March 2025

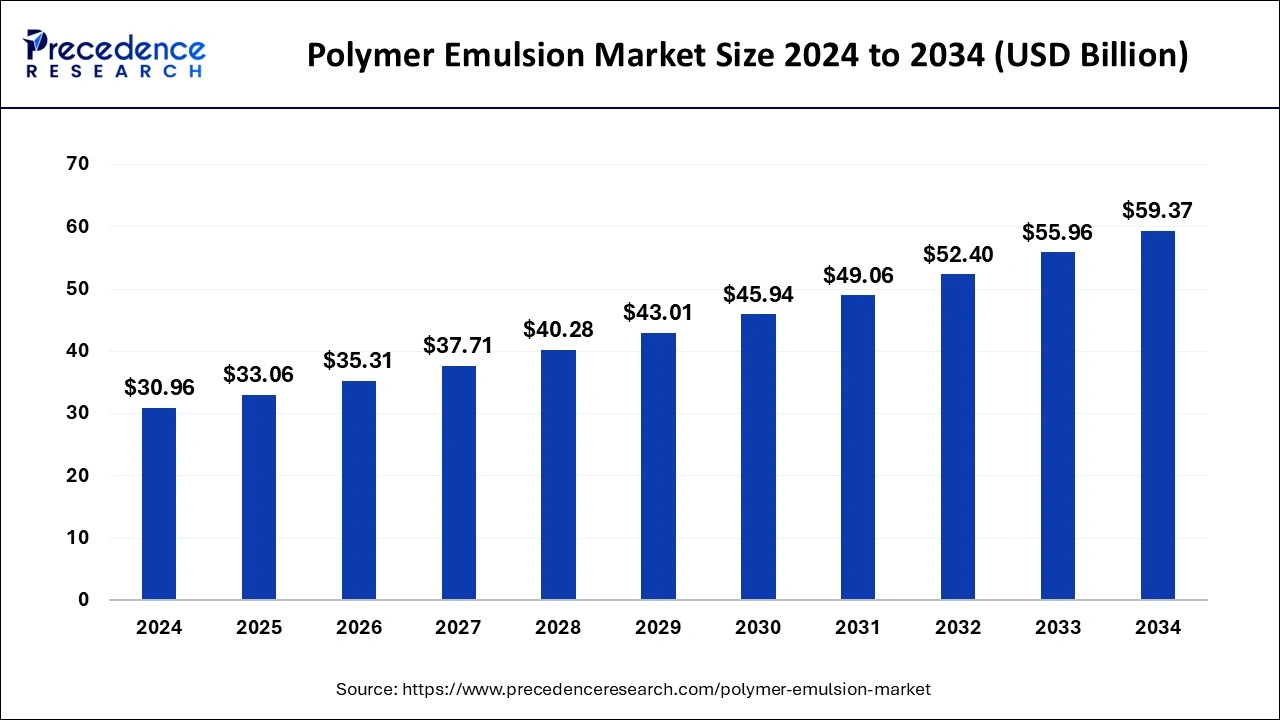

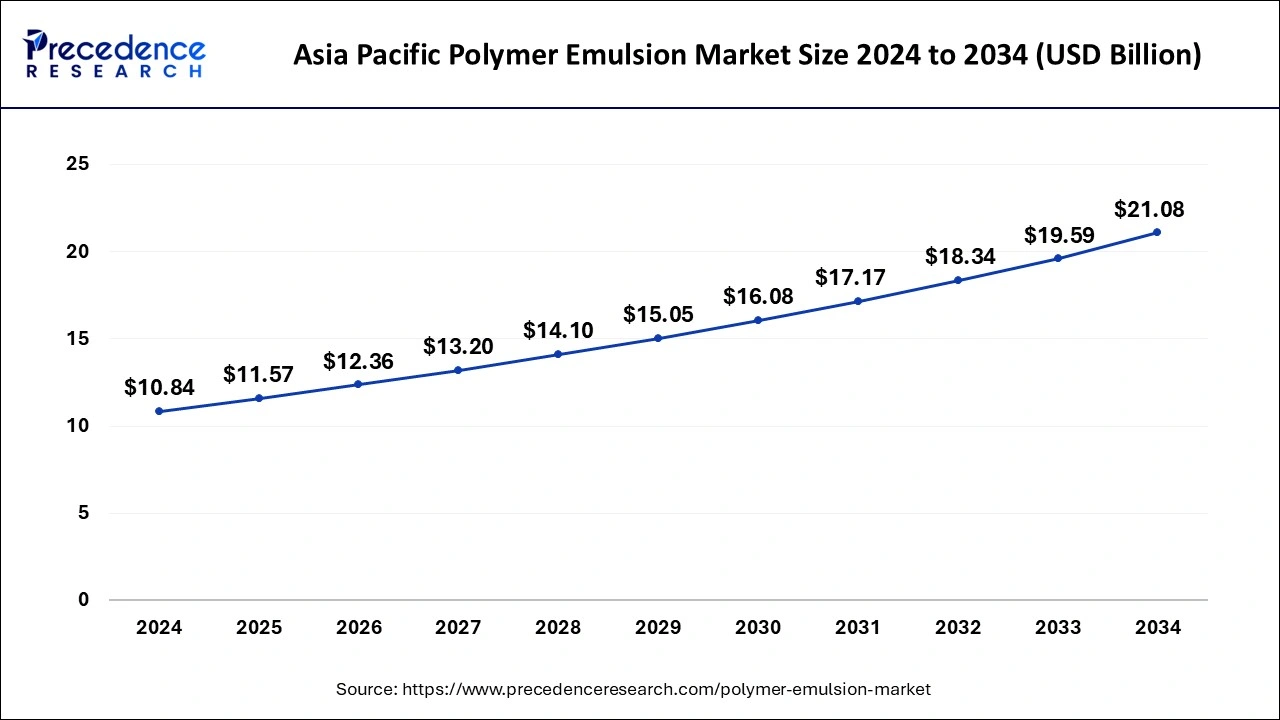

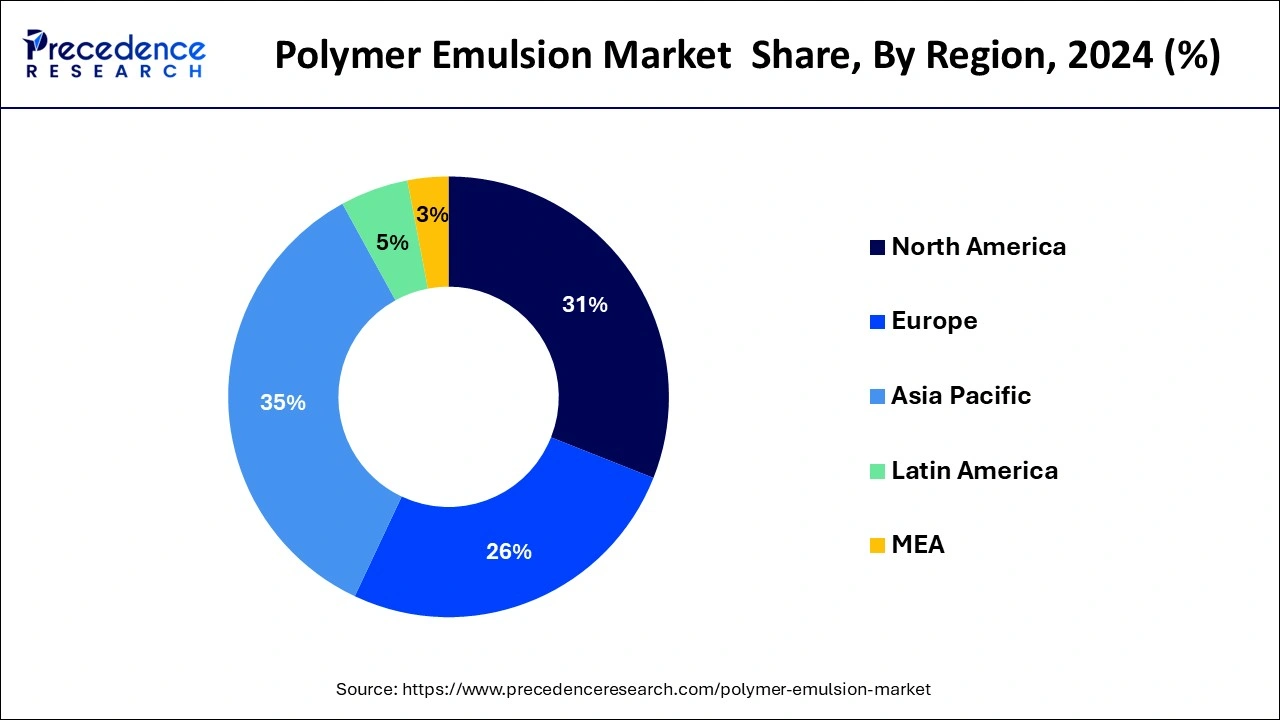

The global polymer emulsion market size is accounted at USD 33.06 billion in 2025 and is forecasted to hit around USD 59.37 billion by 2034, representing a CAGR of 6.73% from 2025 to 2034. The Asia Pacific market size was estimated at USD 10.84 billion in 2024 and is expanding at a CAGR of 6.88% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global polymer emulsion market size accounted for USD 30.96 billion in 2024 and is expected to exceed USD 59.37 billion by 2034, growing at a CAGR of 6.73% from 2025 to 2034.

The Asia Pacific polymer emulsion market size was evaluated at USD 10.84 billion in 2024 and is projected to be worth around USD 21.08 billion by 2034, growing at a CAGR of 6.88% from 2025 to 2034.

In 2024, Asia Pacific dominated the global polymer emulsion market with a maximum market share of 34.14% and is expected to grow at a faster rate during the forecast period. Moreover, the availability of low-cost raw materials, land, equipment and skilled labour are some factors driving the growth of the Asia Pacific emulsion industry. The rapidly expanding Chinese and Indian markets are the primary drivers of this significant growth.

Many construction projects and investments are planned in India, China, the Philippines, Vietnam, and Indonesia, which is expected to increase demand for architectural paints, coatings, and adhesives. India, Thailand, Vietnam, Pakistan, and Malaysia have seen significant increases in automotive production. China, the world's largest automaker, intends to increase EV production to 2 million units per year by 2020 and 7 million units per year by 2025.

Furthermore, with cultural change, the influence of Western culture, increased cosmetic demand from the youth population, and rising women’s employment, demand in the cosmetic & personal care industry is growing at a noticeable rate in the region. As a result, market players in this market are increasing investments and production, driving up demand for raw materials such as polymer emulsion. As a result, all of these favourable market trends are expected to drive the growth of the Asia-Pacific polymer emulsion market during the forecast period.

Polymer emulsion is a type of polymerisation reaction that begins with an emulsion that contains water, monomer, and surfactant. An oil-in-water emulsion is the most common type of emulsion polymerisation, in which droplets of monomer (the oil) are emulsified (with surfactants) in a continuous phase of water. Emulsion polymers have a high molecular weight, polymerise quickly, and are non-toxic to the environment.

In the paper industry, emulsion polymers make sheets, paper bags, boxes, cartons, and other items. As a binding agent, it is used in adhesives such as bands, stickers, glue, windings, and hygiene products. These end-user segments contribute significantly to the growth of the polymer emulsion industry.

| Report Coverage | Details |

| Market Size in 2025 | USD 33.06 Billion |

| Market Size in 2024 | USD 30.96 Billion |

| Market Size by 2034 | USD 59.37 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.73% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising utilisation of polymer emulsion in the automotive industry

As polymer emulsions are used in LASD coatings and can be tailored for flexibility, adhesion, and filler content, the automotive industry is expected to increase demand for them. Another excellent feature for manufacturers is that they easily attach to metal components. Other advantages of using polymer emulsions include lower application costs and improved consistency and repeatability of placement. These coatings are made with styrene-butadiene polymer emulsions.

This is due to its ability to withstand high filler loadings, compatibility with anti-corrosion pigments, and range of strength and flexibility to meet the demands of harsh operating environments. With all of the facts stated above, it is expected that growth in the automotive industry will drive demand for polymer emulsion.

Some raw materials used by industry operators are derived from petrochemical-based feedstocks, such as crude oil and natural gas, which are subject to significant price fluctuations. These price fluctuations could be exacerbated by global macroeconomic factors and supply and demand factors, such as OPEC production quotas and increased global demand for petroleum-based products. Significant changes in the cost and availability of raw materials may have a negative impact on industry operations.

The rise in global residential and commercial development has boosted the demand for polymer emulsions used in architectural paints and coatings. With the growth potential and growing housing needs in Asia, large-scale residential and commercial development projects have been underway. Government initiatives in the Middle East to promote non-oil industries are encouraging investment in sectors such as tourism, hospitality, and healthcare, which has increased demand for and spending on commercial infrastructure.

COVID-19 Impact:

As a result of the COVID-19 outbreak, almost every country has tightened travel restrictions. Since March 2020, the increasing number of infected patients and total lockdown in major industrial hubs have halted the manufacturing industry. Workers have either returned to their hometowns or been quarantined to prevent the spread of the coronavirus. Due to potential upstream supply chain issues, construction, automotive, chemical, textile, and coatings companies have been forced to close locations.

The demand for residential building construction is expected to be low as people are discouraged from looking for new homes due to negative consumer sentiment and declining incomes. Due to the uncertainty of the future, demand for automobiles has dropped dramatically. The global impact on textile orders for clothing and accessories has decreased by 30%.

Chemical manufacturers have either ceased production or are operating at a low utilization rate. However, with the lifting of the lockdown, government bodies around the world are gradually encouraging construction, automotive, chemical, and textile & coatings companies to resume work, and companies are working towards market recovery with the expected increase in sales gradually in coming years.

Based on type, the global polymer emulsion market is segmented into acrylics, vinyl acetate polymers, and SB latex. In 2023, the acrylic segment accounted for the largest market share. The growth of this segment is due to its properties such as low VOC emission and excellent durability, acrylic polymer emulsion is widely used in various applications.

In addition to its versatility, it is also preferred in multiple end-use applications. Acrylics can make rigid, flexible, ionic, non-ionic, hydrophobic, or hydrophilic polymers. They are transparent, resistant to breakage, have a high finish gloss, improved adhesion to non-porous surfaces, and have good flow and stability. They are also commonly known as polyacrylates.

Acrylic emulsion polymers can be easily incorporated into overprint varnishes and inks to provide water resistance, rub resistance, alkali resistance, and high gloss. They can also be used to improve oil, grease, and water resistance in barrier coatings for paper and paperboard products.

Based on application, the global polymer emulsion market is segmented into paints & coatings, adhesives & sealants, and paper & paperboard. In 2023, the paint & coatings segment accounted for the largest market share. The growth of this segment is due to the high demand in industries such as construction and automotive. Polymer emulsion is widely used in paints and coatings due to its lower carbon footprint during manufacturing.

The high VOC content of solvent-based products, combined with the implementation of government air pollution control regulations, has fueled the development of low-VOC paints and coatings. This increased demand for water-based paints and coatings drives growth in the paints and coatings segment.

Based on end use, the global polymer emulsion market is segmented into buildings & construction, automotive, textile & coatings. In 2023, building and construction accounted for the largest market share of around 38%. The high demand for polymer emulsion in architectural paints, deck & trim paints, and elastomeric wall coatings, among others, is driving the segment growth. Its high-water resistance and durability drive its demand in the end-use industries.

By Type

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

December 2024