January 2025

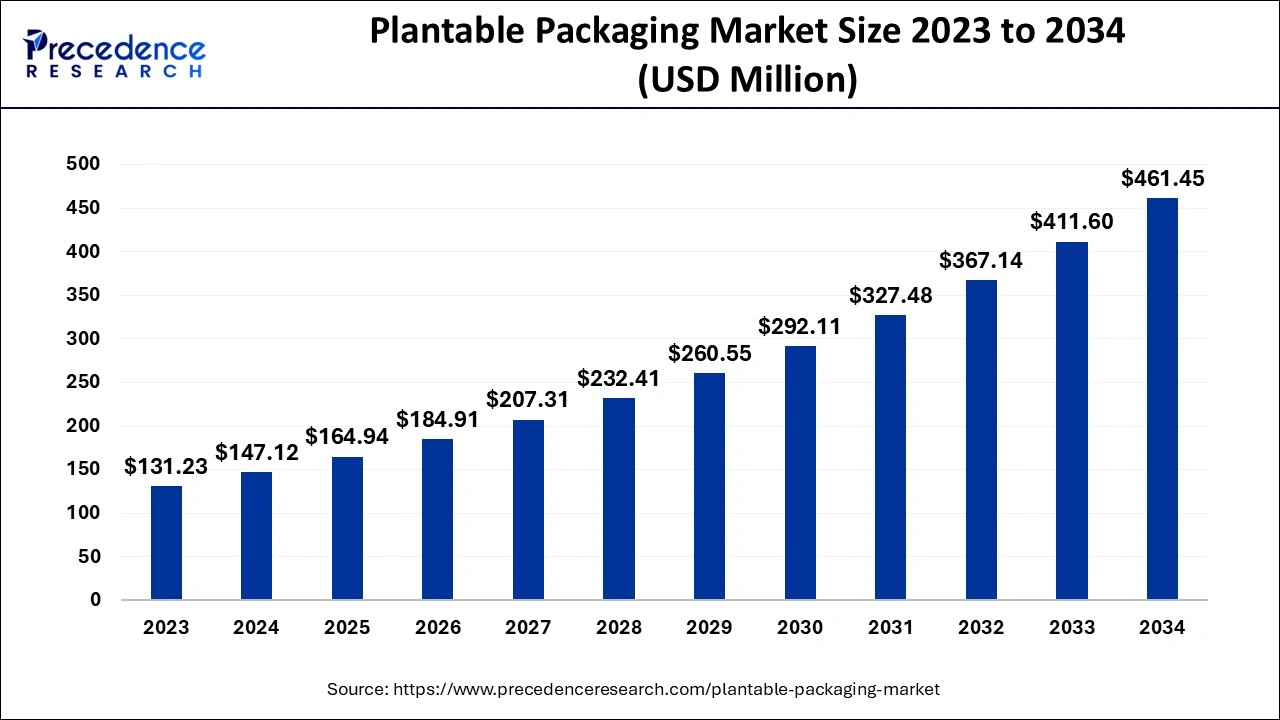

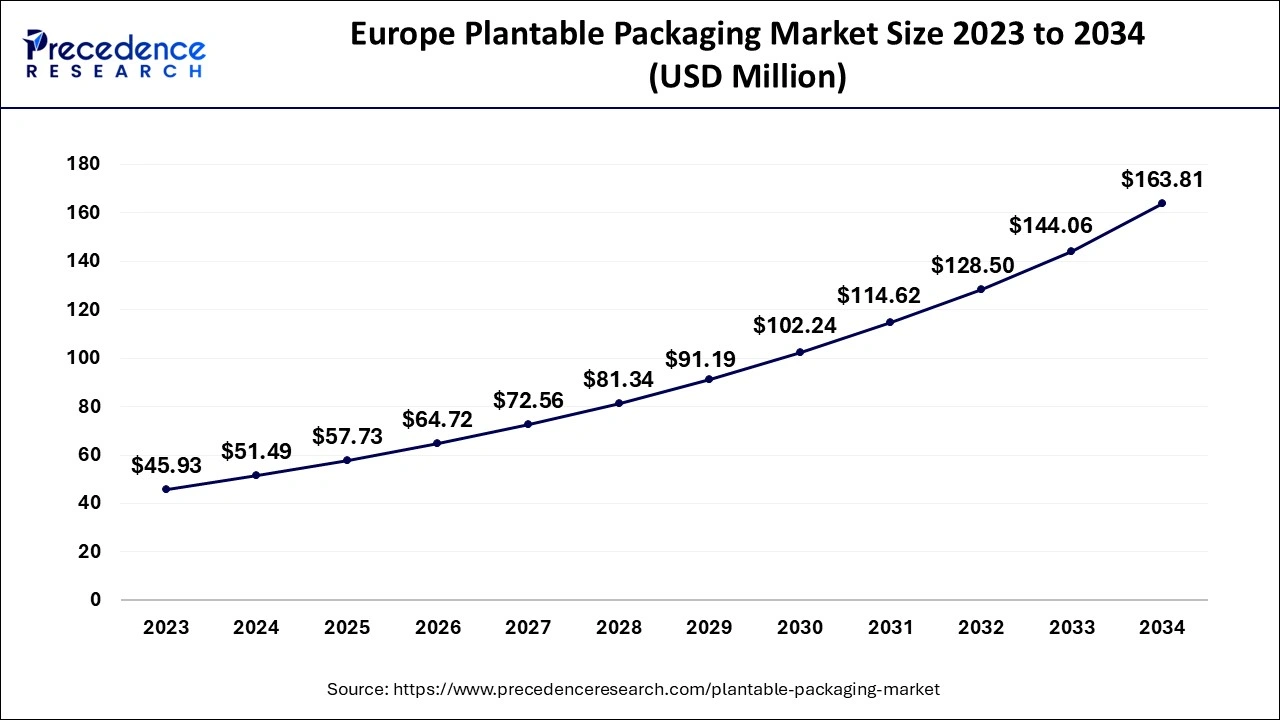

The global plantable packaging market size accounted for USD 147.12 million in 2024, grew to USD 164.94 million in 2025 and is predicted to reach around USD 461.45 million by 2034, representing a healthy CAGR of 12.11% between 2024 and 2034. The Europe plantable packaging market size is evaluated at USD 51.49 million in 2024 and is expected to grow at a CAGR of 12.25% during the forecast year.

The global plantable packaging market size is calculated at USD 147.12 million in 2024 and is projected to surpass around USD 461.45 million by 2034, expanding at a CAGR of 12.11% from 2024 to 2034. The demand for the plantable packaging market is growing due to the rising awareness regarding the environmental benefits of sustainable packaging. Consumers prefer green products that contribute towards market growth.

The Europe plantable packaging market size is evaluated at USD 51.49 million in 2024 and is anticipated to be worth around USD 163.81 million by 2034, growing at a CAGR of 12.25% from 2024 to 2034.

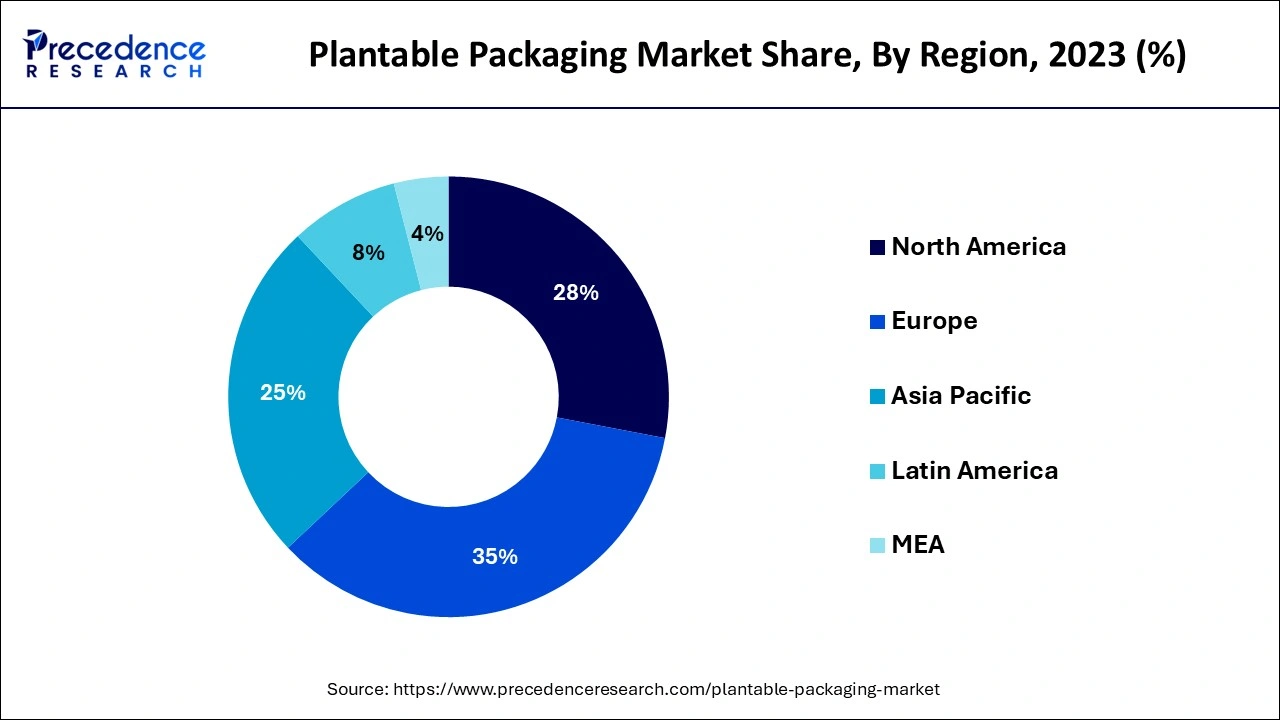

Europe dominated the global plantable packaging market by registering the largest revenue share in 2023. The dominance of the region is attributed to several initiatives by the countries that focus on adopting sustainable packaging solutions. The European Union aims to ban single-use plastic completely by 2030 in products like fruits and vegetables, hotels, and toiletries. The governments in the region are also increasing awareness through educational campaigns and programs. The stringent laws have also led to the adoption of sustainable packaging solutions throughout various industries. Additionally, the rising use of plantable packaging by the UK, France, and Germany in their food and cosmetic industry.

Asia Pacific is anticipated to grow at the fastest CAGR in the plantable packaging market during the forecast period of 2024 to 2034. The growth of the region is attributed to the rising sustainable focus of countries like India, China, and Japan, which brings multiple opportunities to the market. Additionally, the rising urbanization has increased the demand in the food and beverage industry, which stands out as a major driver of the market. Many companies are investing heavily, which can help them innovate new packaging solutions. Additionally, the e-commerce sector is growing rapidly.

Plantable packaging refers to a sustainable form of packaging containing seeds that can later be used to planted in soil. This packaging is made using recycled paper and boards, which can be decomposed after use. The plantable packaging market has been gaining significant popularity in recent times due to its eco-friendly nature. It is a zero waste concept gaining significant popularity across various industries that helps towards its growth. It becomes a substitute for traditional packaging, which can be used to create various types of packaging, such as belly bands, small boxes, and box fillers. The increasing preference towards adopting sustainable packaging is playing a crucial role in driving the market growth.

How Can AI Contribute to the Plantable Packaging Market?

The rise of technologies like Artificial Intelligence (AI) and Machine Learning (ML) are playing a crucial role in enhancing sustainable production. AI algorithms are capable of analyzing huge datasets that can study material patterns and their effects, which can be further enhanced to improve material quality. These technologies also play a significant role in predicting sustainable trends that will help the growth of the plantable packaging market. Additionally, the capability of AI to inspect the packaging through the computers is expected to enhance the overall supply chain processes, working at a rapid speed. All this is also expected to benefit the growing companies financially, helping them to reduce their additional costs.

| Report Coverage | Details |

| Market Size by 2034 | USD 461.45 Million |

| Market Size in 2024 | USD 147.12 Million |

| Market Size in 2025 | USD 164.94 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.11% |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Demand for waste reduction

The rising waste generation is a major issue that drives the need for sustainable adoptions. This has led to the adoption of plastic alternatives which help in reducing waste generation. Many companies are using these sustainable alternatives which can be beneficial towards the growth of the plantable packaging market. Adopting these technologies also helps to reduce the landfill waste that can be used in planting vegetation.

Adoption by corporate companies

The growth of corporate companies across various has led to massive changes in production patterns. The plantable packaging market is gaining rapid attention due to the rising sustainability initiatives by these companies which helps them in setting their brand image and also contribute towards reducing their carbon footprints.

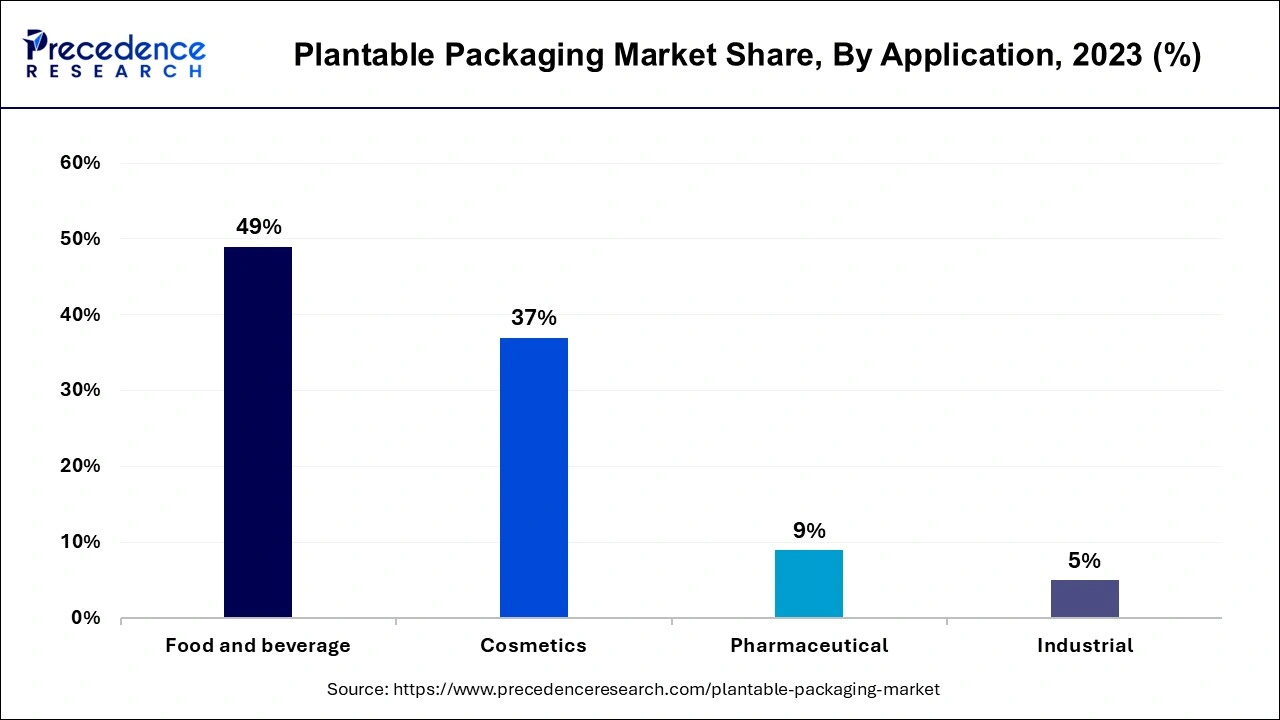

Food and beverage companies are major contributors to the plantable packaging industry as they use packaged items on a large basis. Adopting this packaging will help increase consumer awareness regarding zero waste. Additionally, the adoption of these packaging in beauty and personal care is anticipated.

Higher production costs

The zero waste concept has gained significant popularity in the developed and incomed regions, but there are still some concerns regarding the higher production costs, which can hamper the plantable packaging market growth. The materials used in these packaging are biodegradable, which usually has higher costs than traditional materials. This makes them expensive to use in low-income economies, which can restrict their growth in those regions. Additionally, the lack of technologies and higher prices also increase the competitiveness in the market, which makes it difficult for small-scale companies to mark their footprints.

Government initiatives and policies

The increasing carbon footprint has been a major factor that has led to many changes throughout multiple sectors. The stricter government policies, such as the single-use plastic ban, have played a major role in the growth of sustainable initiatives like the plantable packaging market. These packaging products are becoming popular throughout various industries due to their benefits, which include helping plant vegetation and reducing plastic waste. Governments are supporting these companies, which can help them in adopting sustainable packaging solutions. Additionally, these governments are also playing a crucial role in increasing awareness through educational campaigns.

Expansion in diverse sectors

The expansion of the packaging industry is increasing multiple business opportunities for many companies, which can mark their footprints in the industry. The plantable packaging market is gaining significant popularity due to its expansion in various markets like cosmetics, fashion, gift packaging, and many others. This is helping the plantable packaging companies to expand their portfolio and gain significant shares in the market. Additionally, the rise of e-commerce is another key contributor.

The bioplastics segment stood the dominant in the market in 2023. These materials are derived from sources like vegetable fats, oils, and other biodegradable materials. Some of the bioplastics are polylactic acid, including seeds that can be planted after using the package. The dominance of the plantable packaging market is attributed to the well-developed technologies that play a crucial role in enhancing the longevity of the materials used in these applications. This has led to the rising adoption of these materials, which are easily available in the market. Additionally, the increasing consumer preference for sustainable packaging is expected to raise the demand for bioplastics in the upcoming years.

The seaweed segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. These materials are processed in films which can be available for suitable other packaging. The growth of the plantable packaging market is increasing due to the compostable properties of the seaweed barriers, which makes them a sustainable option. Many companies are adopting the use of these materials as they are fully bio-degradable and match the regulatory standards.

The flexible packaging segment contributed to the largest share of the market in 2023. These packaging can be folded and bent without causing any damage to the product. The dominance of the plantable packaging market is attributed to the rising demand for these packages in the food and beverage industry for products such as tea bags and other snacks. These packages usually have a longer shelf life, which protects the product from any moisture and light. These properties are leading to the increasing adoption of these packages in multiple uses, such as households and cosmetics. Many companies are adopting these packaging options as they emit zero waste during production.

The rigid packaging segment is anticipated to grow at a significant CAGR in the market during the forecast period of 2024 to 2034. These boxes use materials that can protect the product by maintaining a fixed shape. The growth of the plantable packaging market is derived from the rising popularity of high-quality products that require enhanced packaging. Many companies are adopting the use of these packaging methods, which can also help enhance their brand image through visual appeal. The growth in sustainable materials is also expected to drive its demand in the upcoming years.

The food & beverage segment marked its dominance over the global market in 2023. The dominance of the segment is attributed to the huge consumer base of the food and beverage industry. The rising changes towards sustainable packaging bring multiple opportunities in the plantable packaging market. Many companies are investing heavily, which can help them adopt advanced packaging solutions while maintaining regulatory norms. The adoption of plantable packaging is derived from the rising waste generation through traditional packaging. Additionally, the rising consumer awareness regarding the use of biodegradable materials is leading to companies adopting sustainable solutions.

The cosmetics segment is expected to register the fastest growth in the market during the forecast period of 2024 to 2034. The growth of the segment is attributed to the rising popularity of personal care and beauty products. The rise of social media has been playing a crucial role in developing trends that lead to the adoption of cosmetic products. The brands are also adopting changes that help them enhance their brand value. Plantable packaging market companies are focusing on increasing their partnerships, which will help create multiple opportunities through the innovation of sustainable packaging solutions.

Segments Covered in the Report

By Material

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

March 2025