March 2024

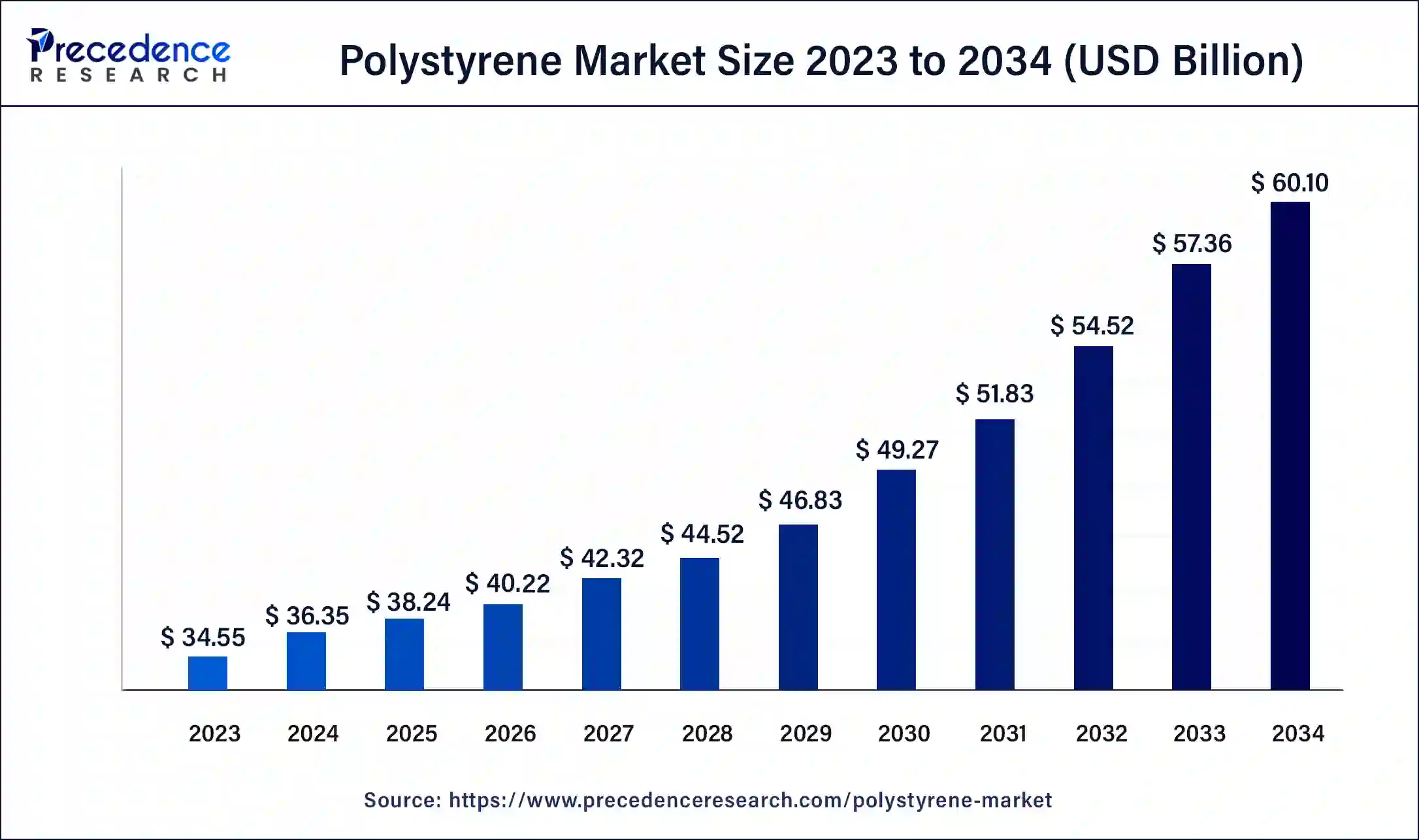

The global polystyrene market size was USD 34.55 billion in 2023, estimated at USD 36.35 billion in 2024 and is anticipated to reach around USD 60.10 billion by 2034, expanding at a CAGR of 5.16% from 2024 to 2034.

The global polystyrene market size is estimated at USD 36.35 billion in 2024 and is predicted to reach around USD 60.10 billion by 2034, growing at a CAGR of 5.16% from 2024 to 2034.

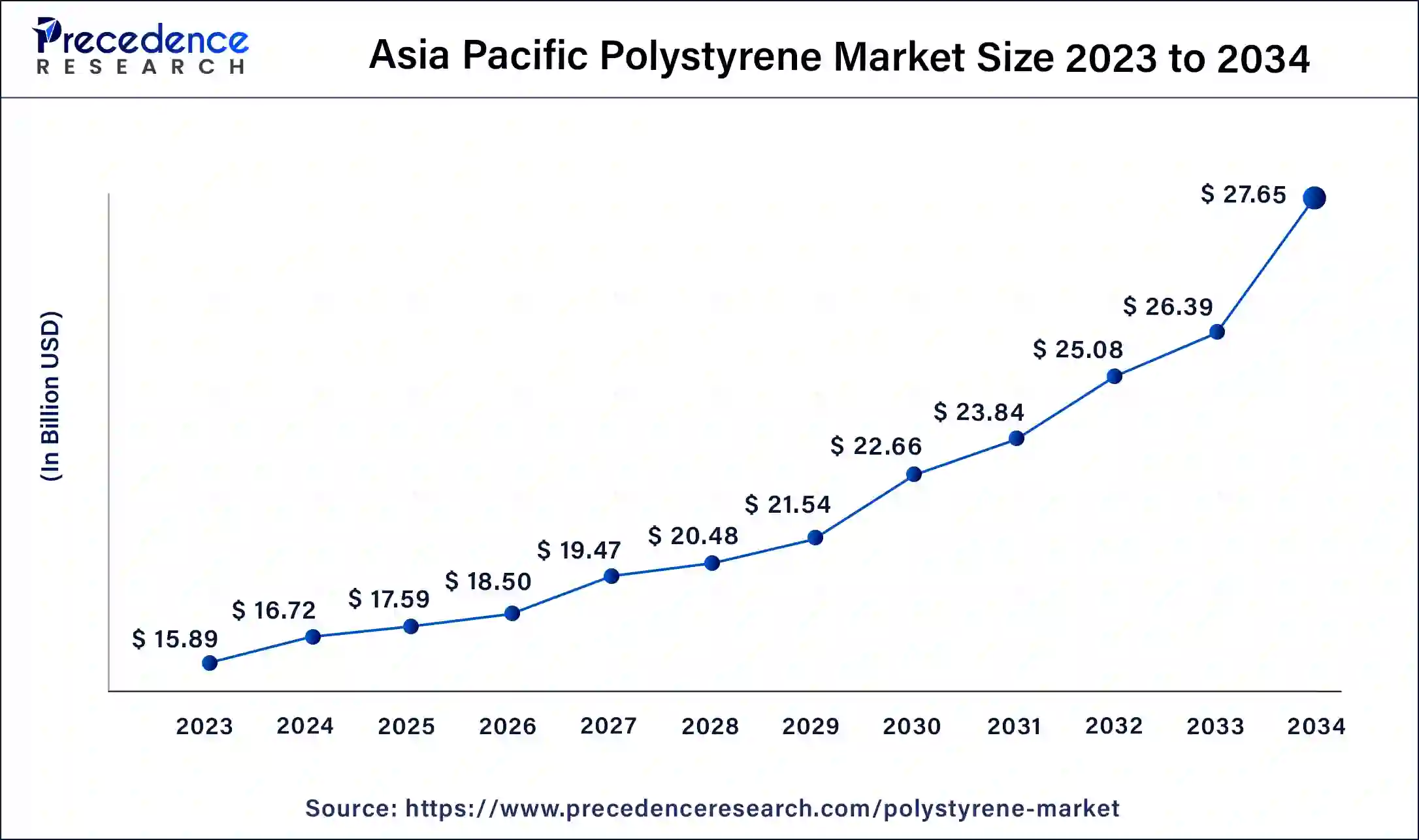

The Asia Pacific polystyrene market size was valued at USD 15.89 billion in 2023 and is expected to be worth around USD 27.65 billion by 2034, at a CAGR of 5.30% from 2024 to 2034.

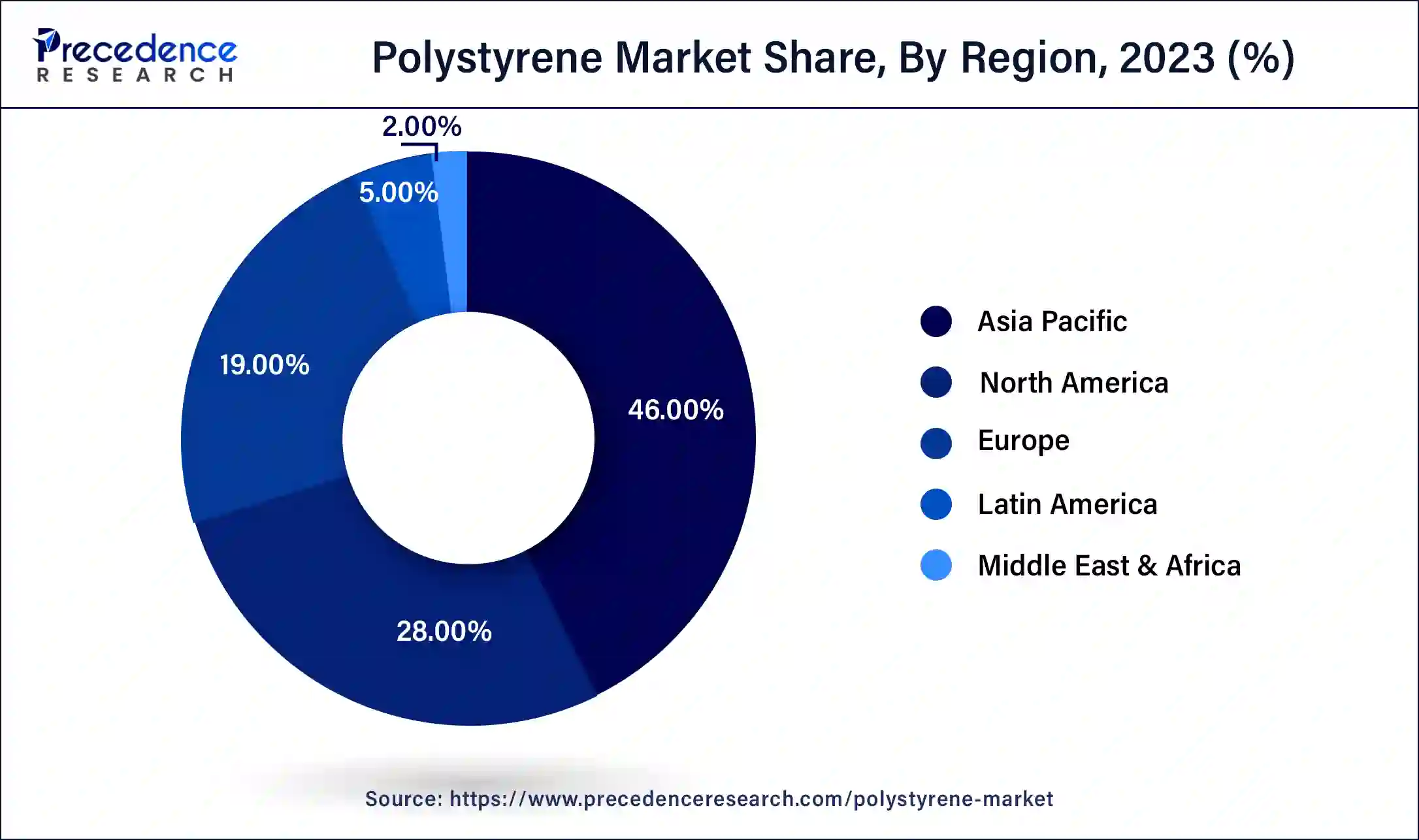

Asia-Pacific has held the largest revenue share 46% in 2023. Asia-Pacific commands a significant share in the polystyrene market due to rapid industrialization, robust construction activities, and a thriving manufacturing sector in countries like China and India. The region's increasing population and urbanization contribute to the demand for packaging and construction materials, where polystyrene finds extensive use. Additionally, a burgeoning consumer goods market further propels the need for polystyrene in packaging applications. The availability of raw materials and a supportive regulatory environment for the plastics industry also contribute to Asia-Pacific's dominant position in the polystyrene market.

North America is estimated to observe the fastest expansion. North America commands significant growth in the polystyrene market due to robust industrial activities, a flourishing packaging sector, and increased demand in construction applications. The region's advanced infrastructure, coupled with a strong presence of key market players, further contributes to its dominance. Additionally, the growing focus on sustainable practices and stringent environmental regulations in North America has led to increased adoption of bio-based and recyclable polystyrene, aligning with the evolving preferences of environmentally conscious consumers and bolstering the market growth in the region.

Polystyrene, a flexible man-made material, is widely used in various industries for its light weight, stiffness, and insulation capabilities. Its formation involves linking styrene units through a process called polymerization, resulting in a thermoplastic substance with diverse applications. One popular form, expanded polystyrene (EPS), is particularly valued for its use in packaging, insulation, and disposable foam products, owing to its cost-effectiveness, buoyancy, and excellent thermal insulation.

Yet, environmental concerns have emerged due to polystyrene's inability to break down naturally, leading to pollution and posing challenges in waste management. There is a growing push for sustainable alternatives and improved recycling efforts. Despite these concerns, the material remains indispensable in industries where its specific qualities address practical needs, sparking ongoing discussions about finding a balance between its applications and environmental impact.

| Report Coverage | Details |

| Market Size in 2023 | USD 34.55 Billion |

| Market Size in 2024 | USD 36.35 Billion |

| Market Size by 2034 | USD 60.10 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.16% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Packaging industry demand and construction industry growth

The demand for polystyrene experiences a substantial uptick driven by the packaging and construction industries. In packaging, polystyrene's lightweight, durable, and cost-effective attributes make it a preferred choice. As the packaging sector constantly seeks innovative materials to meet evolving consumer and logistical needs, polystyrene emerges as a reliable solution due to its capacity to offer secure and lightweight packaging solutions. Its adaptability in creating various packaging forms, combined with its protective qualities, aligns seamlessly with the dynamic requirements of the packaging industry, leading to an increased market demand.

Concurrently, the expansion of the construction industry significantly boosts the need for polystyrene, particularly in the form of expanded polystyrene (EPS). Renowned for its excellent thermal insulation properties, EPS finds widespread application in construction for insulation purposes. With urbanization and infrastructure projects thriving globally, the demand for efficient and cost-effective insulation materials propels the uptake of polystyrene in the construction sector, contributing substantially to the overall market demand for polystyrene products.

Regulatory scrutiny and recycling challenges

The growth of the polystyrene market is constrained by two significant factors: regulatory scrutiny and recycling challenges. Heightened environmental concerns have led to increased regulatory scrutiny, resulting in stringent regulations on the use and disposal of polystyrene. Government measures aimed at reducing single-use plastics and promoting sustainable alternatives impact the market by limiting the scope of polystyrene applications.

Additionally, recycling challenges pose obstacles to market expansion. While there are efforts to promote polystyrene recycling, the logistical complexities and economic viability of recycling processes remain significant hurdles. The collection, sorting, and recycling of polystyrene materials present challenges that slow down the adoption of recycling practices, contributing to the overall restraint on the growth of the polystyrene market in the face of evolving environmental and regulatory landscapes.

Bio-based polystyrene

Bio-based polystyrene is bringing fresh opportunities to the polystyrene market by offering a sustainable alternative. Unlike traditional polystyrene, this type is crafted from renewable sources like agricultural leftovers or bio-based materials, steering away from reliance on fossil fuels. This not only lessens its impact on the environment but also champions a more eco-friendly lifecycle for the product. Bio-based polystyrene tackles worries about the environmental effects of conventional polystyrene and caters to the rising desire for packaging solutions that prioritize our planet.

As rules and consumer choices increasingly favor sustainability, bio-based polystyrene emerges as an inventive solution, paving the way for the market to expand and take the lead in the industry. Collaborations between manufacturers, biotech companies, and policymakers play a pivotal role in advancing research, production, and the widespread adoption of bio-based polystyrene, positioning it as a crucial element in shaping the future of the polystyrene market.

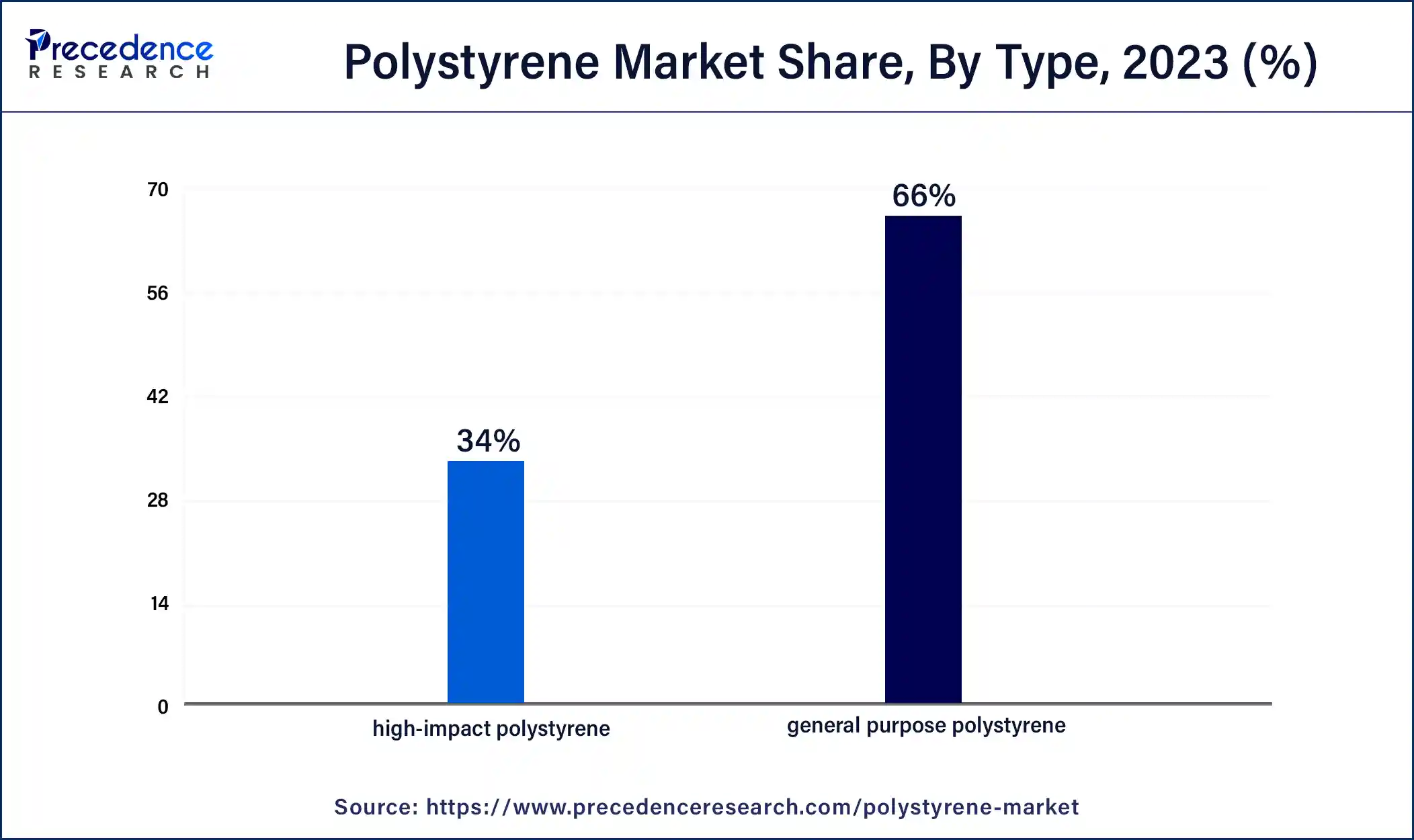

In 2023, the general purpose polystyrene (GPPS) segment had the highest market share of 66% based on the type. General Purpose Polystyrene (GPPS) is a versatile segment in the polystyrene market, known for its clarity, rigidity, and cost-effectiveness. Widely used in packaging, disposables, and consumer goods, GPPS meets diverse industry needs. Current trends in the GPPS segment involve innovations in production technologies to enhance material properties, increased demand from the packaging industry due to its excellent optical clarity, and a focus on developing sustainable formulations to address environmental concerns, aligning with the broader industry shift toward more eco-friendly materials.

The high-impact polystyrene segment is anticipated to expand at a significant CAGR of 1% during the projected period. High-impact polystyrene (HIPS) is a segment within the polystyrene market known for its toughness and impact resistance. It is a versatile thermoplastic commonly used in packaging, consumer electronics, and household goods. Recent trends in the HIPS segment involve an increased demand for sustainable options, leading to innovations in recyclable and bio-based HIPS products. Additionally, advancements in manufacturing technologies contribute to the development of HIPS with enhanced properties, meeting the evolving needs of industries seeking durable and environmentally conscious materials.

According to the application, the packaging segment has held a 35% revenue share in 2023. In the realm of the polystyrene market, the packaging segment revolves around using polystyrene materials for crafting efficient and affordable packaging solutions. This encompasses creating lightweight and sturdy packaging for diverse industries like food, electronics, and consumer goods. An observable trend in polystyrene packaging is the growing emphasis on sustainability.

The industry is witnessing a surge in demand for eco-friendly alternatives, leading to the development of innovative bio-based polystyrene packaging. This evolution aligns with the broader push towards environmentally conscious practices and caters to the increasing consumer preference for sustainable packaging choices.

The automotive segment is anticipated to expand fastest over the projected period. In the polystyrene market, the automotive segment refers to the application of polystyrene in various components within the automotive industry, such as interior trims, insulation, and lightweight structural elements. A prevailing trend in this sector is the increasing focus on light weighting to enhance fuel efficiency and reduce emissions. Polystyrene, with its lightweight properties and versatility, is gaining traction as a material of choice for automotive manufacturers aiming to achieve these objectives while maintaining structural integrity and safety standards.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

September 2024

August 2024

July 2024