September 2025

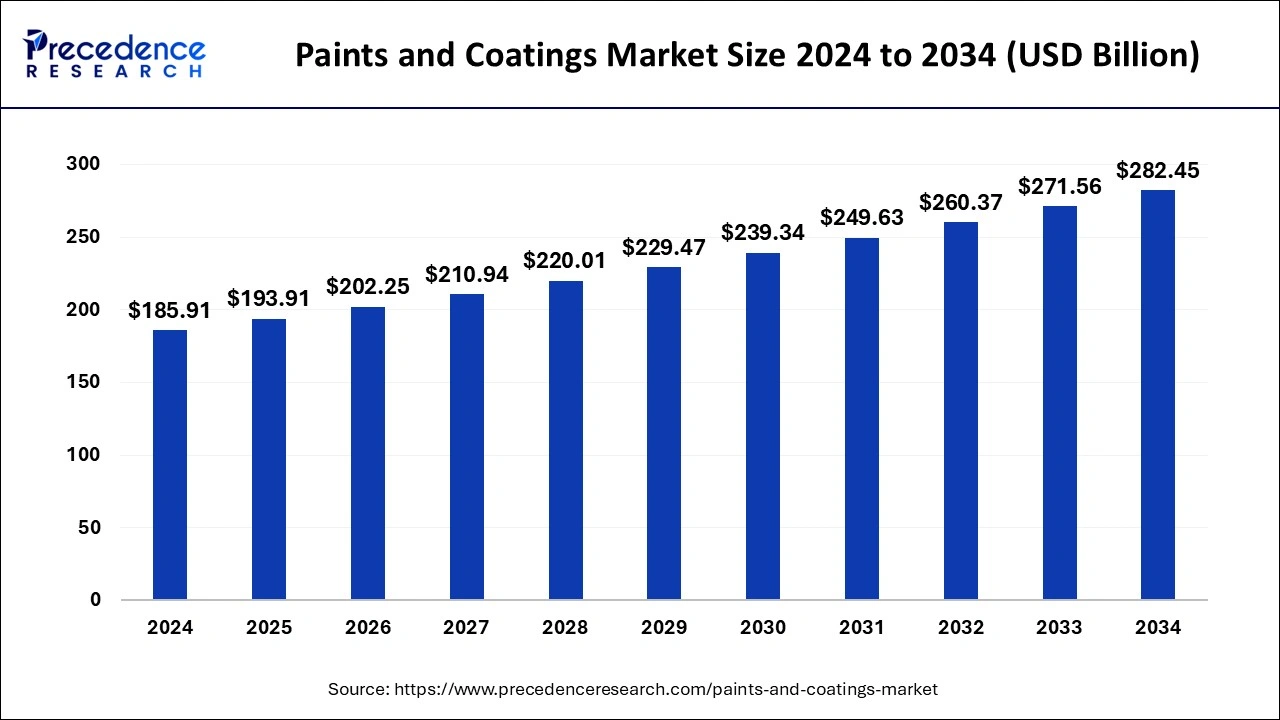

The global paints and coatings market size accounted for USD 185.91 billion in 2024 and is predicted to reach around USD 282.45 billion by 2034, expanding at a CAGR of 4.27% from 2025 to 2034. The paints and coating market is growing due to growing industrialization, which requires paints and coating for infrastructure, equipment, devices, machinery, etc.

By altering research, development, and production procedures, artificial intelligence and machine learning are redefining the paints and coatings sector. AI is essential to the development of innovative coatings with enhanced adhesion, wear resistance, and corrosion resistance. AI is assisting in the development of novel chemical compositions by facilitating in-depth investigation into material characteristics. Paint formulas may be precisely adjusted based on chemical composition thanks to the use of machine learning algorithms to model data. The R&D process is streamlined by this data-driven approach, which also guarantees that goods fulfill industry standards and particular performance requirements. Additionally, AI and ML evaluate variables like paint toxicity, price swings driven by the market, environmental effects, and the feasibility of substitute materials, offering insights that support well-informed decision-making and product formulation improvement.

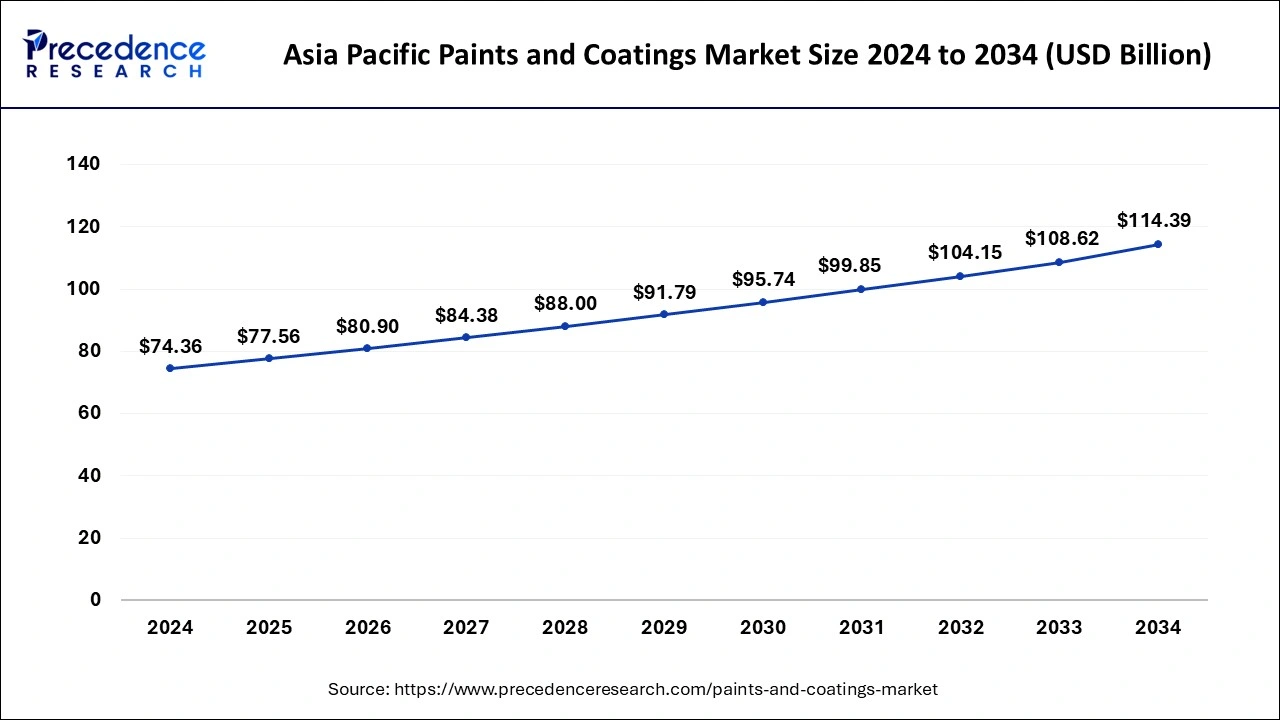

The Asia Pacific paints and coatings market size was exhibited at USD 74.36 billion in 2024 and is projected to be worth around USD 114.39 billion by 2034, growing at a CAGR of 4.40% from 2025 to 2034.

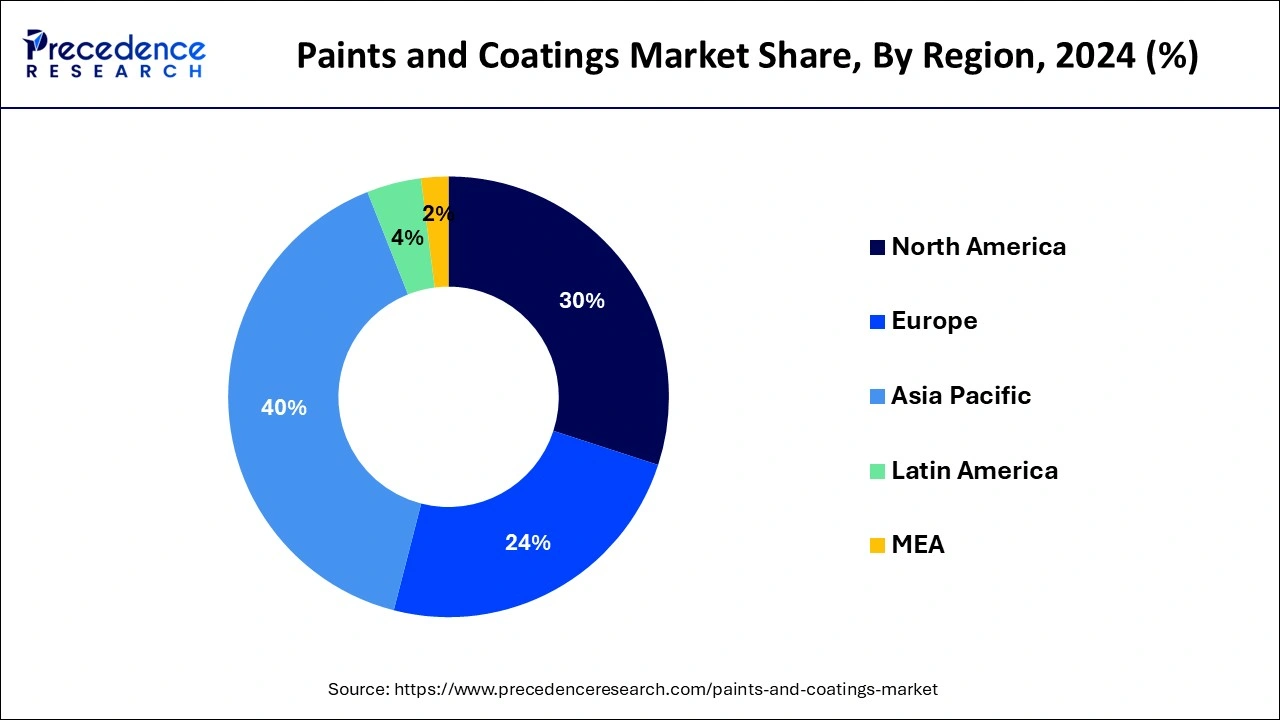

The Asia Pacific covered the major part of the global revenue and accounted highest share in the year 2024. Increasing construction activities coupled with the rising demand from the automotive industry particularly in the emerging countries, for example India, China, Korea, and Southeast Asia predicted to impel the market growth over the upcoming period. Furthermore, easy availability of raw materials together with less strict laws related to VOC emissions compared to other regions such as Europe and North America offers immense growth opportunities to uplift the market growth in the years to come.

In January 2025, Kansai Nerolac Paints Ltd (KNPL), a key player in India’s paint industry, announced its plan to invest ₹98 crore to enhance its production capacity at its Hosur facility in Tamil Nadu. As a subsidiary of Kansai Paint Co Ltd, Japan, the ₹7,393-crore company expects strong growth in the Indian paint market, driven by the rising urbanization and industrialization.

Europe holds the second largest position and accounted for more than 28% of value share out of the global revenue in the year 2024. Growing the construction activities across various countries, such as the Netherlands, the U.K., Hungary, Germany, Sweden, Poland, and Ireland anticipated to augment the demand for paints & coatings over the forthcoming time period. Increased funding from the European Union (EU) coupled with supportive policies that include tax breaks, subsidies, and incentives taken by governments of various European countries propel the growth of the construction industry within the region.

40% of total EU energy consumption is used by the building sector. 36% of total EU greenhouse gas emissions come from buildings. The European Commission has announced a Renovation Wave to improve the energy performance of buildings across the EU. The goal is to double renovation rates by 2030 and ensure these lead to better energy- and resource efficiency. This means that by 2030, 35 million buildings could be renovated, creating up to 160,000 new green jobs in the construction sector.

Rising demand for paints & coatings in automotive, construction, and general industries anticipated to boost the overall market growth. The Asia Pacific region registered high rate of automotive production in the recent past because of surge in disposable income and rising demand for personal transportation is likely to augment the market for paints and coatings over the coming years. Further, rapid industrialization and urbanization particularly in the developing countries, for example China, India, and Southeast Asia estimated to fuel the demand for paints & coatings across various applications.

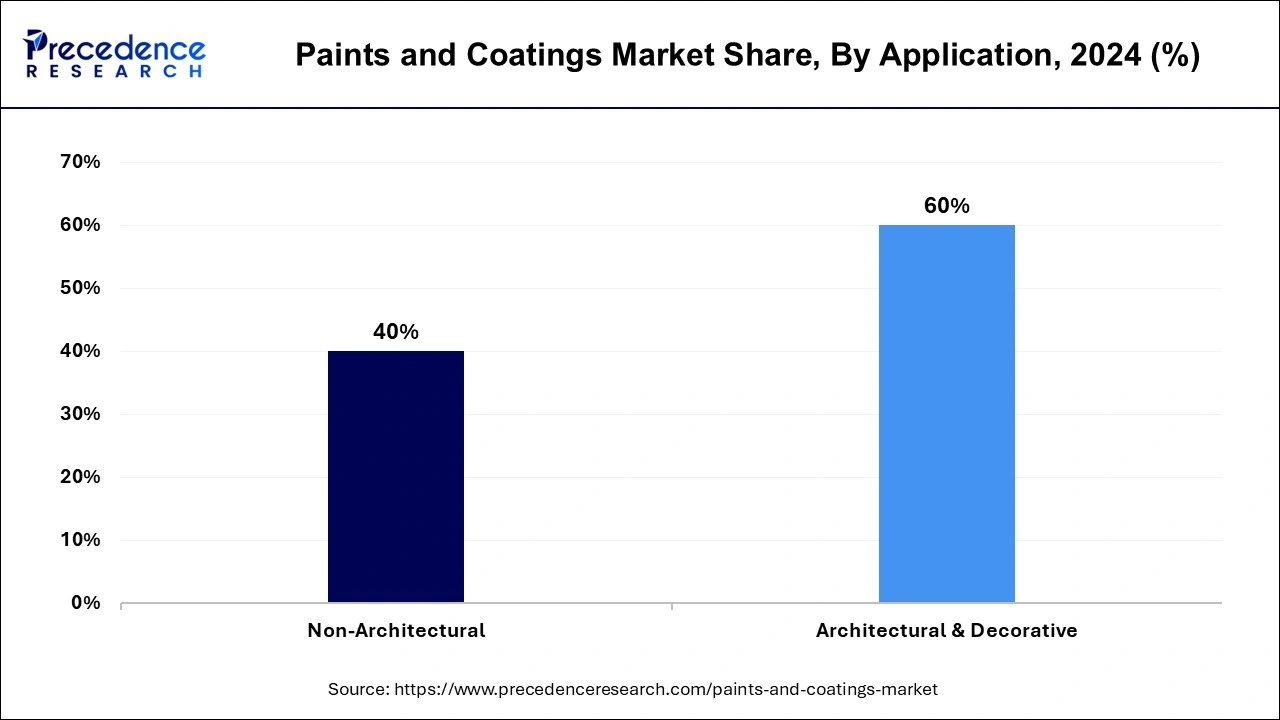

Apart from these factors, paints and coatings are estimated to register high demand from the architectural industry. Within the architectural industry, paints and coatings are largely used in residential construction because of increasing construction output, rising urbanization, and population expansion. Furthermore, various ambitious programs introduced by the governments of the developing countries in the Asia Pacific region are anticipated to act as a significant factor that pushes the residential construction activities within the region.

| Report Highlights | Details |

| Market Size in 2025 | USD 193.91 Billion |

| Market Size in 2024 | USD 185.91 Billion |

| Market Size by 2034 | USD 282.45 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.27% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Segments Covered | Material Type, Product Type, and Application Type |

Paints and Coatings Market: Value Chain Analysis

The value chain of the paints and coatings market consists of raw material suppliers, manufacturers, distribution channels, and end-use industries. The major raw materials required for manufacturing paints and coatings are pigments, resins, solvents, extenders, and additives. Pigments provide color, corrosion resistance, and mechanical strength to paints and coatings; additives such as thickeners, ultraviolet stabilizers, and anti-foaming agents are used in the manufacturing process of paints and coatings; key resins used in paint and coating formulations include acrylic, epoxy, polyurethane, polyester, and alkyd; and solvents are used to control and define the viscosity and drying qualities of the final products.

These raw materials primarily rely on the feedstock derived from oil and natural gas, which results in price volatility. As a result, key raw material suppliers operate through predefined agreements with paint and coating manufacturers.

The first stage of the value chain includes raw material suppliers for paints and coatings. Kamsons Chemicals Pvt. Ltd., Mitsubishi Chemicals Corporation, Adhesives Technology Corporation (ATC), Gellner Industrial LLC, and MegaChem (UK) Ltd. are some of the key raw material suppliers in the global paints and coatings market.

Acrylate and methacrylate are the major raw materials used to produce acrylic resins. Companies such as Evonik Industries AG, Macro Polymers, Dow, Inc., and Kamsons Chemicals Pvt. Ltd. are engaged in the production of acrylic resins. Solvents such as butyl acetate & xylene, pigments, and additives are added to acrylic resins to produce acrylic-based paints and coatings. Arkema S.A., the Sherwin-Williams Company, and Akzo Nobel N.V. are some of the companies engaged in producing acrylic-based paints and coatings.

Bisphenol-A, epichlorohydrin, and phenols are some of the major raw materials used to produce epoxy resins. Huntsman International LLC, Aditya Birla Chemicals, and Hexion, Inc. are engaged in manufacturing epoxy resins. Several additives, solvents, and pigments such as anti-corrosives are added to epoxy resins to produce epoxy-based paints and coatings. PPG Industries, Inc. and RPM International, Inc. are the major companies offering epoxy-based paints and coatings.

Isocyanate and polyol are the major raw materials used to produce polyurethane resins. M.P. Dyechem and Bond Polymers International are among the companies engaged in offering polyurethane resins. Color pigments, additives, primers, and extenders are further added to polyurethane resins to produce polyurethane coatings. Axalta Coating Systems, LLC, The Sherwin-Williams Company, and Hindustan Coatings are involved in offering polyurethane paints and coatings.

Isophthalic acid, phthalic anhydride, maleic anhydride, and glycols , such as propylene glycol, diethylene glycol, and monoethylene glycol are the major raw materials used to produce polyester resins. Arkema S.A., Tough Color Resins Pvt. Ltd., and Karna Paints are some of the manufacturers engaged in producing polyester resins. Additives such as flow & leveling agents, pigments, and solvents are added to polyester resins to produce polyester-based paints and coatings. Akzo Nobel N.V. and Amco Polymers offer polyester coatings.

Polyols and dicarboxylic acid are the major raw materials used to produce alkyd resins. Macro Polymers, Uniform Synthetics, and Mobile Rosin Oil are some of the companies offering alkyd resin. Several types of additives and pigments are added to produce alkyd-based paints and coatings. The Sherwin-Williams Company and Jotun A/S are the major companies involved in producing alkyd coatings.

The second stage of the value chain includes paints and coatings manufacturers. Akzo Nobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, Jotun A/S, Hempel A/S, Nippon Paint Holdings Co., Ltd. and Axalta Coating Systems, LLC are some of the leading manufacturers operating in the global paints and coatings market. Companies such as Akzo Nobel N.V., PPG Industries, Inc., and The SherwinWilliams Company are integrated across the value chain, which gives them operational flexibility to respond rapidly to events such as the actions of competitors and fluctuations in consumer demand. Therefore, the companies involved in the production of raw materials and final products save a lot on cost since the materials required are available in-house.

The third stage of the value chain includes distributors. Manufacturers of paints and coatings distribute finished products through direct and indirect channels. Companies may distribute their products through third-party vendors, distributors, and wholesalers. Product manufacturers form alliances and strategic business partnerships with distributors & suppliers to ensure the marketing and distribution of their products. In addition, RADKA International s.r.o., Metalife Solutions, Kortec, Parker James Protective Coatings Ltd., and Rawlins Paints are some of the distributors operating in the global market.

The final product is used in oil & gas, aerospace, general industry, marine, automotive, power generation, and mining among various other end-use industries. Companies including Lockheed Martin Corporation, United Technologies Corporation, Airbus SE, and The Boeing Company are some of the major end users of paints and coatings. The rising need for the protection of equipment, devices, and machine components in the aforementioned industries is expected to increase the consumption of paints and coatings over the forecast period.

Raw material trends are one of the major factors affecting the paints and coatings market as the market is raw material intensive. The costs of raw materials are very significant for paint and coating manufacturers as 50% of the costs are associated to the raw materials. The raw materials required for manufacturing paints and coatings include pigments, solvents, additives, and resins. Resins such as acrylic, epoxy, polyurethane, alkyd, and polyesters are majorly used in the production of paints and coatings. These resins are derived from acrylate, methacrylate, bisphenol-A, epichlorohydrin, phenols; Isocyanate, polyol; isophthalic acid, phthalic anhydride, maleic anhydride, and glycols such as propylene glycol, Di-ethylene glycol, and mono-ethylene glycol. Pigment and additives is a substance that is responsible for the color change and to enhance the properties of paints and coatings.

These raw materials are derived from crude oil, therefore, the price volatility of crude oil is expected to have a significant impact on the prices of its by-products such as solvents and resins, thereby, impacting the prices of paints and coatings. For instance, in April 2018, PPG Industries, Inc. announced to increase the global prices of its protective and marine coatings to mitigate the increasing operational costs and the cost of raw materials such as epoxy resins, titanium dioxide, zinc powders, and solvents.

In the past few years, raw materials have seen an extreme fluctuation in prices owing to the political instability in oil-producing nations such as Iraq, Saudi Arabia, and other countries of the Middle East. Furthermore, the social unrest in Iran, Venezuela, Iraq, and Libya has adversely affected the crude oil supply in the recent past. Factors such as natural disasters, various demand & supply aspects, and seasonal variations are expected to negatively impact the crude oil prices.

The overall growth rate of the industry depends on high potential regions, such as Asia Pacific, wherein industrial output is above the global average. The considerable rise in consumerism is driven by the exponential growth of end-use industries such as construction, automotive, aerospace, marine, and oil & gas. Factors such as economic growth, rising population, and increased disposable incomes, especially in India and China, are significantly contributing to the growth of end-use industries in the region.

The waterborne segment dominated the global market accounting largest market share in the year 2024. Rising spending in the construction industry along with the shifting consumer preference for environment-friendly products expected to influence the growth of the segment over the analysis period. Water-based paints & coatings are largely used in poorly and confined ventilated spaces. Water-based coatings dry faster compared to solvent-based products owing to the fast evaporation of water content from the coating layer.

However, the solvent-borne coatings segment estimated to register slower growth rate compared to other types of products because of stringent government regulations for the products having high Volatile Organic Compounds (VOC) content. Moreover, increasing application of solvent-based coatings for architectural and industrial purposes due to less time taken to dry as well as better functionality in humid and open environment projected to propel the growth of the segment over the upcoming period.

The architectural & decorative segment has captured a major market share in 2024. This is mainly attributed to the increasing construction activities along with the significant development of road and rail infrastructure across various developed as well as developing countries, such as the U.K., India, the U.S., Germany, China, and European countries predicted to drive the demand for paints & coatings in the architectural & decorative segment during the analysis period.

Key Companies & Market Share Insights

The key players operating in the global paints & coatings market are rigorously competing to offer custom solutions for low-cost and high-performance paints & coating requirements. A company’s hold in the market is determined on the basis of distribution network, strong geographical presence, and extensive product portfolio. Major market players primarily focus on expanding their manufacturing facilities, mergers & acquisitions, investments in Research & Development (R&D) facilities, infrastructural development, and are actively looking for opportunities for vertically integration across the value chain. The above mentioned initiatives help the company to cater the rising demand across the globe, lower the production costs, enhance sales & operations planning, ensure competitive effectiveness, develop innovative technologies & products, and expand their customer base.

By Material

By Product

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

The global sport app market size is calculated at USD 5.32 billion in 2025 and is forecasted to reac...

Online Grocery Market (By Product: Fresh produce, Breakfast and dairy, Snacks and beverages, Staples...

September 2025

May 2025

February 2025

June 2025