October 2024

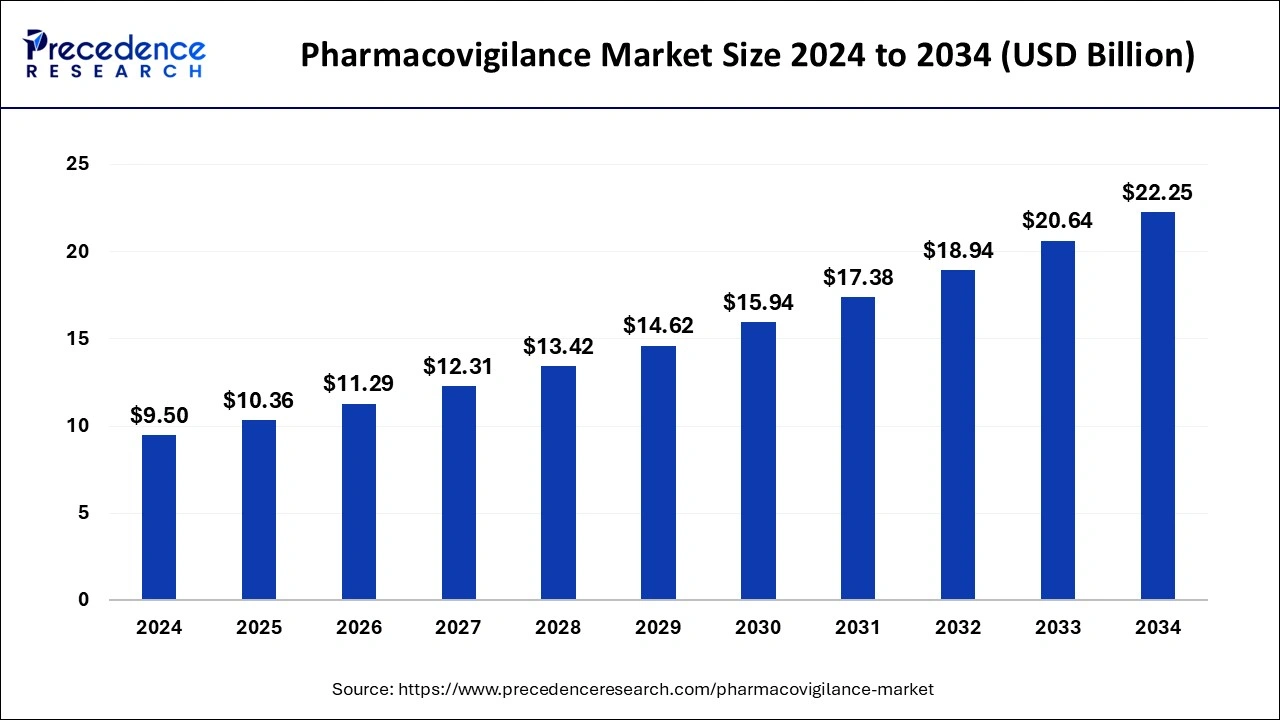

The global pharmacovigilance market size is calculated at USD 10.36 billion in 2025 and is forecasted to reach around USD 22.25 billion by 2034, accelerating at a CAGR of 8.88% from 2025 to 2034. The North America pharmacovigilance market size surpassed USD 2.96 billion in 2024 and is expanding at a CAGR of 8.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pharmacovigilance market size was estimated at USD 9.50 billion in 2024 and is expected to reach over USD 22.25 billion by 2034, poised to grow at a registered CAGR of 8.88% from 2025 to 2034. The growing incidences and prevalence of chronic diseases will continue aiding pharmacovigilance market in the forecast period.

The rising applications of artificial intelligence (AI) in the pharmaceuticals and healthcare industries has led to adoption of AI into the pharmacovigilance market. AI technology helps in detection and assessment of potential adversities by detecting patterns through analyzation of vast amount of data from various sources. With AI technology, detection and assessment of adverse drug reactions helps professionals of the field make an informed decision. The integration of AI in pharmacovigilance services helps in boosting efficiency and effectiveness of the drug monitoring safety process. This market can expand even further with adoption of AI during the forecast period.

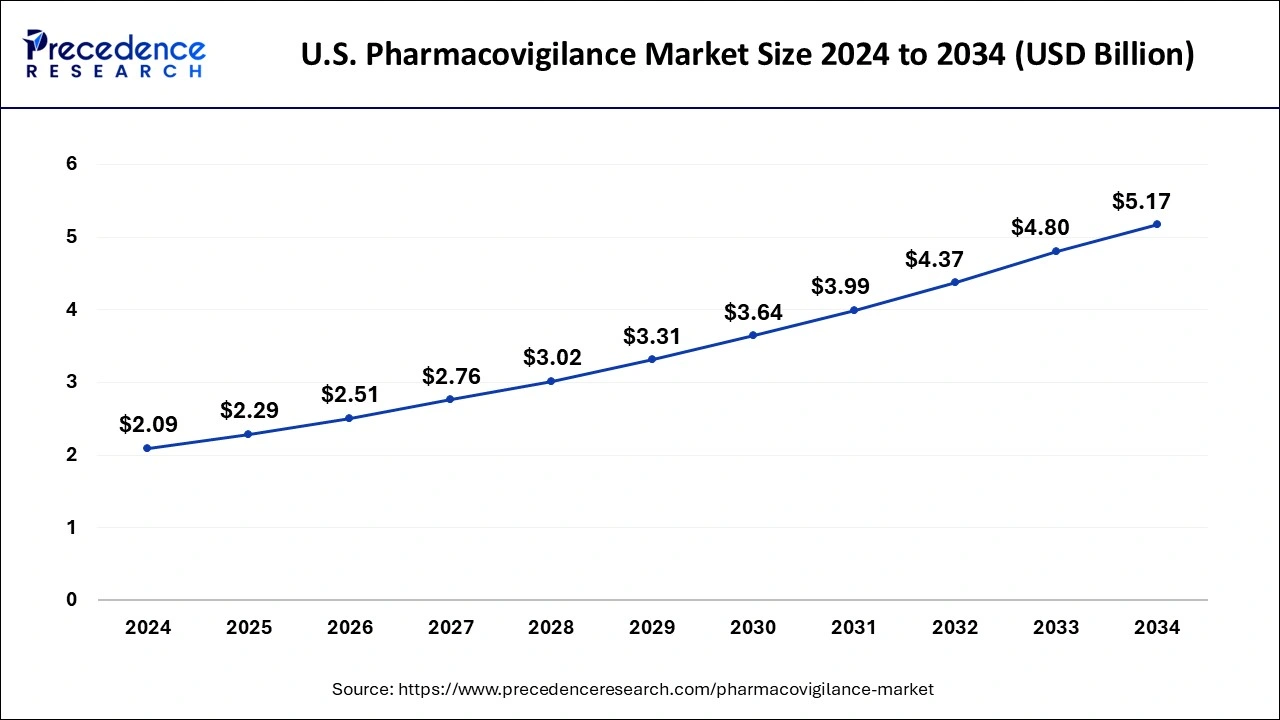

The U.S. pharmacovigilance market size was estimated at USD 2.09 billion in 2024 and is predicted to be worth around USD 5.17 billion by 2034, at a CAGR of 8.90% from 2025 to 2034.

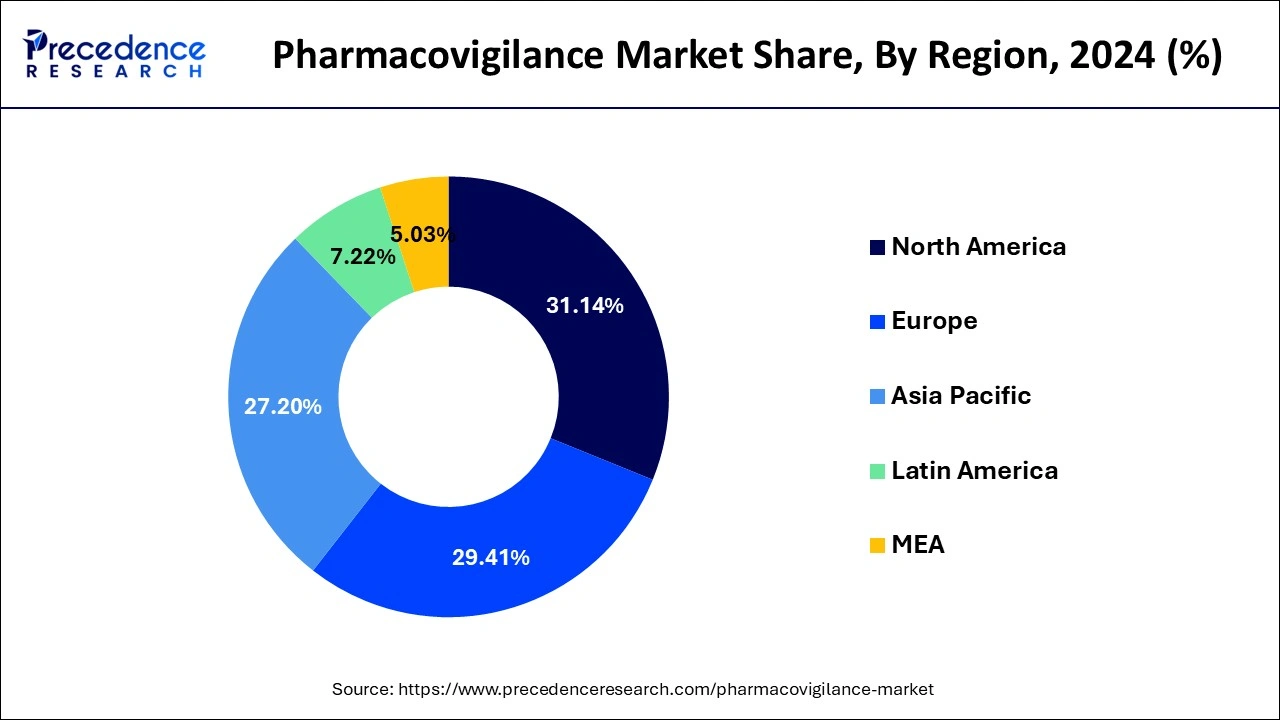

Based on the region, the North America segment dominated the global pharmacovigilance market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The increased prevalence of drug addiction and the resulting adverse drug reactions is a major cause of morbidity and mortality. This is a high-growing rendering factor for North American market growth. The regional market is expected to rise as key manufacturers increase their investments in novel drug development. As a result of the high volume of pharmaceuticals produced, the number of clinical studies and the demand for post-marketing supervision has increased, adding to the regional market’s overall expansion.

On the other hand, the Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. In the coming years, greater productivity, resource sharing, and cost efficiency are expected to propel regional demand for pharmacovigilance. In addition, the regional market is being driven by expanding patient awareness, rising investment, and supportive government actions to address the needs of the population.

Pharmacovigilance has an important role to play in improvement of public health outcomes while helping regulatory decision to make sure the harm from medications is bare minimum. The rising cases of adverse drug reactions has created a necessity for proper drug safety monitoring. The demand for technologies and services that will track, manage and analyze drug safety data effectively are required. The different regulatory agencies across the world and rising adverse drug reactions is expected to boost the growth pharmacovigilance market in the forecast period.

| Report Coverage | Details |

| Market Size in 2025 | USD 10.36 Billion |

| Market Size by 2034 | USD 22.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.88% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Clinical Trial Phase, By Service Provider, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

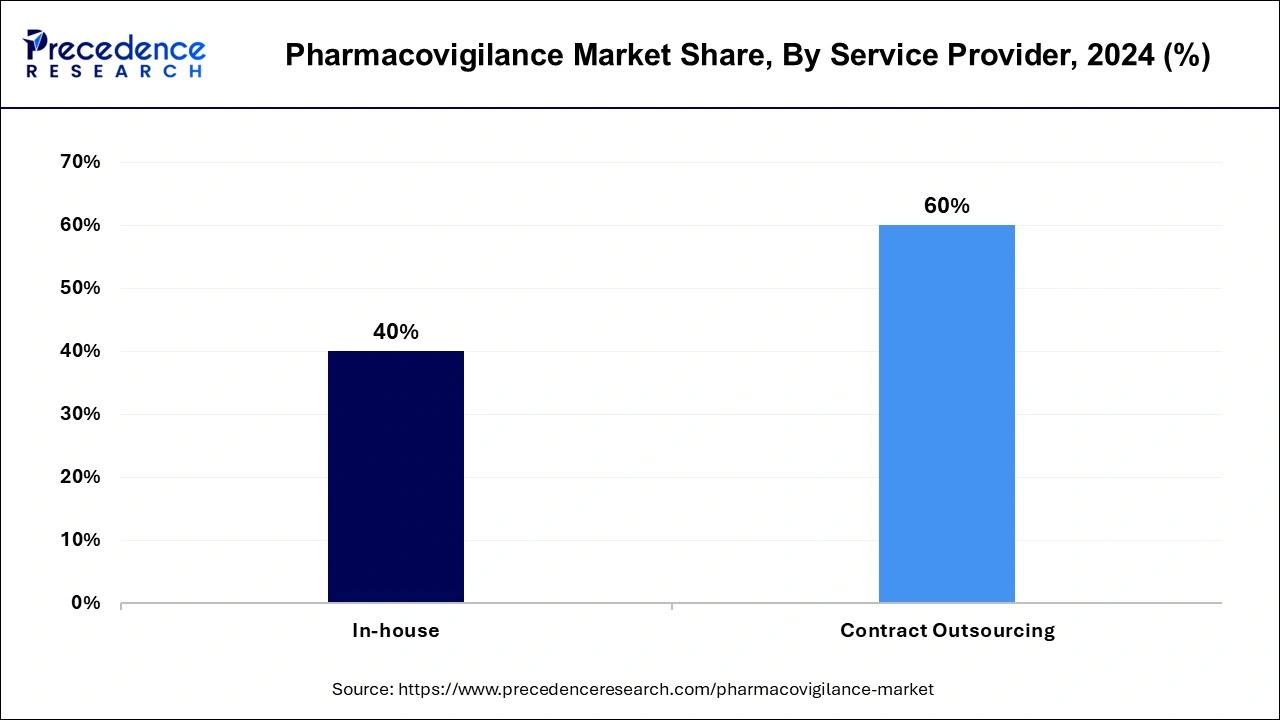

Rising demand for contract outsourcing by pharmaceutical companies

The pharmacovigilance market is witnessing a major shiftthe pharmaceutical companies increasingly looking to outsourcing services for pharmacovigilance. These services offer the companies several benefits because it enables them to have access to a broader spectrum of resources, that include regulatory compliance, specialized management, safety reporting etc. The companies can also manage demand better with outsourcing while reducing costs and overhead expense. The preference towards outsourcing by key pharmaceuticals companies is driving market growth.

Lack of skilled professionals and funding

The demand for the pharmacovigilance services is high. Although, there is a lack of funding along with shortage of professionals that are skilled and trained. This creates a major hurdle for the pharmacovigilance market. The insufficiency in funds lags the establishment of effective mechanisms and infrastructure to properly carry out pharmacovigilance services. There is a delay in reporting and correct monitoring because of lack of skilled professionals. This directly affects the effectiveness of this practice. The key players are trying figure out how to tackle these challenges in an effective way.

Expansion in emerging market

The emerging markets of Latin America and Asia Pacific are incredible opportunities of innovation and growth for the pharmacovigilance market. Both these regions are undergoing urbanization and economic development at a rapid pace. The huge population combined with growing spending capacity and government initiatives has helped propel the healthcare infrastructure. Many key players are looking to expand into these regions by setting research and development facilities close to a large pool of patients. The countries of these region offer this market an expansion and development opportunity.

The phase IV segment has dominated the market with highest revenue share in 2024. The technologies used for clinical trial phase IV, provide as an extra layer of protection for medications in clinical studies. Phase IV is important and essential step in clinical trials as it allows for the detection of negative medication effects. As a result of thorough drug testing on large patient demographics of the highest relevance after commercialization of the drug, the data collected and reviewed during this stage is predicted to be of the highest relevance.

On the other hand, the phase III is expected to grow at rapid pace during the forecast period. Phase III trials are used to determine and confirm a drug’s efficacy. Before a medicine is commercialized, these trials provide further information about probable drug interactions, effectiveness, and drug safety. Over the forecast period, the aforementioned factors are expected to drive revenue generation in the segment.

The contract outsourcing segment has accounted highest revenue share of 60% in 2024. This is owing to the advantages of outsourcing, such as risk minimization, resource flexibility, lower fixed costs, and upfront investment reduction. The pharmacovigilance audits, standard operating procedures, and other specialized services are provided by contract outsourcing businesses.

On the other hand, as a result of substantial research and development by large pharmaceutical and biotechnological businesses for the creation of new pharmaceuticals, the in-house segment is expected to rise moderately over the forecast period. In the following years, this is projected to benefit the industry’s growth prospects.

Based on the end user, the pharmaceutical companies has hed highest revenue share in 2024. Due to increased new product development activities in this sector, the pharmaceutical companies segment is expected to rise significantly in the next years. Drug development and consumption have increased dramatically in recent years. The adverse effects not identified in clinical studies can occur when medications are used by a wide population for longer periods of time.

On the other hand, the hospitals segment is expected to grow at rapid pace during the forecast period. The hospitals and clinics have started to outsource the pharmacovigilance process to avoid large high initial investments and fixed overhead costs, gain additional capacity, and boost resource flexibility. The hospitals can save money by outsourcing pharmacovigilance.

By Clinical Trial Phase

By Service Provider

By End User

By Therapeutic Area

By Type

By Process Flow

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

June 2024