April 2025

The global pharmaceutical contract sales outsourcing (CSO) market size accounted for USD 10.90 billion in 2024, grew to USD 11.85 billion in 2025, and is expected to be worth around USD 25.09 billion by 2034, poised to grow at a CAGR of 8.69% between 2024 and 2034. The North America pharmaceutical contract sales outsourcing (CSO) market size is predicted to increase from USD 3.92 billion in 2024 and is estimated to grow at the fastest CAGR of 8.84% during the forecast year.

The global pharmaceutical contract sales outsourcing (CSO) market size is expected to be valued at USD 10.90 billion in 2024 and is anticipated to reach around USD 25.09 billion by 2034, expanding at a CAGR of 8.69% over the forecast period from 2024 to 2034.

![Pharmaceutical Contract Sales Outsourcing [CSO] Market Size 2024 to 2034 Pharmaceutical Contract Sales Outsourcing [CSO] Market Size 2024 to 2034](https://www.precedenceresearch.com/insightimg/pharmaceutical-contract-sales-outsourcing-market-size.webp)

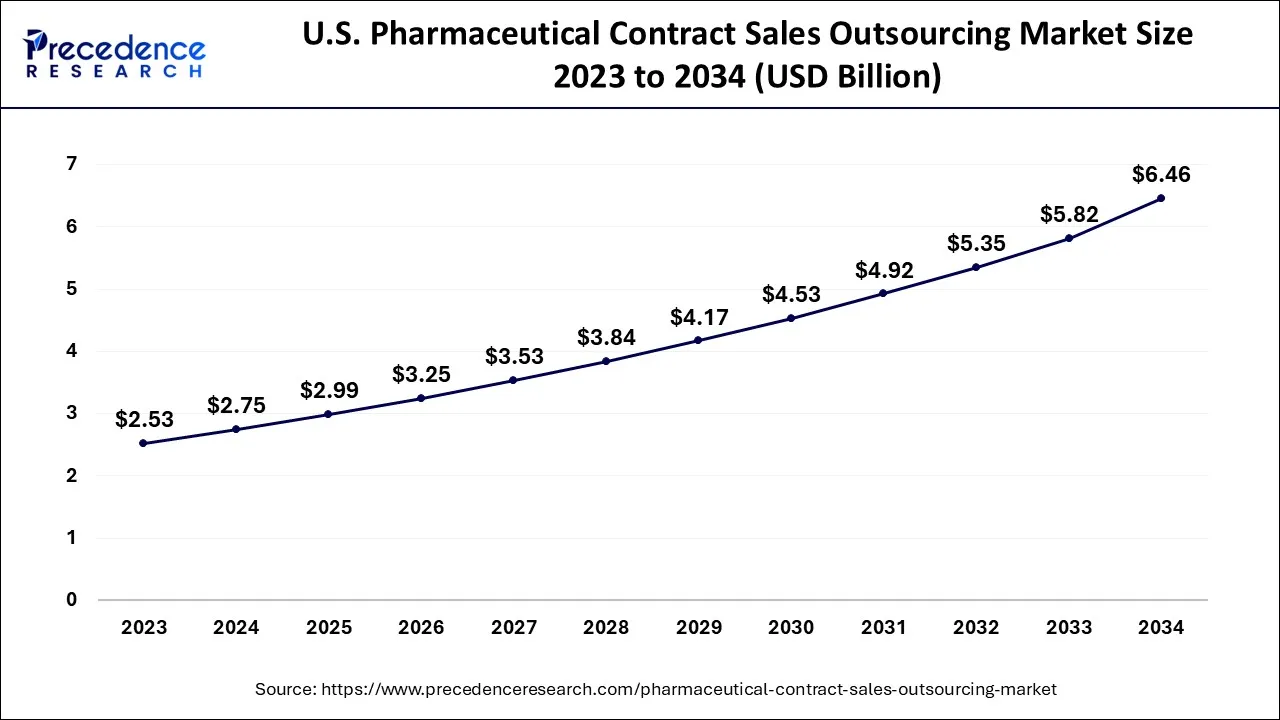

The U.S. pharmaceutical contract sales outsourcing (CSO) market size is exhibited at USD 2.75 billion in 2024 and is projected to be worth around USD 6.46 billion by 2034, growing at a CAGR of 8.92% from 2024 to 2034.

In 2023, North America dominated the market, accounting significant share of about 36%. North America is the largest market for Pharmaceutical Contract Sales Outsourcing (CSO) globally. Several factors drive the market, including many pharmaceutical companies, high healthcare spending, and favorable government policies. The United States dominates the North American market, accounting for most of the market share. The United States has the largest pharmaceutical industry in the world, with a highly developed healthcare system that drives the demand for pharmaceutical products and services.

![Pharmaceutical Contract Sales Outsourcing [CSO] Market Share, By Region, 2023 (%) Pharmaceutical Contract Sales Outsourcing [CSO] Market Share, By Region, 2023 (%)](https://www.precedenceresearch.com/insightimg/pharmaceutical-contract-sales-outsourcing-market-share-by-region.webp)

Additionally, the country has favorable government policies encouraging innovation and investment in the pharmaceutical industry. The Canadian market for Pharmaceutical Contract Sales Outsourcing (CSO) is relatively small compared to the United States but is growing rapidly. The increasing demand for cost-effective solutions and the presence of many pharmaceutical companies drive the Canadian market.

The North American market for pharmaceutical contract cales outsourcing (CSO) is expected to grow in the coming years due to several factors, such as the increasing prevalence of chronic diseases and the ageing population, which drive the demand for pharmaceutical products and services. According to the Centers for disease control and prevention (CDC), in 2020, 6 in 10 adults in the US had at least one chronic disease, and 4 in 10 adults had two or more chronic diseases.

Moreover, according to the United Nations, the population aged 65 and over in North America is projected to increase from 60 million in 2020 to 100 million by 2050. Furthermore, the adoption of advanced technologies in the healthcare industry is driving innovation and investment in the market. In addition, the increasing focus on research and development in the pharmaceutical industry is driving the demand for sales and marketing services. Therefore, North America is an essential pharmaceutical contract sales outsourcing (CSO) market and is expected to grow in the coming years. The region offers several growth opportunities for CSO service providers due to many pharmaceutical companies, high healthcare spending, and favorable government policies.

Pharmaceutical contract sales outsourcing (CSO) is a business model where pharmaceutical companies outsource their sales and marketing operations to third-party companies, also known as contract sales organizations. This trend has become popular in the pharmaceutical industry due to cost savings, increased flexibility, and access to specialized expertise.

Contract sales organizations provide sales team management, training, recruitment, and performance analysis. However, contract sales outsourcing also poses challenges, such as the potential loss of control over the sales process and the need to maintain strong relationships with third-party vendors.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.90 Billion |

| Market Size by 2034 | USD 25.09 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.69% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Service and By Therapeutic Area |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing pressure on pharmaceutical companies to reduce costs and improve efficiency

One major driving force behind the growth of the pharmaceutical contract sales outsourcing (CSO) market is the growing pressure on pharmaceutical companies to enhance efficiency and reduce costs. By outsourcing their sales operations to third-party CSO providers, pharmaceutical companies can reduce expenses associated with maintaining a dedicated sales team, such as salaries, benefits, and training costs. Additionally, CSO providers offer specialized sales expertise and support to help pharmaceutical companies increase sales and market share.

Furthermore, outsourcing sales operations enables pharmaceutical companies to quickly adapt to changes in the market, such as shifts in consumer preferences or new regulations. By partnering with CSO providers, pharmaceutical companies can access a broader range of sales channels, distribution networks, and more targeted and data-driven marketing strategies. Therefore, the growth of the pharmaceutical contract sales outsourcing (CSO) market is driven by the need for pharmaceutical companies to remain competitive and profitable in an increasingly complex and competitive global marketplace.

Regulatory and compliance risks

Regulatory and compliance risks are a significant restraint for the pharmaceutical contract sales outsourcing (CSO) market. Pharmaceutical companies are subject to strict regulations and guidelines when marketing and selling their products. They are ultimately responsible for ensuring their sales representatives are trained and adhere to these guidelines. Failure to comply with these regulations results in legal and financial penalties, reputation damage, and market share loss. When pharmaceutical companies outsource their sales operations to CSO providers, they do not have direct control over the sales representatives and the sales process. This lack of control can create challenges in ensuring that CSO providers comply with regulatory and compliance requirements, particularly if the CSO provider is operating in a different geographic region with other regulations.

Additionally, CSO providers are not as invested in compliance as pharmaceutical companies, as they do not face the same level of legal and financial risk if they fail to comply. This creates a misalignment of interests between pharmaceutical companies and CSO providers, which leads to potential risks related to regulatory and compliance requirements.

Rising use of telemedicine and remote detailing

The COVID-19 pandemic has accelerated the trend towards telemedicine and remote communication as healthcare providers seek to limit in-person interactions to reduce the spread of the virus. This has created a need for remote detailing, which involves using technology to communicate with healthcare providers and present product information. This presents an opportunity for CSO providers to leverage technology to provide remote detailing services and develop innovative and engaging materials. In addition, remote detailing helps pharmaceutical companies reach healthcare providers safely and effectively while reducing costs associated with in-person sales calls.

Using technology to deliver product information and engage with healthcare providers remotely, CSO providers can help pharmaceutical companies maintain their sales and marketing efforts, even amid a pandemic.

Moreover, remote detailing provides greater flexibility and convenience for healthcare providers, as they participate in sales calls from their office or home without needing to travel to a physical location. This helps to improve the overall customer experience and increase the likelihood of successful sales outcomes. Furthermore, using technology in remote detailing provides opportunities for greater data collection and analysis, which helps pharmaceutical companies make more informed decisions about their sales and marketing efforts.

By collecting data on the effectiveness of remote detailing materials and strategies, CSO providers help pharmaceutical companies optimize their sales and marketing efforts and improve their return on investment. Therefore, the increasing use of telemedicine and remote detailing presents a significant opportunity for the pharmaceutical contract sales outsourcing (CSO) market. CSO providers leverage technology to provide innovative and engaging sales and marketing materials while helping pharmaceutical companies safely and effectively reach healthcare providers.

Based on the service, the market is segmented into personal promotion, non-personal promotion, and others. In 2023, the non-personal segment accounted for the highest market share. This is due to factors including the increasing adoption of digital technologies, cost-effectiveness, and the more significant ability to measure ROI. With the growing use of digital technologies in healthcare, there is a need for pharmaceutical companies to adopt new digital marketing strategies to reach healthcare providers and patients.

Non-personal promotion channels such as email, social media, and online advertising provide a cost-effective and targeted way to reach specific audiences. Non-personal promotion is often less expensive than personal promotion, which involves face-to-face interactions between sales representatives and healthcare providers. This makes it an attractive option for pharmaceutical companies looking to reduce costs and maximize their return on investment.

Furthermore, Non-personal promotion channels provide greater visibility into the effectiveness of sales and marketing efforts, as data can be easily collected and analyzed. This allows pharmaceutical companies to make more informed decisions about their marketing strategies and adjust them as needed to improve ROI. Therefore, the growing adoption of digital technologies and the need for cost-effective marketing strategies drive the growth of the non-personal promotion segment.

Based on the therapeutic area, the pharmaceutical contract sales outsourcing (CSO) market is segmented into cardiovascular disorders, oncology, metabolic disorders, neurology, orthopedic diseases, infectious diseases and others. In 2023, the oncology segment accounted for the highest market share. The incidence of cancer worldwide has been increasing over the years, with an estimated 19.3 million new cases and 10 million cancer-related deaths reported in 2020, according to the World Health Organization (WHO).

This has led to a growing demand for cancer treatments and therapies, including pharmaceuticals, and subsequently for pharmaceutical contract sales outsourcing in the oncology therapeutic area. In addition, the introduction of new and innovative cancer therapies, such as targeted therapies and immunotherapies, has also contributed to the growth of the pharmaceutical contract sales outsourcing market in the oncology segment. These complex therapies require specialized knowledge and expertise, which pharmaceutical contract sales outsourcing companies can provide to effectively market and sell these drugs.

Furthermore, the increasing focus on personalized medicine and precision oncology has created new opportunities for pharmaceutical contract sales outsourcing in the oncology segment. These approaches require a deeper understanding of the patient population and their unique treatment needs, which can be facilitated by pharmaceutical contract sales outsourcing services such as market research and KOL engagement. Therefore, the demand for pharmaceutical contract sales outsourcing in the oncology therapeutic area is expected to grow in the coming years, driven by the increasing incidence of cancer and the ongoing development of new and innovative cancer therapies.

Segments Covered in the Report

By Service

By Therapeutic Area

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

February 2025

September 2024