December 2024

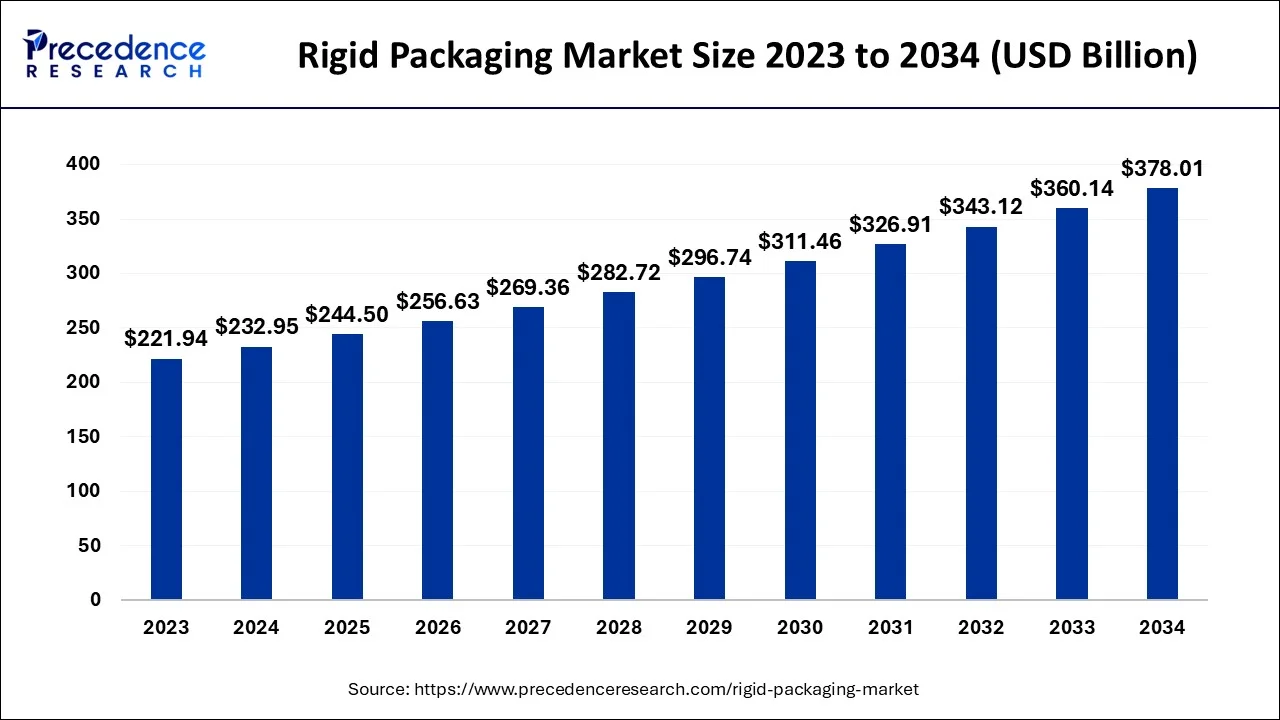

The global rigid packaging market size accounted for USD 232.95 billion in 2024, grew to USD 244.5 billion in 2025 and is projected to surpass around USD 378.01 billion by 2034, representing a healthy CAGR of 4.96% between 2024 and 2034.

The global rigid packaging market size is estimated at USD 232.95 billion in 2024 and is anticipated to reach around USD 378.01 billion by 2034, expanding at a CAGR of 4.96% between 2024 and 2034.

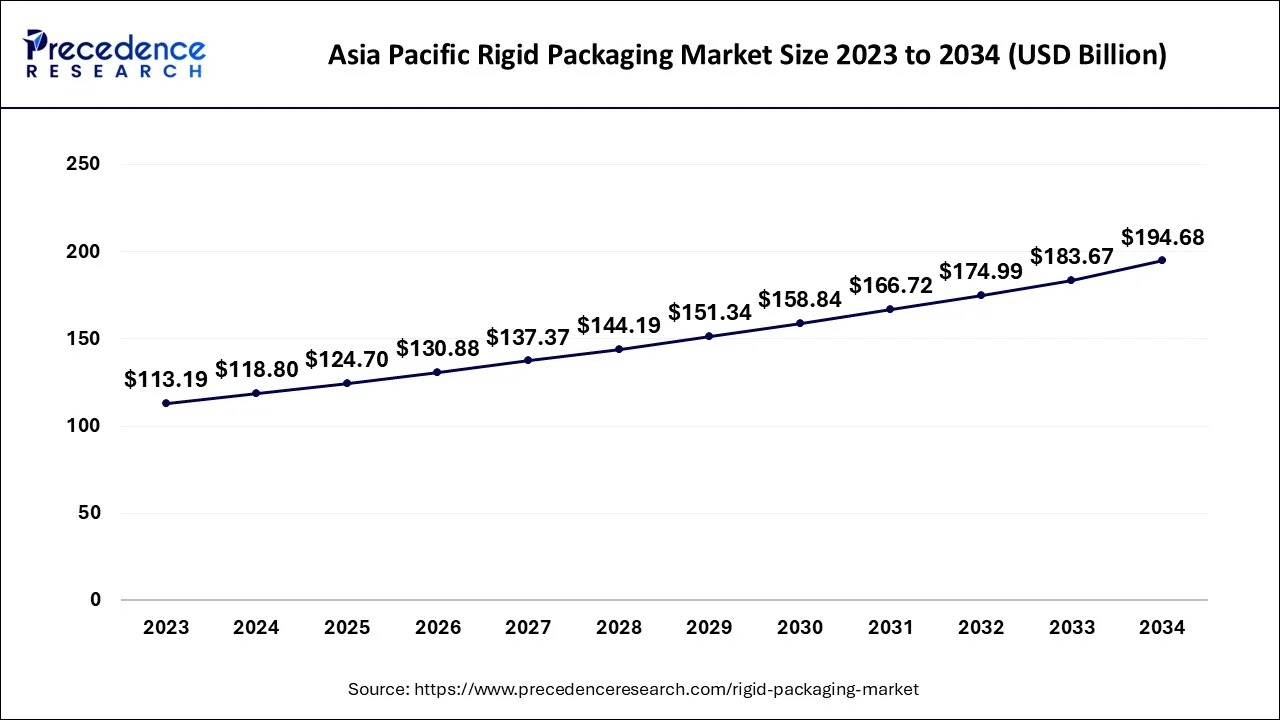

The Asia pacific rigid packaging market size accounted forUSD 118.80 billion in 2024 and is expected to be worth around USD 194.68 billion by 2034, growing at a CAGR of 5.06% between 2024 and 2034.

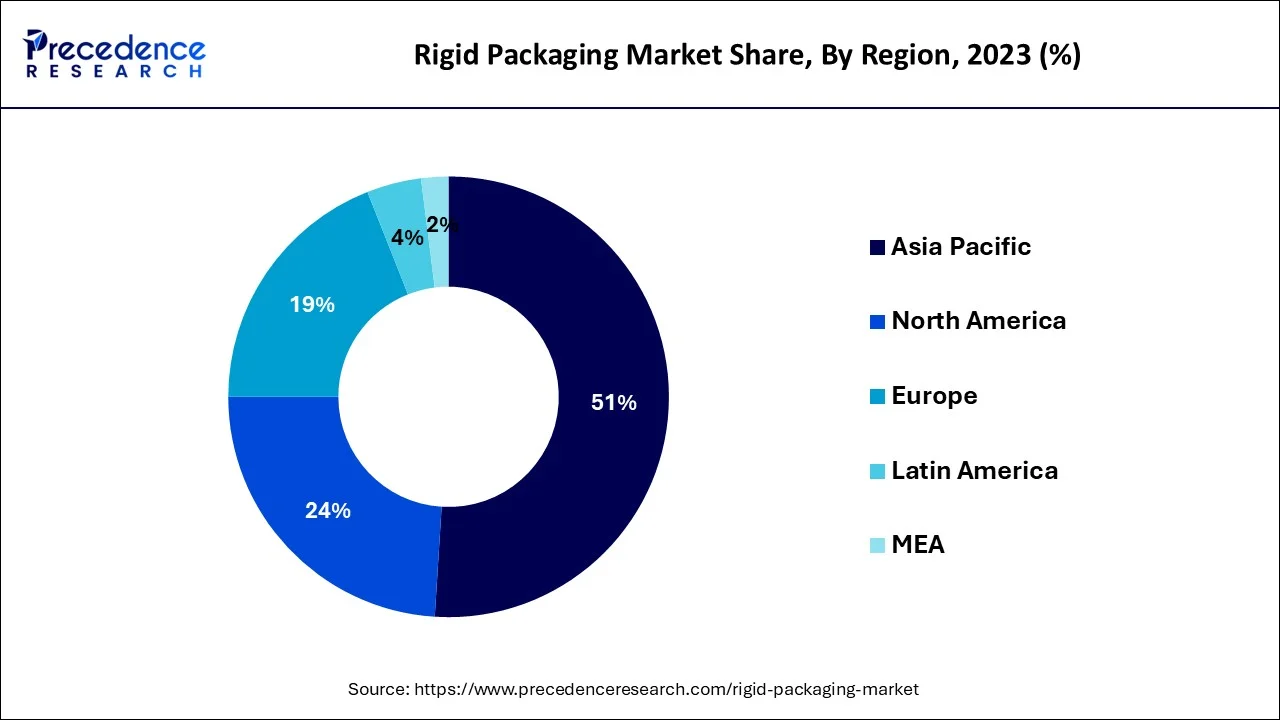

The Asia Pacific is expected to capture the largest market share over the forecast period. The growth in the region is attributed to the growing food & beverages and personal care & cosmetics industry particularly in India and China. The most recent analysis from Euromonitor International indicates that $88 billion worth of beauty and personal care products were sold in China in 2021, an increase of 10% from the previous year. The China Chain Store & Franchise Association also reports that the food and beverage market in China reached $595 billion in 2019, up 7.8% from 2018. Thus, the aforementioned facts support the market growth over the forecast period.

North America is expected to grow at a significant rate over the forecast period. The robust advancements in the rigid thermoform plastic packaging industry are responsible for this region's expansion. Numerous benefits of thermoforming include its lower cost and adaptability. The rigid thermoform plastic packaging industry has seen enormous growth in product manufacture, creating a sizable client base that is fueling the expansion of the North American rigid packaging market.

Europe is expected to grow at a fast rate during the forecast period because the food and beverage industry has a rising requirement for rigid packaging solutions. Due to the presence of some of the biggest food and beverage companies in the region, there will certainly be an increase in the need for rigid packaging solutions. Additionally, the rising demand for personal care and cosmetic products from this region is anticipated to fuel market revenue growth. For instance, the manufacture of body care products and perfumes in Germany generated revenues of USD 4223 million and USD 3020 million respectively in 2022, according to the Federal Statistical Office. Therefore, the aforementioned stats drive the market expansion over the forecast period.

Packaging is referred to as rigid if it cannot be bent or forced out of shape. It is known for its strength and lack of flexibility while also providing things with support and structure. Plastic bottles and boxes, aluminum cans, glass jars, and corrugated and paperboard boxes are a few examples of rigid packaging materials. Cereal boxes, glass liquor bottles, soup cans, and detergent bottles are only a few examples of recognized uses. Flexible packaging protects products from severe heat, corrosion, moisture, and other environmental harmful forces. Rigid packaging is a suitable substitute. With regard to the increased attention of stakeholders, there are quite a few innovations occurring in that field as well as several product advancements.

In rigid packaging solutions, new plastic grades and versions are used to enhance the quality of the packaging that safeguards against external risks. The market is being driven by various factors including the growing food & beverages industry, increasing personal care and cosmetic sector, rising R&D investments, growing product launches, and increasing e-commerce industry.

According to the Australian Institute of Health and Welfare, Australia spent a predicted $220.9 billion on health-related products and services in 2020–21, or $8,617 per person on average. Total health spending (recurrent and capital) increased by 7.1% in real terms over 2019–20 (inflation-adjusted). Even while this growth was higher than the 3.4% average annual growth rate for the ten years leading up to 2020–21, it primarily reflected a return to pre–pandemic health spending trends, especially for non–government spending. Australia's health expenditures made up 10.7% of the country's GDP in 2020–21, an increase of 0.5 percentage points from 2019–20. The overall health spending in 2020–21 was $156 billion, or 70%, supported by the government, and the remaining 29%, or $64.9 billion, was funded by non–government sources.

| Report Coverage | Details |

| Market Size in 2024 | USD 232.95 Billion |

| Market Size by 2034 | USD 244.5 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.96% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Material and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand from the healthcare industry

The governments of developing nations in many regions are investing in modernizing the healthcare systems, particularly in the era of a pandemic. As rigid plastic packaging is durable, hygienic, transparent, and lightweight, it protects medicines from contamination and is ideal for keeping medical products including tablets, syringes, surgical supplies, syrups and other products. Rigid packaging is expected to become more popular on a global scale as a result of the expanding healthcare industry. For instance, as per the China National Health Commission, the total size of China's healthcare industry will reach $2.39 trillion by 2030. Thus, the increasing healthcare industry in developing nations is expected to propel the market growth over the forecast period.

Environmental impact of plastics

High-density polyethylene (HDPE), expanded polystyrene (EPS), polyethylene terephthalate (PET), and polyvinyl chloride (PVC) are the polymers that are most frequently utilized in the packaging industry. Different industries use rigid plastic packaging to protect and sustainably store packed goods like industrial equipment, food, and medical supplies. Recycling, reusing, and segregating plastic garbage is the main issue posed by these plastics. Plastic packaging materials can take up to a thousand years to breakdown in landfills, causing pollution of the land and water. Furthermore, plastics lose mechanical strength when exposed to direct sunshine, while thermoplastics creep and soften at room temperature. Thus, the environmental impact of plastics on environment is one of the major restraints that hamper the market growth during the forecast period.

Increasing uses of rigid packaging in personal care and cosmetic industry

Rigid plastic packaging is used in the personal care and cosmetics sector to package goods for use in sun care, oral care, skin care, body care, perfume, decorative cosmetics, and hair care. This gives the goods frictionless storage and a longer shelf life. In emerging nations, the market for cosmetics and personal care products is expanding quickly, which is driving up demand for rigid plastic packaging. For instance, the Malaysian International Trade Administration estimates that the global market for cosmetics and personal care would expand at a compound annual growth rate of 4% by 2025. Thereby, this is expected to drive the market growth over the forecast period.

Based on the material, the global rigid packaging market is segmented into plastic, metal, paper & paperboard, glass and bioplastic. The plastics segment is expected to capture the largest market share over the forecast period. The widespread use of polyethylene terephthalate (PET) bottles in a variety of sectors, including the food, beverage, and pharmaceutical industries, is responsible for this increase. The rigid thermoform plastic packaging industry is supported by thermoforming due to its advantages. The U.S. Food And Drug Administration (FDA) has approved the widespread use of polystyrene in packaging, which can reduce the risk of foodborne disease in households and is fueling this market's expansion.

On the other hand, paper & paperboard segment is growing at the highest CAGR during the projection period. Paper containers, also referred to as paper packaging, are a high-efficient and affordable alternative that people can use to move, carry, and store a variety of things. Paper-based packaging is increasingly being used because it can be customized to match the needs of a particular product or consumer and is designed to be strong yet lightweight. Moreover, the use of paper-based packaging will contribute to a sustainable, safe, and healthy environment, among many other advantages because it is made from renewable resources. Thus, owing to these properties the segment will drive the market growth.

Based on the application, the global rigid packaging market is divided into food & beverages, pharmaceuticals, personal care, and others. The food & beverages segment is expected to grow at a significant rate over the forecast period.

The containers benefit from the rigid plastic packaging's flavor-absorbing, long-lasting, lightweight, and durable qualities. The food item is kept safe and contaminant-free in rigid plastic packaging containers including bottles, cans, and jars, among others. In developing nations including the United States, Canada, China, India, and other nations, there is a swiftly growing demand for rigid plastic packaging. Demand for rigid plastic packaging is being driven by the food and beverage industry's continued expansion. For instance, the China Chain Store & Franchise Association estimates that the country's food and beverage (F&B) market grew by 7.8% from 2018 to 2019, reaching over US$595 billion.

Additionally, the Food Export Midwest USA reported that the USDA's Office of Agricultural Affairs (OAA) in Rome stated that Italy's food retail sales in 2019 were US$145 billion, an increase of 1% from the previous year. Thus, this is expected to drive the market growth over the forecast period.

Segments Covered in the Report:

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

August 2024

April 2025

January 2025