September 2024

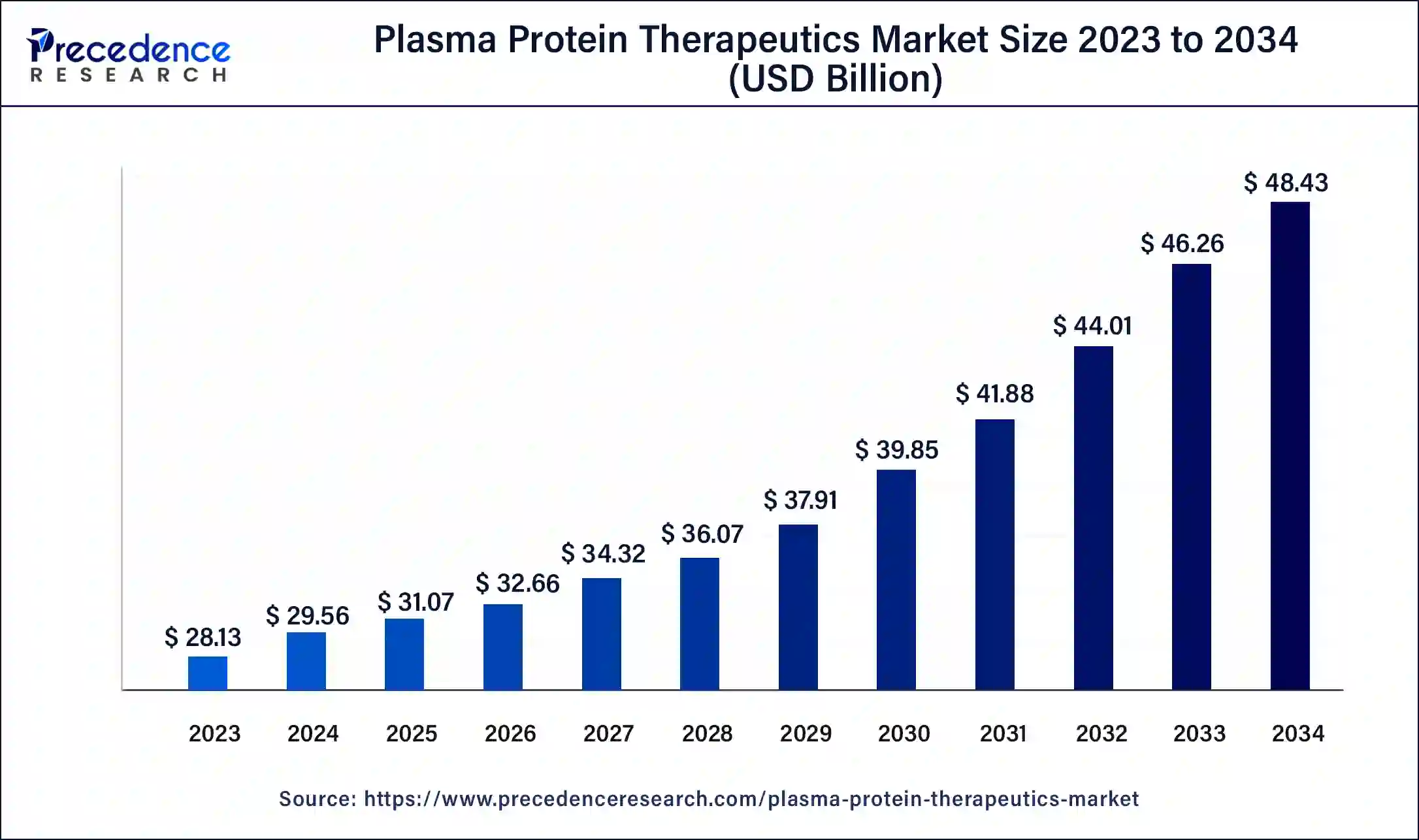

The global plasma protein therapeutics market size was USD 28.13 billion in 2023, estimated at USD 29.56 billion in 2024 and is anticipated to reach around USD 48.43 billion by 2034, expanding at a CAGR of 5.06% from 2024 to 2034.

The global plasma protein therapeutics market size accounted for USD 29.56 billion in 2024 and is predicted to reach around USD 48.43 billion by 2034, growing at a CAGR of 5.06% from 2024 to 2034.

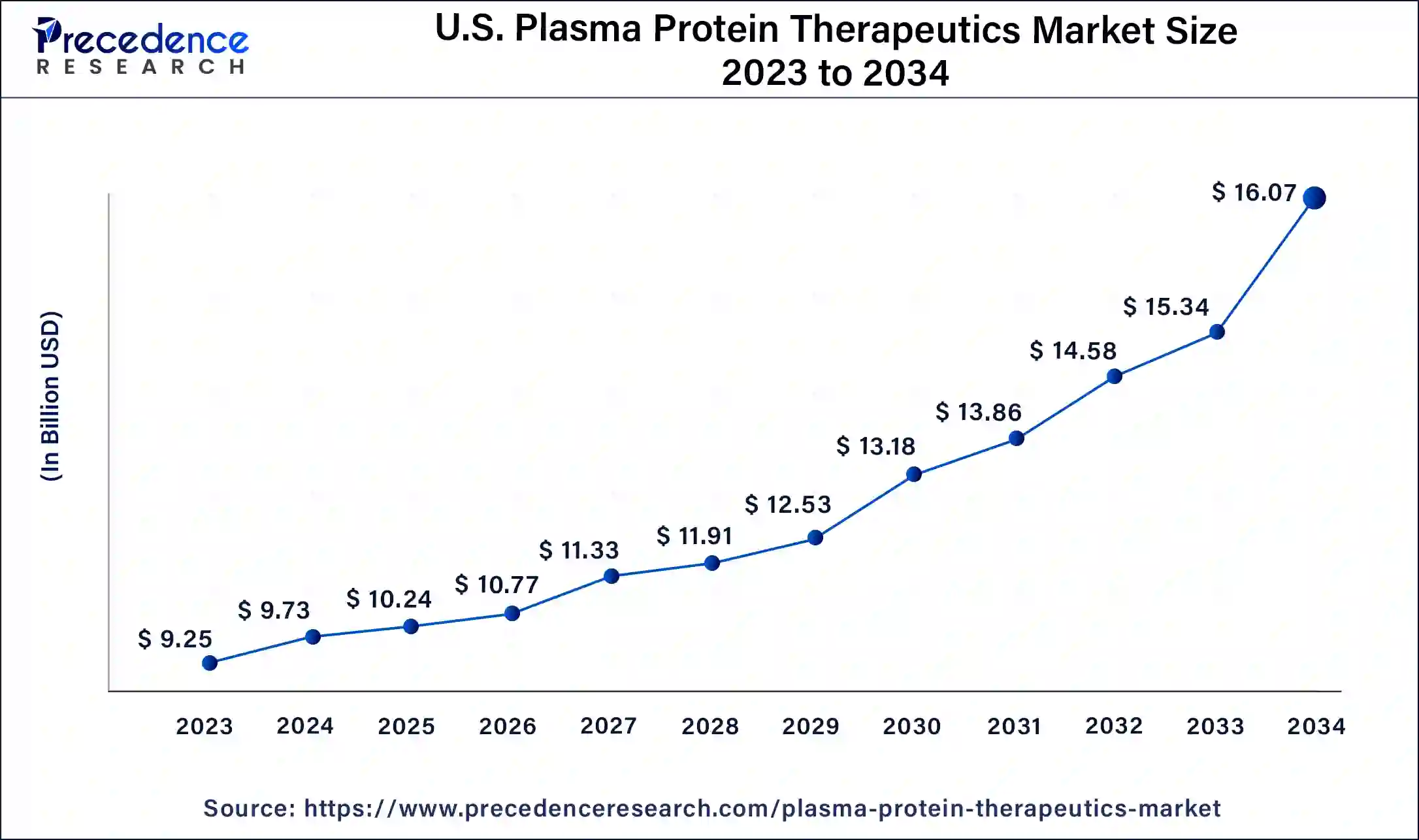

The U.S. plasma protein therapeutics market size was valued at USD 9.25 billion in 2023 and is expected to reach USD 16.07 billion by 2034, growing at a CAGR of 5.14% from 2024 to 2034.

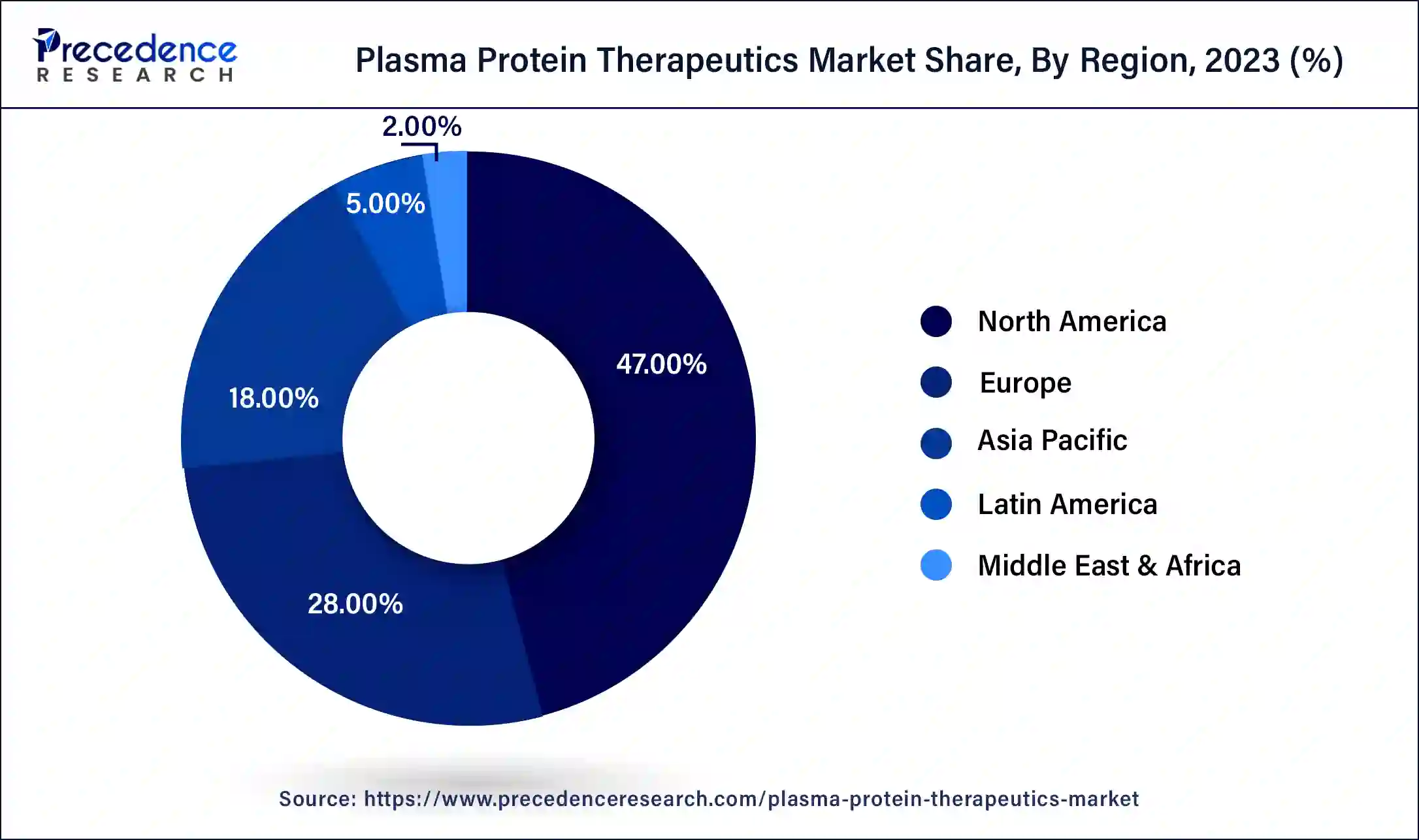

North America has held the largest revenue share of 47% in 2023. North America holds a significant share in the plasma protein therapeutics market due to factors like robust healthcare infrastructure, high healthcare expenditure, and a well-established regulatory framework. The region benefits from advanced research and development activities, fostering the introduction of novel therapies. Additionally, a growing prevalence of chronic diseases, increasing awareness, and a favorable reimbursement landscape contribute to the dominance of North America in the plasma protein therapeutics market, making it a key hub for both production and consumption of these essential medical products.

Asia-Pacific is estimated to witness the highest growth. Asia-Pacific commands a significant share in the plasma protein therapeutics market due to factors such as a large patient population, increasing healthcare infrastructure, and rising awareness of plasma-derived therapies. The region's economic growth facilitates greater access to advanced medical treatments. Moreover, strategic initiatives by key market players, collaborations, and the expansion of healthcare systems contribute to the market's prominence. The growing prevalence of diseases requiring plasma protein therapies further propels the demand in Asia-Pacific, solidifying its pivotal role in the global landscape.

Plasma protein therapeutics refers to a category of medical treatments crafted from human plasma, the liquid portion of blood. These specialized therapies are fundamental for addressing various medical conditions, especially those associated with rare and chronic diseases. The production process involves collecting plasma from donors, breaking it down into its distinct elements, and extracting specific proteins through a method known as fractionation.

These therapeutic proteins are pivotal in treating a range of disorders such as immunodeficiency, hemophilia, and autoimmune diseases. Noteworthy examples include immunoglobulin that enhance the immune system in individuals with primary immunodeficiency disorders, clotting factors crucial for hemophilia patients, and albumin used to manage conditions like shock or severe burns by sustaining blood volume. The plasma protein therapeutics market has witnessed substantial growth due to the rising incidence of rare diseases and the expanding applications of these vital blood-derived proteins in therapeutic interventions.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 5.06% |

| Market Size in 2023 | USD 28.13 Billion |

| Market Size in 2024 | USD 29.56 Billion |

| Market Size by 2034 | USD 48.43 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Application, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanded label claims and technological advancements

Expanded label claims and technological advancements are pivotal factors propelling the surge in demand for plasma protein therapeutics. The broadening of regulatory approvals and expanded label claims for existing products plays a critical role in opening up new avenues of application. This allows manufacturers to address a wider range of medical conditions, increasing the market's attractiveness by providing versatile solutions for various patient populations.

Simultaneously, ongoing technological advancements, especially in plasma fractionation techniques and purification processes, enhance the overall efficiency of extracting therapeutic proteins. These innovations result in higher product quality, improved safety profiles, and increased efficacy. The continuous refinement of these technologies not only meets rigorous regulatory standards but also positions Plasma Protein Therapeutics as cutting-edge and reliable treatment options, thereby driving heightened confidence among healthcare professionals and patients and fueling the growing market demand.

Limited plasma donation pool and slow adoption of subcutaneous administration

The limited plasma donation pool and slow adoption of subcutaneous administration methods serve as significant restraints in the plasma protein therapeutics market. The dependence on human plasma donation creates a finite and sometimes insufficient supply, impacting the scalability of production. This limitation is exacerbated by challenges in recruiting and retaining donors, potentially leading to shortages and affecting the overall availability of plasma-derived therapies.

Additionally, the slow adoption of subcutaneous administration, despite its advantages in terms of patient convenience and reduced healthcare resource utilization, hampers market growth. Resistance to change within healthcare systems, coupled with a preference for traditional administration methods, may impede the broader adoption of more patient-friendly delivery options. Overcoming these restraints requires strategic initiatives to expand the plasma donation pool, improve donor recruitment practices, and actively promote the benefits and efficiency of subcutaneous administration methods to both healthcare providers and patients.

Advancements in purification technologies and personalized medicine approaches

Advancements in purification technologies and personalized medicine approaches are pivotal in shaping opportunities within the Plasma Protein Therapeutics market. Enhanced purification methods, driven by technological innovation, enable the production of higher-quality plasma-derived therapies. This not only ensures improved safety profiles but also addresses regulatory requirements, presenting an opportunity for manufacturers to deliver more effective and reliable treatments.

Simultaneously, personalized medicine approaches offer a transformative avenue for the market. Tailoring plasma protein therapies to individual patient characteristics and needs has the potential to optimize treatment outcomes. The ability to identify specific patient profiles and customize therapies accordingly aligns with the broader trend toward precision medicine, presenting a substantial opportunity to meet evolving healthcare demands and further expand the applications of plasma protein therapeutics. These combined advancements position the market for sustained growth by aligning with both regulatory expectations and the increasing focus on individualized patient care.

In 2023, the immunoglobulin segment held the highest market share of 35% on the basis of the product type. The immunoglobulin segment in plasma protein therapeutics market includes products derived from human plasma containing antibodies to enhance the immune system. This segment has witnessed a notable surge in demand, driven by increasing prevalence of immunodeficiency and autoimmune disorders. Ongoing advancements in purification techniques and the development of subcutaneous administration methods have further propelled the growth of immunoglobulin therapies. The trend towards self-administration and improved patient compliance is shaping the immunoglobulin segment, reflecting a broader shift in the plasma protein therapeutics market.

The albumin segment is anticipated to witness highest growth at a significant CAGR of 6.5% during the projected period. The albumin segment in the plasma protein therapeutics market refers to the category of therapeutic products derived from human plasma, primarily focusing on albumin, a vital blood protein. Albumin plays a crucial role in maintaining blood volume and is utilized in critical care scenarios, including trauma and surgery. Current trends indicate a growing demand for albumin-based therapies, driven by increased awareness of its applications in diverse medical conditions, particularly in critical care settings. This trend is further bolstered by ongoing advancements in purification technologies, ensuring the production of high-quality albumin products.

According to the application, the hemophilia segment has held 32% revenue share in 2023. In the plasma protein therapeutics market, the hemophilia segment focuses on treating individuals with hemophilia, a genetic disorder impairing blood clotting. This therapeutic application involves providing clotting factor proteins derived from human plasma, addressing deficiencies in patients. Current trends indicate a growing emphasis on developing advanced clotting factor therapies with extended half-lives, enhancing treatment convenience and reducing the frequency of infusions. The evolution of these therapies showcases a commitment to improving the quality of life for individuals with hemophilia through innovative and more efficient plasma protein treatments.

The primary immunodeficiency disorder segment is anticipated to witness the highest growth over the projected period. The Primary Immunodeficiency Disorder (PID) segment in the plasma protein therapeutics market pertains to the treatment of individuals with weakened immune systems. This includes conditions like agammaglobulinemia and common variable immunodeficiency.

A notable trend in this segment is the increasing recognition and diagnosis of PID cases globally. Improved awareness and advancements in diagnostic methods are driving the demand for plasma-derived immunoglobulin, providing targeted therapeutic solutions. As a result, the PID segment is experiencing steady growth, emphasizing the critical role of plasma protein therapeutics in addressing immune deficiencies.

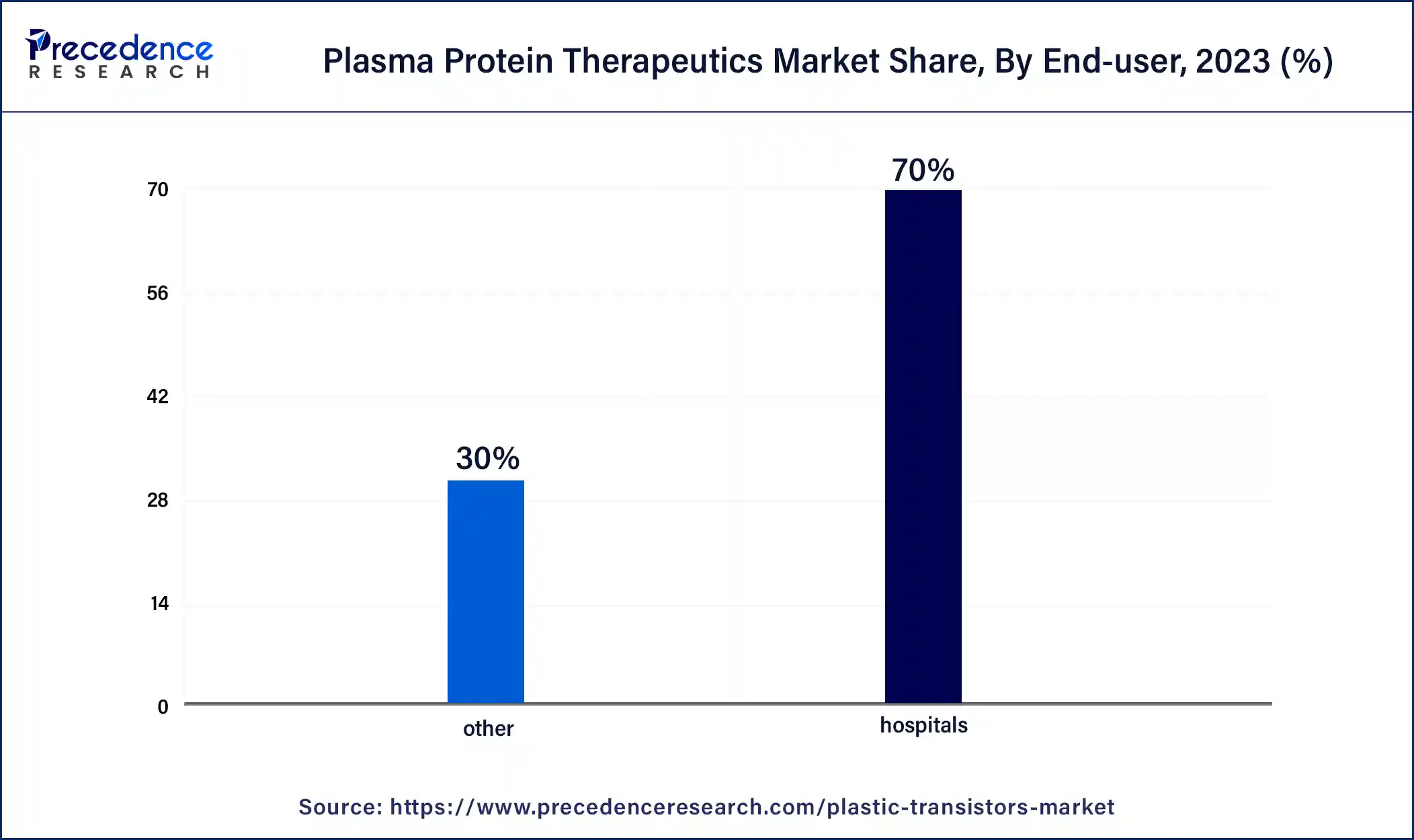

According to the end user, the hospitals segment held 70% revenue share in 2023. In the plasma protein therapeutics market, the hospital segment refers to healthcare facilities where patients receive infusion therapies and specialized treatments. Hospitals serve as crucial end users, administering plasma protein therapies to patients with various conditions, including immunodeficiency and coagulation disorders. The trend in this segment involves an increasing preference for on-site administration of these therapies, allowing for immediate medical supervision, optimized treatment plans, and efficient healthcare resource utilization within hospital settings. This trend ensures a comprehensive and streamlined approach to patient care.

The other segment is anticipated to witness the highest growth over the projected period. The segment in the plasma protein therapeutics market encompasses diverse end users beyond the primary categories. This may include smaller clinics, research institutions, or specialty healthcare providers. A trend in this segment involves increased adoption of plasma protein therapies for specialized applications, such as research purposes or unique medical conditions. As the market evolves, collaborations with niche end users and the exploration of unconventional applications are likely to contribute to the continued expansion and diversification of the plasma protein therapeutics market.

Segments Covered in the Report

By Product Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

November 2024

January 2025