November 2024

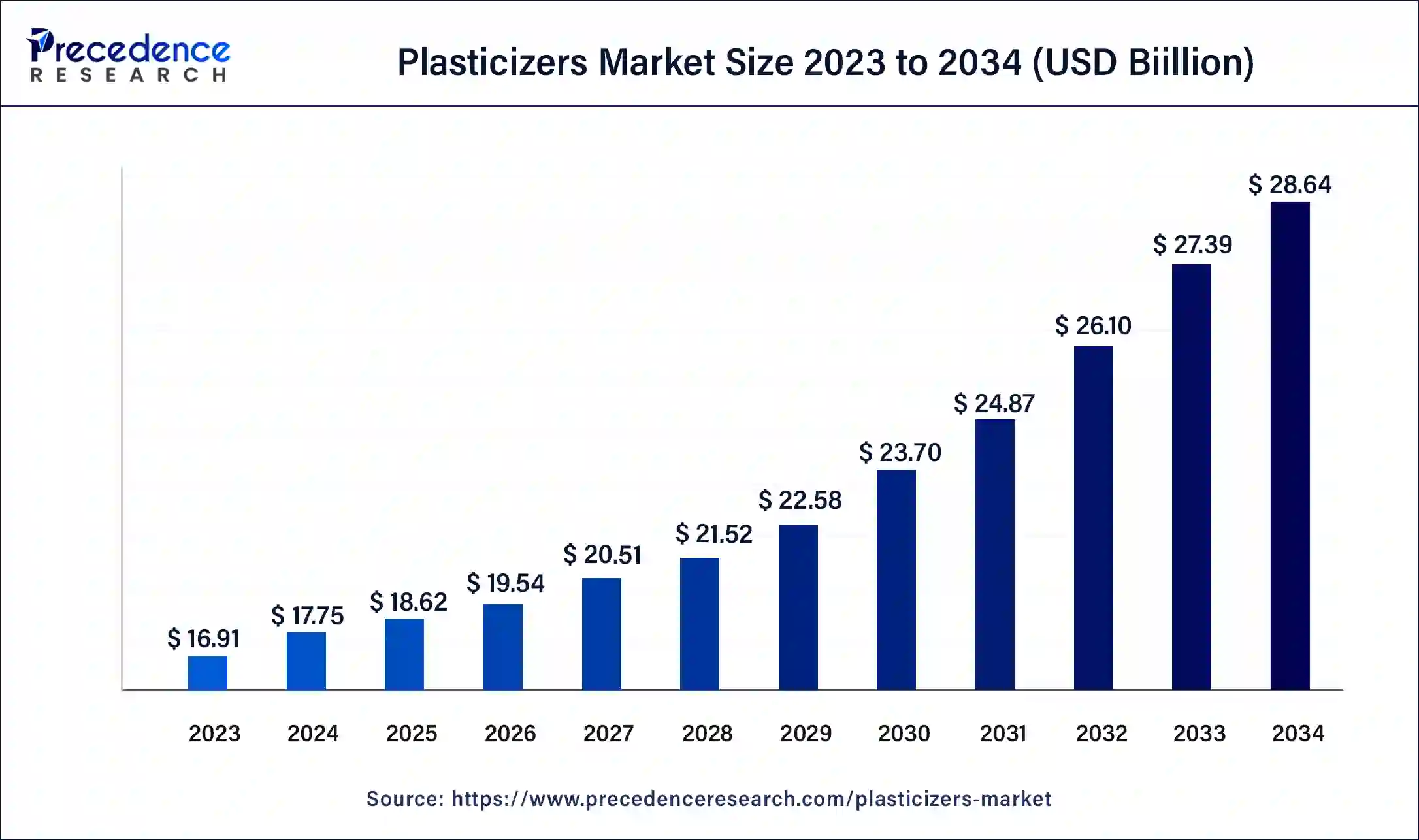

The global plasticizers Market size was USD 16.91 billion in 2023, estimated at USD 17.75 billion in 2024 and is anticipated to reach around USD 28.64 billion by 2034, expanding at a CAGR of 4.90% from 2024 to 2034.

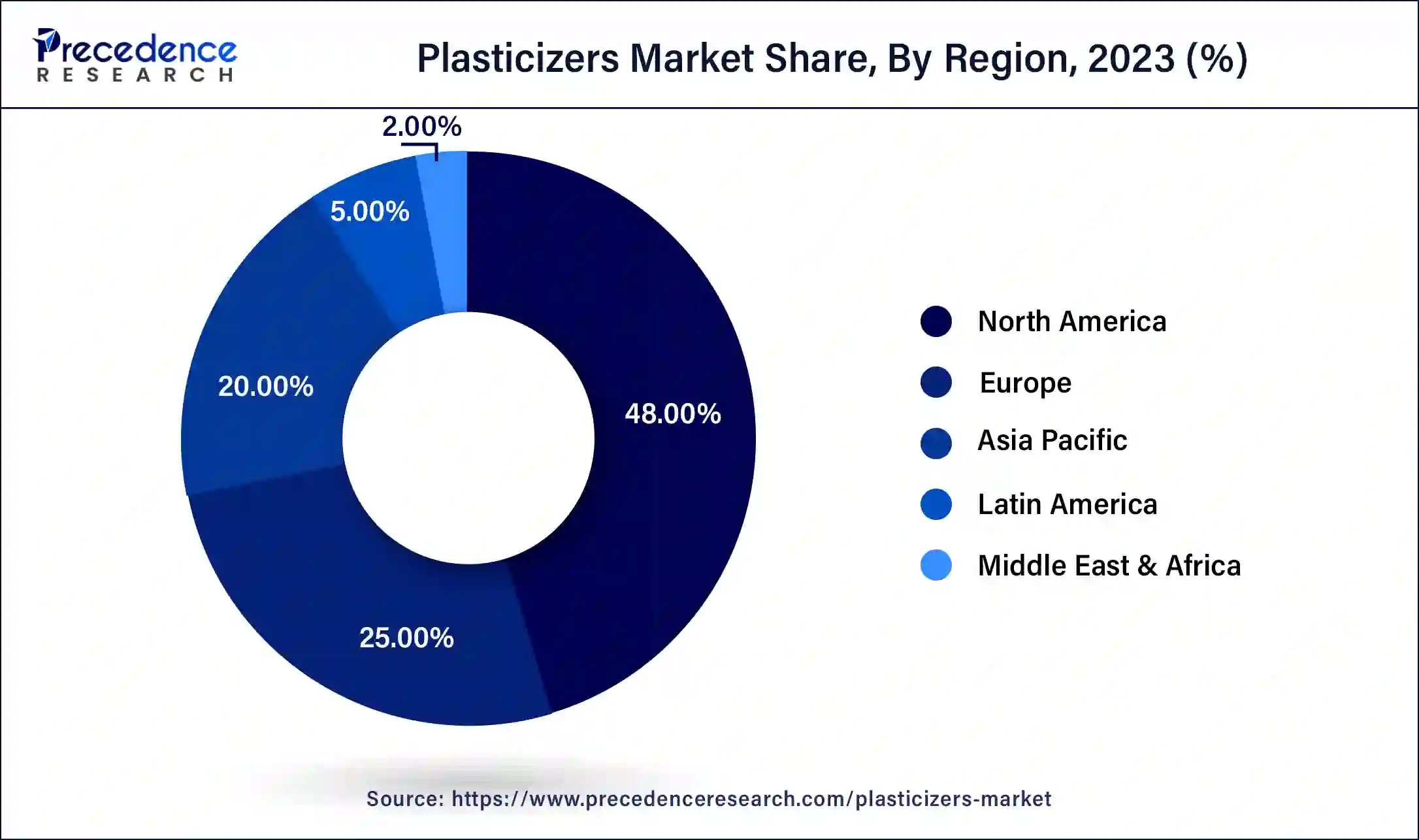

The global plasticizers market size accounted for USD 17.75 billion in 2024 and is predicted to reach around USD 28.64 billion by 2034, growing at a CAGR of 4.90% from 2024 to 2034. The North America plasticizers market size reached USD 8.12 billion in 2023.

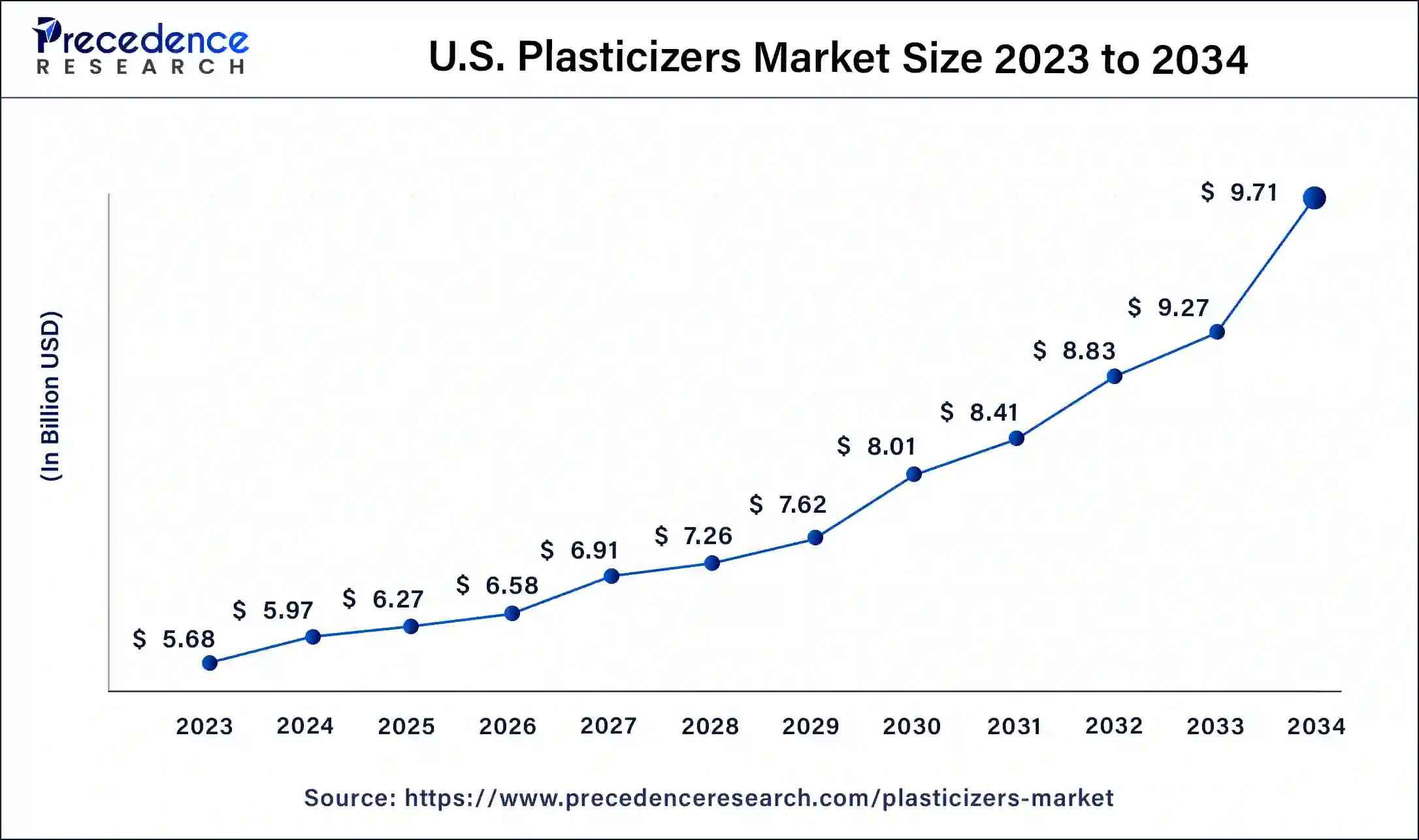

The U.S. plasticizers market size reached USD 5.68 billion in 2023 and is anticipated to be worth around USD 9.71 billion by 2033, poised to grow at a CAGR of 5.43% from 2024 to 2034.

North America has held the largest revenue share of 48% in 2023. North America holds a major share of the plasticizers market due to a robust demand across diverse industries, including construction, automotive, and consumer goods. The region's stringent environmental regulations have driven the adoption of eco-friendly plasticizers, contributing to market growth. Additionally, a thriving construction sector, coupled with increasing investments in infrastructure projects, has elevated the demand for plasticizers. The presence of key market players, technological advancements, and a focus on sustainable practices further solidify North America's significant position in the global plasticizers market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific dominates the plasticizers market due to rapid industrialization, robust construction activities, and increasing automotive production in countries like China and India. The region's burgeoning population, urbanization, and rising disposable income contribute to the high demand for flexible materials in various applications.

Additionally, favorable government policies, infrastructure development, and a growing consumer goods sector further fuel the demand for plasticizers. The dynamic economic growth and expanding end-use industries position Asia-Pacific as a key player, holding a major share in the global plasticizers market.

Plasticizers serve as essential additives in the production of plastics, playing a key role in enhancing their flexibility, durability, and workability. These substances are integrated into plastic formulations to increase elasticity and render the material more adaptable to bending and stretching. By lowering the glass transition temperature of the polymer matrix, plasticizers ensure that the plastic remains pliable even at lower temperatures, broadening its utility across diverse applications like packaging, toys, medical devices, and construction materials.

Phthalates, a commonly used class of plasticizers, has raised concerns regarding potential health and environmental risks. Consequently, there has been a push towards developing and adopting alternative plasticizers that maintain desired material properties while addressing associated issues. The choice of plasticizer hinges on specific application requirements, with careful consideration given to factors such as safety, performance, and compliance with regulatory standards.

| Report Coverage | Details |

| Market Size in 2023 | USD 16.91 Billion |

| Market Size in 2024 | USD 17.75 Billion |

| Market Size by 2034 | USD 28.64 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.90% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Phthalates, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Construction industry growth and rising packaging industry

The growth of the construction industry and the expanding packaging sector significantly drive the demand for plasticizers in the market. In the construction industry, plasticizers play a pivotal role in enhancing the flexibility and durability of various materials, including PVC pipes, cables, and flooring. As construction activities continue to surge globally, there is a heightened need for these additives to ensure the integrity and longevity of construction materials, contributing to the robust demand for plasticizers.

Simultaneously, the rising packaging industry is a major catalyst for increased plasticizer demand. Flexible packaging materials, crucial for accommodating changing consumer preferences and the growing e-commerce landscape, heavily rely on plasticizers to impart flexibility and resilience. The dynamic nature of the packaging sector, driven by innovations and sustainability concerns, fuels the continual requirement for plasticizers to meet the evolving demands of this critical market segment. Together, the construction and packaging industries form a formidable force propelling the sustained growth of the plasticizers market.

Environmental and health concerns

Worries about the environment and human health are putting a squeeze on the growth of the plasticizers market. Certain types of plasticizers, especially phthalates, are being closely examined due to their potential harm to ecosystems and people. This increased awareness has led to stricter rules and a growing preference for more sustainable options. As society becomes more conscious of the environmental and health implications associated with conventional plasticizers, there is a mounting call for industries to adopt greener practices.

While this shift towards eco-friendly options is commendable for its sustainability benefits, it poses challenges for manufacturers in terms of reformulating products, adjusting production processes, and ensuring consistent performance. Consequently, environmental and health concerns act as formidable hurdles, requiring the plasticizers industry to navigate a landscape that demands both effectiveness and reduced environmental impact to meet evolving standards and consumer expectations.

Growing demand for bio-based plasticizers

The escalating demand for bio-based plasticizers is emerging as a significant opportunity in the plasticizers market. As sustainability gains traction, there is a growing preference for plasticizers derived from renewable sources, presenting a lucrative market segment for manufacturers. Bio-based plasticizers, sourced from materials such as plant oils, offer a more environmentally friendly alternative to traditional options, aligning with the heightened awareness of eco-conscious consumers and stringent regulatory standards.

Manufacturers in the plasticizers market can capitalize on this trend by investing in research and development to create innovative bio-based formulations. The development of these sustainable alternatives not only meets the increasing demand for environmentally responsible products but also positions companies favorably in the competitive landscape. Companies that successfully navigate this shift towards bio-based plasticizers have the opportunity to capture market share and contribute to the overall sustainability goals of the plastics industry.

The phthalates segment had the highest market share of 34% in 2023. Phthalates, a prominent type in the plasticizers market, are chemical compounds commonly used to enhance the flexibility of plastics. Despite their widespread use, the phthalates segment faces challenges due to environmental and health concerns, prompting a shift towards non-phthalate alternatives.

Regulatory restrictions on certain phthalates have catalyzed this transition, with the market witnessing a growing trend of innovation in non-phthalate formulations. Manufacturers are increasingly investing in research to develop safer and more sustainable plasticizer options, aligning with the industry's evolving preferences and regulatory landscape.

The aliphatic dibasic esters segment is anticipated to expand at a significant CAGR of 5.1% during the projected period. Aliphatic dibasic esters, a type of plasticizer widely used in the plastic industry, are derived from aliphatic acids and alcohols. These esters boast excellent solvating properties, making them suitable for diverse applications like coatings, adhesives, and flexible PVC formulations.

A noteworthy trend in the plasticizers market is the increasing preference for aliphatic dibasic esters due to their low toxicity, enhanced biodegradability, and alignment with stringent environmental regulations. This shift underscores the industry's commitment to adopting sustainable and environmentally friendly plasticizer alternatives.

The wires & cables segment has held a 31% revenue share in 2023. In the plasticizers market, the wires and cables segment refer to the incorporation of plasticizers in the manufacturing of flexible and durable materials used for insulation and sheathing in electrical wiring and cable applications. Plasticizers enhance the flexibility and resilience of these materials, ensuring optimal performance in various conditions.

A notable trend in the wires and cables segment of the plasticizers market involves the increasing demand for non-phthalate plasticizers, driven by regulatory considerations and a growing emphasis on environmental sustainability. Manufacturers are innovating formulations to meet these evolving requirements while maintaining the desired properties of flexibility and durability in wires and cable applications.

The consumer goods segment is anticipated to expand fastest over the projected period. The consumer goods segment in the plasticizers market encompasses the use of these additives in products such as toys, packaging materials, and household items. In recent trends, there's a growing emphasis on producing flexible and durable consumer goods, driving the demand for plasticizers. The market observes a shift towards eco-friendly formulations to meet consumer preferences for sustainable and safe products. As regulations tighten and awareness of environmental impacts increases, manufacturers within the Consumer Goods segment are exploring non-phthalate and bio-based plasticizers to align with these evolving trends.

Segments Covered in the Report

By Phthalates

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

July 2024

August 2024