April 2025

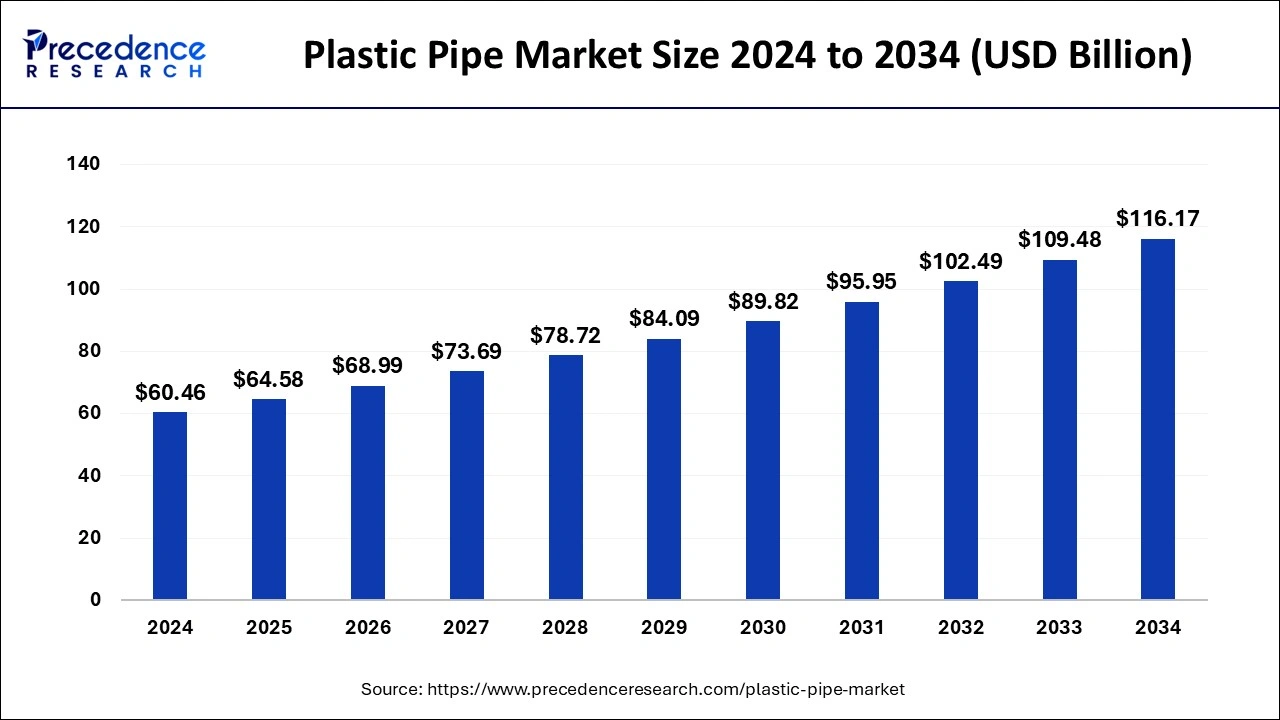

The global plastic pipe market size is calculated at USD 64.58 billion in 2025 and is forecasted to reach around USD 116.17 billion by 2034, accelerating at a CAGR of 6.75% from 2025 to 2034. The Asia Pacific plastic pipe market size surpassed USD 29.71 billion in 2025 and is expanding at a CAGR of 6.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global plastic pipe market size was estimated at USD 60.46 billion in 2024 and is predicted to increase from USD 64.58 billion in 2025 to approximately USD 116.17 billion by 2034, expanding at a CAGR of 6.75% from 2025 to 2034. Government subsidies for irrigation equipment can significantly grow the market.

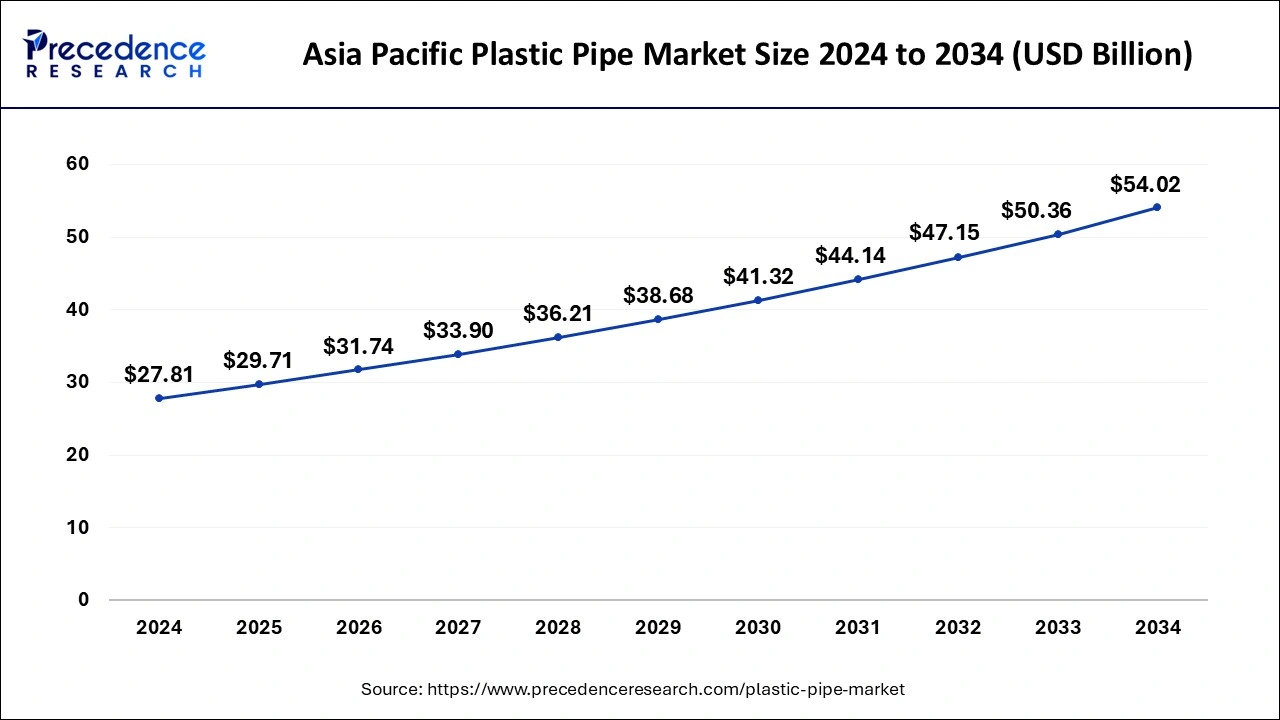

The Asia Pacific plastic pipe market size was estimated at USD 27.81 billion in 2024 and is expected to be worth around USD 54.02 billion by 2034, at a CAGR of 6.87% from 2025 to 2034.

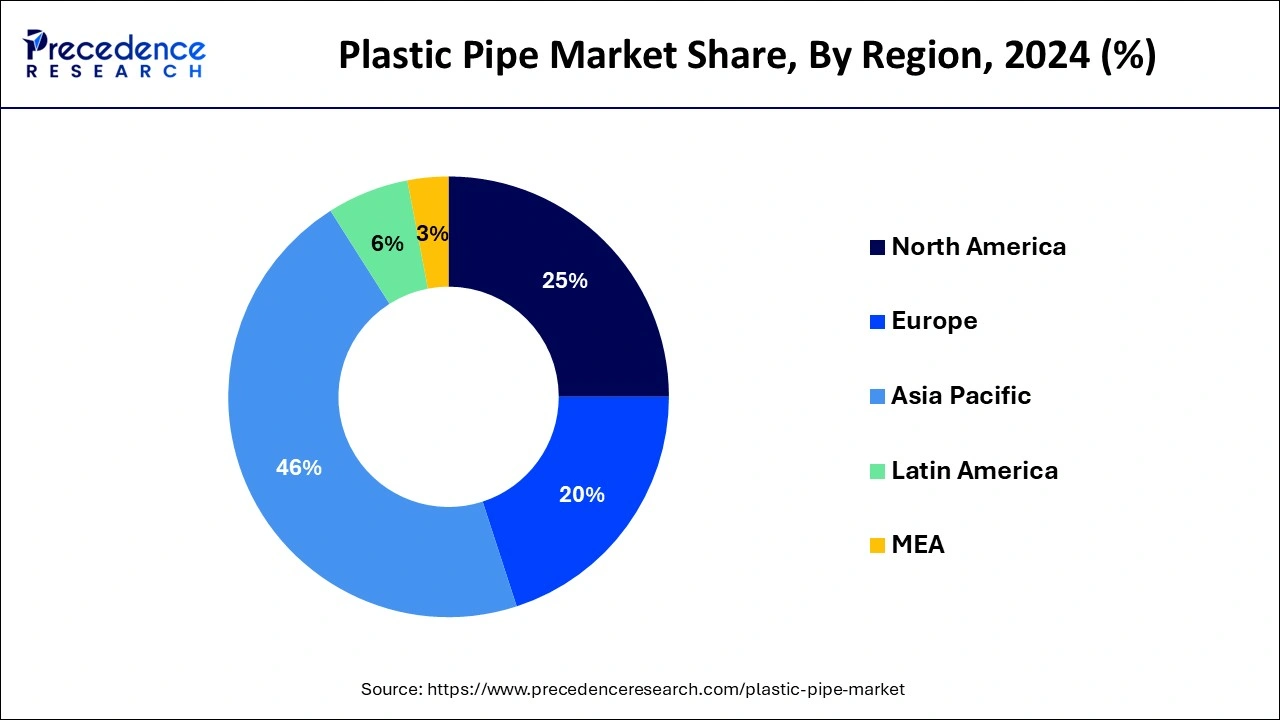

Asia Pacific dominated the plastic pipe market in 2024. Due to the fast industrialization, infrastructural development, and urbanization of nations like China and India, the plastic pipe market in the Asia Pacific is predicted to rise. The need for plastic pipes in the area is being driven by factors such as population growth, rising building project investments, and government measures to upgrade the region's sanitation and water supply infrastructure. Additionally, the region is seeing a rise in the use of plastic pipes due in part to increased awareness of its advantages, which include cost-effectiveness, corrosion resistance, and lightweight design.

North America is expected to grow at the highest CAGR during the forecast period. A number of variables, such as strong infrastructure development, technological advancements in plastic pipe manufacturing, a growing need for affordable and long-lasting piping solutions, and strict regulations supporting the use of plastic pipes for a variety of applications, contribute to North America's market dominance in the plastic pipe industry. Plastic pipe adoption in building, water distribution, and industrial applications is further fuelled by the region's robust economy and emphasis on environmental practices.

The plastic pipe market refers to plastic pipes that are made of different types of plastic materials, including polyvinyl chloride (PVC), cross-linked polyethylene (PEX), chlorinated polyvinyl chloride (CPVC), and polyethylene (PE). Plastic pipes are useful for many purposes, like plumbing, irrigation, drainage, and industrial applications. Plastic pipes are widely used because they are simple to install, lightweight, strong, and resistant to corrosion. Additionally, the end users of plastic pipes are building & construction, agriculture, oil & gas, etc.

The plastic pipe market is fragmented with multiple small-scale and large-scale players such as Pipe Corporation, Supreme Industries, Finolex Industries Ltd., Kubota ChemiX Co., Aliaxis Group S.A., Mexichem SAB de CV, Chevron Phillips Chemical Company, Wienerberger AG, Kotec Corporation, ASTRAL, POLYTECHNIK Ltd, Tommur Industry CO., Ltd.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.75% |

| Market Size in 2025 | USD 64.58 Billion |

| Market Size by 2034 | USD 116.17 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Application Type, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing application for agricultural purposes

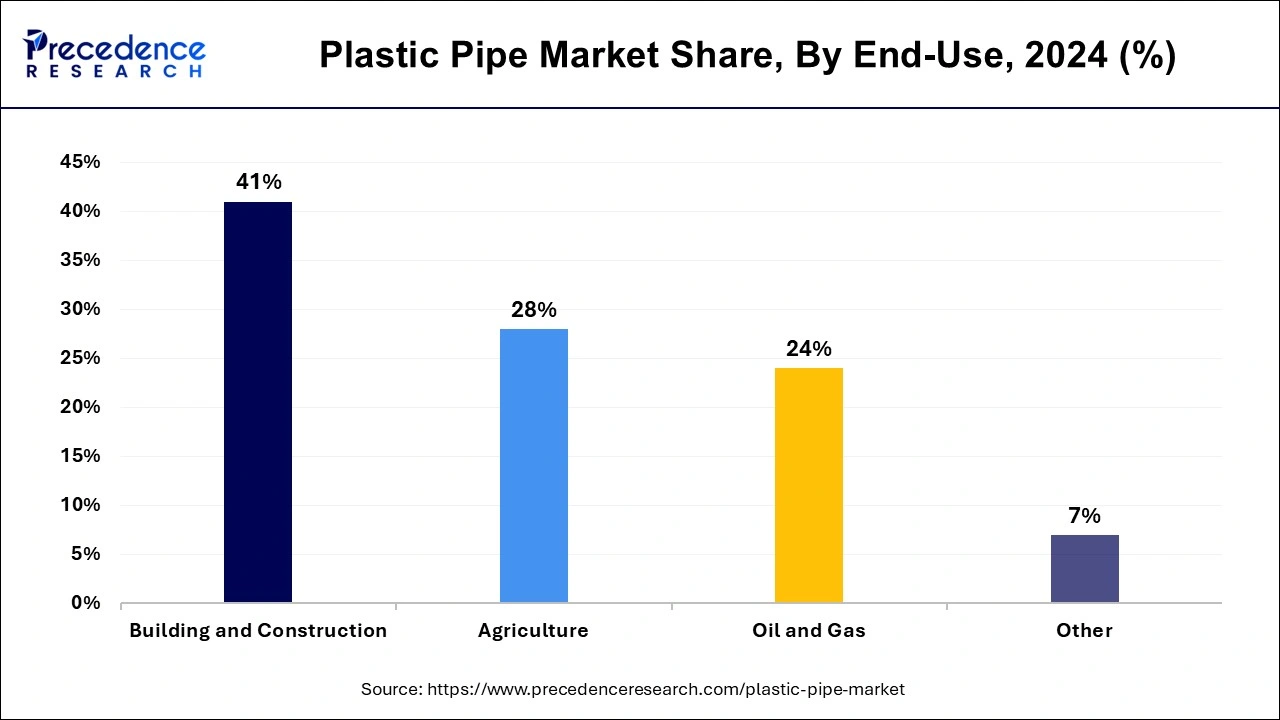

The growing application in agriculture purpose can boost the plastic pipe market. The use of advanced irrigation techniques in agriculture is driving the demand for strong, long-lasting plastic pipes. These plastic pipes are used for the setups of greenhouses as well as for drainage, irrigation, and water supply. So, as the application of agriculture grows, the demand for plastic pipes increases significantly, which leads to the growth of the market.

Government subsidy on irrigation equipment

The subsidies by the government for irrigation equipment can significantly grow the plastic pipe market. The government subsidies on irrigation equipment involve financial subsidies to incentivize farmers or agricultural enterprises to invest in irrigation technology such as drip irrigation systems, sprinkles, and other water-efficient equipment. The goal of government subsidies is to boost agricultural production.

Regulatory and environmental concerns

The regulatory and environmental concerns may slow down the plastic pipe market. Larger laws governing the use and disposal of plastics might hold down market expansion by raising production costs and necessitating more testing and certification. Public outrage against plastic products, particularly plastic pipes, may result from growing awareness of plastic pollution and its effects on the environment. This may lead to a decline in demand and stricter laws around the use of plastics.

Technical advancement in plastic pipes

The technical advancement may be an opportunity for the growth of the plastic pipe market. Manufacturers are continuously improving plastic pipe formulations to maximize their strength, flexibility, and resistance to environmental factors. Pipes that can withstand higher pressure and temperatures are now possible for innovations in chemical composition and additions.

The maintenance and administration of plastic pipes have been revolutionized by the installation of sensors and monitoring systems. Additionally, IoT-enabled plastic pipes that are innovative in nature provide real-time temperature, pressure, and water flow monitoring, which helps detect leaks or possible problems early on. Nanotechnology was used to create plastic pipes that have improved properties. Infrastructure that is more resilient and sustainable is achieved through the use of nano-additives, which strengthen pipelines and increase their resistance to corrosion.

The polyvinyl chloride segment dominated the plastic pipe market in 2024 and is expected to sustain this dominance throughout the forecast period. Polyvinyl chloride is widely used in a variety of industries, including electronics, packaging, healthcare, and construction. It is renowned for being affordable, adaptable, and durable. In accordance with the chemicals added throughout the production process, polyvinyl chloride can be either rigid or flexible. For a number of reasons, polyvinyl chloride or PVC is dominant in a number of industries and remains so. The reasons for the dominance of polyvinyl chloride include its incredible adaptability and finding applications in everything from building materials to healthcare devices. Its affordability, chemical resistance, and longevity make it appealing for a variety of applications. The ease of installation, transportation, and manufacturing of polyvinyl chloride further contributes to its extensive use. The polyvinyl chloride dominance has been maintained in spite of concerns about the environment caused by efforts to increase recycling and minimize its environmental impact.

The water supply segment dominated the plastic pipe market in 2024. Plastic pipes are widely used in water supply systems because they are flexible, long-lasting, and corrosion resistant. Potable water is frequently transported in residential, commercial, and industrial contexts using plastic pipes such as PVC (polyvinyl chloride), CPVC (chlorinated polyvinyl chloride), PE (polyethylene), and PEX (cross-linked polyethylene). Compared to conventional metal pipes, these pipes are less likely to leak, lightweight, and simple to install. They also resist scale accumulation and chemical reactions, which can increase the plumbing system's longevity. However, to guarantee the water supply system's lifespan and safety, proper installation and maintenance are necessary. Plastic pipes are perfect for water supply because, in contrast to metal pipes, they do not corrode when exposed to water or dirt.

The sewerage segment is expected to grow to the highest CAGR during the forecast period. Sewage refers to a network of pipes, drains, and other infrastructure that is used to transport waste and wastewater from residences, workplaces, and other buildings to safe disposable sites or a treatment facility. The expected growth of sewerage in the plastic pipe market as municipalities and infrastructure developers seek efficient, cost-effective, and durable solutions for handling sewage.

The building & construction segment dominated the plastic pipe market in 2024. The process involved in constructing residential, commercial, industrial, or infrastructure-related structures is collectively referred to as building and construction. It involves a number of phases, such as project planning, design, funding, and execution, utilizing a variety of materials, including steel, concrete, and wood. Because they are strong and resistant to rust, plastic pipes can be used in a variety of construction applications, such as HVAC, plumbing, and drainage. Plastic pipes are a desirable option for building projects looking to cut expenses because they are frequently more affordable than more conventional materials like metal or concrete pipes.

The agriculture segment is expected to grow to the highest CAGR during the forecast period. The market is anticipated to increase due to its various applications in the agriculture sector, such as water supply networks, drainage systems, and irrigation systems. Plastic pipes are becoming more and more popular in agricultural settings. Dependability and efficiency are essential due to their advantages, such as durability, resistance to corrosion, and affordability. The use of precision agriculture and other cutting-edge agricultural methods is also driving increasing demand for plastic pipes to support contemporary irrigation and water management strategies.

By Material

By Application Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

September 2024

August 2024