January 2025

Pet Insurance Market (By Policy Type: Accident, Accident & Illness, Embedded Wellness; By End-user: Dogs, Cats, Horses, Exotic pets, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

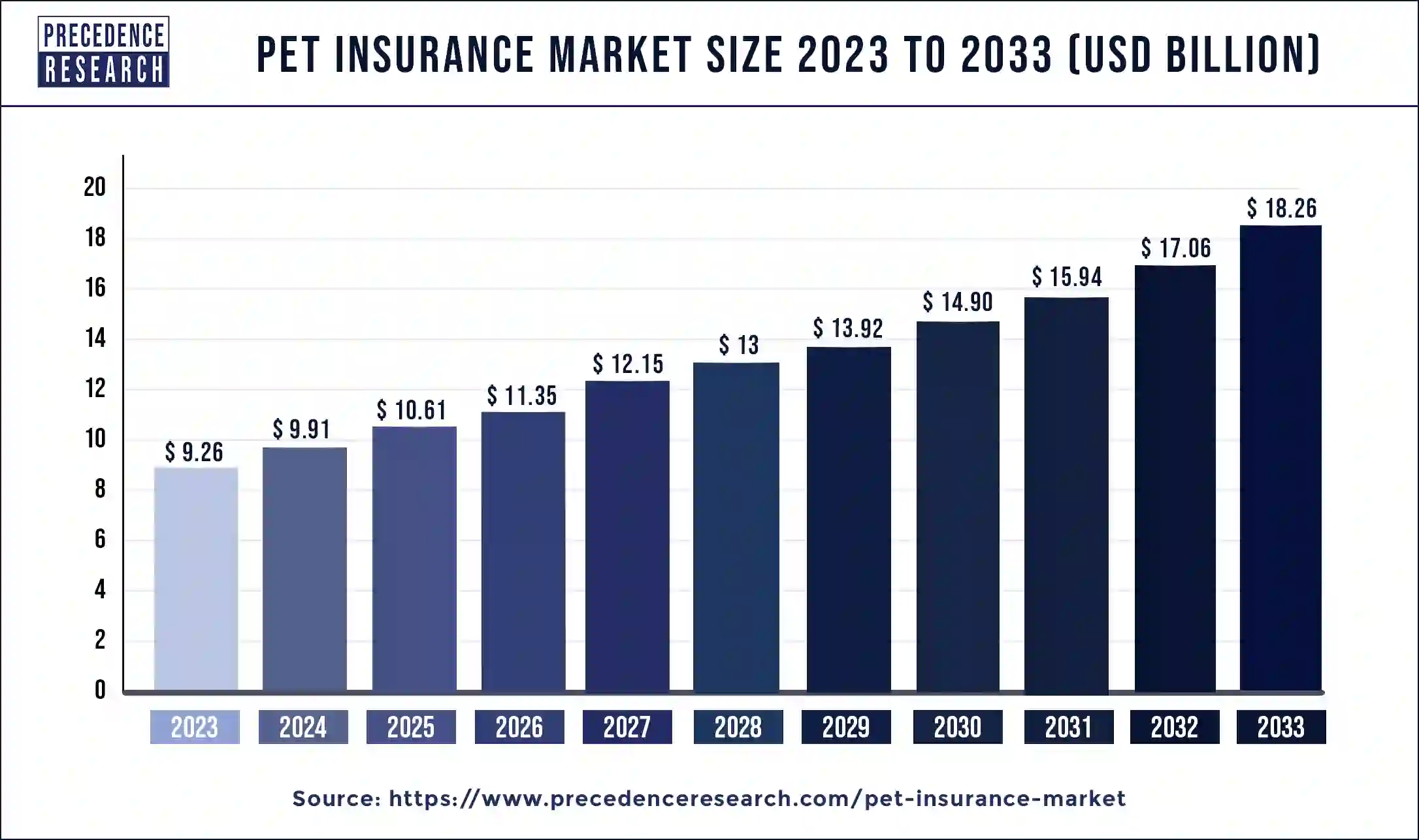

The global pet insurance market size was valued at USD 9.26 billion in 2023 and is anticipated to reach around USD 18.26 billion by 2033, growing at a CAGR of 7.03% from 2024 to 2033. The rising number of pet adoptions is driving the growth of the pet insurance market.

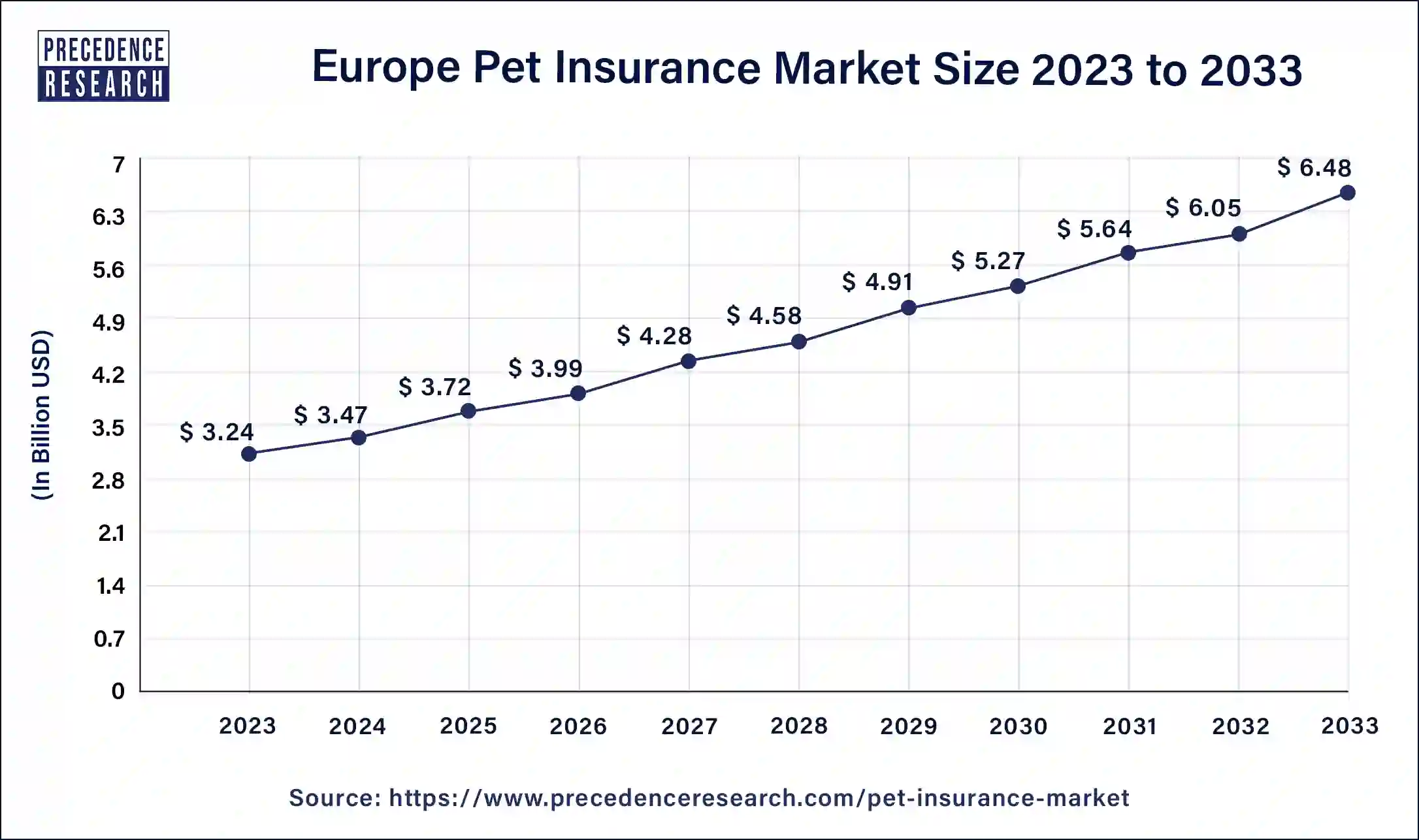

The Europe pet insurance market size reached USD 3.24 billion in 2023 and is projected to hit around USD 6.48 billion by 2033, poised to grow at a CAGR of 7.17% from 2024 to 2033.

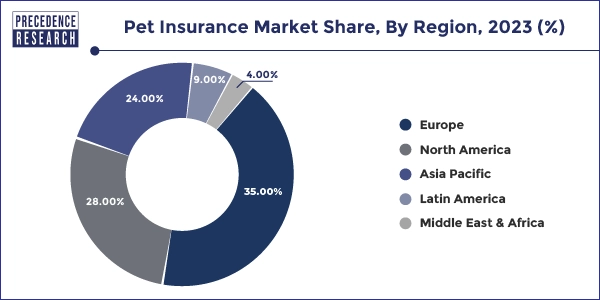

Europe dominated the pet insurance market share of 35% in 2023. The increasing adoption of pets, convenient pet services, and the spreading awareness of insurance benefits have been the major growth factors for the dominance of the region. The European pet food industry Federation stated that Europe registered a total number of 340 million pets in 2022.

The United Kingdom has been the home for most of the rescued dogs, which has resulted in the demand for pet insurance, especially to cater to the needs of homeless dogs. According to the demand, many insurance companies in the UK have started providing insurance to rescued dogs, and some of the companies provide lifetime insurance services to rescue dogs.

Asia-Pacific is expected to witness significant development in the pet insurance market from 2024 to 2033. Countries like India are considered to be the fastest-growing pet insurance industry because of the rising awareness of the well-being and health of pets. India has witnessed a massive growth in dog adoptions. The rapid urbanization in countries like India, China, and Japan Increases the demand for many pet insurance services.

North America is expected to witness notable growth during the forecast period. The pet insurance rate in North America has witnessed significant growth in the past few years. The increasing number of pet owners in countries like the United States of America increases the demand for pet insurance. Many companies in the U.S. are providing insurance to homeless dogs, which stands out as a potential growth factor for the pet industry.

Pet Insurance Market Overview

Pet insurance refers to a policy designed to help pet owners manage the veterinary costs of their pets and ensure their health and medical expenses. It is similar to health insurance for human beings, which includes unexpected medical treatment and accidents. The growing pet adoption rates and increasing veterinary costs due to the limited availability of professionals are raising the demand for pet insurance. The increasing awareness and benefits of insurance for pets are also considered important factors for the growth of the pet insurance market.

The market includes traditional companies, veterinary clinics, and some special pet insurance providers. These companies offer various benefits to pet owners as they include multiple policies for the safety of the pets. The humanization of pets, especially in urban areas, is one of the major reasons behind the growth of the pet insurance market. The demand for quality veterinary professionals and services is also expected to contribute to the capital of the animal welfare industry. However, COVID-19 has increased health awareness, especially in countries with growing economies.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.03% |

| Global Market Size in 2023 | USD 9.26 Billion |

| Global Market Size by 2033 | USD 18.26 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Policy Type and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Upsurge in the demand for financial security

The technological and medical advancements in the industry have been one of the major factors behind the increasing number of pet adoptions, and this has resulted in higher demand for qualified veterinary professionals. These factors are the major reason behind the higher medical costs of veterinary accidents. To manage the financial stability of their family, many pet owners are considering insurance as a safe and stable option for their pets. Therefore, the upsurge in demand for financial security is observed to act as a driver for the pet insurance market.

The insurance policy for pets covers all the medical costs, including urinalysis, blood tests, x-rays, and unexpected accidents involving the pet. This allows the pet owners to manage their other expenses and be financially secure. Many changes are being made in the insurance policy, as they are also providing new annual checkup packages for their pets, which may help in understanding the pet's overall health and medical complications.

The increasing humanization of pets

The trend of pet adoption has been rapidly increasing all over the world, especially in urban cities, which have witnessed almost double the growth expected. The changing urban lifestyle, which is mainly isolated, has resulted in the need for pets as a companion and a family member. Many researches have also proved that a person who has a pet is comparatively happier than the person without it. This has resulted in an increasing number of pet insurance for the well-being and safety of the pet.

Restraint

Limited benefits of pet insurance

Health insurance for pets provides several benefits, but there are many factors that are missed and may not be beneficial to all pets. The pet insurance policies don’t cover pre-existing conditions, which can lead to missing out on the claims if the pet has any former or hereditary condition. The policy also misses out on the routine wellness of the pet as it includes it as an optional service with separate charges. This may not be feasible for all pet owners and can potentially freeze the growth of the pet insurance market. Many insurance companies are required to make changes according to customer demand to grow their business.

Opportunities

Increasing pet adoptions

The changing dynamics of lifestyle in urban cities have increased the number of pet adoptions by humans. Pets like dogs and cats are nowadays considered family members. Humans consider pets as companions in the urban lifestyle. Many people also adopt dogs for their security due to the increasing threat in recent times.

Many pet owners are comparatively happy as compared to other people, as having a pet can reduce a person's stress levels. The rising disposable income is also contributing to the adoption of pets. This stands out as an opportunity for many insurance companies and businesses.

The surging number of companies in the pet market

Advancements in technologies and pet care infrastructure are upsurging the demand for more quality and convenient options in the pet market. The pet insurance market is expecting growth due to the increasing number of adoptions and humanization of pets. Many companies are stepping into the market due to the demand for more veterinary professionals and insurance companies.

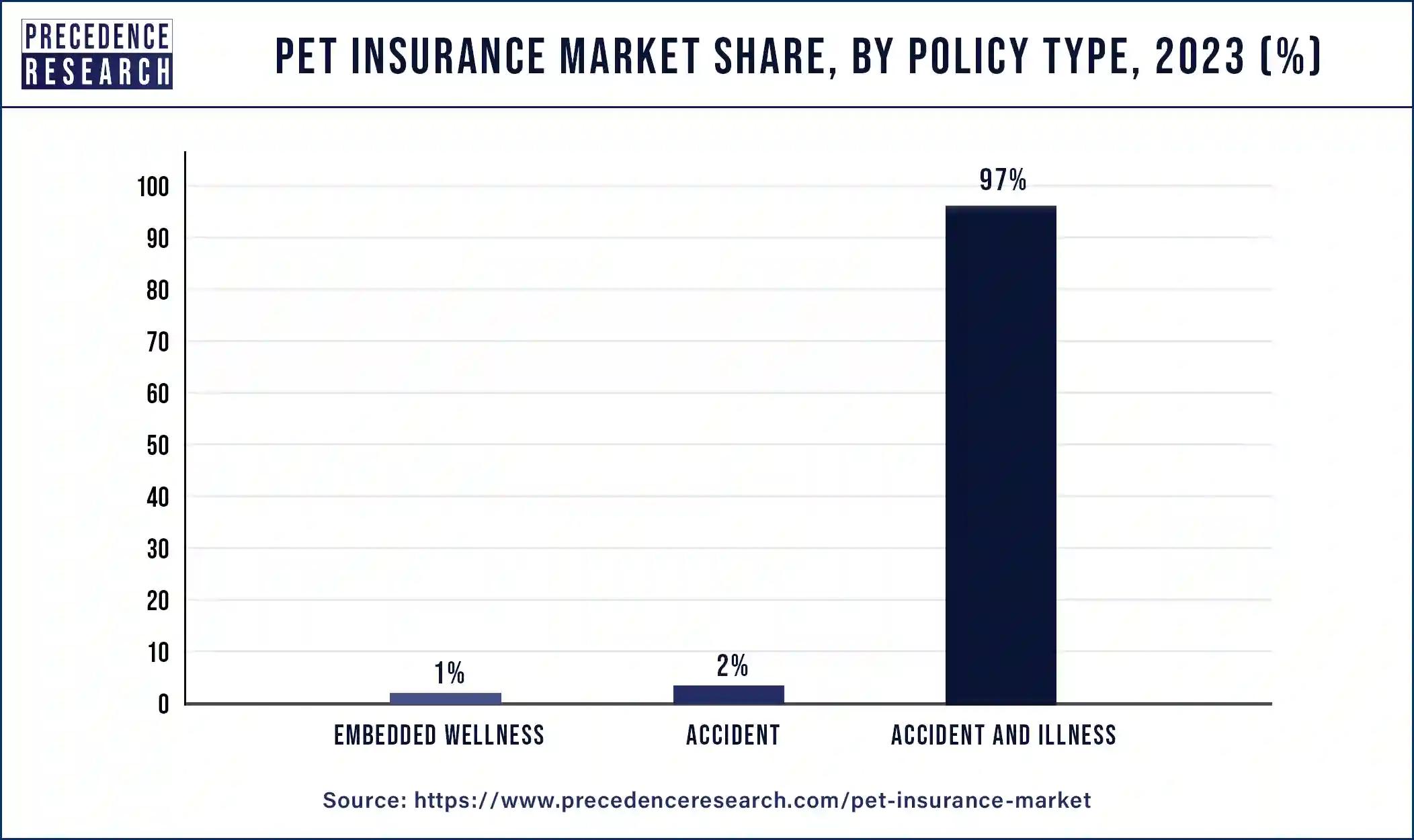

The accident & illness segment held the largest revenue share of 97% in 2023. This segment is also expected to witness significant growth, with a CAGR from 2024 to 2033. This growth is expected at a much faster rate due to the high costs of veterinary treatment and other expenses. The increasing awareness of policies regarding pet illnesses is attributed to the expansion of the pet insurance market. The companies providing policies related to illness and accidents of pets have witnessed most of the growth in the whole pet industry. These companies also include policy claims caused by chronic diseases, medications, and annual checkups.

The accident insurance segment held a substantial share of the pet insurance market in 2023. These types of policies are only included in premium plans, whereas these are provided as optional in other basic insurance plans. These types of plans are mostly claimed by the elite class, but due to the increasing risk, the upper middle class is also inclined towards adding this option to their insurance plans.

In the pet insurance market, the embedded wellness segment held a notable share in 2023. This plan includes services like dental work, pet immunization, and many more. These kinds of wellness policies are not considered in major basic insurance plans.

The dogs segment dominated the pet insurance market in 2023. dog segment is also expected to dominate the market in the upcoming years. The reason behind the dominance of dog segments is the high adoption rates due to the multiple qualities of dogs. They are considered to be the most loyal among all animals. This has resulted in the growth of dog adoption and expansion in service offerings by many companies. According to many studies, dogs are the priority when considering having any pet. Many people consider him the best companion of human beings as he understands the emotions of humans and also protects his family.

The cats segment is expected to gain a significant share during the upcoming years. Many people prefer cats as their pets due to the low maintenance costs and less allergic nature. They also contribute to human’s mental and physical well-being. This has resulted in significant spending on these pets and boosted the growth of the pet insurance market.

Segments Covered by the Report

By Policy Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

January 2025

December 2024