January 2025

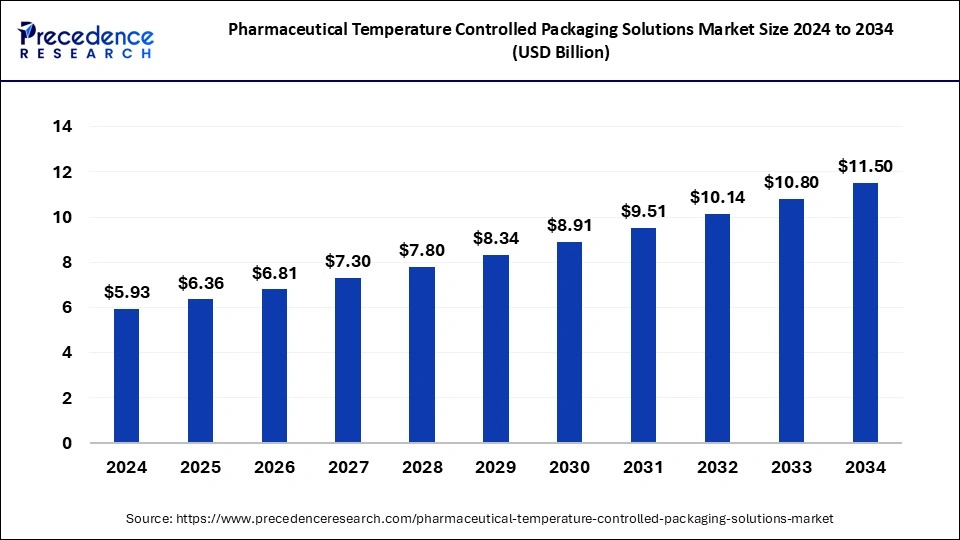

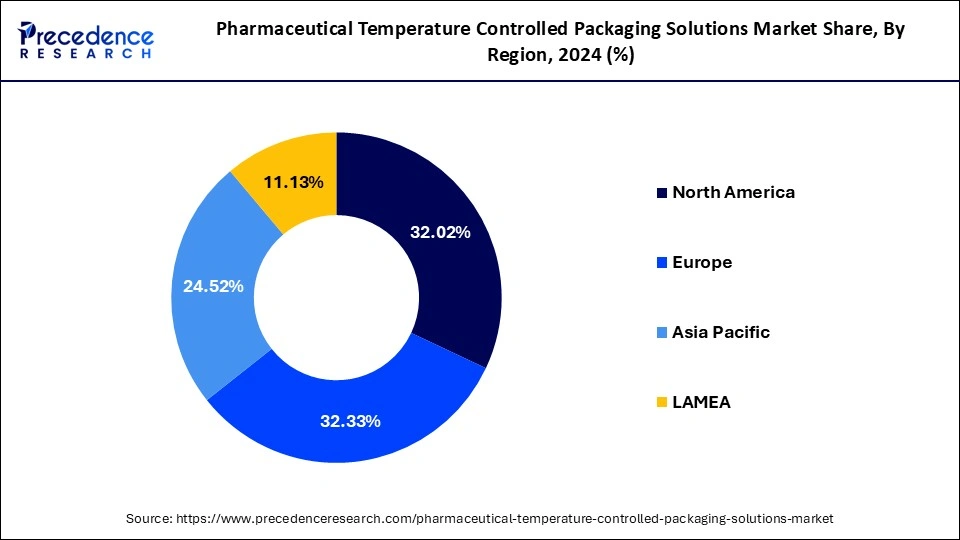

The global pharmaceutical temperature controlled packaging solutions market size accounted for USD 6.36 billion in 2025 and is forecasted to hit around USD 11.50 billion by 2034, representing a CAGR of 6.80% from 2025 to 2034. The North America market size was estimated at USD 1.90 billion in 2024 and is expanding at a CAGR of 5.84% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmaceutical temperature controlled packaging solutions market size was calculated at USD 5.93 billion in 2024 and is predicted to increase from USD 6.36 billion in 2025 to approximately USD 11.50 billion by 2034, expanding at a CAGR of 6.80% from 2025 to 2034.

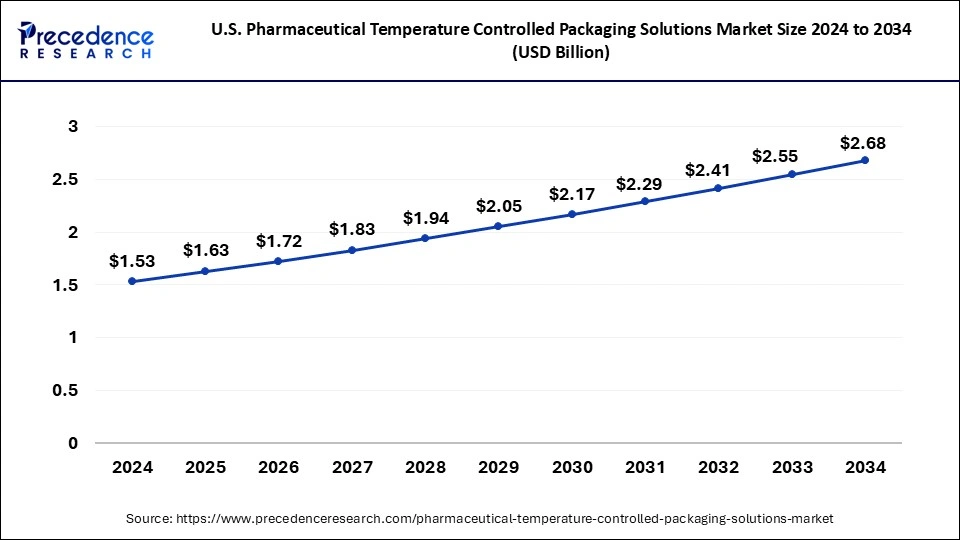

The U.S. pharmaceutical temperature controlled packaging solutions market size was exhibited at USD 1.53 billion in 2024 and is projected to be worth around USD 2.68 billion by 2034, growing at a CAGR of 5.73% from 2025 to 2034.

North America emerged as largest market for temperature-controlled packaging solutions for pharmaceuticals with considerable market share. The market is perceiving high growth on the background of escalating demand from healthcare industry. In this region, high demand for transportation vaccines, drugs and clinical trials has prompted the substantial growth of temperature-controlled packaging solutions. North America, particularly the U.S. is home to many recognized market participants those are involved in evolving technologies and process essential to develop cold chain system proficiently.The present strain of coronavirus has overturned the pharmaceutical supply chain across the globe which has become a foremost roadblock for significant market players. China’s leading role as the ‘world’s factory’ and the domino effect of worldwide lockdowns, product slowdowns, dearth of raw materials, and labor scarcities are putting the international supply chain in general and North America’s temperature-controlled pharma packaging marketplace in specific at risk.

Pharmaceutical temperature-controlled packaging solutions industry in Asia Pacific is projected to grow at the highest CAGR during years to come. This growth can be attributed to the cumulative demand for insulated packaging from nations, such as Japan, China, and India.Asia Pacific is anticipated to perceive momentous growth on account of current stress of coronavirus as well as due to current restrictions on the export of numerous active pharmaceutical ingredients (APIs) from India. Further,restriction on high number of U.S. based generic drug manufacturers whose supply chain is profoundly dependent on Chinese suppliers is also stimulating market growth.

The pharmaceutical temperature-controlled packaging solutions market refers to the industry segment focused on providing packaging solutions specifically designed to maintain the temperature integrity of pharmaceutical products during transportation and storage. These solutions are crucial for preserving the efficacy and safety of temperature-sensitive medications and vaccines, which can be compromised if exposed to temperature fluctuations outside of their specified range. The market for pharmaceutical temperature-controlled packaging solutions encompasses a wide range of products and services, including insulated shipping containers, refrigerated packaging systems, temperature monitoring devices, data loggers, thermal blankets, and packaging materials with insulating properties.

One of the most challenging supply chains include shipping temperature-controlled products from source to destination while preserving product temperature. Normal supply chains have numerous variables to manage to safeguard a successful outcome. Yet, when temperature control is encompassed another 30 to 40 variables add to the complication. Employment of firm government regulation and rulesby the government to progress the distribution practices of pharmaceutical goods are predictable to spur the market growth. As per the Food & Drug Administration (U.S.), Regulation 21 CFR 211.150 Distribution procedures, pharmaceutical products must be shipped insuitable temperatures and underneath accurate circumstances in harmony with necessities and suitable manual, electronic or electromechanical temperature and humidity recording equipment, and/or logs, devices must be used to document appropriate storage of prescription drugs.

Escalating research and development programs across the world for improving packaging and manufacturing process in pharmaceuticals and biotech sectors are predictable to bolster the market growth of temperature-controlled packaging solutions for pharmaceuticals. Furthermore, the swelling development of novel drugs and therapies like r-proteins, monoclonal antibodies stem cells together with pharmaceutical materials have elevated the demand for cold chain packaging system at numerous phases of product development, thus boosting the growth of the market. However, future demand for temperature-controlled packaging solutions is anticipated to be curtailed owed to rising concerns connected to the environmental influence of packaging waste and severe government rules for the same.

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.80% |

| Market Size in 2025 | USD 6.36 Billion |

| Market Size by 2034 | USD 11.50 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, Region |

Increasing demand for biopharmaceuticals

The pharmaceutical temperature-controlled packaging solutions market is being driven by the global demand for biopharmaceuticals. Biopharmaceuticals, such as vaccines, proteins, and monoclonal antibodies, are often highly sensitive to temperature fluctuations. Maintaining their stability throughout the supply chain is critical to ensuring their efficacy and safety. Temperature-controlled packaging solutions are necessary to preserve the integrity of these delicate biologics.

The pharmaceutical industry has become increasingly globalized, with products often manufactured in one region and distributed to multiple countries worldwide. This complex supply chain necessitates robust temperature-controlled packaging solutions to ensure that biopharmaceuticals remain within their specified temperature range during transit across various climates and geographical locations.

Environmental concerns

Many temperature-controlled packaging solutions rely on refrigerants and other materials that can have a negative impact on the environment. As environmental regulations become stricter, pharmaceutical companies may face pressure to adopt more sustainable packaging solutions, which could restrain the market growth of traditional temperature-controlled packaging. Temperature-controlled packaging solutions must be compatible with various transportation modes, including air, sea, and land. Ensuring compatibility across different transportation networks can be challenging and may limit the adoption of certain packaging solutions.

Technological advancements

With advancements in sensor technology and IoT (Internet of Things), temperature-controlled packaging solutions can now offer more precise monitoring and control of temperature-sensitive pharmaceuticals during storage and transportation. This ensures the efficacy and safety of the drugs, reducing the risk of spoilage or degradation. Technologies such as blockchain can be integrated into

temperature-controlled packaging solutions to enhance security and traceability. This ensures that pharmaceutical products are not tampered with or counterfeited during transit, maintaining their integrity and safety.

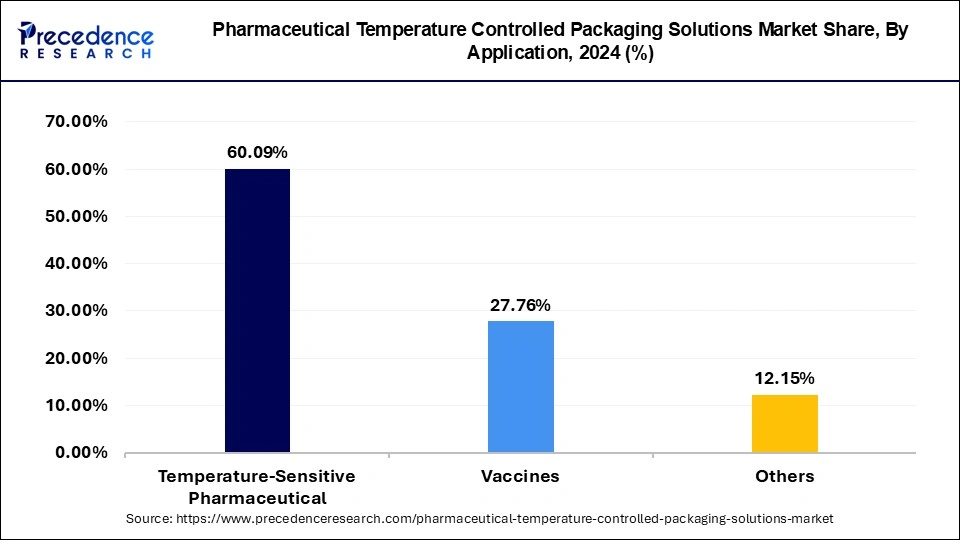

In 2024, the temperature-sensitive pharmaceutical segment held the largest share of the market. Pharmaceutical products, especially certain medications, vaccines, and biologics, are highly sensitive to temperature variations. Even slight deviations from the recommended storage conditions can lead to degradation or loss of efficacy. Therefore, there's a critical need for temperature-controlled packaging solutions to maintain the integrity of these products during storage and transportation.

The demand for temperature-sensitive pharmaceuticals is consistently high due to the increasing prevalence of chronic diseases, the growing aging population, and the development of biologic drugs and vaccines. As a result, pharmaceutical companies need reliable temperature-controlled packaging solutions to deliver their products safely to patients, healthcare providers, and distribution centers worldwide.

The vaccines segment is observed to grow at the fastest rate during the forecast period. Vaccines are often highly sensitive to temperature variations. They require precise temperature control to maintain their efficacy. This necessity for precise temperature control drives the demand for sophisticated temperature-controlled packaging solutions. With the development of new vaccines and the expansion of existing immunization programs, there's a growing need for vaccine production and distribution on a larger scale. This increased volume of vaccines being transported necessitates efficient and reliable temperature-controlled packaging solutions to safeguard their integrity throughout the supply chain.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market Revenue, By Application, 2022-2024 (USD Million)

| By Application | 2022 | 2023 | 2024 |

| Temperature-Sensitive Pharmaceutical | 3,110.13 | 3,330.71 | 3,563.91 |

| Vaccines | 1,399.90 | 1,518.73 | 1,646.25 |

| Others | 634.71 | 676.76 | 720.74 |

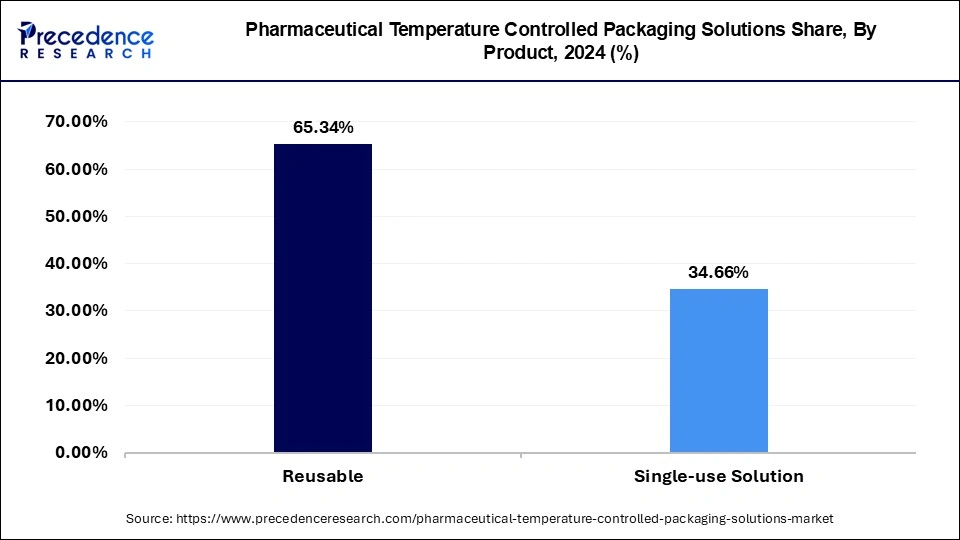

The reusable segment dominated the market in 2024. Reusable packaging solutions often offer better insulation and temperature control capabilities compared to single-use options. This is crucial in pharmaceutical transportation, where maintaining product integrity and efficacy is paramount. Reusable packaging can provide more reliable temperature control, reducing the risk of temperature excursions and ensuring that pharmaceutical products remain within specified temperature ranges throughout the shipping process.

Global Pharmaceutical Temperature Controlled Packaging Solutions Market Revenue, By Product, 2022-2024 (USD Million)

| By Product | 2022 | 2023 | 2024 |

| Reusable Solutions | 3,375.20 | 3,618.20 | 3,875.41 |

| Single Use Solutions | 1,769.54 | 1,908.00 | 2,055.49 |

Key Companies & Market Share Insights

The rising emphasis of manufacturers to make use of reusable packaging containers is probable to support the growth of the pharmaceuticals temperature-controlled packaging solutions market. On account of regulatory pressure and the necessity to diminish transportation costs, merchants are concentrating on approving reusable packaging containers than one-way or disposable systems as it decreases the practice of insulation products and refrigerants that are linked with global warming and ozone depletion. The above-mentioned influences are expected to substitute the growth of the market across the world during estimated period.

The majority of the crucial players uphold a strategic focus on North American and Western European markets, on account of the high penetration of related products in the region, while APEJ is also striking a market with nations such as China and India with astonishing healthcare and medical facilities. Foremost market companies in the pharmaceuticals temperature-controlled packaging solutions market are also directed on the development of new-fangled products with improved properties, at the same time cost competitiveness will endure a robust differentiation strategy.

By Product

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

September 2024

February 2025