August 2024

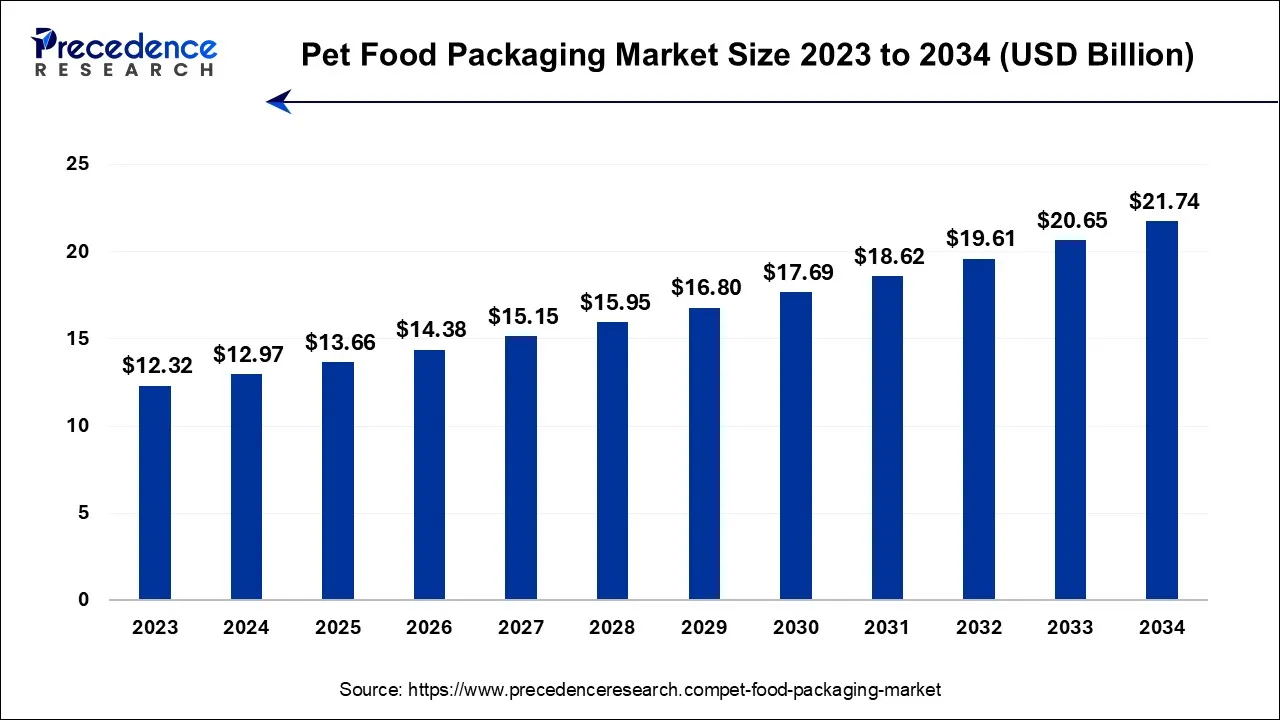

The global pet food packaging market size is calculated at USD 12.97 billion in 2024, grew to USD 13.66 billion in 2025, and is predicted to hit around USD 21.74 billion by 2034, poised to grow at a CAGR of 5.3% between 2024 and 2034. The North America pet food packaging market size accounted for USD 5.67 billion in 2024 and is anticipated to grow at the fastest CAGR of 5.35% during the forecast year.

The global pet food packaging market size is expected to be valued at USD 12.97 billion in 2024 and is anticipated to reach around USD 21.74 billion by 2034, expanding at a CAGR of 5.3% over the forecast period from 2024 to 2034.

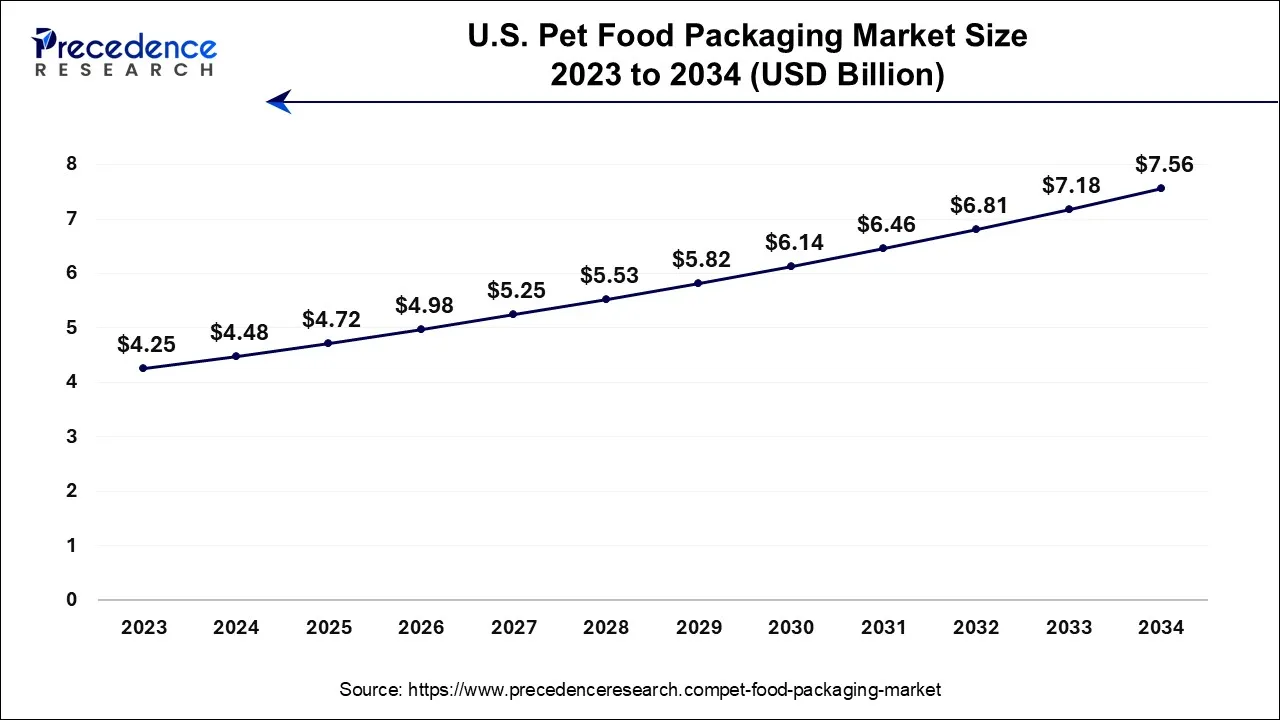

The U.S. pet food packaging market size is accounted for USD 4.48 billion in 2024 and is projected to be worth around USD 7.56 billion by 2034, poised to grow at a CAGR of 5.4% from 2024 to 2034.

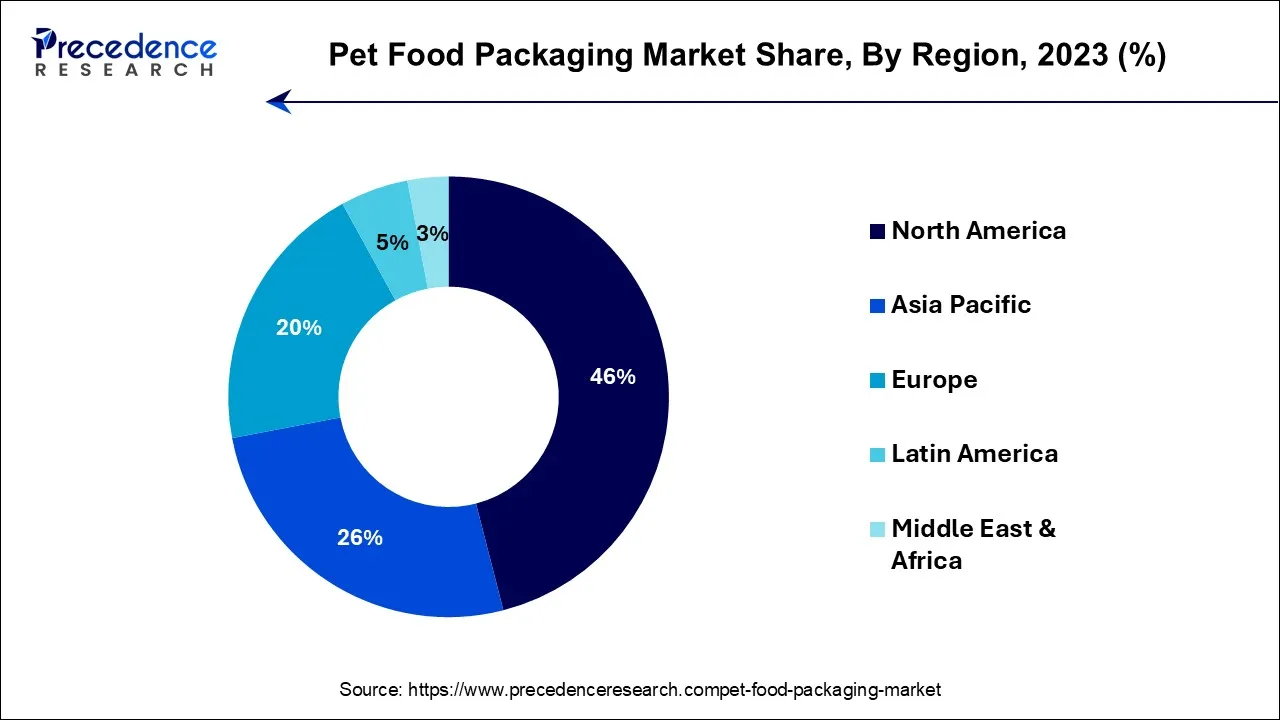

North America has held the largest revenue share 46% in 2023. North America holds a significant share in the pet food packaging market due to several key factors. The region has a large and continuously growing pet population, with pet owners increasingly seeking high-quality and premium pet food products. This demand for premium pet food necessitates advanced packaging solutions that reflect quality and nutrition.

Furthermore, a strong emphasis on sustainability and eco-friendly packaging aligns with the region's environmental awareness. The well-established e-commerce infrastructure and the convenience-seeking consumer base also drive the need for robust and secure pet food packaging, contributing to North America's dominant market share.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region dominates the growth of the pet food packaging market due to a combination of factors. The region has witnessed a substantial increase in pet ownership, with a growing middle-class population and urbanization trends. Rising consumer awareness about pet health and nutrition drives the demand for premium pet food products, thereby boosting the need for innovative and informative packaging.

Moreover, the pet food industry's expansion, increased disposable income, and the emergence of e-commerce have created a thriving market for packaging solutions. Asia-Pacific's diverse pet food preferences and the large population of pet owners contribute significantly to its major growth in the global pet food packaging market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.30% |

| Market Size in 2024 | USD 12.97 Billion |

| Market Size by 2034 | USD 21.74 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Material Type, By Food Type, and By Animal Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Humanization of pets

The humanization of pets is a significant driver behind the growth of the pet food packaging market. As more people consider their pets as integral members of their families, they seek premium, high-quality pet food products that mirror the quality and nutritional standards of human food. This shift in consumer perception has led to several packaging-related trends that drive market growth. Firstly, pet owners demand packaging that conveys a sense of quality, transparency, and safety. They seek informative labels that provide details about ingredients, sourcing, and nutritional benefits, akin to what they expect from human food products.

Secondly, the desire to provide pets with the best nutrition has spurred the use of specialized packaging materials that maintain the freshness and integrity of the pet food, ensuring it is as nutritious as possible for their furry companions. Additionally, premium pet food packaging often features attractive designs and branding elements that resonate with pet owners, reflecting their devotion to their pets. This connection between pet food packaging and the humanization of pets has driven innovation in design, materials, and labeling to meet the evolving needs and expectations of pet owners, ultimately contributing to the growth of the pet food packaging market.

Cost Concerns

Cost-related issues present a notable impediment to the expansion of the pet food packaging market. The utilization of high-end and sustainable packaging materials, which resonate with consumer demands for quality and environmental responsibility, frequently leads to elevated production expenses. These increased costs can act as a hurdle for pet food manufacturers, especially those with limited resources or smaller operations. In a competitive industry, managing expenditures while satisfying ever-evolving consumer desires for innovative packaging solutions can be a formidable task.

Moreover, the financial burden linked to procuring sustainable and eco-friendly materials, such as biodegradable or recyclable options, can strain supply chain dynamics and contribute to an overall escalation in packaging costs. To maintain a competitive edge, pet food packaging enterprises must navigate these cost-related concerns while concurrently meeting the expectations of consumers for premium and environmentally conscious packaging. Striking this delicate equilibrium can pose significant challenges, potentially impeding the market's growth, especially for companies operating with constrained financial resources.

Portion Control and Convenience

Portion control and convenience are emerging as key drivers of opportunity in the pet food packaging market. Pet owners are increasingly looking for packaging solutions that make feeding their pets more manageable and hassle-free. Packaging options that offer precise portion control help pet owners avoid overfeeding, ensuring their pets receive the right amount of food for their specific dietary needs. This trend presents opportunities for packaging with built-in measuring features or pre-packaged individual servings. Busy lifestyles and on-the-go pet owners are seeking packaging that simplifies feeding routines.

Resealable packages and easy-pour spouts enhance convenience, keeping pet food fresh and making serving more efficient. Innovative packaging that aligns with these preferences can attract pet owners and enhance brand loyalty. Pet food packaging companies have opportunities to design solutions that meet the demands of modern pet owners, resulting in a competitive edge and growth in the market.

According to the material type, the plastic segment has held 36% revenue share in 2023. The prominence of the plastic segment in the pet food packaging market can be attributed to its versatility, affordability, and protective attributes. Plastic materials, such as polyethylene and polypropylene, excel in repelling moisture, ensuring the pet food's freshness. Moreover, plastic packaging's lightweight nature enhances its suitability for shipping and online retail.

Its adaptability in design allows for a wide array of appealing shapes and sizes, attracting consumers. Plastic packaging is also compliant with regulations and offers efficient solutions for both dry and wet pet food products, making it the preferred choice and a significant player in the pet food packaging market.

The paper and paperboard segment is anticipated to expand at a significant CAGR of 6.4% during the projected period. The paper and paperboard segment dominates the growth of the pet food packaging market due to its eco-friendly and sustainable characteristics. Consumers are increasingly concerned about the environment and prefer packaging materials that are biodegradable and recyclable. Paper-based packaging offers these qualities while maintaining product freshness and integrity.

Additionally, it is cost-effective, lightweight, and customizable, making it a versatile choice for various pet food products. The segment's popularity aligns with the growing emphasis on sustainability, creating a strong market presence and driving its major share in the pet food packaging industry.

In 2023, the dry food segment had the highest market share of 45% on the basis of the food type. The dominance of the Dry Food segment in the pet food packaging market can be attributed to its popularity among pet owners. Dry pet food is favored for its extended shelf life, ease of use, and cost-effectiveness, making it a common choice. Given its non-perishable and lightweight characteristics, it demands robust and economical packaging to preserve the product's quality and freshness.

This requirement has spurred innovation in pet food packaging, solidifying the Dry Food segment's prominent position in the market. The packaging solutions for dry food effectively cater to the needs of both consumers and manufacturers, establishing it as a major player in the industry.

The others segment is anticipated to expand fastest over the projected period. The "Others" segment holds a major growth in the pet food packaging market primarily due to the diversity of pet food products beyond traditional dry kibble and canned options. This segment encompasses specialty diets, organic and natural foods, frozen pet foods, and various treat categories.

The unique packaging requirements for these niche products, such as freshness preservation for frozen food or premium packaging for organic options, contribute to its significant share. As consumer preferences for specialized pet food continue to grow, the "Others" segment is poised to maintain its substantial growth in the pet food packaging market.

In 2023, the dogs segment had the highest market share of 49% on the basis of the animal type. The dog segment holds a major share in the pet food packaging market due to the sheer popularity and large population of dogs as pets. Dogs are among the most commonly kept pets globally, leading to a consistently high demand for dog food and its associated packaging.

Furthermore, dog owners often seek a variety of food types and packaging sizes, ranging from kibble to wet food, treats, and specialty diets. This diversity of products results in a substantial market share for dog food packaging, as packaging manufacturers cater to the specific needs and preferences of dog owners.

The cats segment is anticipated to expand fastest over the projected period. The cat segment holds a major grpwth in the pet food packaging market due to several reasons. Cats are the second most popular pets globally, and their population is consistently high. Cat owners tend to be more discerning and health-conscious, demanding premium and specialized cat food products. This demand drives innovation in packaging to convey quality and health benefits, which cat owners are willing to invest in. The cat food segment's growth is further accelerated by the increasing humanization of pets, where cats are often treated as family members, creating a substantial market growth for premium and customized cat food packaging.

Segments Covered in the Report

By Material Type

By Food Type

By Animal Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

October 2024

January 2025