March 2025

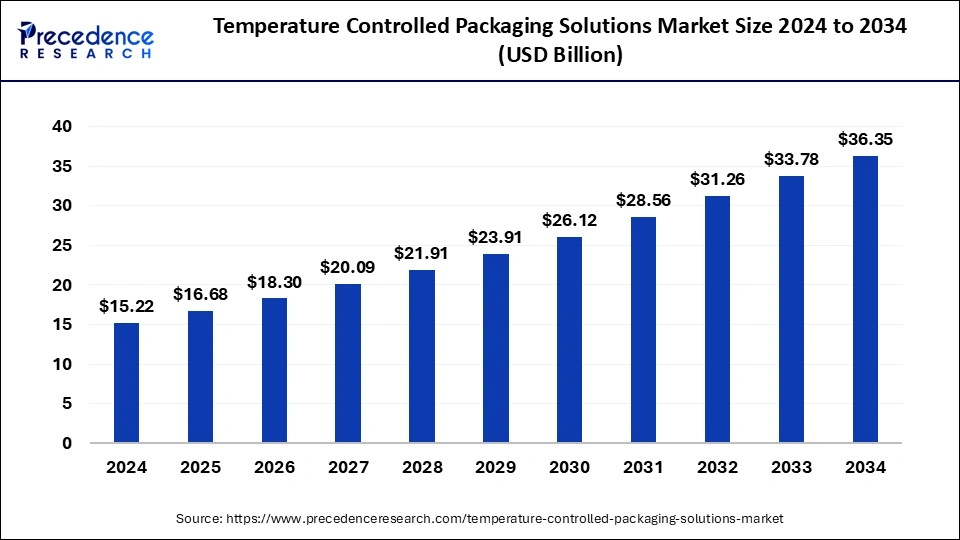

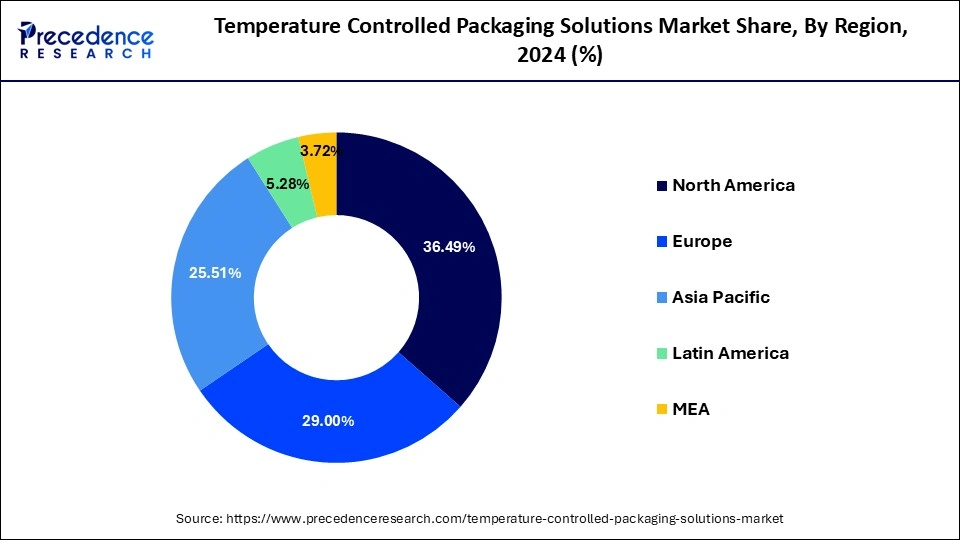

The global temperature controlled packaging solutions market size accounted for USD 16.68 billion in 2025 and is forecasted to reach around USD 36.35 billion by 2034, accelerating at a CAGR of 9.04% from 2025 to 2034. The North America market size surpassed USD 5.55 billion in 2024 and is expanding at a CAGR of 9.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global temperature controlled packaging solutions market size was evaluated at USD 15.22 billion in 2024 and is predicted to increase from USD 16.68 billion in 2025 to approximately USD 36.35 billion by 2034, expanding at a CAGR of 9.04% from 2025 to 2034.

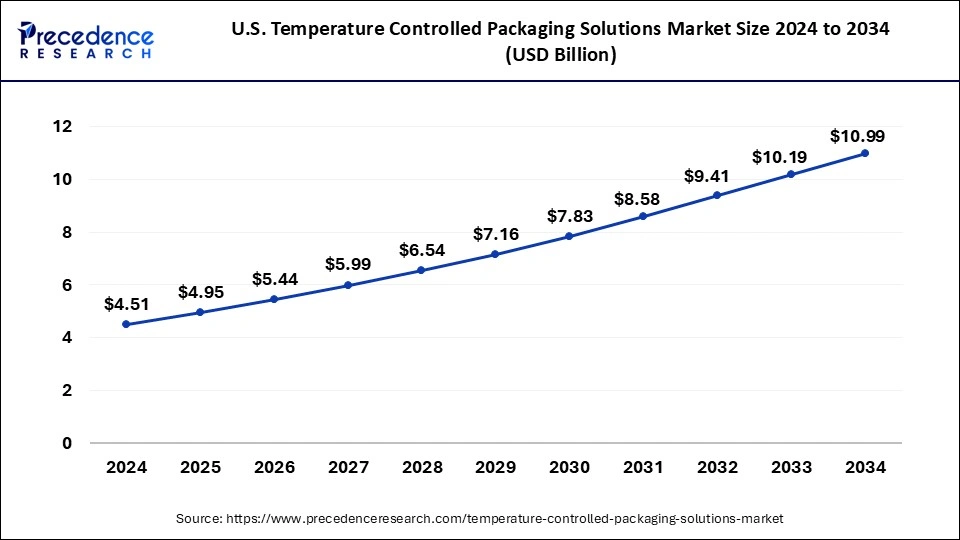

The U.S. temperature controlled packaging solutions market size was exhibited at USD 4.51 billion in 2024 and is projected to be worth around USD 10.99 billion by 2034, growing at a CAGR of 9.27% from 2025 to 2034.

North America has held largest revenue share in the temperature controlled packaging solutions market in 2024. The market is witnessing high growth on the backdrop of burgeoning demand from healthcare sector. The demand for transportation drugs, vaccines and clinical trials in North America has triggered the temperature controlled packaging solutions growth. North America, especially the U.S. is home to many established players which are engaged in developing technologies and process necessary to develop cold chain system efficiently.

Due to the increasingly rising demand for frozen goods and well developed infrastructure in large urban populations, China is a top market for cold chain production. A rapid transition from a manufacturing and construction-led economy to a consumer-led economy is currently under way in China. In the middle class, rapid growth provides tremendous opportunities. The demand for the use of cold chain storage and transportation systems has increased in cities such as Beijing and Shanghai.

Growing demand for fresh and frozen foods, combined with increasing use in the pharmaceutical industry, is expected to fuel market growth in the future. In addition, the rapid global growth of the cold-chain industry is expected to have a positive effect on business growth.

Further, rising consumer health awareness has fuelled the worldwide market for fresh fruits and vegetables. China and South Africa have seen rapid increases in fresh food over the past few years. As a result, grocery stores, including supermarkets, hypermarkets and convenience stores, have increased their investment in advanced fruit and vegetable packaging technology.

Additionally, the demand for frozen foods around the world has been boosted by evolving lifestyles and busy schedules. Owing to time constraints, customer tastes are moving towards ready to eat meals. For their shipping, these frozen and ready to cook foods need a particular temperature. Therefore, it is expected that a favorable trend in the consumption of frozen foods would benefit the scope of temperature-controlled packaging. The countries with a strong demand for frozen food are the U.S., China, India and the Philippines.

| Report Highlights | Details |

| Market Size by 2025 | USD 16.68 Billion |

| Market Size by 2034 | USD 36.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.04% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for fresh and frozen food

Rising demand for fresh and frozen food across the globe is major factor driving growth of the global temperature-controlled packaging solutions market. Changing lifestyles along with busy schedules have driven the demand for the frozen foods across the globe especially in the developed countries like U.S. Canada etc. Time constraint has become main factor for shifting consumer preferences towards ready to eat meals. These frozen and ready to cook foods need a specific temperature for their shipment, owing to which the favorable trend of the consumption of frozen foods is predictable to encourage the scope of temperature-controlled packaging.

The Philippines, India, China, and the U.S. are the highly demanding frozen food countries that are propelling global industry growth. Demand for convenient foods has also increased with the growing buying power of South Asian countries such as Pakistan, Bangladesh and India. In addition, the variety of processed foods that is expected to continue and will fuel the growth of the target industry in the near future has been endorsed by the rising participation rate of women in the workforce.

The demand for vegetables as well as fresh fruits worldwide has been powered by rising health awareness among consumers. China and South Africa have seen rapid increases in fresh food over the past few years. As a consequence, grocery retailers, including supermarkets, hypermarkets and convenience stores, have increased their investment in advanced fruit and vegetable packaging technology.

In addition, the leading importers of fresh fruits and vegetables from developed countries are the Netherlands, the United Kingdom and Belgium. The banana is the fruit most eaten in the U.S. and European countries. Therefore, within the next few years, fresh fruit and vegetable suppliers worldwide are expected to use temperature-controlled packaging solutions for their finished products.

Intensifying product type in the pharmaceutical industry

Intensifying product type in the pharmaceutical industry is among major factors expected to augment growth of the global temperature-controlled packaging solutions market. Wide application reach of the pharmaceutical industry is fueling the demand for temperature-controlled packaging products considerably. Temperature controlled pharmaceutical packaging solutions is an important tool for mitigating risk and preserving product quality during the supply chain phase by stabilizing the internal temperature.

This scheme helps to secure shipments in any part of the medical supply chain. Inactive pharmaceutical ingredients with balanced temperatures, vaccines, biological samples & products, clinical trials, and medical products with unique timeline specifications are some of the main applications of temperature-controlled packaging solutions. The Food and Drug Administration has defined thermal specifications for the various drugs to be shipped, treated, and processed. The thermal and hygiene requirements of healthcare goods, including medications, vaccines, blood, and organs, are met by these containers.

International health organizations like the World Health Organization have stressed reducing vaccine waste over the past few years. Moreover, rising vaccine wastage monitoring programs are expected to fuel demand for the commodity in the future. It is expected that the introduction of strict government rules and government regulations to improve the distribution practices of pharmaceutical products would fuel market growth.

The market growth of temperature-controlled packaging solutions for pharmaceuticals is expected to be fueled by increasing research and development programs across the globe to enhance the manufacturing and packaging processes in the pharmaceutical and biotech industries. In addition, the growing production, alongside pharmaceutical materials, of novel drugs and therapies including monoclonal antibodies, r-proteins, stem cells, has further increased demand for a cold chain packaging system thereby driving market growth.

Stringent rules & regulations formulated by government agencies

Stringent government regulations associated with the usage of specific types of pharmaceutical products for production of temperature-controlled packaging solution is major factor expected to limit growth of the global temperature-controlled packaging solutions market over the forecast time frame.

Additionally, many safety measures are essential to maintain during packaging of pharmaceutical product like the container should be clean, dry etc. These factors are predictable to limit the market growth of temperature-controlled packaging solutions for pharmaceuticals. Moreover, certain precautions need to be maintained during the packaging of pharmaceutical products, such as clean and dry containers, etc.

It is expected that the above factors will limit the market growth of temperature-controlled packaging solutions for pharmaceuticals. In the pharmaceutical industry, the high investment and maintenance costs associated with the temperature-controlled pharmaceutical packaging solution are expected to inhibit market growth over the forecast period.

Lack of understanding of the advantages of temperature-controlled pharmaceutical packaging solutions, as only a few companies in the industry are using temperature-controlled pharmaceutical packaging solutions, is expected to hamper market growth over the forecast period.

Growing focus of pharmaceutical manufacturer to produce drugs and therapies for rare diseases

Growing focus of pharmaceutical manufacturers on producing drugs and therapies for rare disease is expected to create lucrative growth opportunities in the global market. Key layers operating in the pharmaceutical industry are investing hugely on the research and development of vaccines for the rare diseases including blood diseases. Increasing government initiatives and rising support encouraging companies worldwide to develop orphan drugs for the rare diseases.

Food and Drug Administration has approved numbers of such drugs for rare diseases in last few years. These orphan drugs are formulated by the ingredients of high value and with the short shelf lives. This results into high requirement of the stringent temperature-controlled atmosphere and thereby this is predictable to raise the ultra-low temperature range packaging solutions and fuelling target industry growth.

Acceptance of novel great performance convection systems that are efficient for warehousing as well as supply of healthcare products is predictable to offer huge potential opportunities for the vendors in the global industry across the globe. Moreover, increased adoption of thermal controlled solutions that are used to enhance the shelf life is expected to support growth of the industry. For, instance, demand for the vacuum panel insulation with phase change materials can enhance the shelf life of stored pharmaceutical product hence increasing adoption of such advanced technologies in the pharmaceutical industry is anticipated to fuel the market growth.

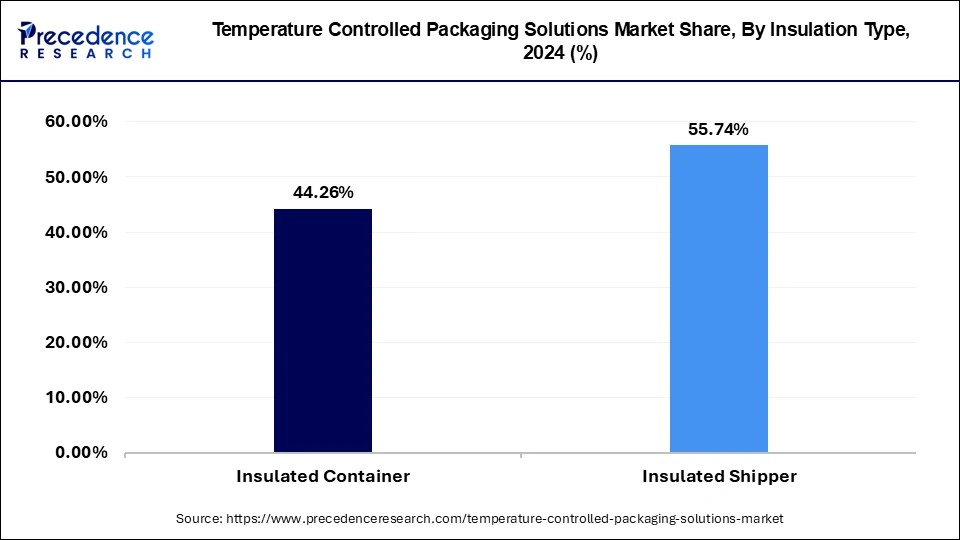

The insulated shippers are expected to gain highest share of 55.83% in 2024. The convenience of shippers is expected to be promoted by a wide variety of applications in many industries including pharmaceutical, food and beverage, and chemical. The demand for insulated shippers has been increased constantly by developing technology. The introduction of phase change materials (PCMs) and vacuum insulated panels (VIP) technology, for example, has enabled insulated shippers to offer a low-distribution temperature range. The shipping of medicinal and pharmaceutical products has gained considerable utility from these products.

In 2024, insulated containers produced an income of USD 6.13 billion. These containers are used mainly to transport food, chemicals, biological materials, blood, and organs. To monitor and log the temperature of the entire distribution system, these containers are a vital part of the cold chain.

Global Temperature Controlled Packaging Solutions Market Revenue, by Insulation Type, 2022-2024 (USD Million)

| Insulation Type | 2022 | 2023 | 2024 |

| Insulated Container | 5,601.34 | 6,139.24 | 6,735.46 |

| Insulated Shipper | 7,108.36 | 7,761.36 | 8,482.84 |

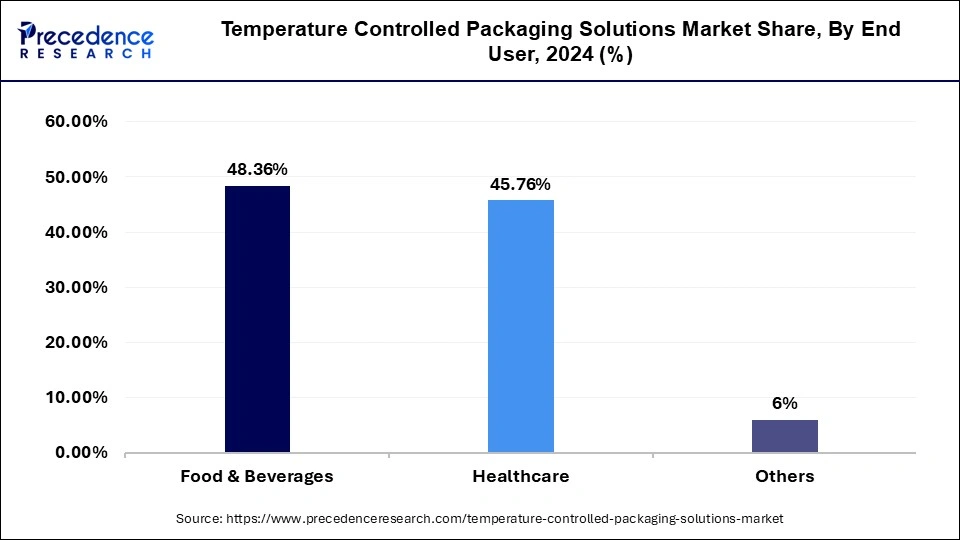

The temperature-controlled packaging solutions industry is divided into food & beverages, healthcare, and others (chemical and biothermal) depending on the type of end consumer. With the aid of a temperature-controlled packaging solution, the food & beverage business includes the transport of temperature-sensitive items from one place to another. During transportation, foods such as beef, dairy goods, frozen foods, and beverages such as cold drinks, milk, and others need temperature-controlled packaging solution.

The logistics industry has been substantially boosted by booming international trade and trade liberalization, including the North American Free Trade Agreement (NAFTA) and the European Union Free Trade Agreement (FTA). A big part of this industry is the transportation and packaging sector, and over the years it has seen tremendous growth.

Similarly, due to the globalization of foreign trade in perishable products, the cold-chain industry is rising at a lucrative pace worldwide. The advancement of technology has fuelled this industry's growth and increased demand for insulated packaging around the world. However, dielectric materials have gained significant importance over the past few years owing to their increasing demand and opportunity in applications such as food & beverages, healthcare, and others.

Global Temperature Controlled Packaging Solutions Market Revenue, by End User, 2022-2024 (USD Million)

| End User | 2022 | 2023 | 2024 |

| Food & Beverages | 6,178.50 | 6,739.85 | 7,359.45 |

| Healthcare | 5,768.18 | 6,334.40 | 6,963.16 |

| Others | 763.02 | 826.35 | 895.69 |

The global Temperature Controlled Packaging Solutions market seeks intense competition among the market players owing to rapid changing consumer preference. Further, the industry participants are prominently adopting inorganic as well as organic growth strategies that include partnership, collaboration, merger & acquisition, and many others to maintain their competitive edge in the global market. Apart from this, they invest prominently in the R&D activity for new product development & advancements.

By Type

By Insulation Type

By Product Type

By End User

By Material

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

January 2025