March 2025

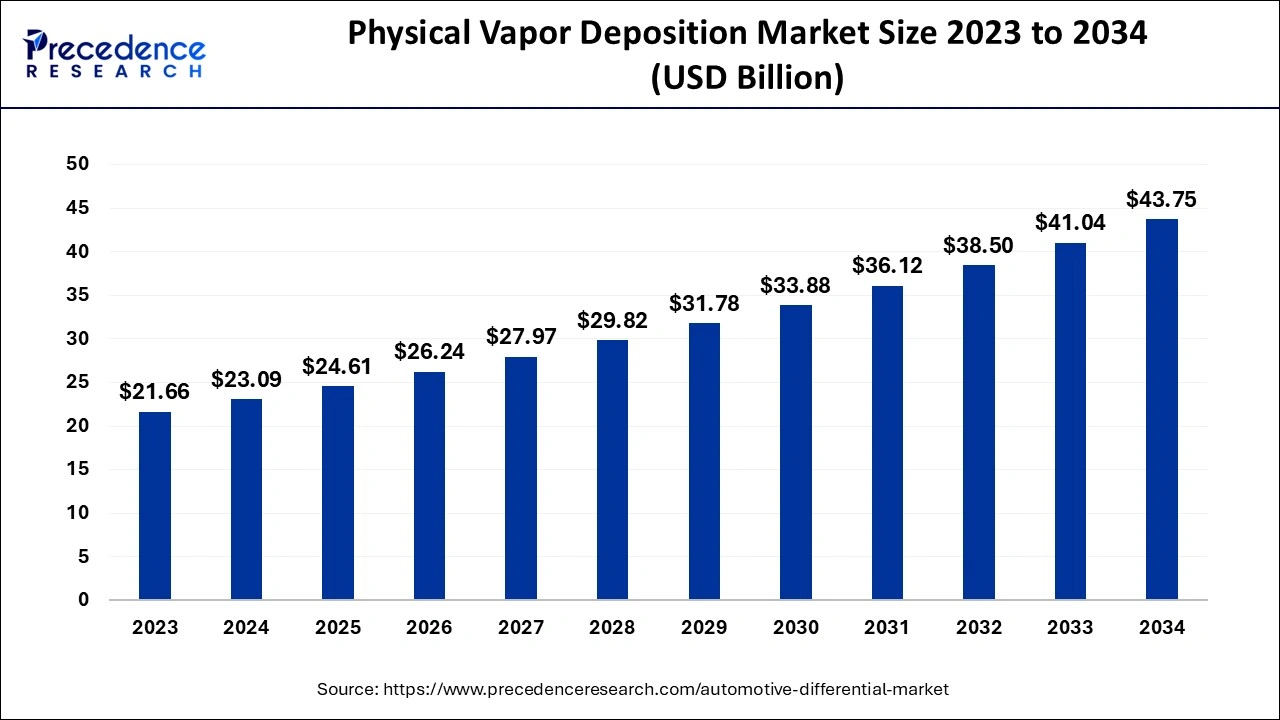

The global physical vapor deposition (PVD) market size accounted for USD 23.09 billion in 2024, grew to USD 24.61 billion in 2025 and is predicted to surpass around USD 43.75 billion by 2034, representing a healthy CAGR of 6.60% between 2024 and 2034.

The global physical vapor deposition (PVD) market size is accounted for USD 23.09 billion in 2024 and is anticipated to reach around USD 43.75 billion by 2034, growing at a CAGR of 6.60% from 2024 to 2034.

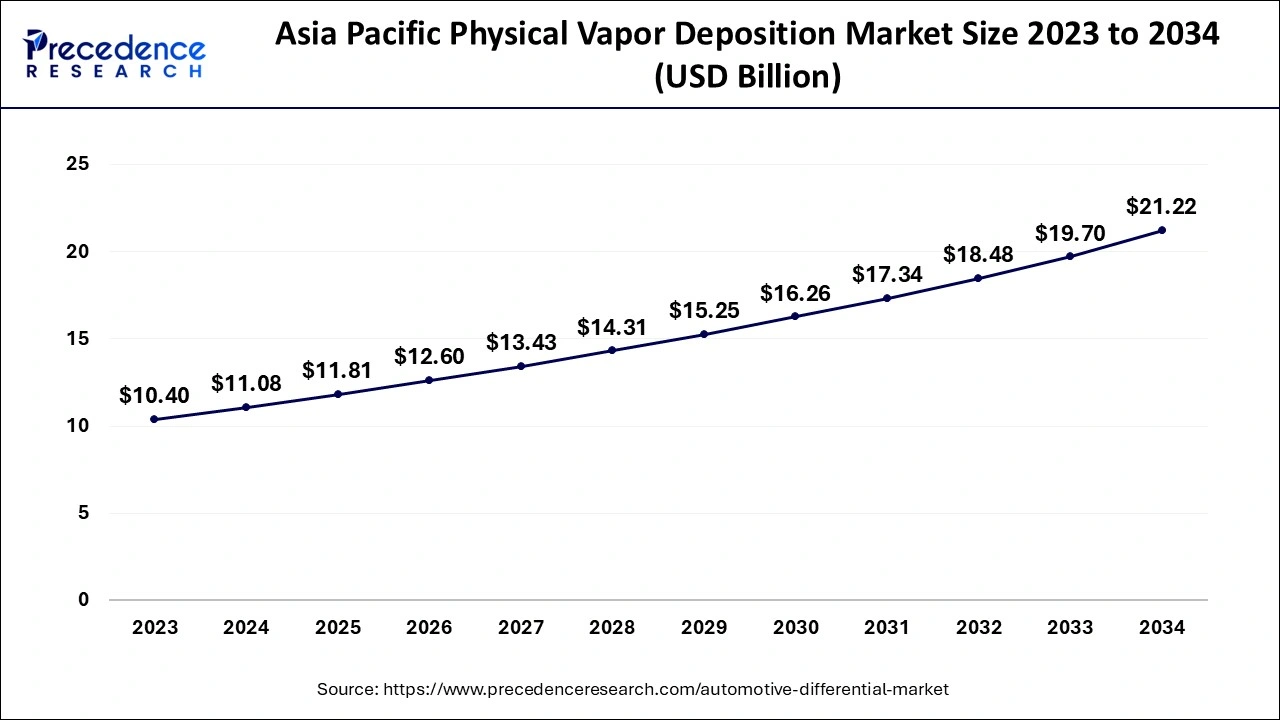

The Asia Pacific physical vapor deposition (PVD) market size is evaluated at USD 11.08 billion in 2024 and is predicted to be worth around USD 21.22 billion by 2034, rising at a CAGR of 6.70% from 2024 to 2034.

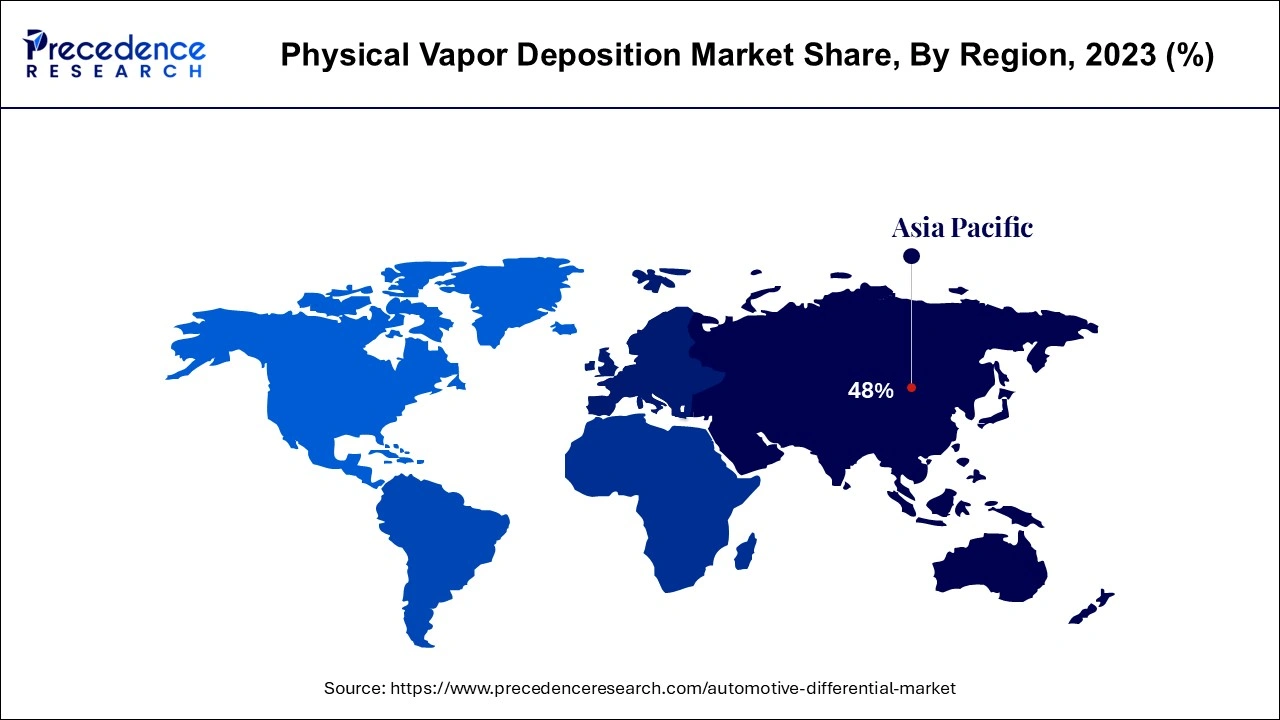

Asia Pacific is one of the largest producers of solar panels, automotive vehicles, microelectronics, and consumer electronics in the globe. The presence of a huge number of manufacturing facilities of various products like medical devices, vehicles, and electronic components has significantly fostered the demand for PVD in the Asia Pacific, which led to the dominance of this region in the global physical vapor deposition market. The rapid industrialization in the region resulted in higher pollution levels and climate change issues. This has shifted the focus of the government towards developing and shifting to solar energy sources that have significantly driven the demand for the solar panels. Moreover, the rising volume of medical equipment and electric vehicle manufacturing in a nation like China is expected to offer huge growth opportunities to the market players in the forthcoming future. The presence of several top electronic manufacturers in the region such as Samsung, MI, and Baja is expected to boost the demand for the PVD during the forecast period.

North America is estimated to be the most opportunistic market during the forecast period. The rising prevalence of diseases and rapidly ageing population in the US is significantly driving the demand for numerous medical equipment for diagnosis and treatment. Therefore, the rising demand for medical equipment in US is expected to significantly boost the demand for the PVD coatings in the region. Furthermore, the rising adoption of automotive vehicles or electric vehicles in the region is another major factor behind the growing adoption of the PVD in North America.

The rapidly rising demand for thin-film coating in decorative applications and in various end-use verticals like the microelectronics industry is boosting the growth of the global physical vapor deposition market. The rapidly rising demand for various consumer electronics such as desktops, laptops, and smartphones across the globe owing to the rising penetration of digital services and the internet is significantly driving the global physical vapor deposition market. The rising popularity of remote working or work from home trends across the globe and the rapid IT and telecommunications industry is boosting the demand for laptops, desktops, and mobile phones at an aggressive rate. This burgeoning demand for the electronic devices is expected to have a significant and positive impact on the global physical vapor deposition market growth during the forecast period. The rapidly growing healthcare industry owing to the surging prevalence of various chronic diseases and the rising geriatric population across the globe is expected to boost the demand for the physical vapor deposition market.

The physical vapor deposition coating is extensively used in medical equipment as decorative coating and the higher biocompatibility of the physical vapor deposition coating allows its application in medical equipment. Therefore, the rising demand for medical equipment in hospitals, clinics, and surgical centers across the globe is expected to drive the global physical vapor deposition market. Furthermore, the rising adoption of solar power is surging the demand for solar panels globally. The PVD coating is used in the production of solar panels as it makes the solar panels corrosion-resistant and increases the life of the panels. The PVD coating is also expected to have a significant demand for the production of next-generation perovskite-crystalline silicon cells in the forthcoming years and augment the market growth in the upcoming future.

| Report Coverage | Details |

| Market Size in 2024 | USD 23.09 Billion |

| Market Size by 2034 | USD 43.75 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.60% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Substrate, By Process, By End User, and Geography |

Rising Penetration of Microelectronics And Semiconductors

The growing application of microelectronics across various sectors is anticipated to propel the physical vapor deposition market. The small electronic equipment, which is micrometers in size, is manufactured using microelectronics for application in various sectors such as automotive, healthcare, and defense. Physical vapor deposition mainly uses microelectronics. Hence, the rising microelectronics industry is fueling the physical vapor deposition industry. Various steps involved in microelectronic devices consist of thin film materials deposition, prototyping of thin films, modification of materials, as well as etching of films.

The processes of physical vapor deposition, such as evaporation and sputtering, are used on components of microelectronics to impact wear resistance and hardness prior to the installation of components in devices. Additionally, the rising demand for consumer electronics is also expected to boost the need for microelectronics. Consumer electronics devices use microelectronics for applications such as smartphones, tablets, LED TVs, flat-screen monitors, and other devices. Mainstream electronics contain packages of semiconductors as well as surface-mount technology processes. Various factors like the growing population of the middle class, rising disposable income, shifting spending, as well as rapid urbanization are predicted to drive the need for consumer electronics which further propels the use and application of microelectronics.

Furthermore, physical vapor deposition aids in raising the appearance of products as well as the durability of products and base materials with additional functions. Moreover, a process medium is not needed to make it eco-friendly. Hence physical vapor deposition has wide applications in consumer and industrial applications. The CHIPS and Science Act funded USD 52.70 billion in the U.S. for production and R&D, which further propelled the production of semiconductors. Along with this, in Singapore, India, China, and South Korea, ongoing production facilities are developed. This development of the semiconductors market is expected to increase the demand for physical vapor deposition services.

According to the Semiconductor Industry Association (SIA), the sale of semiconductors in 1999 was 149.4 billion, and in 2019 was approximately USD 412.3, with a CAGR of 5.2%. However, as per World Semiconductor Sales Statistics (WSTS), the market of semiconductors fell in 2020 but is anticipated to grow by CAGR of 8.4% in 2023 due to high growth in the optoelectronic sector. This further increases the demand for physical vapor deposition technology.

Implementation of Digitization Solutions Propels the Market

There has been an increase in productivity and opportunities over the years due to the implementation of digitization solutions. Along with this, it is also being used in various applications such as healthcare, travel, media, finance, as well as manufacturing to enhance connectivity and develop a strong value chain. The Electronics System Design & Manufacturing (ESDM) market is projected to expand significantly over the forecasted period owing to the expansion of end-use industries. The rising demand for machine learning and artificial intelligence is propelling the worldwide demand for electronic products. The performance of electronic components is enhanced by the implementation of physical vapor deposition. The translucent and thin nature of the coating, for example, allows light as well as electromagnetic waves to pass across coated components in the automotive industry. Multi-sensor technology must be incorporated into the most recent models of automobiles. It also contributes to the enhancement of the aesthetics and safety aspects of electronic systems in automobiles. Massive investments by both the private and public sectors, backed up by strong regulatory support, and increased demand for electronic products are likely to contribute to worldwide market growth in emerging as well as developed countries.

Rising Demand for Medical Applications

Surgical devices and biomedical devices are designed to enhance the quality of life. The devices must be low-frictional, durable, as well as biocompatible. The implementation of physical vapor deposition coating in biomedical devices offers the characteristic mentioned above. The coating provides superior performance due to the altered surface properties of the devices. The medical device sector produces items utilized in settings that include hospitals, clinics, home healthcare, and nursing homes. Physical vapor deposition coatings are used on tools and equipment to improve their effectiveness, efficiency, and longevity. As these technologies develop, the hospitalization period and medical fees become cheaper. As a result of its widespread use of medical equipment, the PVD market is expected to experience considerable demand from the medical sector. The industry's demand for PVD in medical devices is determined by healthcare spending in a specific location. Some of the major factors which influence the demand for medical devices include awareness, availability, adaptability, and affordability.

The growing need for better healthcare facilities in emerging markets, along with an increase in the number of hospitals, is predicted to propel the expansion of the medical equipment market. Additionally, the rising expenditure on healthcare as well as the existence of well-equipped healthcare hospitals and centers, is also positively affecting the market for medical equipment. The above-mentioned factors are anticipated to boost the use of surgical equipment, which is likely to propel the market. As per the Department of Pharmaceuticals, the worldwide medical device market is estimated to be over USD 220 billion.

High Cost

The lack of innovative products as well as a high capital investment is anticipated to hinder the expansion of the physical vapor deposition industry. The launch of new products and advancement in existing technologies requires high capital investment in R&D activities. The fluctuating prices of raw materials used in coatings such as zirconium, chromium, titanium, and aluminum are limiting the supplier and service providers, which further limits the market growth. The operating cost of PVD coating consists of electricity, material, periodic maintenance, as well as common gases (which include argon and nitrogen). The highest consumable cost is of materials, and thus, the fluctuation in raw materials costs directly impacts the profit margin of various small as well as medium scaled suppliers. The physical vapor deposition coating technology is limited due to rising capital expenses. The price involves the raw material expenses in addition to equipment costs as well as skilled labor to run the machinery. The physical vapor deposition technique requires a cooking system for operating the procedure at a vacuum and high temperature. Hence, skilled professionals are required to conduct the operation, which further increases the cost.

Furthermore, the cost of raw materials fluctuates due to the rising demand for titanium alloys in aircraft and aerospace applications. High energy levels are required for the generation of plasma and target material vaporization. This energy required during deposition leads to higher operational costs. Additionally, regular cleaning, maintenance, as well as replacement of consumables such as crucibles and targets is mandatory. The maintenance cost, along with servicing of equipment and vacuum system maintenance, is expected to contribute to the overall expenses of the physical vapor deposition system. This is expected to impact on the market further during the predicted period. Along with this, technology is being patented, which further acts as a hindrance to market growth.

Application of Physical Vapor Deposition in Low E-Glass Production

The rising application of PVD in the production of low e-glass for construction and automotive industries is projected to develop opportunities for the growth of the market. The materials used in physical vapor deposition coating of low e-glass consist of aluminum alloy, copper and its alloy, silver, and chromium. The low e-glass assists in reducing heat loss, which is mainly essential in the construction sector. Along with this, there is an increase in the demand for low e-glass in the automotive sector which propels the growth of the physical vapor deposition industry. The incorporation of new technologies leads to new requirements. For instance, the physical vapor deposition of plastics allows the use of plastics to decrease the weight of various automobiles while maintaining the appearance of a surface that is metallic. Along with this, the packaging sector has some requirements for novel physical vapor deposition coatings. Previously the film of aluminum had a better moisture permeation barrier for flexible packaging. In some cases, multiple PVD coatings are applied to further enhance the low-E properties or provide additional functionalities such as solar control, glare reduction, or self-cleaning capabilities. Laminations, where multiple glass layers are sandwiched with PVD coatings in between, can also be employed to achieve specific performance requirements. Hence, the above-mentioned factors are anticipated to boost the physical vapor deposition market.

Based on the Type, the PVD equipment segment dominated the global PVD market, accounting for a market share of around 59.37% in 2023. The surface coating companies are seeking to eliminate carbon emissions and adopt eco-friendly processes. The PVD offers the benefits of a low carbon footprint and hence the demand for PVD equipment is extensively high in surface coating companies across the globe. The PVD coating is achieved by adopting quality equipment that allows the user to streamline the processes. The manufacturers are engaged in the development of application-specific PVD equipment for decorative coatings, high-estimate tool coatings, automotive components and large die and broaches, which is anticipated to boost the growth of the global PVD market in the forthcoming future.

Moreover, the physical vapor deposition market players are engaged in the development of magnetron sputtering systems that are used in the deposition of various films on wafers such as gold, platinum, aluminum alloys, aluminum, and tungsten. This factor is anticipated to further drive the growth of the PVD equipment segment in the global physical vapor deposition market.

On the other hand, PVD services are expected to be the fastest-growing segment with a CAGR of around 6.6% during the forecast period. The PVD equipment is expensive and hence there is a high demand for PVD coating services in the market. Furthermore, the PVD companies provide skilled and experienced PVD equipment operators that offer specialized output to the customers, and hence the demand for PVD services is expected to foster during the forecast period.

By Type

By Substrate

By Process

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

February 2025

March 2025