March 2025

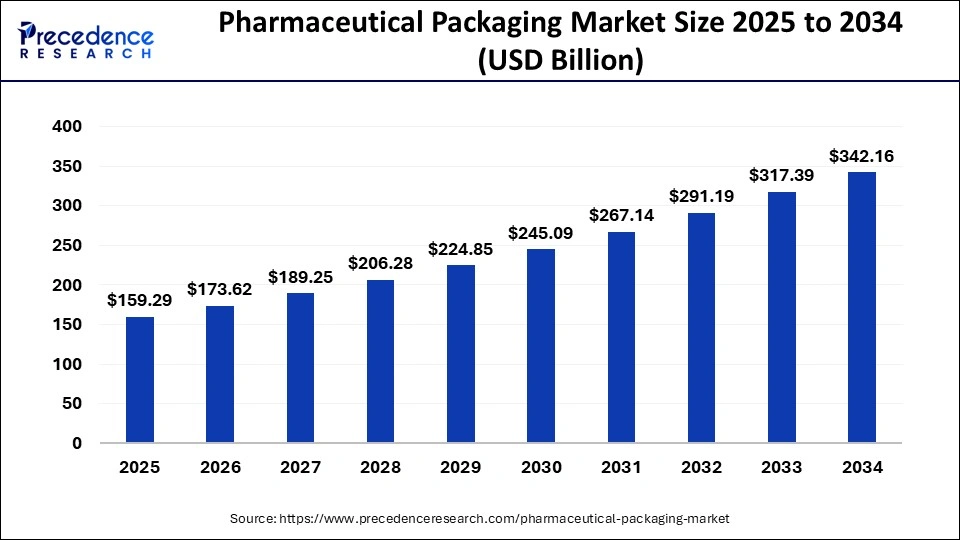

The global pharmaceutical packaging Market size is estimated at USD 159.29 billion in 2025 and is anticipated to reach around USD 342.16 billion by 2034, expanding at a CAGR of 8.88% from 2025 to 2034. The North America pharmaceutical packaging market size reached USD 56.99 billion in 2024 and is expanding at a CAGR of 8.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical packaging market size accounted for USD 146.14 billion in 2024 and is predicted to reach around USD 342.16billion by 2034, with a CAGR of 8.88% from 2025 to 2034.

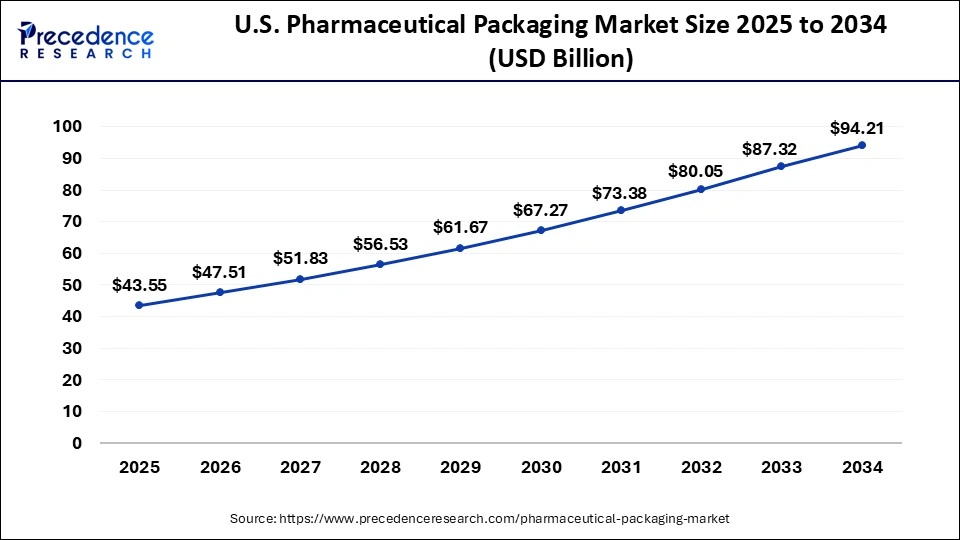

The U.S. pharmaceutical packaging market size was estimated at USD 39.93 billion in 2024 and is predicted to be worth around USD 94.21 billion by 2034, at a CAGR of 8.96% from 2025 to 2034.

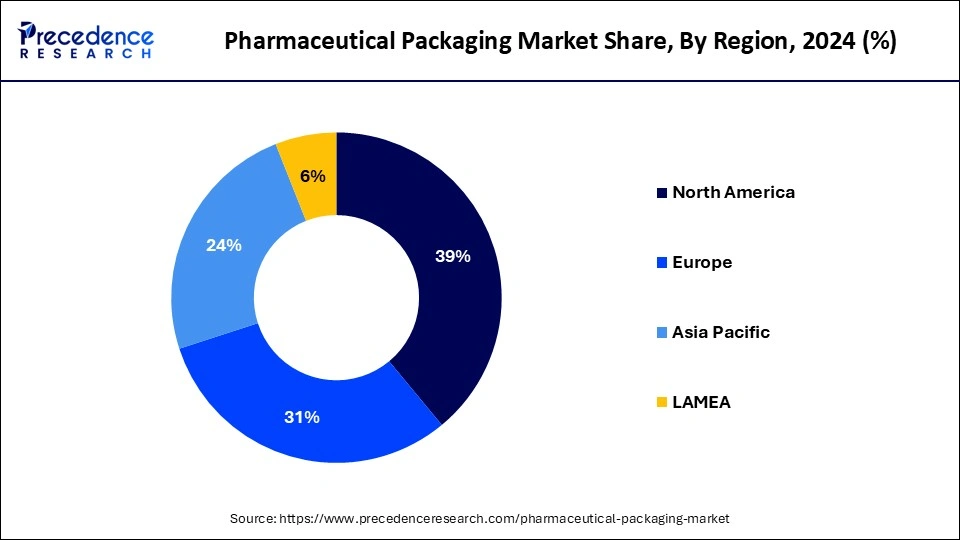

North America led the global market accounting for a value share of around 39% in 2024. The region witnesses significant presence of leading pharmaceutical players in countries that include Canada, the U.S., and Mexico. U.S. registered as the largest pharmaceutical market globally because of developed healthcare infrastructure in the country, high investments in drug development, and high per capita income. In addition, the presence of large number of leading healthcare product manufacturers, such as Johnson & Johnson; Pfizer Inc.; Bristol-Myers Squibb Company; Merck & Co., Inc.; and AbbVie Inc. further expected to contribute prominently towards the growth of the region.

The Asia Pacific projected to witness the fastest growth rate over the forthcoming years. Japan, India, China, and South Korea are some of the prominent markets because of rapidly increasing population along with steady economic growth in the region estimated to propel the packaging demand in the upcoming years. Further, supportive government regulations related to drug safety expected to further boost the growth of the region.

Significant growth in the pharmaceutical industry mostly in the developing economies that include India, China, and Brazil because of rising disposable income, increasing population, and increasing focus on the life expectancy anticipated to be the major driverfor the market growth. In addition, increasing focus of pharmaceutical packaging solution providers on sustainability along with the adoption of recyclable and biodegradable materials is likely to boost the market growth. Moreover, rising preference for convenient packaging types that include auto injectors and prefilled syringes estimated to create immense growth opportunities for the industry players operating in the market.

Increasing demand for patient-oriented drugs and medicines further expected to positively influence the market growth. Some medicines are manufactured using animal, microorganism, plant, or human cells and are commonly prone to contamination as well as are heat sensitive, this in turn estimated to fuel the demand for specific packing solutions leading to the growth in the pharmaceutical packaging market.

| Report Coverage | Details |

| Market Size in 2024 | USD 146.14 Billion |

| Market Size in 2025 | USD 159.29 Billion |

| Market Size by 2034 | USD 342.16 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 8.88% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Material, and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Emphasis on recyclable packaging

Multiple initiatives are being taken by the government and administrations to boost the pace of recyclability. In June 2023, the Cabinet Health of the United States announced the launch of first recycling program for pill bottles. Under the program, consumers/users and even companies can recycle pill bottles. The program aims to eliminate microplastics which is beneficial for human health as well as the environment.

With such initiatives multiple manufacturers are focusing on the development of recyclable packaging for the pharmaceutical industry in order to fulfill the market’s demand. In January 2023, Aptar Pharma launched a high-performance nasal spray for the pharmaceutical industry with recyclable packaging.

Consumers and regulatory bodies are pushing for reduced waste and eco-friendly practices. The shift towards recyclable packaging has led pharmaceutical companies to adopt recyclable solutions. As the demand for such packaging solutions rises, the pharmaceutical industry will focus on the development of environmentally conscious options. Thus, the element acts as a driver for the market.

Rising prices of raw materials

The escalating cost of materials poses a significant constraint for the pharmaceutical packaging market. As raw material prices surge due to supply chain disruptions, increased demand and fluctuating currency values, packaging manufacturers face mounting challenges. These elevated costs cascade down the production chain, compelling pharmaceutical companies to grapple with higher packaging expenses. The pharmaceutical sector demands packaging materials that adhere to stringent quality and safety standards. Escalating material costs, such as plastics, glass and aluminum can substantially impact profit margins. Manufacturers may find I challenging to balance quality and cost-effectiveness, potentially leading to compromised packaging integrity. Thus, rising prices of raw materials act as a restraint for the market.

Development of innovative packaging solutions

In May 2023, a prominent pharmaceutical packaging developer, Bormioli Pharma announced its plan to submit innovative designs for pharmaceutical packaging solutions. The new innovative packaging solutions aim to focus on augmented reality for drug delivery and child-resistant closure systems with biometric recognition.

On the other hand, in 2024, a global leader in sustainable packaging solutions, Huhtamaki announced an innovative packaging solution for the global pharmaceutical industry. The company has launched an innovative push up blister packaging solution with high-performance blister packaging lines. Additionally, the packaging solutions launched by Huhtamaki aim to offer a more sustainable alternative to the traditional packaging.

The development of innovative packaging solutions presents significant opportunities for the market’s growth as these solutions can enhance medication safety, improve patient compliance and address environmental concerns. Features like child-resistant closures, smart packaging and high-performance blister packaging offer improved solutions. These innovations cater to both regulatory and consumer requirements, contributing to the market’s growth.

Stringent regulations

The pharmaceutical packaging industry faces obstacles with the growing challenge of rising stringent regulations. These regulations, often aimed at ensuring patient safety and product efficacy, have become a stringent restraint for the industry. Pharmaceutical products require packaging that adheres to specific quality standards, tamper resistance, child-resistant closures and clear labeling of ingredients. As regulations evolve and become more rigorous, pharmaceutical companies face increased pressure to comply with complex requirements, leading to higher costs for packaging development, testing and approval.

The grip of stringent regulations can be complicated for the manufacturers that can limit the entry of new players in the market. It can be challenging in terms of time and cost needed for receiving approvals. Thus, the stringent regulations factor acts as a major challenge for the market.

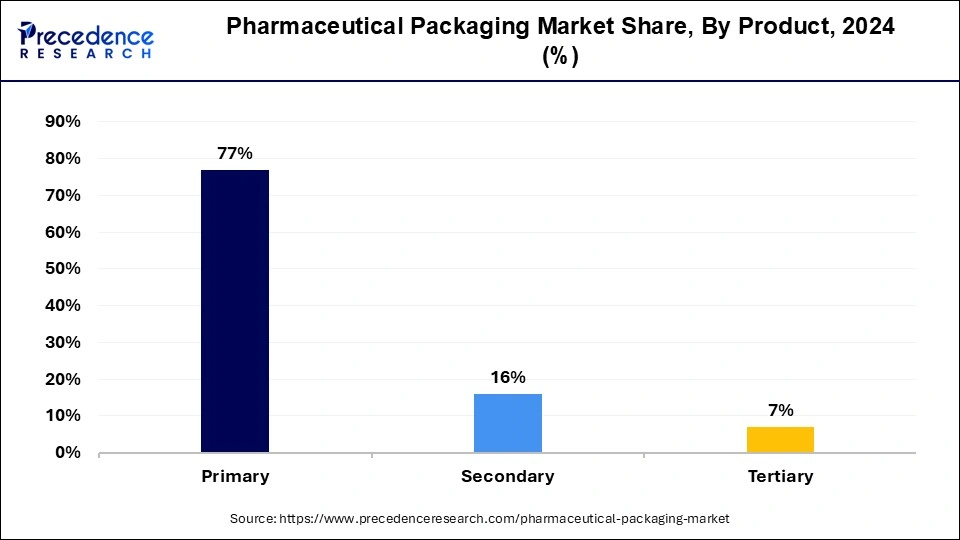

The primary pharmaceutical packaging product segment captured the maximum value share of 77% in 2024 and projected to retain its position over the analysis period. Product advantages that include quality assurance, prevention from contamination, safety during transportation, and enhanced performance are the major factors that anticipated to propel the product demand over the upcoming period.

The primary packaging product segment has been further classified into medication tubes, caps &closures, plastic bottles, blister packs, parenteral containers, pouches, prefillable inhalers, and others. Plastic bottles are the widely used product for packaging various types of medicines and thus emerged as the leader in the primary packaging products.

The secondary product segment projected to witness a highest CAGR over the forecast period. The secondary packaging refers to a consecutive covering or package that are mostly used for the grouping of pharmaceutical packages. They are largely used for logistics and transportation along with display and branding purposes. This type of packaging is used for protecting drugs as well as the primary packaging.

In 2024, pharmaceutical manufacturing held the largest revenue share and projected to maintain the same trend over the forthcoming years. Increasing demand for better medical facilities along with rising population projected to impact positively on the market growth. In addition, favorable government initiatives supporting the development of healthcare industry mostly in the developing countries estimated to boost the segment growth over the analysis period.

Drug or medicine manufacturers are significantly outsourcing the pharmaceutical packaging activities for saving their expenses and time both. Increasing preference for outsourcing service rather than investing on the establishment of packaging infrastructure projected to propel the growth of contract packaging segment during the upcoming years.

By Product

By Material

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

August 2024

September 2024

February 2025