January 2025

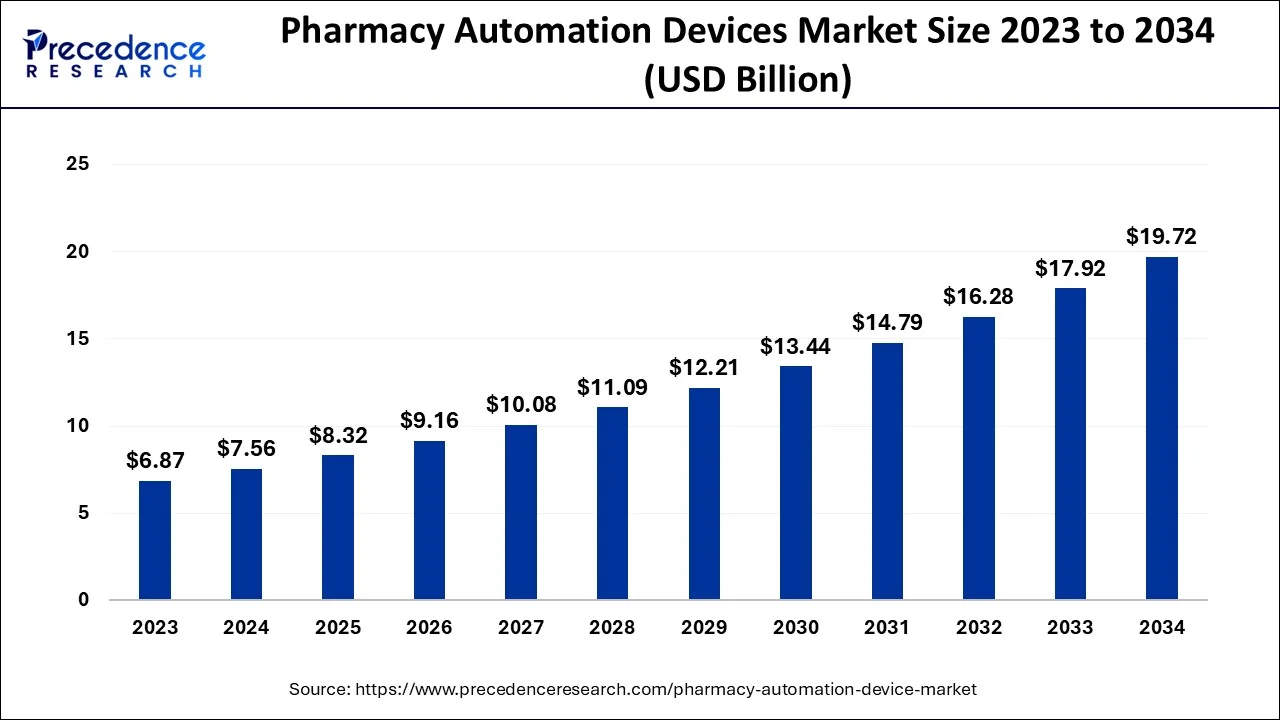

The global pharmacy automation devices market size is predicted to increase from USD 7.56 billion in 2024, grew to USD 8.32 billion in 2025 and is anticipated to reach around USD 19.72 billion by 2034, poised to grow at a CAGR of 10.06% between 2024 and 2034. The North America macy automation devices market size is calculated at USD 3.93 billion in 2024 and is estimated to grow at a fastest CAGR of 10.16% during the forecast year.

The global pharmacy automation devices market size accounted for USD 7.56 billion in 2024 and is predicted to surpass around USD 19.72 billion by 2034, expanding at a CAGR of 10.06% between 2024 and 2034.

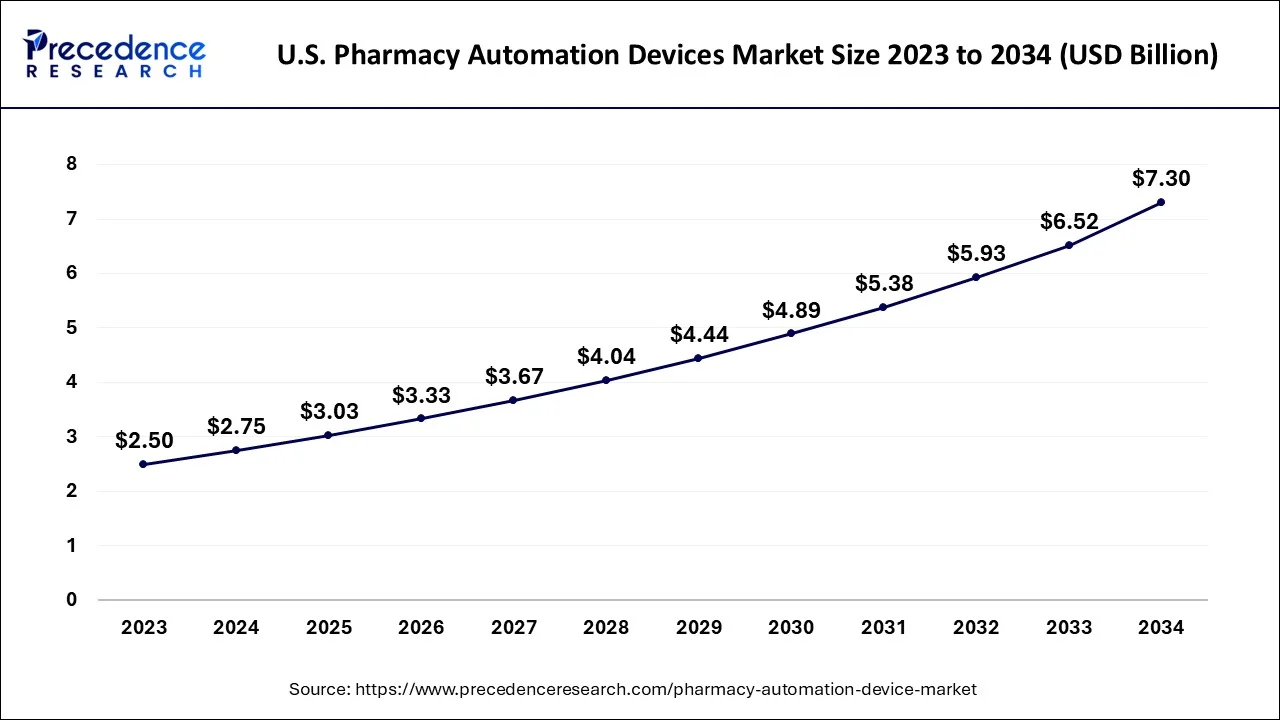

The U.S. pharmacy automation devices market size is estiimated at USD 2.75 billion in 2024 and is expected to be worth around USD 7.30 billion by 2034, expanding at a CAGR of 10.25% from 2024 ti 2034.

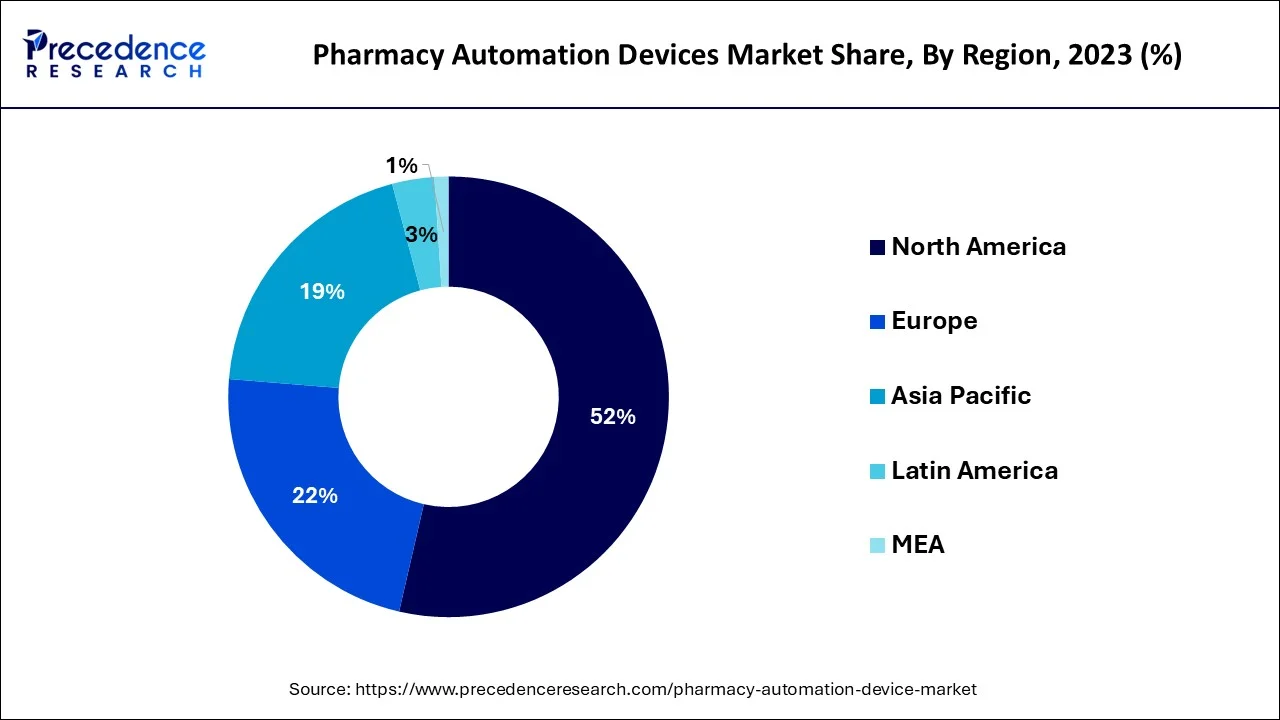

North America dominated the market with the largest market size in 2023. The region will continue its dominance due to the presence of the major and potential pharmaceutical industries across the region. The rapid adoption of technologies in the medication and healthcare sector will lead to higher demand for pharmacy automation devices in the region. Increasing investment by the government bodies as well as the major players for the research and development program to automate pharmaceutical operations in the region along with the willingness by the industry to transform into advanced solutions highlight the growth of the market in North America.

In November 2022, American Portwell Technology announced the launch of a medical touch monitors to ease the operations and activities for the pharmaceutical and healthcare industries. These monitors ensure the safety of medical electrical equipment and act as a quality management system.

Asia Pacific is expected to witness the fastest growth during the forecast period. The growth of the region is expected due to the rising population in the countries like India and China which directly leads to the higher demand for healthcare services. To fulfill the ever-increasing demand efficiently and effectively the pharmaceutical industry is forced to adapt the automation process for faster and error-free workflow. This factor would likely increase the demand for the pharmacy automation devices market in the region.

Pharmacy automation is the most advanced topic in the pharmacy and healthcare industry. Although the healthcare sector is divided into many subtypes, pharmacy automation is the latest and current market to cover. Pharmacy automation devices refer to the devices or gadgets that accelerate the handling of the same healthcare task without human intervention with the help of the most technically advanced robots or machines. Pharmacy automation devices also offer the automation of all pharmaceutical processes related to dispensing, storing, medication delivery and other managing other business operations.

Increasing demand for healthcare services due to the increase in the aging population across the world and higher demand for mediation treatment directly leads to the fueled growth for the pharmacy automation devices market due to the quick and efficient workflow of the pharmaceutical industry.

In the pharmaceutical industry, there is always a need for a higher quality of pharma products, medical packing needs a higher efficient process of production. There is a higher demand for pharmaceutical automation processes due to the increasing need for sensitive and precise handling of the products as well as strict quality control and traceability. Automation devices also ensure an efficient process in the strict regulations in the pharmaceutical industry. Automation had the hands on the distribution, manufacturing, and healthcare facilities.

Pharmaceutic al automation devices started getting popularity since the Covid-19 pandemic, these devices helped the overall healthcare and pharmaceutical industries to perform certain activities without or with less human intervention to contain the spread of virus. Moreover, lack of medical staff and shortage of professionals in the pharmaceutical industry will act as growth factors for the global pharmaceutical automation devices market.

Pharmaceutical automation devices can be used for distribution, treatment, and other healthcare needs. Pharmaceutical automation device is also used in one of the main pharmaceutical processes like storing and dispensing. Using automation in storing and dispensing drugs and other medical requirements will eliminate the error and contaminations that come with the normal process which is done traditionally.

The higher adaptability of the technologies in the healthcare as well as pharma sector for the convenience of the patients, minimizing the workload of the healthcare professionals and error-free and quick workflow will contribute to the growth of the pharmacy automation devices market.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.56 Billion |

| Market Size in 2024 | USD 8.32 Billion |

| Market Size by 2034 | USD 19.72 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.06% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased safety, efficiency, and resource allocation

Human pharmacists have to maintain their alertness for extended periods of time, which is a demanding duty. Inadequate measurement or contamination of medicine poses tremendous risks for pharmacies and their consumers equally. The exact weight, aspect ratio, and cleanliness of the drug can all be guaranteed by machines; however, many operations are required. According to a study published in the Journal of the American Pharmacist Association, robotic dispensing technologies allow pharmacists to fill 100 prescriptions in less than 46.5 minutes every 100, as opposed to the more labor-intensive count-and-pour approach. The time saved here can be used by pharmacy staff to enhance customer service or work on drug development. Thus, the increased safety and efficiency by pharmacy automation devices is observed to act as a driver for the market.

Difficulty in the adaptation of automation process in pharmacies

There is no fixed size of the automation devices for every other pharmacy. Every pharmacy used different software and hardware for the automation processes. It has been observed that pharmacists may take time to adapt to the automation process rather than the traditional process. Difficulty in adaptation is also due to the higher installation cost of the automation process. Many small-scale pharmacies with weak potential cannot afford the automation process due to the cost or the sizes of the automation devices. All these factors create restraints for the market.

Deployment of robotic automation systems

In pharmacy and healthcare operations, robotic process automation and AI are tightly related. It drives all repetitive operations carried out by robotic devices, such as counting, weighing, mixing, packaging, and storing, but it is unable to interpret data intelligently, learn, or make judgments. Robotics and other automated solutions used in the pharmaceutical and healthcare industries improve the precision of procedures like automatically ordering and retrieving pharmaceuticals based on their distinctive barcodes, placing orders, and tracking returns. Additionally, it makes it possible for pharmacies to gather, store, update, and quickly retrieve patient data as well as produce reports for caregivers, medical professionals, and regulatory bodies. Thus, the deployment of robotics in the pharmaceutical industry opens an opportunity for the market’s expansion.

The medication dispensing system segment dominated the market with the largest market share in 2023. The growth is attributed to the increasing need for quick and effective patient care services. Pharmacy and hospitals are adopting technological advancements to improve performance and patient care. The automated medication dispensing system is a much quicker and more efficient process than the traditional one. An automated dispensing system will regulate the real-time alert at the point of dispensing, or it will look for expired or canceled items.

It will minimize the error at the time of dispensing drugs. Automated medication dispensing analyzes according to the requirement of the patient at the point of care. Automated medication dispensing systems almost cut out incorrect drug selection. All these factors contribute to the higher adoption of the automated medication dispensing system.

The automated medication compounding systems segment is expected to boost in terms of its market share during the forecast period. The growth of the automated medication compounding segment is attributed to the higher need for customized medicines for the treatment of patients having chronic diseases. Medication compounding is a medicine that is made according to the need and prescription which is given by the physicians. Automated medication compounding systems minimize the rising pressures on pharmacies and increase the cost of the drugs. Automated medication compounding mainly manages the inventory and supply chain of the drugs. These factors have impacted the growth of the segment in the pharmacy automation devices market.

The retail pharmacy segment dominated the market with the largest market revenue in 2023, the segment will continue to grow at a significant rate during the forecast period. The growth of the segment is attributed to the rising application of prescription filling, streamlined operation and inventory tracking at retail pharmacies. Retail pharmacies are rapidly adopting the automation process for minimizing errors in the workflow, increasing the number of pharmacies and management for their work efficiently. Automation devices in retail pharmacies reduce the mistakes/errors that often take place in the traditional management process. Automation devices in retail pharmacies are observed to help in analyzing the real-time inventory management and this will allow the pharmacists to save cost time invested while improving the accuracy and convenience of delivery of drugs. Thus, pharmacy automation devices are largely involved in the growth of the retail pharmacy segment.

The outpatient pharmacies segment is expected to generate a considerable revenue share during the predicted timeframe. Outpatient pharmacies dispense drugs for outpatients. Outpatients are typically located off-campus and also on-campus in the healthcare sector. It is an institutional pharmacy that gives healthcare facilities to registered outpatients receiving treatments. The rising number of at-home care settings, especially for the geriatric population will promote the segment’s growth. The outpatient pharmacies require automation solutions and devices to ease down the medication delivery process.

Segments Covered in the Report:

By Product

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

July 2024

January 2025