April 2025

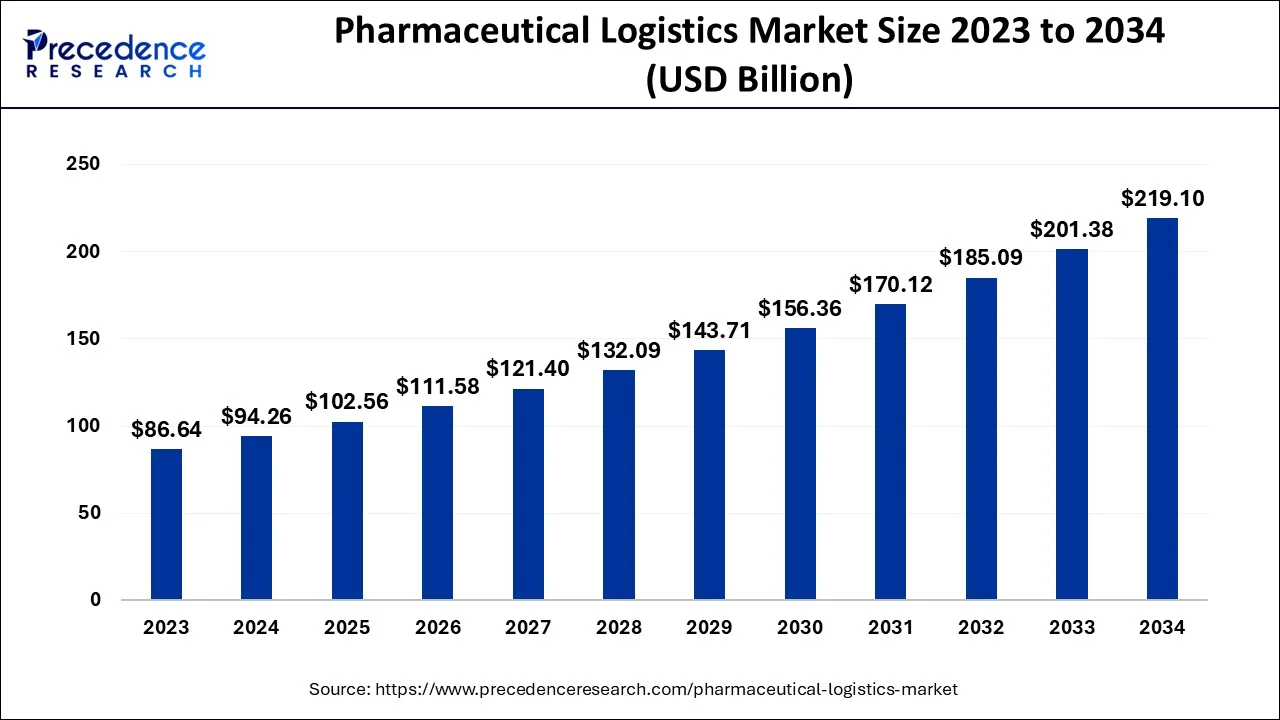

The global pharmaceutical logistics market size is predicted to increase from USD 94.26 billion in 2024, grew to USD 102.56 billion in 2025 and is anticipated to reach around USD 219.1 billion by 2034, poised to grow at a CAGR of 8.80% between 2024 and 2034.

The global pharmaceutical logistics market size accounted for USD 94.26 billion in 2024 and is predicted to surpass around USD 219.1 billion by 2034, expanding at a CAGR of 8.80% from 2024 to 2034.

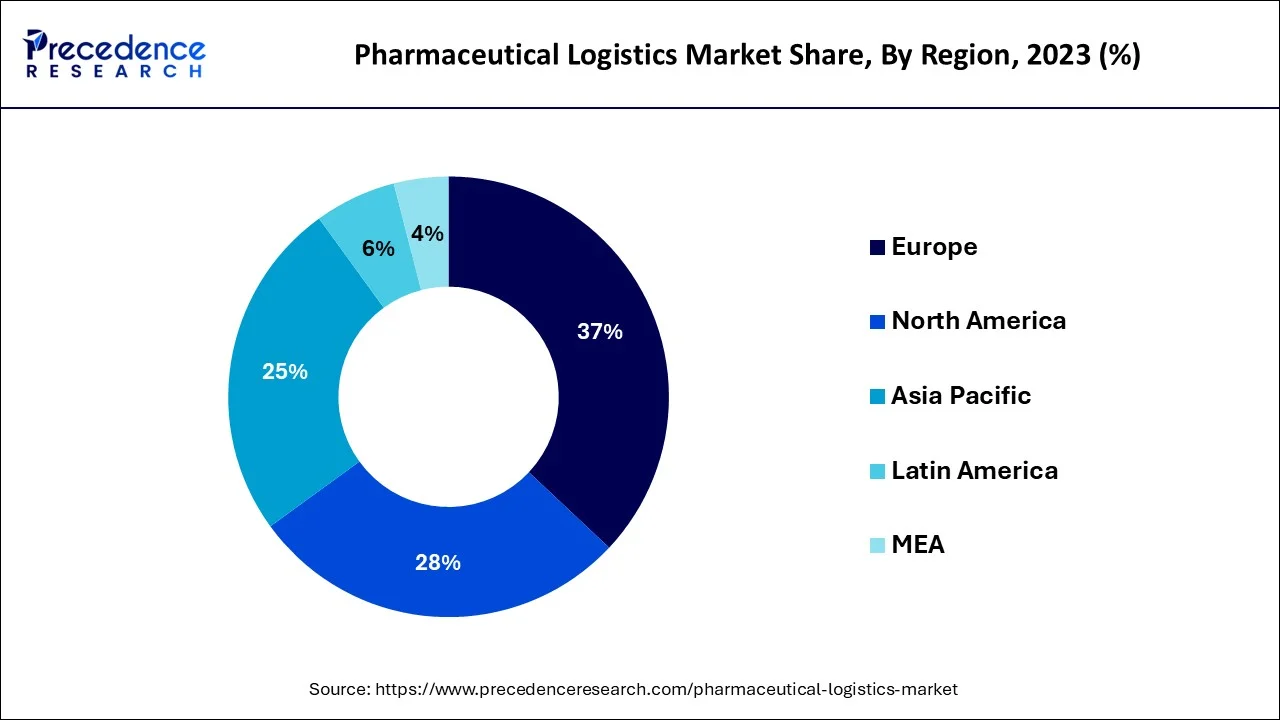

The Europe segment held the highest revenue share of over 37% in 2023, in terms of revenue and is estimated to sustain its dominance during the forecast period. The demand for pharmaceutical logistics is expanding in the UK, Germany, and France, owing to rising generic medicine sales and healthcare regulations that favor generics. Due to the presence of a large number of regional and multinational companies, the pharmaceutical logistics market in Europe is highly fragmented.

On the other hand, the Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. During the forecast period, Asia-Pacific is expected to develop at the fastest CAGR. The rising healthcare and pharmaceutical industries in countries such as Japan, China, and India are driving the pharmaceutical logistics market in Asia-Pacific.

The logistics is used in the pharmaceutical sector to handle the acquisition, storage, and transportation of resources. In this industry, logistics enables for the continual delivery of pharmaceuticals, equipment, and devices from suppliers and distributors located across the country. The pharmaceutical sector largely serves huge drugstore retail chains, medical goods wholesalers, as well as hospitals and clinics directly.

An increasing preference for biological pharmaceuticals in recent years, as well as a growing number of enterprises opting to outsource is some of the important drivers expected to drive demand for pharmaceutical logistics in the anticipated period. The large volumes of pharmaceutical products are increasingly being shipped over long distances by manufacturers.

These pharmaceutical products are often delicate and costly. The pharmaceutical logistics allows for consistent refrigeration of products from the time to manufacture, through shipping, storage, handling, and to delivery. The growing market for temperature-sensitive medications and biological medical products, as well as growing awareness among pharmaceutical and logistics firms are expanding the scope for temperature-controlled pharmaceutical logistics and benefitting the growth of pharmaceutical logistics market during the forecast period.

There are some constraints and obstacles that will stifle the market expansion. The factors such as inefficient products and price rules that differ from place to place around the world. These factors may limit the pharmaceutical logistics market’s growth in the anticipated future.

The rising demand for household healthcare products and the growing necessity to fast track support are both contributing to market expansion. Furthermore, the demand for pharmaceutical logistics is increasing as the requirement for maintaining the cold chain integrity of pharmaceutical products grows, and the cost of distribution is being reduced by developing a single source distribution channel.

The rise in pharmaceutical demand is one of the primary drivers driving the growth of cold chain logistics for the pharmaceutical industry. Over the last few years, global life expectancy has increased significantly. The global pharmaceutical sales are predicted to increase during the forecast period, owing to an increase in average life expectancy. The amount of pharmaceutical trade has expanded globally as a result of rising pharmaceutical sales. In recent years, the pharmaceutical export sector in the U.S. has seen tremendous expansion. The end-user industries are utilizing cold chain logistics to meet the growing demand of the pharmaceutical industry.

There are lot of market players in the global pharmaceutical logistics market, thus it’s tremendously fragmented. The large firms face hurdles as a result of high market fragmentation, which prevents them from growing into other markets or countries.

A major concern for the cold chain logistics segment for the pharmaceutical logistics industry is the functional obstacles in cold chain logistics that increase operating costs. The logistics service providers must make a strategic decision when purchasing land for warehouses, which is part of cold chain logistics. The cold chain is an important function, and having a cold storage close to the manufacturing plant is essential. The profitability of cold chain logistics companies is being harmed as industrial rents is rising. An increase in land costs will require cold chain service companies to invest greater resources. Due to this vendor profit margin will be under pressure. In addition, due to expanding supply-demand imbalance for industrial buildings, warehouse rents are likely to rise in coming years.

| Report Coverage | Details |

| Market Size in 2023 | USD 94.26 Billion |

| Market Size by 2034 | USD 219.1 Billion |

| Growth Rate | CAGR of 8.80% From 2024 to 2034 |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Component, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Based on the type, the non-cold chain logistics segment dominates the market with revenue hare of 73% in 2023. Cold chain logistics is crucial in reducing perishable product and commodity wastages while also providing farmers with fair rates. Cold chain logistics is critical in the pharmaceutical sector for increasing drug efficacy along the supply chain to end users.

On the other hand, the cold chain logistics is expected to grow at rapid pace during the forecast period. Due to growing demand for non-cold chain pharmaceutical medications and other products, the segment is likely to have a significant share in upcoming years.

The storage segment accounted 65.6% market share in 2023. The rapidly expanding demand for generic and branded pharmaceutical medicines has increased the requirement for storage facilities to conserve and procure these products’ effectiveness after production and delivery to distributors and retailers through numerous channels.

On the other hand, the transportation is expected to grow at rapid pace during the forecast period. The transportation segment is expected to increase at a rapid pace during the forecast period. The air freight logistics, sea freight logistics, and overland logistics make up the transportation component segment. The pharmaceutical logistics market is being driven by the increased adoption of sea-based pharmaceutical logistics, which can handle sensitive large molecule biologics as well as individualized medications.

Pharmaceutical key market players are constantly pursuing strategic initiatives such as mergers and acquisitions to maintain their market position. FedEx, for example, acquired Manton Air-Sea Pty Ltd. FedEx was able to strengthen its geographical footprint in Asia-Pacific as a result of the acquisition.

The various developmental strategies such as partnerships, new product launches, acquisition, joint venture, R&D investments, and mergers fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Type

By Component

By Application

By Procedure

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

February 2025

September 2024