September 2024

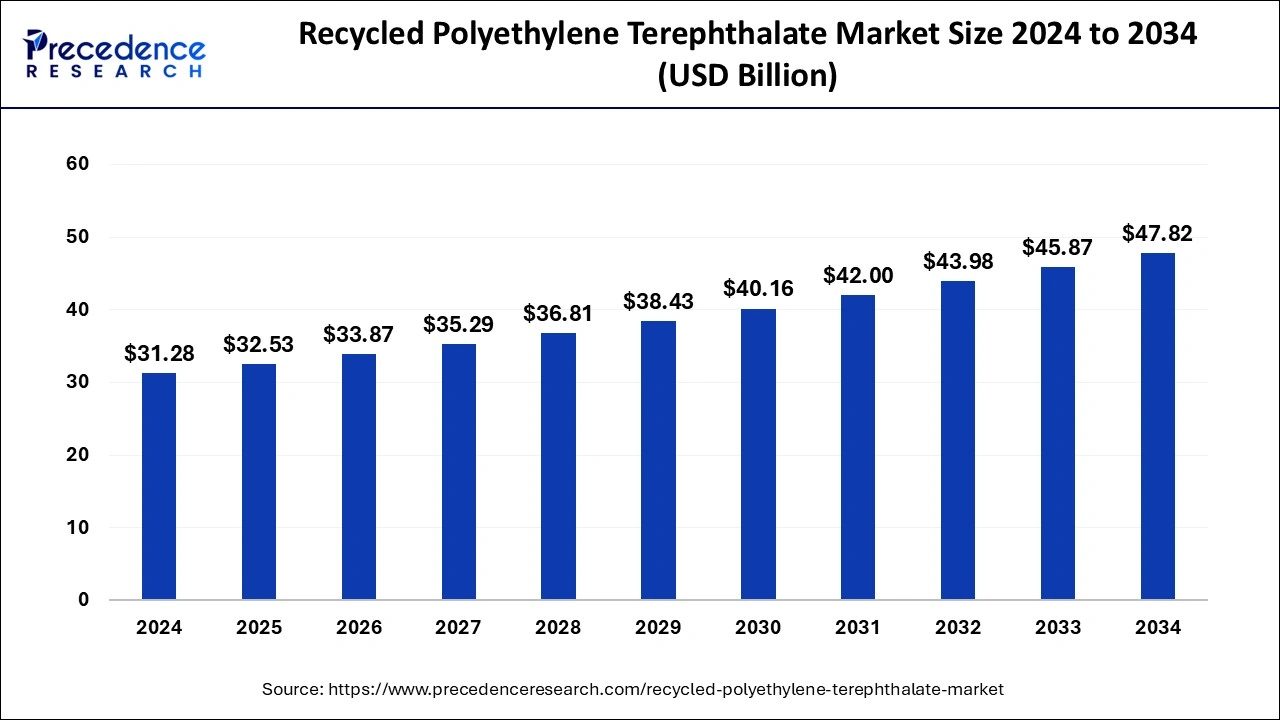

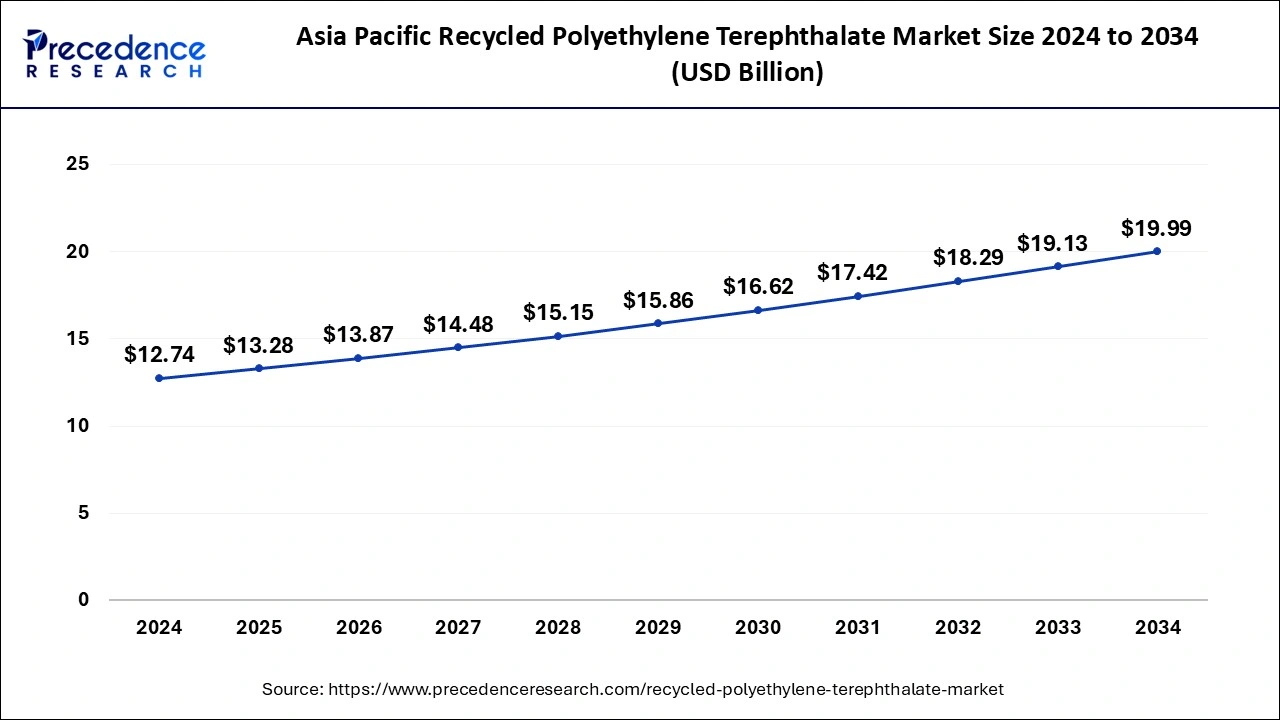

The global recycled polyethylene terephthalate market size is calculated at USD 32.53 billion in 2025 and is forecasted to reach around USD 47.82 billion by 2034, accelerating at a CAGR of 4.33% from 2025 to 2034. The Asia Pacific recycled polyethylene terephthalate market size surpassed USD 12.74 billion in 2024 and is expanding at a CAGR of 4.60% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global recycled polyethylene terephthalate market size was accounted for USD 31.28 billion in 2024 and is expected to exceed around USD 47.82 billion by 2034, growing at a CAGR of 4.33% from 2025 to 2034.

The Asia Pacific recycled polyethylene terephthalate market size reached USD 12.74 billion in 2024 and is projected to be worth around USD 19.99 billion by 2034, growing at a CAGR of 4.6% from 2025 to 2034.

Asia Pacific held the majority share of global recycled polyethylene terephthalate industry in 2023. This trend is estimated to continue as brand owners initiate the growth in usage of recycled materials in their products. The growth of Asia Pacific recycled polyethylene terephthalate market is mainly attributed by shift in production facilities of various end uses towards countries particularly in China, India and Indonesia. Japan’s rate of PET bottle recycling is among the highest in the world which is about 85%. With the commitment of brand owners to increase the amount of recycled materials in their packaging, PET recyclers have to catch-up to meet the growing demand.

The growth of global recycled polyethylene terephthalate market is mainly attributed to growing consumer awareness regarding environment and rising demand for sustainable alternatives. Furthermore, various companies from food and beverage industry such as Coca-Cola planned to move from virgin PET bottles with recycled polyethylene terephthalate by 2025 in Western European region. On the other hand, emission of carcinogenic compounds is expected hamper the growth of global recycled polyethylene terephthalate market in near future. Even so, rising demand for recycled polyethylene terephthalate from non-food sector is predicted to open massive opportunities for market players in years to come.

| Report Coverage | Details |

| Market Size in 2025 | USD 32.53 Billion |

| Market Size by 2034 | USD 47.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.33% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising utilization of PET material from the food and beverages industry

In August 2023, Coco Cola India announced the launch of 100% recycled bottles made with PET material. With this launch, the company becomes first in India to use 100% recycled polyethylene terephthalate for the food and beverage industry. Coco Cola has set a goal to use at least 50% recycled material for its packaging purposes. As consumer awareness of environmental concerns rises, industries are actively seeking sustainable packaging solutions. PET, known for its durability and lightweight nature, has become a popular choice for packaging bottled water and other food and beverage products. The surge in PET usage has led to a significant rise in plastic waste, prompting the need for recycling initiatives. Recycled polyethylene terephthalate offers an eco-friendly alternative by repurposing used PET materials. multiple food and beverage companies are committing to using a certain percentage of recycled material, this commitment also grows the demand for recycled polyethylene terephthalate material. Thus, the rising utilization of PET materials from the food and beverage industry is observed to drive the growth of the market.

Consumer perception about the quality

The obstacle to the market’s growth is caused by consumer perception. Consumers might worry about potential contamination, reduced durability and visual imperfections in products made with recycled polyethylene terephthalate. Despite its environmental benefits, there can be skepticism surrounding the quality and safety of products made from recycled polyethylene terephthalate. Lack of awareness and knowledge about such products can cause the perception. To address such restraints, the manufacturers or key players may have to adopt market strategies in order to demonstrate trust in the quality of the product.

Supportive government regulations

Supportive government regulations can enhance consumer awareness and preference for products made from recycled polyethylene terephthalate. Transparent labeling and certifications indicating the use of recycled content can foster trust and enable consumers to make more sustainable choices. Government support also fosters innovation in recycling technologies, leading to more efficient and cost-effective PET recycling methods. This, in turn, makes recycled PET products more competitive in the market, potentially lowering prices and expanding their applications across various industries. Thus, supportive government regulations present a significant opportunity for the market.

Lack of infrastructure

The lack of infrastructure poses a major challenge for the recycled polyethylene terephthalate market. Recycled polyethylene terephthalate is a crucial component of sustainable packaging solutions and products. However, its growth is hindered by the absence of proper collection, sorting and processing facilities. Insufficient recycling infrastructure leads to challenges in collecting post-consumer PET waste. Inadequate recycling programs and collection systems result in limited availability of high-quality PET waste feedstock for recycling facilities. This impacts the overall supply chain and can lead to increased costs for sourcing suitable materials.

Based on product type, the global recycled polyethylene terephthalate market is segmented into clear and colored. Clear recycled PET held the largest share in product type segment of the global recycled polyethylene terephthalate market in 2023 and is also expected hold its place in forecast period. The growth of this segment is mainly attributed to rising demand for production of fibers and resins paired with rising demand for bottles. Furthermore, clear recycled polyethylene terephthalate containers possess the characteristics like flexibility, lightweight and durability. Colored recycled PET segment is predicted to account noticeable share in coming years.

Fiber, sheet and film, strapping, food & beverage containers and bottles, non-food containers and bottles and others are the end user segment of global recycled polyethylene terephthalate market. In 2023, fiber end user segment accounted highest sales volume, the growth of fiber end user segment is primarily driven by growing demand from clothing and accessories automobiles and textile. Rising demand of recycled polyethylene terephthalate in non-food sector is also predicted to shape the global recycled polyethylene terephthalate market in coming years. Food and beverage containers and bottles segment is predicted to show growth at a CAGR of 7.9% during forecast period.

By Product Type

By End Use Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

December 2024

February 2025