October 2024

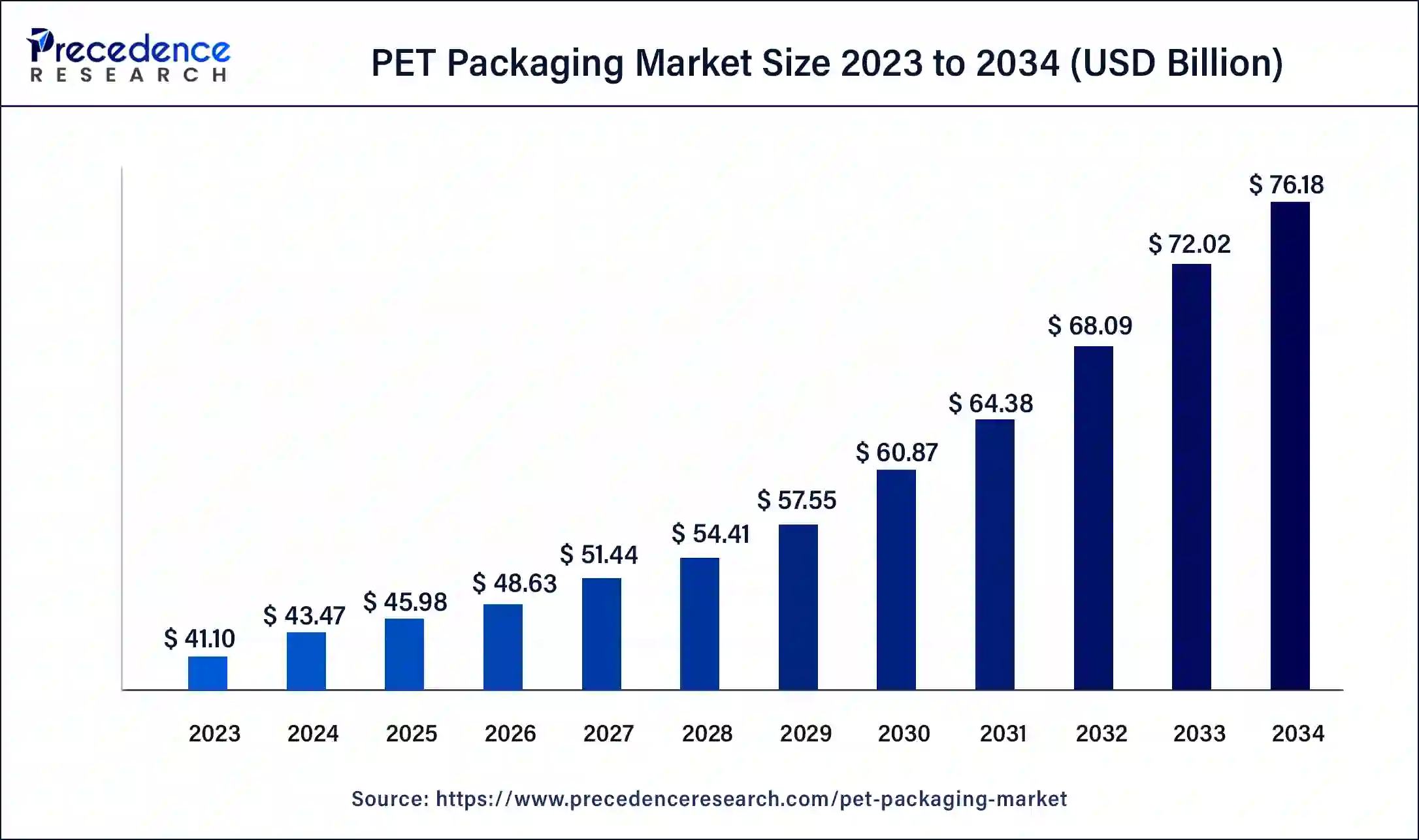

The global PET packaging market size surpassed USD 41.10 billion in 2023 and is estimated to increase from USD 43.47 billion in 2024 to approximately USD 76.18 billion by 2034. It is projected to grow at a CAGR of 5.77% from 2024 to 2034.

The global PET packaging market size is projected to reach around USD 76.18 billion by 2034 from USD 43.47 billion in 2024, at a CAGR of 5.77% between 2024 and 2034. The PET packaging market is driven by the consumers' preference for portable and lightweight packing formats is growing.

The packaging industry sector that uses PET (polyethylene terephthalate) as a material for product packaging is known as the PET packaging market. Because of its strength, clarity, and recycling capacity, PET is a plastic polymer frequently used to create bottles, containers, and other packaging solutions. The manufacturing, distribution, and consumption of PET packaging items across various industries, including food and beverage, personal care, pharmaceuticals, and household goods, are all included in this market.

Polyethylene terephthalate packaging is highly regarded as transparent, lightweight, and shatter-resistant, making it perfect for consumer goods. It improves end customers' accessibility and convenience, especially in the food and beverage industry. The PET packaging market drives innovation in packaging technology and design. Improvements in PET materials and manufacturing techniques increase productivity, safety, and performance, benefiting producers and consumers.

Table: Top Exporters of Plastic Packaging Material

| Country | Materials | No. of Shipments in 2023 |

| China | plastic | 133,646 |

| Vietnam | plastic | 30,830 |

| India | plastic | 18,584 |

How can AI help the PET packaging industry?

Artificial intelligence (AI) driven vision systems can instantly check PET bottles and packaging for flaws, including impurities, cracks, and deformities, guaranteeing that premium standards are upheld. AI is also capable of analyzing machine data to forecast when maintenance is necessary, saving downtime and averting possible flaws in the manufacturing process. AI can assist in the design of PET packaging to minimize the environmental impact by using fewer materials without sacrificing quality. Artificial Intelligence (AI) can enhance sorting and recycling procedures by effectively detecting and separating various kinds of plastic, hence improving the quality of recycled PET.

| Report Coverage | Details |

| Market Size by 2034 | USD 76.18 Billion |

| Market Size in 2023 | USD 41.10 Billion |

| Market Size in 2024 | USD 43.47 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.77% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Packaging Type, Product Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for packaged foods and beverages

Consumers with busier lifestyles seek convenience, which has increased the demand for packaged goods and drinks. Because PET packaging is manageable, strong, and lightweight, it provides a valuable solution. PET packaging is the best for consumption when traveling. Its portability and ease of carrying align with the expanding popularity of convenience foods and drinks.

PET permits a wide range of package designs, encompassing variations in dimensions, hues, and forms. This adaptability enables firms to differentiate themselves and attract customers with eye-catching packaging. PET packaging is becoming increasingly common due to innovations, including increased barrier qualities and lightweighting. These developments assist in addressing the changing demands of the food and beverage sector. This drives the growth of the PET packaging market.

Competition from alternatives

Glass's non-reactive nature and capacity to maintain product quality make it a popular choice for premium packaging, particularly when it comes to food and beverages. Customers and manufacturers may select Glass over PET due to this perception. Glass is 100% recyclable and has an endless recycling cycle without sacrificing quality. It is a popular choice for brands looking to lessen their carbon impact and ecologically aware consumers.

PET is usually more affordable; however, the cost of other materials is falling as technology develops and economies of scale are achieved. As a result, alternatives may become more reasonably priced. Adopting alternatives can positively impact market dynamics and manufacturing decisions due to their economic advantages, mainly if those alternatives offer higher recycling rates or less environmental impact.

Environmental concerns

One type of plastic that adds to the growing problem of plastic pollution is PET. When PET products are disposed of incorrectly, they can damage wildlife and marine life by ending up in rivers, oceans, and other natural areas. The long-term ecological impact of PET is a significant worry due to its persistence in the environment and its slow decomposition process, which can take hundreds of years. Environmental factors are becoming increasingly important in corporate social responsibility plans. PET packaging's detrimental effects on the environment can harm a business's reputation and brand image. As a result, companies are spending more and more on sustainable packaging solutions to meet their CSR objectives and enhance public perception. This limits the growth of the PET packaging market.

Rise of e-commerce

The amount of goods transported directly to consumers has significantly increased due to e-commerce. The increasing number of consumers who shop online has led to a growing demand for packaging solutions that ensure safe and effective product delivery. In the e-commerce industry, sustainability practices are becoming increasingly important, and many businesses are looking for recyclable and environmentally friendly packaging choices. PET is recyclable, and improvements in recycling technologies have made PET more efficient, which aligns with e-commerce companies' environmental objectives. This opens an opportunity for the growth of the PET packaging market.

The rigid segment dominated the PET packaging market in 2023. Rigid PET packaging is adaptable and works well for various products, including beverages and personal hygiene items. Because of its adaptability, producers in a variety of industries choose it. PET is well known for having superior barrier qualities that shield goods from elements like moisture, air, and other elements that can lower their quality. As a result, stiff PET packaging increases product shelf life, which is especially important for food and drink. PET containers are lightweight even though they are stiff, which lowers the shipping cost and lessens logistics' carbon imprint. This makes rigid PET packaging a cost-effective and environmentally responsible choice for producers.

The flexible segment shows a significant growth in the PET packaging market during the forecast period. Rigid PET packaging is not as sustainable as flexible PET packaging. Because of its smaller weight, flexible PET packaging usually requires less material, which minimizes waste and lowers shipping costs. Because PET is so recyclable, efforts to enhance the infrastructure and procedures for recycling have increased the need for flexible PET packaging. Businesses increasingly embrace environmentally responsible methods, such as incorporating recycled PET (rPET) into their packaging.

Several industries employ PET packaging, including food and beverage, pharmaceuticals, personal care, and home goods. It is a popular option due to its adaptability in packing various items, including liquids and solids. Flexible PET packaging allows for high degrees of customization, allowing manufacturers to set their products apart with distinctive sizes, shapes, and printed patterns. This flexibility facilitates marketing and branding efforts.

The films & wraps segment dominated the PET packaging market in 2023. PET films and wraps are highly prized for their transparency and clarity, which makes them perfect for packaging commodities, including consumer goods, food items, and beverages where visibility is essential. PET offers superior mechanical strength and durability, guaranteeing damage-free handling, transportation, and packaging storage. PET films provide good gas and moisture barriers, assisting in preserving packed goods' quality and freshness. This is especially crucial for the food and beverage sector.

The bottles & jars segment is observed to be the fastest growing in the PET packaging market during the forecast period. PET is a highly recyclable material, and the need for recyclable packaging solutions has increased as environmental sustainability becomes more widely recognized. Recycled PET (rPET) is becoming increasingly popular among businesses to satisfy both legal and customer demands for environmentally friendly packaging.

The utilization of recycled materials, the reduction of plastic waste, and circular economic activities are being encouraged by governments and organizations globally. This has helped expand the PET bottles and jars market as businesses choose more environmentally friendly packaging solutions.

The food & beverage segment dominated the PET packaging market in 2023. PET is inexpensive for mass production since it is easily molded into various sizes and forms. Compared to alternatives like glass, the production method is less harmful to the environment and uses less energy. Because PET packaging is lightweight, it uses less energy during transit. Its space-saving design and stackability significantly reduce the cost of shipping and storage.

Strict packaging laws guarantee product quality and safety in the food and beverage sector. Because PET complies with these regulations, producers find it a more desirable option. PET is a dependable and standardized material widely accepted in the packaging sector due to its adherence to international standards.

Asia Pacific dominated in the PET packaging market in 2023. PET packaging demand is primarily driven by the beverage industry, which produces alcoholic beverages, soft drinks, and bottled water. Due to shifting lifestyles and growing health consciousness, beverage consumption has increased dramatically in Asia-Pacific countries, positively impacting the PET packaging industry. The market for packaged food items, such as dairy products, snacks, and ready-to-eat meals, is also expanding. PET packaging is used because it is transparent, strong, and lightweight, which makes it perfect for food packaging.

Several prominent international and regional players drive the PET packaging market in Asia-Pacific, spurring innovation and competition. To maintain a competitive edge and launch new products or enhance current ones, these businesses make significant investments in R&D.

North America shows significant growth in the PET packaging market during the forecast period. Improved resin formulas and sophisticated molding techniques, among other innovations in PET packaging technology, have increased product performance, cost-effectiveness, and versatility, making PET a desirable option for various packaging applications. Developments in lightweight PET bottles and containers lower material prices and shipping expenses, which appeals to manufacturers and customers concerned with environmental effects and the economy.

Consumer spending on packaged goods has increased due to the post-pandemic economic recovery. PET packaging is in high demand due to the growing food and beverage industry and the growth of e-commerce. The circular economy is being supported, the PET packaging market is growing, and PET recycling efficiency and capacity are being improved thanks to investments in recycling infrastructure and technological breakthroughs in North America.

Europe shows a notable growth in the PET packaging market during the forecast period. Recyclable materials are preferred because European governments and consumers are becoming more concerned about environmental issues. PET is a great option for packaging because of its high degree of recyclable content. Compared to other packaging materials, PET packaging is comparatively cheap, making it a desirable choice for producers trying to cut expenses. In Europe, there is an increasing need for PET packaging due to the growth of the food and beverage industry and the pharmaceutical and personal care sectors.

Segments Covered in the Report

By Packaging Type

By Product Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

January 2025

January 2025