expected to grow at a CAGR of 5.6% during the forecast year.

The global pet food and supplements market size is worth around USD 117.31 billion in 2024 and is anticipated to reach around USD 200.39 billion by 2034, growing at a CAGR of 5.5% during the forecast period 2024 to 2034.

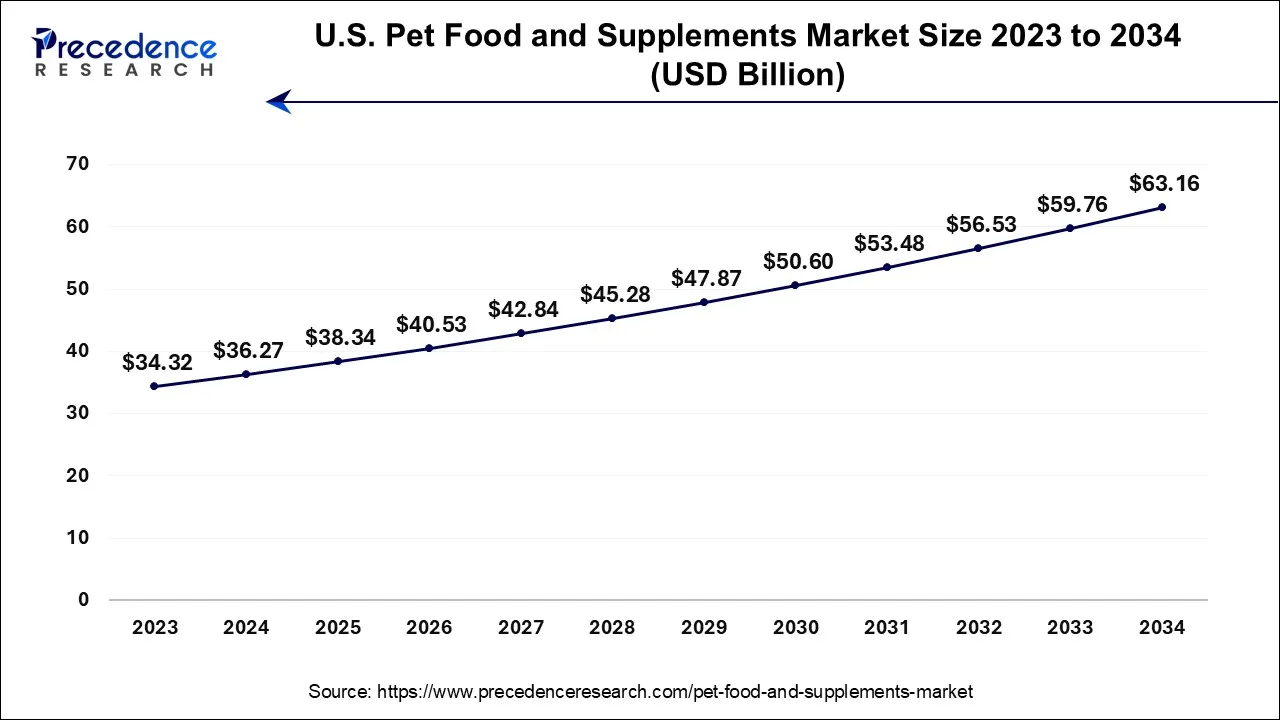

The U.S. pet food and supplements market size is evaluated at USD 36.27 billion in 2024 and is projected to be worth around USD 63.16 billion by 2034, growing at a CAGR of 5.7% from 2024 to 2034.

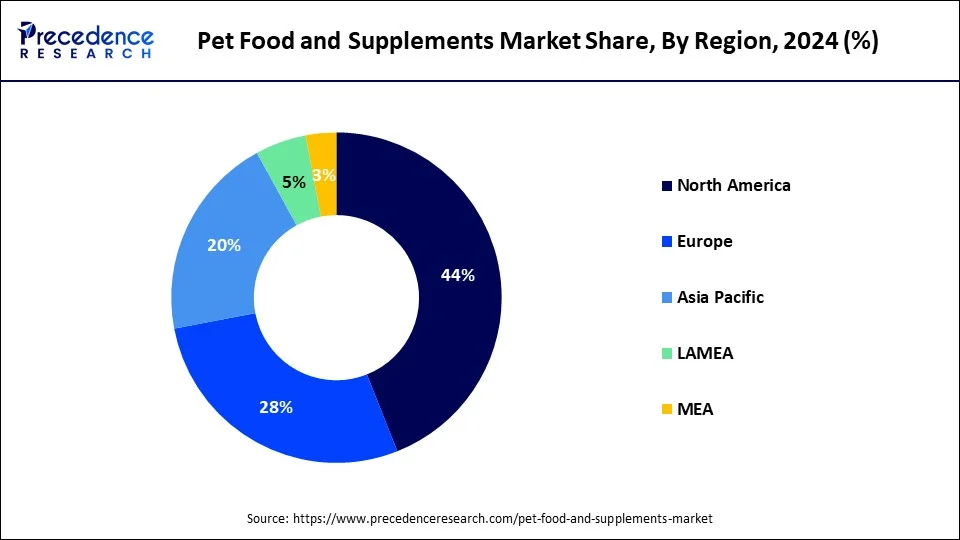

North America has held the largest revenue share of 44% in 2023. North America holds a substantial share in the pet food and supplements market due to several key factors. Firstly, the region has a high level of pet ownership, with a significant portion of households having dogs, cats, and other pets, driving consistent demand for pet-related products.

Secondly, North American consumers are increasingly health-conscious for their pets, seeking premium and specialized pet food and supplements. Additionally, the presence of well-established pet food companies and a robust e-commerce infrastructure provides consumers with a wide range of options and convenient access to pet products. These factors collectively contribute to North America's major share in the pet food and supplements market.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific commands a significant growth in the pet food and supplements market for several key reasons. The region's rapid urbanization and increasing disposable income have led to a growing pet ownership culture, particularly among the burgeoning middle class. This has propelled demand for high-quality pet food and supplements.

Additionally, changing consumer preferences towards premium and natural products has boosted market growth. The region's large and diverse pet population, including a variety of species beyond dogs and cats, offers a vast customer base. Furthermore, expanding e-commerce platforms and a focus on pet health and wellness contribute to Asia Pacific's substantial presence in the market.

Pet food denotes nutrition tailored for household animals, such as dogs and cats. This nutrition is expertly formulated to meet their distinct dietary prerequisites, guaranteeing the provision of crucial nutrients necessary for their health and overall well-being. Pet food is available in assorted formats, including dry kibble, moist canned varieties, and even raw diets, with each variant meticulously balanced to offer the right combination of proteins, carbohydrates, fats, vitamins, and minerals, catering to the specific demands of diverse species and life stages.

Conversely, pet supplements serve as supplementary products that can be administered alongside a pet's regular dietary intake to address specific health issues or provide supplementary nutritional support. These supplements come in various forms, like tablets, powders, or liquid preparations, and may comprise elements like joint-supporting compounds, omega-3 fatty acids, vitamins, and minerals. Many pet caretakers turn to supplements to enhance their pets' coat quality, promote joint flexibility, or boost overall vitality. It is highly recommended for pet owners to seek professional guidance from a veterinarian before integrating supplements to ensure they align with their pet's individual requirements and do not disrupt their primary diet.

| Report Coverage | Details |

| Market Size by 2034 | USD 200.39 Billion |

| Market Size in 2024 | USD 117.31 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.5% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Pet, Application, Source, Distribution Channel, Food Type, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising pet ownership

The surge in pet ownership is a compelling catalyst propelling the growth of the pet food and supplements market. This escalation can be attributed to a myriad of factors. Foremost, the deepening emotional connection and companionship between humans and their pets have fostered an undeniable humanization of animals. As pets are increasingly considered cherished family members, pet owners exhibit a heightened inclination to invest in their pets' overall welfare. Consequently, this inclination drives a growing demand for premium and specialized pet food and supplements, tailored to the distinctive dietary and health prerequisites of these cherished companions.

Furthermore, the burgeoning trend of pet ownership has triggered an upswing in health consciousness among pet custodians. They are becoming progressively discerning about their pets' nutritional needs and overall well-being, thereby intensifying the quest for top-tier, nourishing pet food and supplements designed to fortify their pets' vitality and prolong their well-being. In essence, the burgeoning prevalence of pet ownership serves as a driving force for the market, expanding the consumer base and nurturing a more profound emphasis on pet health, consequently resulting in amplified sales of pet food and supplements.

Consumer price sensitivity

Consumer price sensitivity is a notable restraint affecting the pet food and supplements market's growth. Pet owners, particularly in times of economic uncertainty, may become more cost-conscious when it comes to purchasing pet-related products. This sensitivity can limit the market's ability to introduce and sell premium and high-cost pet food and supplements. When consumers seek affordability, they may opt for less expensive alternatives, which can directly affect the sales of premium offerings. Manufacturers and suppliers may encounter challenges in maintaining profitability while accommodating price-sensitive consumers, potentially impeding their capacity to invest in research and development for innovative and superior-quality products.

The presence of cost-conscious consumers also deters the market from fully capitalizing on the potential for premiumization and specialized nutrition. To address this restraint, businesses in the pet food and supplements sector often need to strike a balance between offering value-focused options and premium products while providing transparent information about the quality and benefits of their offerings to justify higher price points.

Eco-friendly and sustainable devices

CBD and hemp-based products are creating exciting opportunities in the pet food and supplements market. These products, derived from cannabis plants, are gaining acceptance for their potential health benefits in pets. Firstly, they offer natural alternatives for managing issues like anxiety, pain, and inflammation in pets, which is particularly appealing to pet owners looking for holistic and non-pharmaceutical solutions. Secondly, the market for CBD and hemp-based pet products is relatively new and less saturated compared to traditional pet supplements. This allows for innovative product development and market entry.

Additionally, the increasing legalization and destigmatization of cannabis products in various regions is expanding the potential customer base. Pet owners are becoming more health-conscious and are actively seeking products that promote their pets' overall well-being. CBD and hemp-based products align with this trend, providing a unique niche within the market. As research continues to uncover the potential benefits of these products, the pet food and supplements market has a growing opportunity to cater to the demand for natural, alternative pet health solutions.

According to the pet, the dog segment has held 35% revenue share in 2023. The dog segment dominates the pet food and supplements market due to several factors. Dogs are among the most popular and numerous pets globally, leading to a substantial consumer base. Their diverse dietary needs and life stages require a wide range of specialized food and supplements, driving product diversity and market growth. Additionally, the growing trend of humanization of dogs, where they are considered family members, leads to increased demand for premium and specialized products, further solidifying the dominance of the dog segment in the market.

The other segment is anticipated to expand at a significant CAGR of 6.2% during the projected period. The other segment holds significant growth in the pet food and supplements market because it encompasses a diverse range of non-dog and non-cat pets, such as birds, reptiles, small mammals, and fish. These pets have unique dietary and nutritional requirements, creating a demand for specialized food and supplements. Additionally, this segment caters to the growing popularity of small pets and exotic animals. As pet ownership diversifies beyond traditional cats and dogs, the "Others" category captures this expanding market, making it a major player in the industry.

The multivitamins segment had the highest market share of 35% on the basis of the application in 2023. The multivitamins segment commands a significant share in the pet food and supplements market due to its broad applicability across various pet types and life stages. multivitamins are essential for addressing overall health and nutritional gaps in pets, making them a staple in pet owners' routines. They offer a convenient and comprehensive way to ensure pets receive the essential vitamins and minerals required for their well-being. With a focus on preventive healthcare and the desire for simplified supplementation, the multivitamins segment enjoys a major share as a fundamental and versatile component in the pet food and supplements market.

The others segment is anticipated to expand fastest over the projected period. The others segment commands significant growth in the pet food and supplements market by application due to its inclusive nature, covering a wide array of non-dog and non-cat pets. This segment caters to the nutritional needs of various animals like birds, reptiles, fish, and small mammals, each with distinct dietary requirements.

Moreover, it accommodates the growing trend of pet owners embracing less conventional pets, including exotic species. As the diversity of pet ownership expands, the others category remains pivotal, ensuring the market effectively addresses the unique nutritional demands of this diverse range of animals.

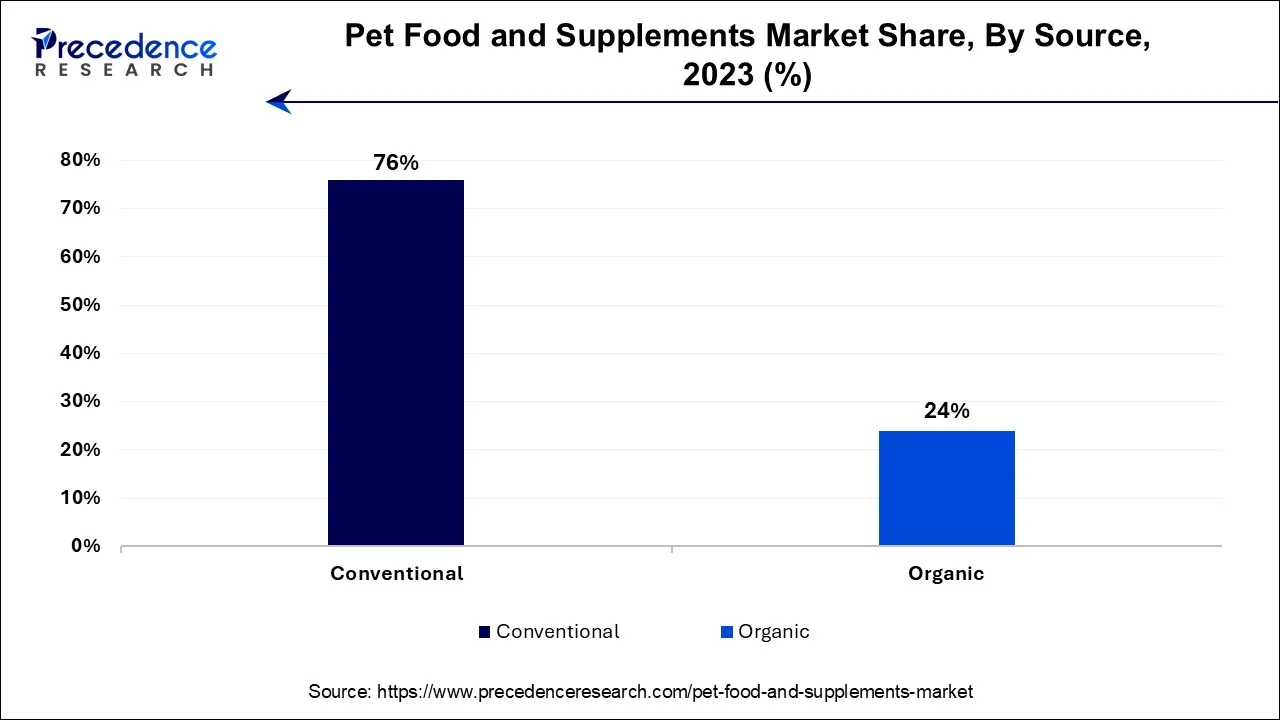

The conventional segment had the highest market share of 76% on the basis of the source in 2023. The conventional segment holds a significant share in the pet food and supplements market because it caters to a wide and established customer base seeking traditional pet food and supplements. Conventional sources offer affordable and widely recognized options, appealing to price-sensitive consumers. Many pet owners trust and are familiar with these standard products, fostering brand loyalty.

Furthermore, conventional sources have a track record of safety and quality, making them a preferred choice for pet owners. While there is a growing demand for premium and specialized products, the conventional segment's affordability and reliability maintains its substantial market share.

The organic segment is anticipated to expand fastest over the projected period. The organic segment plays a prominent role in the pet food and supplements market because of the growing interest in natural and healthy options for pets. Pet owners increasingly favor products free from artificial chemicals, pesticides, hormones, and antibiotics. Organic pet food and supplements align with this trend, offering a healthier choice for their beloved animals. With a rising focus on pet health and wellness, the organic segment captures significant growth in the market, addressing the evolving preferences of pet owners who seek high-quality and chemical-free options for their pets.

The offline segment had the highest market share of 86% on the basis of the distribution channelin 2023. The offline distribution channel commands a significant share in the pet food and supplements market for several reasons. Many consumers prefer hands-on shopping, particularly for items with direct implications on their pets' well-being. Physical stores like pet specialty shops and veterinary clinics also offer the advantage of seeking expert guidance from knowledgeable staff. Additionally, traditional shopping methods continue to appeal to a segment of consumers, thus upholding the prominence of the offline distribution channel in the realm of pet food and supplements.

The online segment is anticipated to expand fastest over the projected period. The dominance growth of the online distribution channel within the pet food and supplements market can be attributed to its remarkable blend of convenience and accessibility. Online platforms extend a vast spectrum of pet-related products, empowering pet owners with an extensive selection of brands and offerings for comparison and selection. What's more, the ability to shop from the comfort of one's home, bolstered by the wealth of customer reviews and endorsements, streamlines the purchasing experience.

The online segment's eminence is further propelled by the growing wave of e-commerce and the surging preference for contactless retail experiences, making it an influential cornerstone of the pet food and supplements market's success.

Segments Covered in the Report

By Pet

By Application

By Source

By Distribution Channel

By Food Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

April 2025

September 2024