September 2024

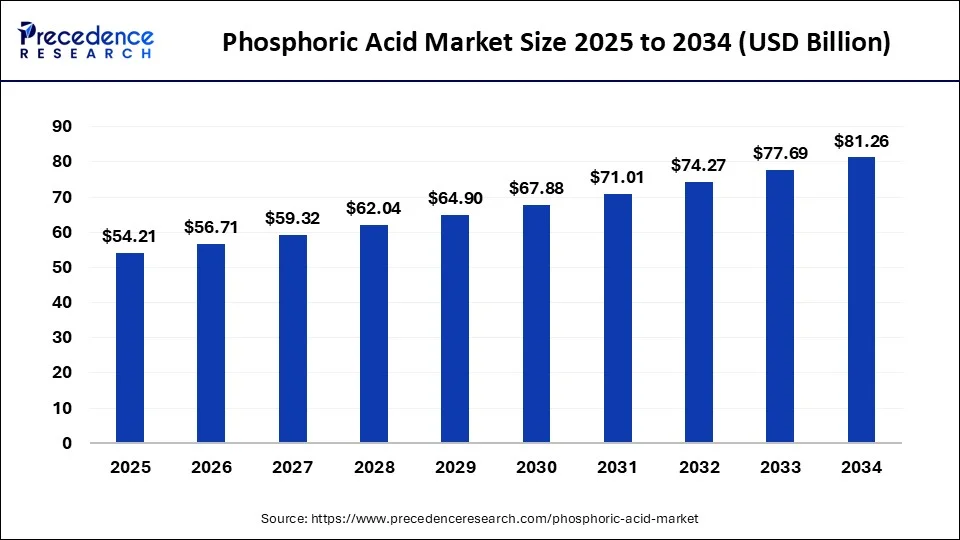

The global phosphoric acid market size accounted for USD 51.83 billion in 2024, grew to USD 54.21 billion in 2025 and is projected to surpass around USD 81.26 billion by 2034, representing a healthy CAGR of 4.60% between 2024 and 2034.

The global phosphoric acid market size is estimated at USD 51.83 billion in 2024 and is anticipated to reach around USD 81.26 billion by 2034, growing at a CAGR of 4.60% from 2024 and 2034.

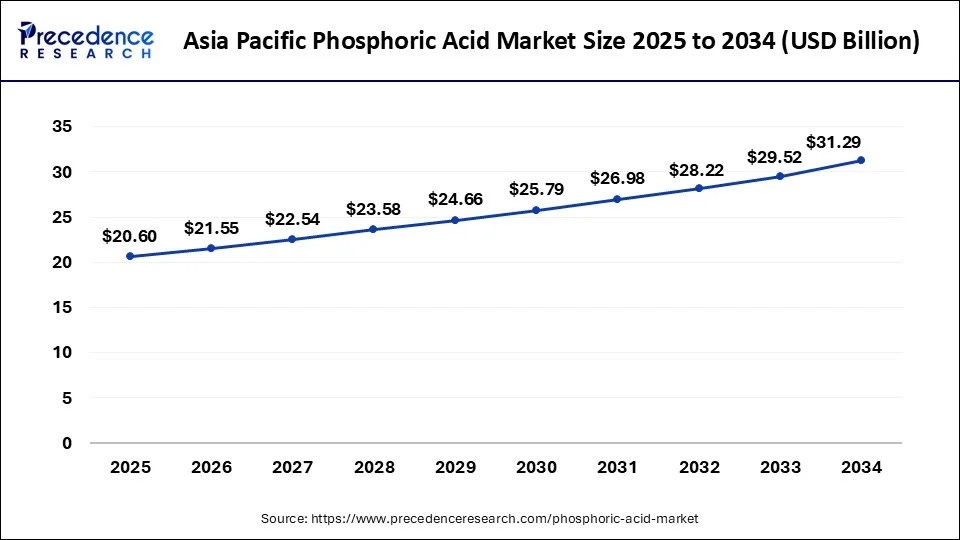

The Asia Pacific phosphoric acid market size accounted for USD 19.70 billion in 2024 and is estimated to reach around USD 31.29 billion by 2034. at a CAGR of 4.73% from 2024 to 2034.

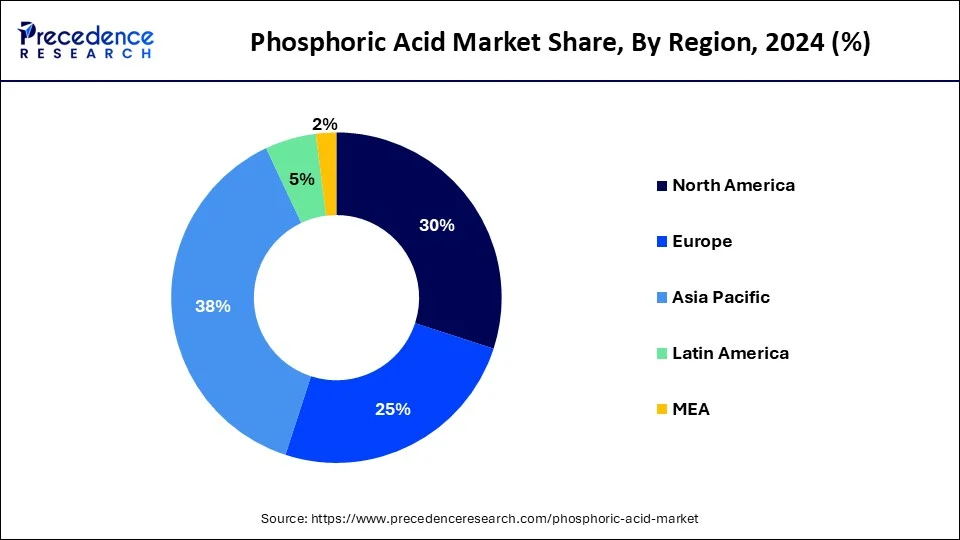

Asia-Pacific has held the largest revenue share of 38% in 2023. In the Asia-Pacific region, the phosphoric acid market is witnessing notable trends. The agricultural sector remains a key driver due to increasing food demand, leading to higher fertilizer production and phosphoric acid consumption. Additionally, the food and beverage industry's growth, driven by changing consumer preferences and urbanization, contributes to rising demand for food-grade phosphoric acid. Furthermore, the region's expanding industrial and manufacturing activities, especially in emerging economies, further boost the market. Sustainable production practices and technological advancements are also gaining prominence as Asia-Pacific aims to align with global environmental standards.

Europe is estimated to observe the fastest expansion. In Europe, the phosphoric acid market is marked by several trends. The region is experiencing a growing demand for sustainable and eco-friendly production methods, aligning with stringent environmental regulations. Additionally, the food and beverage industry is steadily increasing its usage of phosphoric acid as an acidity regulator and flavor enhancer in various products. As sustainability and food quality become paramount, Europe's phosphoric acid market is witnessing a shift towards cleaner production methods and a surge in applications in the food sector.

Moreover, in North America, the phosphoric acid market is characterized by several prominent trends. This emphasis is driven by both regulatory pressures and consumers' preferences for eco-friendly products. Furthermore, the region's food and beverage industry is actively exploring innovative applications for phosphoric acid, notably as an acidity regulator and flavor enhancer across a diverse spectrum of products. These trends reflect a concerted effort in North America to align with environmental standards and cater to evolving consumer demands in the food sector.

The market also benefits from advancements in production technologies, which enhance efficiency and reduce environmental impacts. Overall, North America's phosphoric acid market reflects a dynamic landscape responding to evolving industry and consumer demands.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 4.6% |

| Market Size in 2024 | USD 51.83 Billion |

| Market Size by 2034 | USD 81.26 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Process Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Agricultural demand propels market demand in the phosphoric acid market as phosphoric acid plays a critical role in fertilizer production. With the world's growing population and the need to enhance agricultural yields, there is an escalating demand for efficient fertilizers containing phosphoric acid. This compound provides essential phosphorus to crops, ensuring optimal growth and yields. As global food security concerns persist, the agricultural sector's consistent reliance on phosphoric acid for fertilizer production continues to drive robust demand in the market. Moreover, the phosphoric acid market experiences a surge in demand due to the food and beverage industry's requirements.

Phosphoric acid serves as a crucial acidity regulator and flavor enhancer in various products, including carbonated beverages and processed foods. As consumer preferences for such products continue to rise globally, the need for phosphoric acid in food and beverage manufacturing grows substantially. This industry-driven demand underscores phosphoric acid's pivotal role in ensuring the desired taste and quality of a wide range of food and drink items, propelling market growth.

Environmental concerns pose a restraint on the phosphoric acid industry by raising alarm over phosphorus runoff from agricultural applications. This runoff can lead to water pollution, ecosystem disruptions, and adverse environmental impacts. In response, regulators enforce stringent restrictions on the use of phosphoric acid. Concerns about its ecological footprint and potential harm to aquatic systems have heightened, creating challenges for the market as it strives to adopt more environmentally responsible production practices and mitigate its impact, which can lead to increased compliance costs and limited usage in certain regions.

Moreover, health and safety regulations serve as a restraint on the phosphoric acid market by imposing strict compliance requirements on the handling, transportation, and storage of phosphoric acid. These regulations are aimed at ensuring worker safety and preventing potential hazards associated with the chemical. Complying with these stringent standards can result in increased operational costs for manufacturers, necessitating the implementation of robust safety measures and training programs. The complexity of adhering to such regulations can pose logistical challenges and additional expenses, impacting the overall market demand and profitability.

Sustainable production practices drive market demand in the phosphoric acid market as environmental consciousness rises. Consumers and regulators increasingly favor eco-friendly and responsible production methods. Companies adopting sustainable techniques not only mitigate environmental concerns related to phosphoric acid production but also meet the growing demand for greener chemicals. This commitment to sustainability enhances the market's reputation, attracts environmentally-conscious consumers, and ensures compliance with evolving environmental regulations, ultimately boosting demand for phosphoric acid produced through eco-friendly processes.

Moreover, advanced technologies surge the demand in the phosphoric acid market by enhancing production processes. Innovations, such as more efficient extraction methods and automation, increase production capacity, reduce energy consumption, and improve cost-effectiveness. These technologies enable manufacturers to meet growing demand while maintaining competitive pricing. Moreover, advanced methods address environmental concerns, aligning with sustainability expectations. As the market embraces cutting-edge technologies, it gains efficiency, cost savings, and environmental benefits, driving increased demand for phosphoric acid across various industries.

Impact of COVID-19:

The phosphoric acid market experienced mixed effects due to the COVID-19 pandemic. In the early stages, the market faced disruptions in supply chains, as lockdowns and travel restrictions hampered the transportation of raw materials and finished products. These challenges temporarily impacted production and distribution, causing delays. However, as the pandemic progressed, certain aspects of the market saw shifts in demand.

The agricultural sector, which relies heavily on phosphoric acid for fertilizer production, remained resilient as governments prioritized food security. Increased home gardening and agricultural activities by individuals during lockdowns also boosted demand. Conversely, segments related to the food and beverage industry, such as the production of carbonated beverages and processed foods, saw a decline in demand due to restaurant closures and changes in consumer behavior. This resulted in reduced consumption of phosphoric acid in these applications. Overall, the phosphoric acid market demonstrated adaptability, with demand shifts influenced by changing consumer needs and economic conditions during the pandemic.

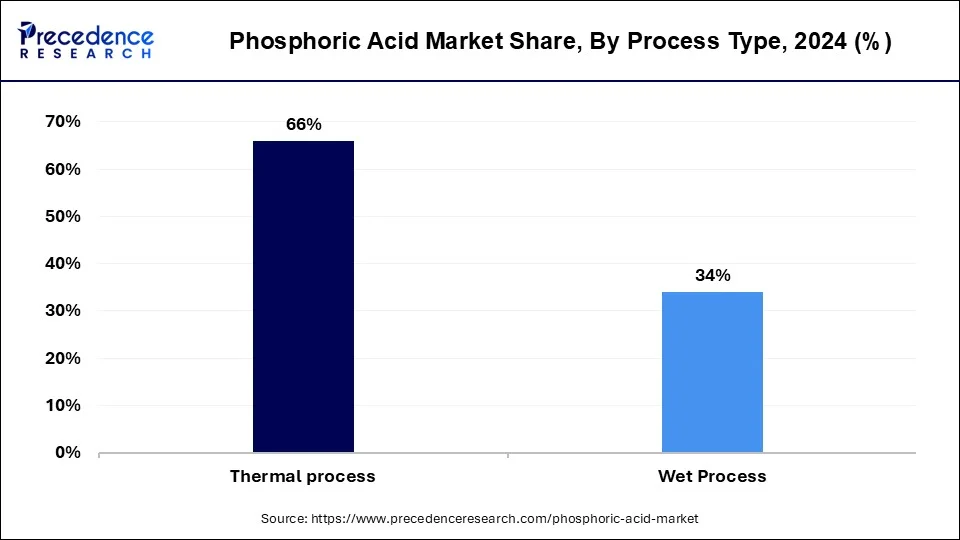

The thermal process segment has held 66 % revenue share in 2023. The thermal process in the phosphoric acid market refers to a manufacturing method where phosphate rock is subjected to high-temperature treatment, typically via combustion or smelting processes. This results in the production of phosphoric acid. Trends in the thermal process segment of the phosphoric acid market include a focus on improving energy efficiency and reducing environmental impact.

Manufacturers are investing in advanced technologies and cleaner combustion methods to enhance production sustainability. Additionally, efforts are being made to maximize phosphate rock utilization and minimize waste in the thermal process, aligning with the industry's growing emphasis on eco-friendly and resource-efficient production techniques.

The Wet Process is anticipated to expand at a significantly CAGR of 6.8% during the projected period. The wet process is a conventional method of producing phosphoric acid, involving the reaction of phosphate rock with sulfuric acid. This process yields a high-purity phosphoric acid suitable for various industrial applications, particularly in the production of fertilizers and food additives.

In the phosphoric acid market, the wet process remains a dominant production method due to its reliability and high-quality output. However, the industry is witnessing a trend toward adopting more sustainable practices and improving energy efficiency within the wet process to reduce environmental impacts and operating costs. These efforts align with the growing emphasis on sustainability and environmental responsibility in the chemical manufacturing sector.

The fertilizer segment held the largest market share of 44% in 2023. Within the phosphoric acid market, a prominent application area is fertilizers. These substances enhance soil fertility by supplying crucial nutrients to plants, with phosphoric acid being a pivotal ingredient. A significant trend in this sector is the escalating global need for fertilizers to enhance agricultural yields and ensure food security. Furthermore, there's a rising focus on environmentally friendly and sustainable fertilizers, spurring innovations in phosphoric acid-based fertilizer formulations. These innovations aim to reduce environmental footprints while maximizing crop productivity, in line with the broader sustainability objectives within modern agriculture.

The water treatment segment is projected to grow at the fastest rate over the projected period. Water treatment in the phosphoric acid market refers to the application of phosphoric acid as a corrosion inhibitor and pH adjuster in processes aimed at purifying and conditioning water for various industrial and municipal purposes. Trends in this segment include a growing emphasis on sustainable and environmentally friendly water treatment methods, which drive the demand for eco-friendly phosphoric acid formulations. Additionally, the increasing need for effective corrosion control in water systems and infrastructure maintenance further propels the utilization of phosphoric acid in water treatment processes.

Segments Covered in the Report

By Process Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

December 2024

August 2024