February 2025

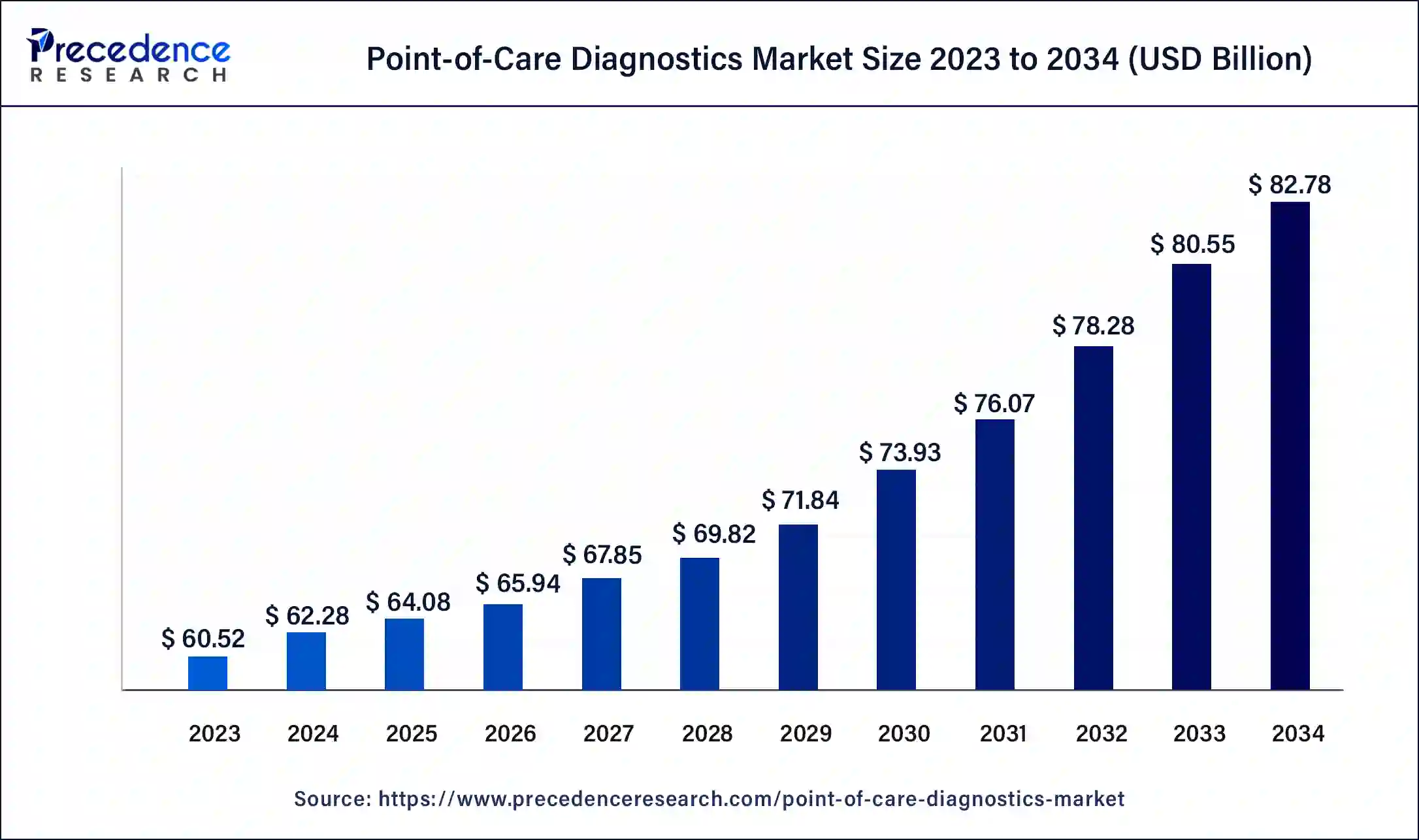

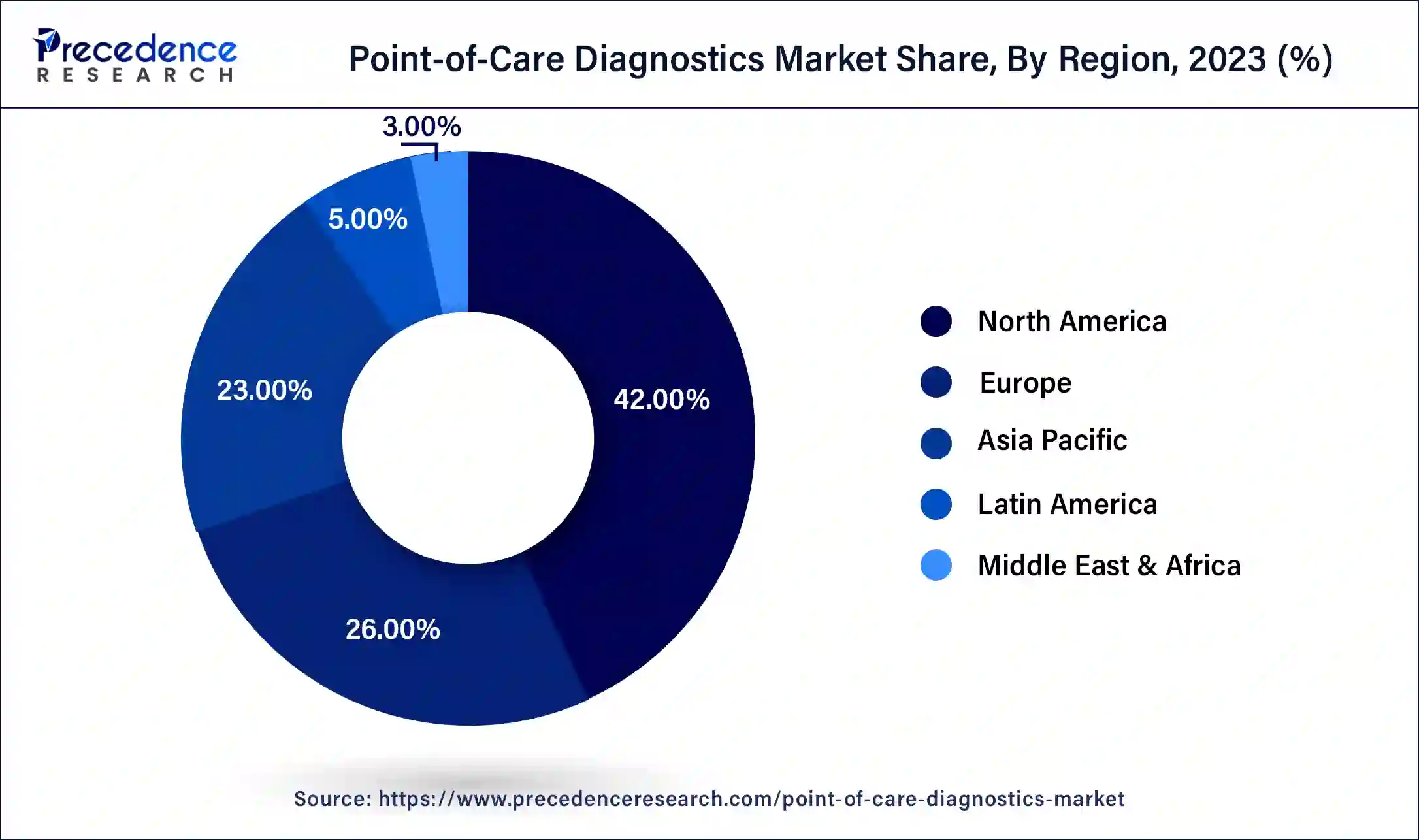

The global point-of-care diagnostics market size is estimated at USD 64.08 billion in 2025 and is anticipated to reach around USD 82.78 billion by 2034, expanding at a CAGR of 2.89% from 2025 to 2034. The North America point-of-care diagnostics market size is estimated at USD 26.15 billion in 2025 and is expanding at a CAGR of 2.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global point-of-care diagnostics market size accounted for USD 62.28 billion in 2024 and is predicted to reach around USD 82.78 billion by 2034, growing at a CAGR of 2.89% from 2025 to 2034.

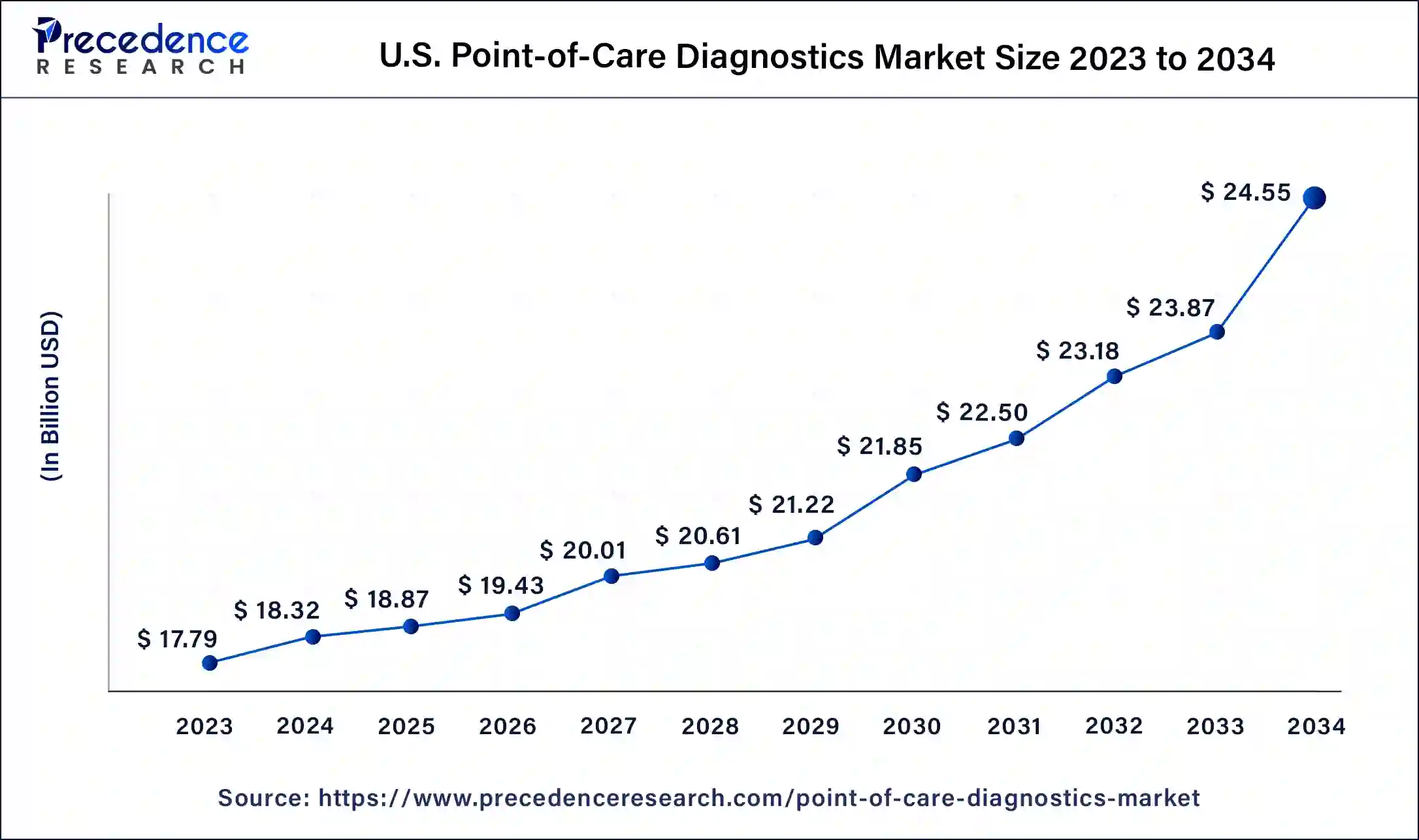

The U.S. point-of-care diagnostics market size was valued at USD 18.32 billion in 2024 and is expected to reach around USD 24.55 billion by 2034, growing at a CAGR of 3% from 2025 to 2034.

With the rising incidence and prevalence of lifestyle diseases in North America, the region is gaining traction. The greater awareness of self-testing and home care kits, as well as considerable adoption of novel technologies, are expected to boost the growth of the point of care diagnostics market in the North America.

On the other hand, the Asia-Pacific is estimated to be the most opportunistic segment during the forecast period. Due to the increasing number of market players exploring the region’s untapped economies, the Asia-Pacific market is expected to grow significantly over the forecast period. Furthermore, the increased use of point of care diagnostics kits in countries such as China, Japan, and India is a key driver of growth in the Asia-Pacific region.

Europe is expected to grow significantly in the point-of-care diagnostics market during the forecast period. Europe is experiencing a rise in the incidence rates of various diseases, along with the rise in adoption of new technologies. This increases the demand for the use of point-of-care diagnostics within the population. Thus, this promotes the market growth.

UK

The industries in the UK are utilizing various technological advancements in the development of new point-of-care diagnostics kits. At the same time, rising diseases are increasing their use. This increases their production, which in turn increase the collaboration among the industries.

Germany

There is a rise in the demand for the use of rapid point-of-care diagnostics approaches. Thus, new research is being conducted for their development to deal with the rising diseases. This is further supported by the government fundings.

The medical devices utilized to get an instant result in the investigation (diagnosis & monitoring) of various diseases, such as cancer, diabetes, heart diseases, and others are referred to as point-of-care (POC) diagnostics in this report. The global point-of-care diagnostics industry has a lot of room for growth for both established and new companies. The point-of-care diagnostics market is growing due to technological developments in POC devices, rising infectious disease incidence, and increased expenditures by key companies.

The rising occurrences of target disorders, as well as the increased prevalence of infectious diseases such as tuberculosis and AIDS, are boosting the expansion of the point of care diagnostics industry. The growing desire for rapid tests among the general public is also helping the point-of-care diagnostics industry grow. The need to make the healthcare sector more patient-centered is proven to be a positive factor in the point-of-care diagnostics market’s growth rate. Many patients may find the centralized testing method inconvenient because of it necessitates multiple trips to clinics to complete the entire evaluation process. Point of care devices provides a much-needed boost in the direction of a patient-centric approach. As a result, the point-of-care diagnostics market may see a significant increase in growth rate during the forecast period.

Point-of-care diagnostics has changed patient care because of their simplicity and efficiency. POC technologies have evolved efficiency. Point-of-care diagnostics (POC) technologies have evolved and improved as the area of microfluidics has progressed. Microfabrication and microfluidics methods have advanced so much in the last several years that POC devices can now be made at a cheap cost, are simple to use, portable, and produce quick results. In the subject of microfluidics technology, there are numerous research projects underway.

Due to the usage of micro fluids, nano diagnostics, chips, point-of-care diagnostics is gaining widespread acceptability among patients throughout the world. The samples are taken from the patient’s site for completing tests, and findings can be obtained in a very short amount of time.

The increased frequency of chronic and infectious in developing economies is one of the primary factors driving the growth of point-of-care diagnostics market. The chronic diseases such as rheumatism, diabetes, and cancer are on the rise around the world for a variety of causes, including an ageing population, unhealthy lifestyle, and environmental factors.

The adoption of glucose monitoring testing kits is driven by factors such as the need for early detection of hyperglycemic and hypoglycemic diabetes, the high prevalence of diabetes, the convenience of continuous glucose monitoring over traditional monitoring, availability of glucose monitors, and increased awareness of the products around the world, and growing technological innovations.

| Report Coverage | Details |

| Market Size by 2034 | USD 82.78 Billion |

| Market Size in 2025 | USD 64.08 Billion |

| Market Size in 2024 | USD 62.28 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.89% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the product, the infectious diseases segment dominated the market with the highest share 61% in 2024. Due to the increased prevalence of various infectious disorders, the infectious diseases segment of the market is expected to grow significantly during the forecast period.

On the other hand, the glucose testing segment has captured the second position in 2023. The rising diabetic and cancer population, the adoption of new point-of-care diagnostics technologies, and the growing preference for home glucose testing are all factors that contribute to the growth of the glucose testing segment.

Based on the end user, hospital bedside led the market with highest share in 2024. Due to the rising prevalence of chronic diseases requiring long term care and frequent monitoring in critical care units, as well as rapidly growing awareness of the availability of cost-effective and highly innovative point of care diagnostics products, this segment accounted for the largest share of the point-of-care diagnostics market.

On the other hand, urgent care and retail clinic segment is expected to grow at a faster rate during the forecast period. The increase in the number of clinics and urgent care centers, as well as the government’s measures to improve patient care in hospitals through the use of quick point of care diagnostics tests and other programs, are expected to drive the expansion of this segment during the forecast period.

The various developmental strategies such as business expansion, investments, new product launches, acquisition, partnerships, joint venture, and mergers fosters market growth and offers lucrative growth opportunities to the market players. Precipio Inc., for example, joined the point of care diagnostics market in July 2020 by forming a partnership with ADS Biotech to create a COVID-19 detection test kit based on a lateral flow immunoassay.

Recent developments

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

October 2024

October 2024